XRP and the Looming DeFi Event Horizon?

Posted on 26/06/2025 | 490 Views

There’s been a flood of exciting developments around the XRP Ledger (XRPL) and XRP itself, so let’s take a moment to connect some dots and explore how institutional adoption and DeFi integration are coming together.

First off, Ripple has confirmed that the long-awaited Ethereum Virtual Machine (EVM) sidechain is set to go live in Q2, essentially, any day now. This is huge. This means developers will be able to integrate Ethereum-based smart contracts and DeFi applications directly into the XRP ecosystem, unlocking new opportunities such as liquidity pools and yield generation. The testnet has already attracted a wave of developers, and the sidechain is designed to offer faster and cheaper settlement compared to Ethereum. Axelar (AXL) has played a key role here too, linking the XRPL with over 80 other blockchains, including Cosmos (ATOM). We’re clearly entering a multi-chain world.

Additionally, FIRELIGHT is set to launch on the FLARE Network, a DeFi platform developed by Sentora that enables yield earning via smart contracts. XRP will be the first supported asset, allowing it to be locked, smart contract-enabled, and used to earn passive income. Bitcoin, Litecoin, and Dogecoin are next in line. What does that mean? More XRP could be locked up, reducing liquid supply, typically positive for price if demand holds strong.

Demand

Trident Digital recently announced a US$500 million XRP treasury strategy. In their words, this positions them at the “forefront of integrating decentralised financial assets into treasury and capital management.” They plan to acquire XRP as a long-term reserve asset, stake it, and actively engage with Ripple’s ecosystem. Interestingly, Trident also merged with IntoTheBlock to form Sentora, the team behind FIRELIGHT. Sentora raised US$25 million in Series A funding from Ripple, Tribe Capital, FLARE, and New Form Capital to build a serious institutional DeFi platform.

So yes, there’s a high likelihood Trident’s massive XRP treasury will be used on FIRELIGHT, locking up even more XRP to generate yield.

This ties into another major XRP reveal: VivoPower recently made a US$121 million yield-generating play on the FLARE Network. The pattern is clear, institutional money is flowing into XRP, looking to stake, lock up, and earn.

XRP ETF

Canada just approved three spot XRP ETFs: 3iQ, Evolve, and Purpose. While the US is still reviewing 11 different spot XRP ETF applications, Canada is already live. These ETFs hold actual XRP in custody, reducing circulating supply. On launch day, the Canadian ETFs saw CAD$39 million in inflows, a strong sign of demand.

What could this mean for XRP?

- Increased Institutional Demand

ETFs make it easier for regulated capital to enter. Pension funds, family offices, and asset managers can now gain exposure to XRP.

More demand = upward pressure on price.

- Reduced Circulating Supply

XRP held in ETF custody isn’t actively traded — it’s locked up.

Less supply = more scarcity = bullish signal.

- Improved Legitimacy & Sentiment

ETF approvals signal regulatory green lights, building trust among conservative investors.

This boosts broader adoption and market confidence.

And it doesn’t stop there.

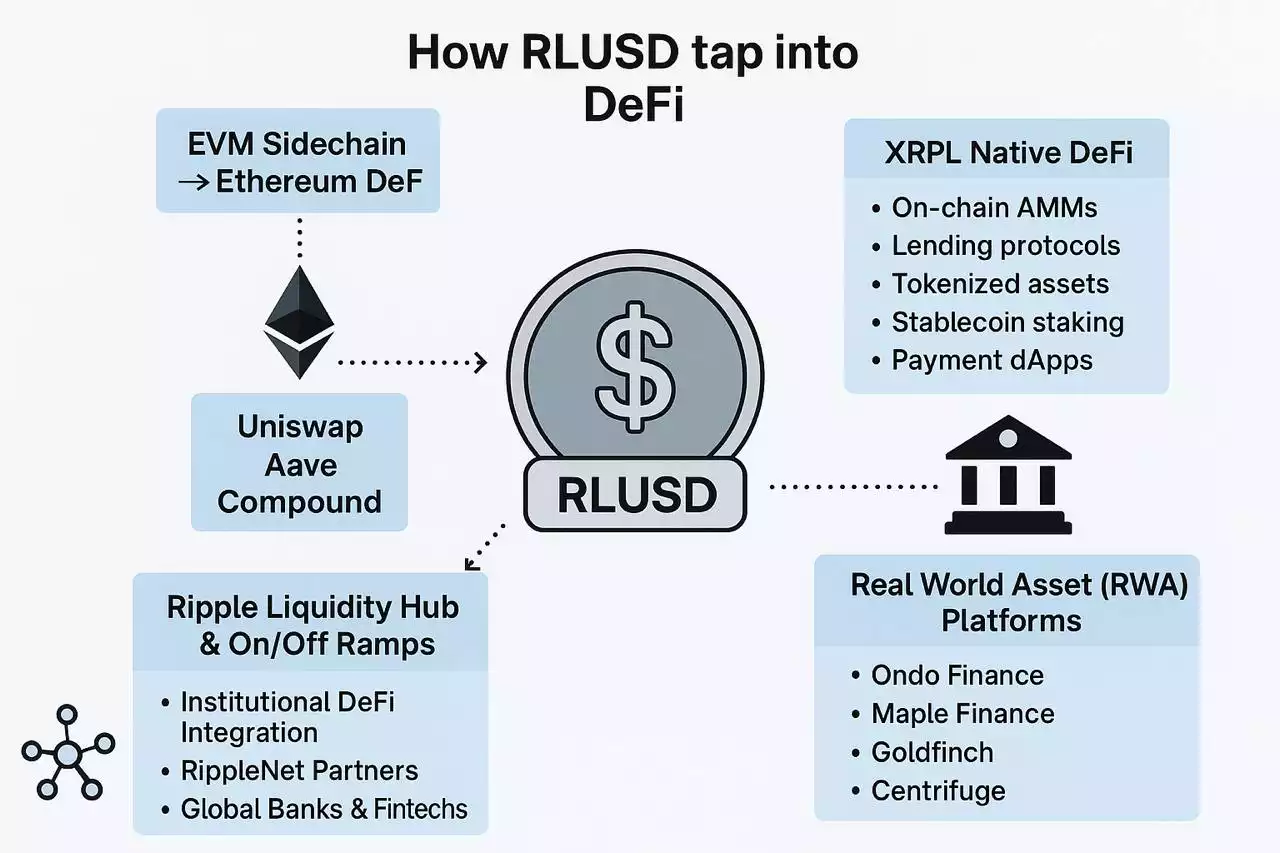

Let’s introduce the growing role of stablecoins like RLUSD and USDC (both now running on the XRP and Ethereum blockchains) and how they might interact with the upcoming wave of DeFi protocols.

RLUSD is Ripple’s attempt to build a multi-chain, regulatory-friendly stablecoin with strong DeFi capabilities. With the XRPL’s upcoming EVM sidechain, RLUSD is positioned to integrate into both Ethereum-based and native XRPL DeFi projects, giving it dual utility that could appeal to institutional and retail users alike. Combine that with the second-largest stablecoin issuer, USDC, and its cross-chain functionality, and the future looks exceptionally bright.

It’s also rumoured that Ripple may not be the only behemoth planning to use the XRPL. Other major players are quietly exploring tokenisation and derivatives.