Tech, Capital, and Talent Go Where They Are Treated Best… A Global Crypto Story

June 27, 2024

In recent years, the United States has witnessed a troubling trend: the exodus of cryptocurrency talent, capital, and innovation to regions with more favourable regulatory environments. This shift is driven by a lack of clear regulations and legislative action from Congress, which has created a cloud of uncertainty over the industry. The current government, including figures like President Biden and Senator Elizabeth Warren, is often perceived as stifling innovation to protect the incumbent banking system. Meanwhile, regions in Asia and the Middle East are emerging as new hubs for crypto, thanks to their more supportive regulatory frameworks.

Regulatory Challenges in the USA and here in Australia

The U.S. crypto industry faces significant challenges due to unclear and sometimes hostile regulatory stances. The Securities and Exchange Commission (SEC), under the leadership of Gary Gensler, has taken a particularly aggressive approach. This has led to numerous enforcement actions against major crypto exchanges like Coinbase, Kraken, Robinhood and Binance. Critics argue that the SEC’s actions are less about protecting investors and more about maintaining the status quo of the traditional financial system. Joseph Lubin, co-founder of Ethereum and CEO of Consensys, has accused the SEC of intentionally stifling innovation to protect the existing financial landscape.

The Australian Securities and Investments Commission (ASIC) plays a central role in the Australian regulatory landscape. ASIC has emphasized that cryptocurrencies are considered investment assets and are subject to capital gains tax (CGT). This treatment aligns with the broader financial regulatory framework, ensuring that crypto transactions are tracked and taxed appropriately.

Australia has been relatively slow in addressing the need for clear cryptocurrency legislation. In 2022, the Australian Treasury consulted on a proposed regulatory framework for crypto assets and secondary service providers like exchanges. Fast forward to March 2023, a Bill was proposed by Senator Bragg, which the Senate Economics Committee rejected in September 2023.

In October 2023, the Government released a consultation paper outlining various objectives, conducts and customer protections with a closing date of December 2023 with draft legislation to be released early 2024. There has been no further progress since December 2023 closing date.

The slowly evolving legislative landscape presents several challenges for crypto industry participants. One of the primary concerns is the potential impact on small crypto exchanges. The introduction of stringent licensing requirements and AML/CTF regulations could increase operational costs and compliance burdens for smaller players, potentially leading to a consolidation in the market. This could limit competition and innovation, as smaller exchanges might struggle to meet the new regulatory demands.

Moreover, the lack of specific legislation for blockchain technology and distributed ledger technologies (DLT) creates a degree of uncertainty. While ASIC provides guidelines, the absence of targeted laws for these technologies means that companies operating in the blockchain space must navigate a complex regulatory environment that may not fully address their unique challenges.

In a recent interview with Sky News, ASIC Chair Joe Longo stated ASIC’s stance in relation to the crypto industry; “… people think crypto is not regulated. It is regulated. It may not be completely regulated, which is why we have law reform coming. So, part of ASIC’s [regulatory] strategy is to test the regulatory perimeter.”

This sounds unnervingly similar to the stance of the United States SEC under Chair Gentler, who has tried to stretch the lawful boundaries and shoehorn 2024 technology into a 1933 Howey Test Supreme Court ruling. The SEC has been illegally crossing legislative boundaries in numerous recent Court findings (losses), being labelled “displaying a lack of faithful allegiance to the law, arbitrary and capricious, and even so far as being sanctioned by the Court.”

Clear and consistent regulatory rules are crucial for fostering innovation in the crypto industry. By establishing a well-defined framework, regulators can provide certainty for businesses, investors, and consumers. This, in turn, can encourage investment and development within the sector. It is hoped that the United States Government and the Australia Government act with these aims in a timely manner, lest see the continued exodus of capital, talent and innovation leave for more favourable jurisdictions.

The Exodus Begins

Faced with these regulatory hurdles, many U.S.-based crypto companies are considering relocating to more crypto-friendly regions. According to a report by Fintech Nexus, the lack of regulatory clarity is driving an increasing number of firms to move their operations overseas, taking their talent and innovation with them. Coinbase CEO Brian Armstrong highlighted this issue, revealing that the SEC had recommended delisting all cryptocurrencies except Bitcoin, which would have effectively ended the crypto industry in the U.S.

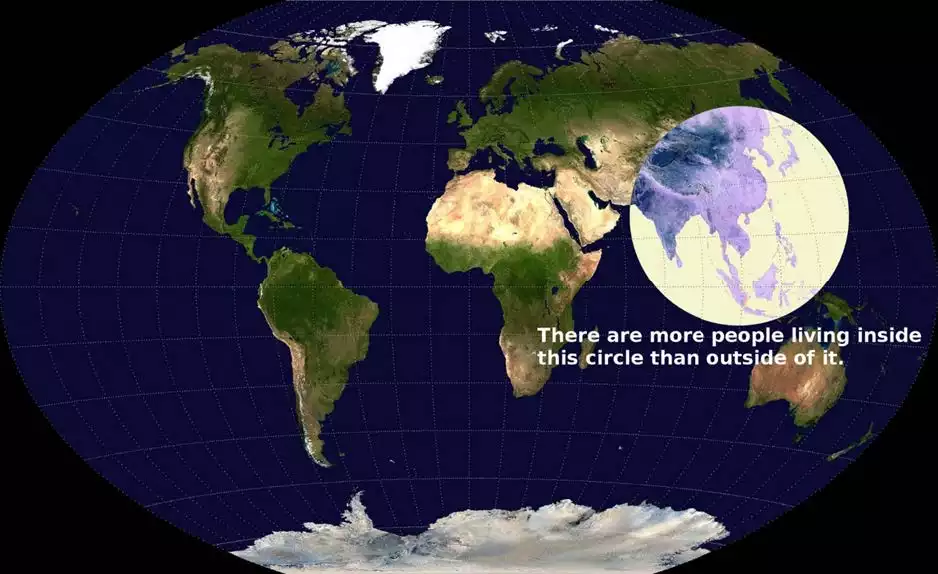

The Valeriepieris Circle: A Global Perspective and Why it Matters …

A notable concept in understanding global population distribution is the Valeriepieris Circle, which shows that half of the world’s population lives within a circle centred in Asia. This region’s rapid adoption of crypto highlights a broader trend: innovation and capital flow to where they are best treated.

Asia: A New Crypto Haven

Asian countries have been quick to capitalize on the U.S.’s regulatory missteps. Japan and South Korea, for instance, have established clear and supportive regulatory frameworks for cryptocurrencies. Japan was the first country to define crypto assets in legal terms and has continued to refine its regulations to support the industry. South Korea, while not recognizing cryptocurrencies as legal tender, allows trading under strict anti-money laundering laws.

Ripple, a major player in the crypto space, has launched a significant initiative to support the development of the XRP Ledger in Japan and Korea, committing one billion XRP to foster innovation and community growth in these markets. This move underscores the attractiveness of these countries as new hubs for crypto development.

Middle East: Surging Crypto Adoption

The Middle East is also experiencing a surge in crypto adoption, driven by favourable regulations and growing interest in digital assets. The UAE, in particular, has emerged as a leader in the region, with 72% of local users investing in Bitcoin. The number of daily crypto traders in the Middle East increased by 166% in 2024, and this growth is expected to continue. This rapid adoption is attracting more international and regional crypto companies to the UAE.

Singapore: A Leading Crypto Hub

Singapore has positioned itself as a leading hub for cryptocurrency in the Asia-Pacific region. With $627 million in funding for cryptocurrency companies in 2023, Singapore is leveraging its highly connected population, excellent telecommunications network, and skilled workforce to boost crypto adoption. Over half of finance-savvy Singaporeans own crypto, with staking emerging as a popular use case.

Thailand and Indonesia: Rising Stars

Thailand ranks 10th in the 2023 Global Cryptocurrency Adoption Index and boasts a high proportion of cryptocurrency ownership among internet users. The country had 13.02 million crypto users in 2023, a figure projected to grow steadily. Indonesia, with 18.51 million registered cryptocurrency investors by the end of 2023, is another rising star in the crypto world. The Indonesian government’s supportive stance, including the launch of the world’s first state-backed cryptocurrency bourse, has fuelled this growth.

Hong Kong: A Growing Financial Hub

Hong Kong’s financial services industry is also embracing digital assets, with several brokerage firms offering crypto trading services. A supportive regulatory environment is fuelling this interest, with the Securities and Futures Commission (SFC) providing clear guidelines for virtual asset trading platforms. This regulatory clarity is attracting more investors and large institutions to the crypto market in Hong Kong.

Fighting Back: The Crypto Industry’s Legal Battles

Despite the challenges, the crypto industry in the U.S. is not backing down. Companies like Ripple, Coinbase, Kraken and Debt Box are fighting back in court, challenging the SEC’s authority and advocating for clearer regulations. Brad Garlinghouse, CEO of Ripple, has emphasized the ignorance of U.S. politicians regarding the crypto business and suggested that some government representatives might be deliberately obstructing the sector.

The Political Landscape: New Voices for Crypto

The upcoming U.S. elections could bring significant changes to the regulatory environment for cryptocurrency. Candidates like Donald Trump have taken a pro-crypto stance, promising to protect the industry from over-regulation. Organizations such as Fairshake are supporting candidates who advocate for clearer regulations and a more supportive environment for blockchain innovators.

In another positive trend for the crypto community, new political figures are emerging. For instance, John Deaton is running against Elizabeth Warren for the Senate seat in Massachusetts. Deaton, a former Marine, is known for his CryptoLaw firm and his advocacy for the crypto industry. He has battled the SEC on behalf of 76,000 XRP holders and filed Amicus Briefs (“Friend of the Court” filings to provide additional information) in support of Coinbase and LBRY in their legal battles against the SEC.

Conclusion

The U.S.’s current regulatory approach to cryptocurrency is driving talent and innovation to more favourable regions in Asia and the Middle East. While the SEC continues its aggressive stance, the crypto industry is fighting back in the courts and through political advocacy. As new pro-crypto voices emerge in the political landscape, there is hope for a more supportive regulatory environment in the future with government change and the recognition of exponential growth opportunities. Over half of the planet’s population and their respective governments have adapted clear and fair regulations, with capital clearly moving to these new economic growth hubs. For now, the United States’ significant “capital investment cog” appears disengaged from the world’s crypto engine. With clear and present threats from their Regulators, the US risks falling behind as other regions continue to advance in the crypto space. Australia’s legislators and regulators seem to be following in the United States footsteps with their delayed and slow approach, thus risking industry growth, solutions, efficiencies and investment potential blockchain and cryptocurrencies present. Over half the planet’s population live on Australia’s doorstep and are actively adapting and supporting the blockchain/crypto industry. Two questions remain. Will we as a nation legislate and participate in a timely manner or similarly lose ground to the majority of the world like the U.S.? Will you participate in the exponential growth opportunities that blockchain technology and crypto represent; opportunities that more than half the planet already has clear access to…

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Join us here or connect with Ainslie Crypto’s team at 1800 296 865 or via info@ainsliecrypto.com.au. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie has been a trusted dealer and custody provider for Gold 1.0 for 50 years and has brought the same service to Gold 2.0, Bitcoin, since 2017.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provides swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.