Crypto Advertising Blitz Causes Record Inflows

February 6, 2024

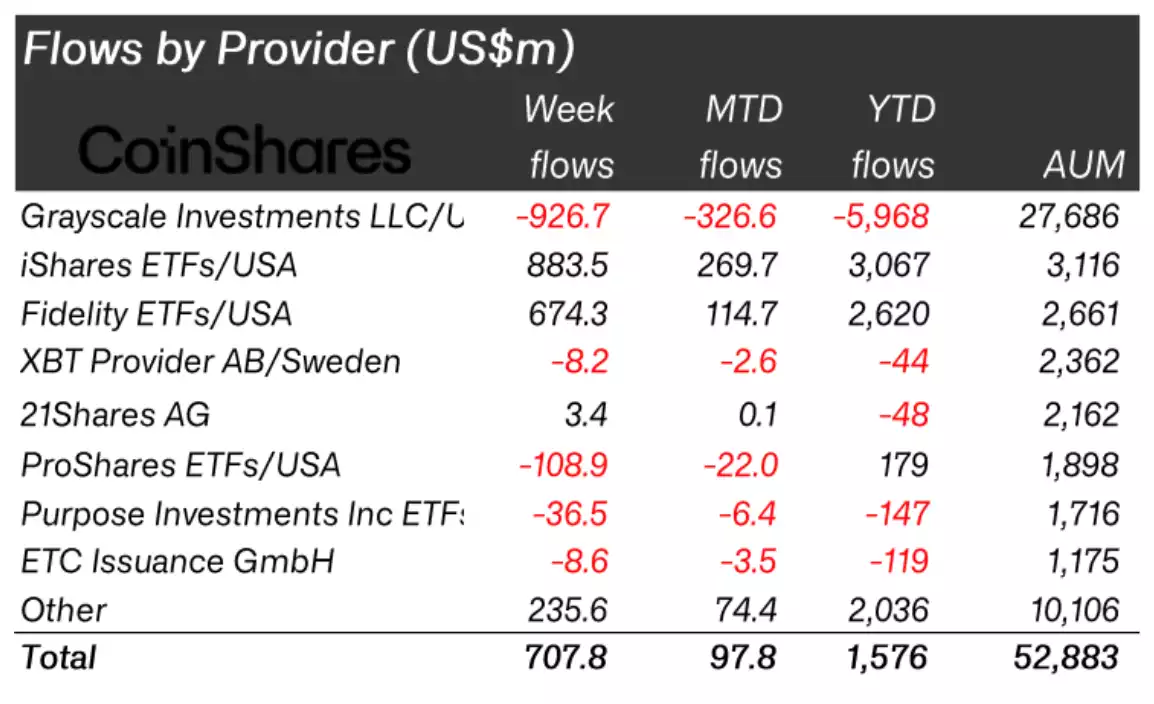

In the wake of unprecedented inflows into cryptocurrency investment products, with Bitcoin leading the charge, a significant driver behind this surge has been an innovative advertising blitz, spearheaded by some of the industry’s largest entities. Last week’s crypto investment product influx saw a notable AU$1.09 billion (US$708 million) flow in, nearly 99% attributable to Bitcoin, and Solana also catching investors’ attention with AU$20.02 million (US$13 million) in inflows.

This influx of investment coincides with a strategic advertising campaign, as Google, the world’s largest search engine, lifted its five-year ban on cryptocurrency promotion. This policy shift came in the wake of the U.S. Securities and Exchange Commission (SEC) green-lighting America’s first basket of spot Bitcoin ETFs. Industry giants such as BlackRock, VanEck, Bitwise, Fidelity, Grayscale, and Invesco quickly capitalized on this opportunity, launching ad campaigns aimed at drawing retail capital into their cryptocurrency funds. Although Google hasn’t disclosed the spending figures for these promotions, the ability to advertise on such a significant platform likely intensified competition among issuers like ARK 21Shares and Franklin Templeton.

Despite Google’s continued prohibition on promoting initial coin offerings (ICOs), the pivot in its ad policy has enabled firms to spotlight their crypto-backed funds, significantly impacting investment flows. The Financial Times highlighted the aggressive marketing efforts by various issuers, aiming to marshal retail capital into their funds through Google ads and social media platforms, including Elon Musk’s X. These marketing efforts, coupled with the issuers’ race to offer attractive ETF fees and even fee waivers for up to 12 months, have played a crucial role in the substantial inflows—and outflows—observed in the market.

Notably, Grayscale has been a primary driver behind significant outflows, with investors exiting the Grayscale GBTC worth over AU$6.16 billion (US$4 billion) in the days following the ETF approvals. However, JPMorgan analysts anticipate a slowdown in these outflows as BlackRock and Fidelity surged into the top 10 ETFs last month, amassing a combined AU$7.39 billion (US$4.8 billion) in inflows. In a strategic move to mitigate risk and ensure greater safety for investors, some issuers are diversifying their crypto custodians.

This recent period marks an exciting phase for the crypto sector, characterised by a rush of short-term trades being squeezed out and the market soaring to new highs, buoyed by advertising efforts and the anticipation of further ETF approvals. Amidst this vibrant backdrop, the Bitcoin and Solana inflows underscore a growing investor appetite for digital assets, heralding an era of increased institutional involvement and the potential for further market expansion.

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Join us here or connect with Ainslie Crypto’s team at 1800 AINSLIE or via info@ainsliecrypto.com.au. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie have been a trusted dealer and custody provider for Gold 1.0 for 50 years and bring the same service to Gold 2.0, Bitcoin, since 2017.

In an era where traditional banking systems impose increasing limitations, Ainslie Crypto offers a forward-thinking payment solution with the Australian Digital Dollar (AUDD) platform. Developed by Novatti, AUDD allows you to navigate beyond the constraints of conventional financial systems, offering stability, security, and ease in your crypto transactions.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provide swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.