Bitcoin Upcoming Halving Fuels Market Optimism

January 16, 2024

The introduction of spot bitcoin exchange-traded funds (ETFs) in the U.S. heralds a new epoch in the crypto market, particularly with the bitcoin halving event on the horizon. The approval of these ETFs by the U.S. Security and Exchange Commission (SEC) has led to mixed outcomes, reflecting the highs and lows of a hype-driven market.

With over AU$1.05 billion flowing into the top three bitcoin ETFs, not including Grayscale’s AU$33 billion fund (converted from the GBTC trust), there’s clear evidence of strong demand for mainstream avenues into bitcoin (BTC). Before the approval on Wednesday, Jan. 10, bitcoin saw a surge to a recent peak of approximately AU$72,000.

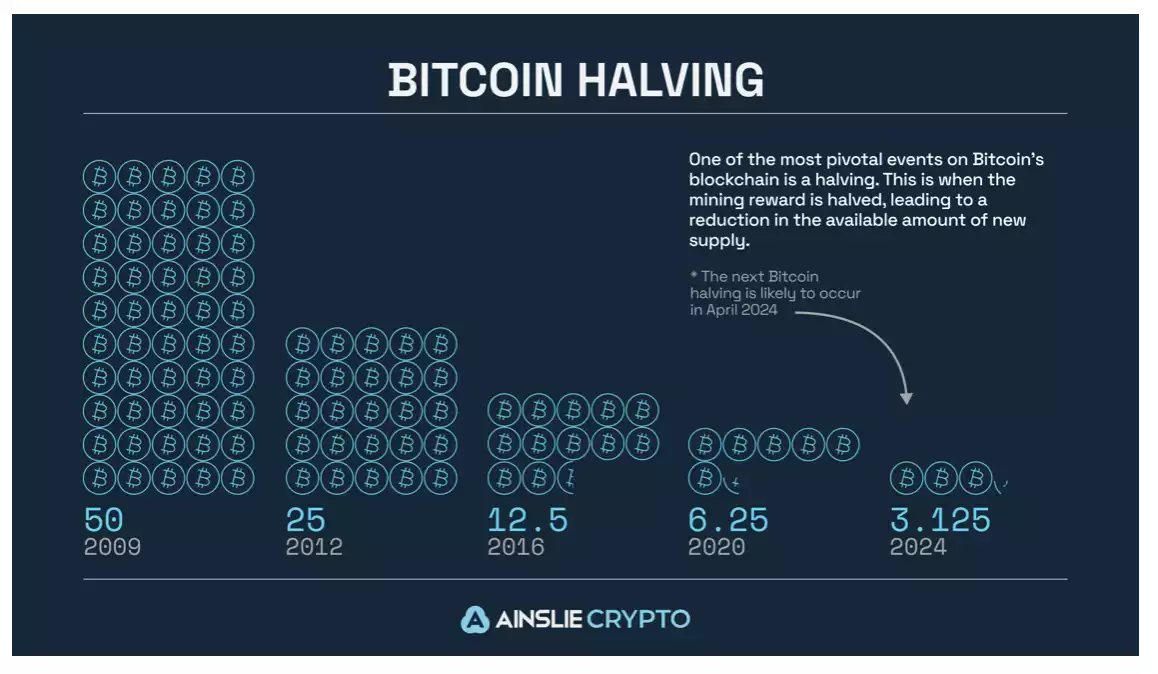

Analysts and traders are now speculating whether the upcoming bitcoin halving, which cuts the number of new bitcoins issued to miners, will similarly energise crypto prices. This periodic event, happening every four years, has sparked debates on its impact on bitcoin’s value.

The bitcoin halving is fundamentally about supply: bitcoin’s price could rise post-halving if the inflow of new coins slows and network usage remains stable or grows.

Historically, bitcoin has experienced significant growth after each halving. For instance, six months following the 2016 halving, bitcoin surpassed the AU$1,500 mark for the first time. A similar surge occurred in 2020, setting a new record high.

CoinShares’ “Mining Report” suggests that a peak in mining power often occurs around four months before a halving, potentially indicating positive sentiment. But the economic rationale behind a bitcoin supply shock is debatable since new bitcoins will continue to be issued for the next century, ultimately reaching the 21 million cap set by Satoshi Nakamoto.

CoinShares predicts increased competition in bitcoin mining post-halving, leading to the exit of less efficient miners. Bitcoin’s efficiency has improved by 90% since the last halving, but mining difficulty has soared, reaching historic highs in 2023. Post-halving, the average cost of producing each bitcoin is expected to stabilise at just under AU$57,000, considering various factors like hardware, electricity costs, and overall mining profitability.

The BTC price recently dipped to its support zone as focus shifted to Ethereum and other altcoins. Currently, 79.33% of BTC wallet addresses remain profitable, as per on-chain data. Analysts believe that BTC issuers’ accumulation of the asset could drive a recovery, stimulating demand.

The demand for Bitcoin from ETF issuers might trigger a rebound in BTC price, as it appears to have found support at AU$62,550. BTC is presently in a support zone (AU$62,125.50 to AU$65,017.50) where 2.93 million addresses acquired 991,100 BTC. The next target is the AU$65,017.50 level.

Bitcoin’s recent decline may be attributed to factors such as an increase in supply on exchanges and whale profit-taking. The supply of BTC on exchanges rose from a six-month low of 5.30% on January 7 to 5.39% last Monday. An increase in exchange supply is typically viewed as bearish, as it can lead to heightened selling pressure.

As the crypto market continues to evolve with these new developments, there remains a strong sense of optimism among investors and enthusiasts. Despite the current fluctuations in price, the underlying interest in Bitcoin and its potential for long-term growth is undeniable.

The resilience of Bitcoin, demonstrated by its recovery from various market cycles, reinforces its status as a pioneering digital asset. The growing adoption of cryptocurrencies in mainstream finance, coupled with technological advancements and regulatory clarity, sets the stage for a bright future in the crypto space.

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Join us here or connect with Ainslie Crypto’s team at 1800 AINSLIE or via info@ainsliecrypto.com.au. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie have been a trusted dealer and custody provider for Gold 1.0 for 50 years and bring the same service to Gold 2.0, Bitcoin, since 2017.

In an era where traditional banking systems impose increasing limitations, Ainslie Crypto offers a forward-thinking payment solution with our Australian Digital Dollar (AUDD) platform. Developed by Novatti, AUDD allows you to navigate beyond the constraints of conventional financial systems, offering stability, security, and ease in your crypto transactions.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provide swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.