Bitcoin Report – July 2025

Posted on 31/07/2025 | 309 Views

Today our Independent Research Analyst, Isaac Ho from the Ainslie Research Team brings you the latest monthly deep dive specifically on Bitcoin – including market analysis, on-chain metrics, sentiment, and technical analysis. He highlights some of the key charts that were discussed and analysed by our expert panel in the latest Beyond the Block episode and expands upon his work with some additional insights. We encourage you to watch the video of the original presentation if you haven’t already.

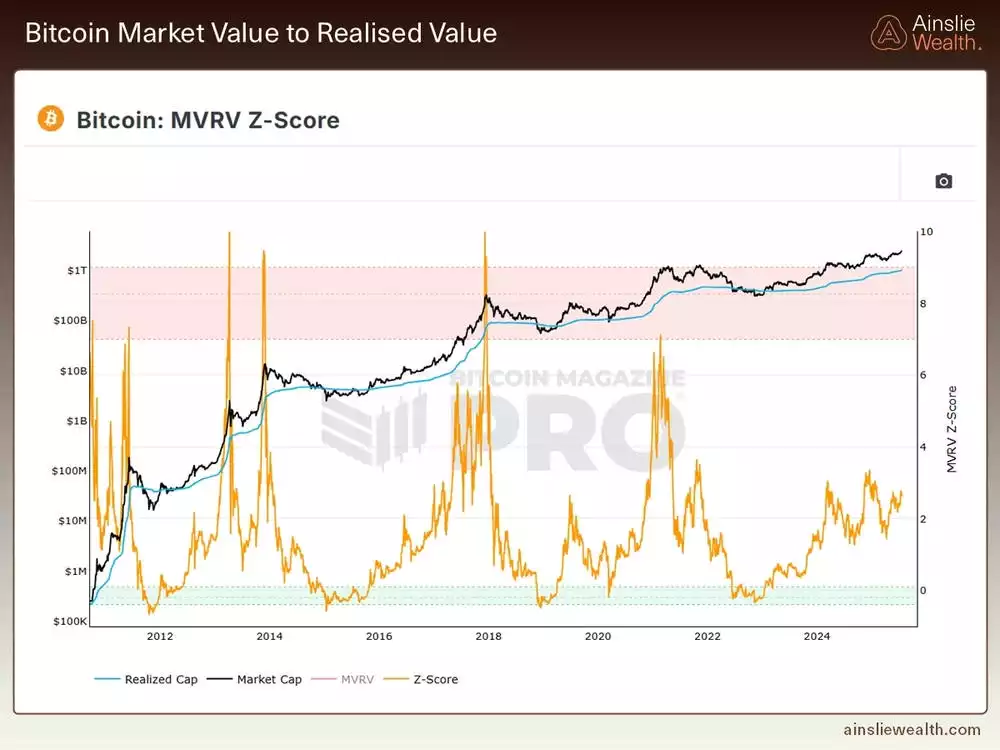

MVRV Z-Score Signals Institutional-Led Cycle

The MVRV Z-Score isn’t exhibiting the dramatic spikes seen in past bull markets. Instead, it remains relatively subdued—reflecting a broader observation that this cycle appears to be driven more by institutional capital than retail speculation.

In previous cycles, retail enthusiasm pushed the Z-Score into heavily overvalued territory. This time, the trend is far more controlled. The gradual, stepwise price appreciation has tracked alongside a steadily rising realised cap, helping to keep the Z-Score in check.

Rather than timing market tops, the MVRV Z-Score provides insight into the market’s underlying sentiment and capital structure. At present, it suggests restraint, not exuberance. With retail participation still limited—confirmed by multiple behavioural and flow metrics—the signal indicates further room to run before the market approaches overheated conditions.

Sentiment Lags, Resilience Persists

Overall sentiment remains sluggish—not collapsing, but clearly muted—which is telling in itself. Despite ongoing geopolitical risks and global uncertainty, Bitcoin has shown strong price resilience, hinting at underlying strength in the market.

The Fear & Greed Index recently underscored its reliability, having dropped into “Extreme Fear” just weeks ago—a historically contrarian buy signal. At the time, sentiment was deeply bearish, but price action told a different story. Since then, Bitcoin has rallied sharply, and the index now sits at 67—well into “Greed” territory.

The speed of this shift is noteworthy. While it marks a meaningful sentiment recovery, such rapid turnarounds often reflect underlying fragility. This suggests potential for short-term volatility, even as the broader trend remains constructive.

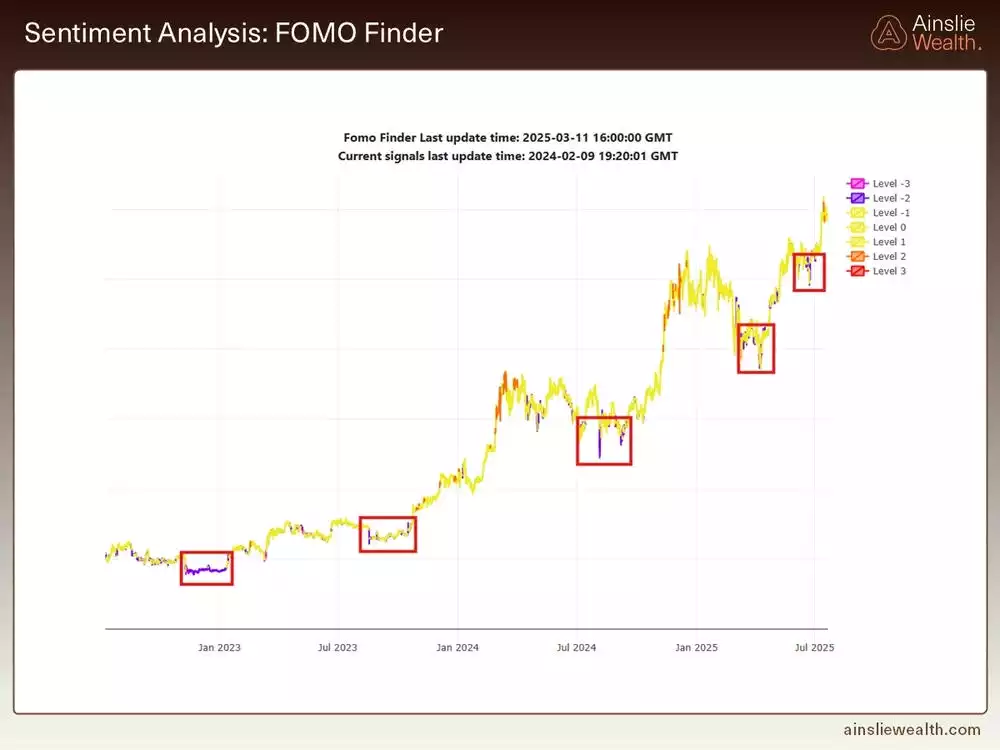

FOMO Finder Reinforces Cyclical Signals

The FOMO Finder continues to show a consistent weekly cycle. Historically, its purple “fear” signals have aligned with significant market lows. The latest example followed a sharp sell-off that triggered widespread liquidations and heightened fear—only to be met by a swift rebound. This is the kind of price action that often marks pivotal turning points.

The indicator has since moved into the yellow zone, suggesting reduced fear without tipping into greed. While not a standalone tool, the FOMO Finder is a strong confirmation signal—particularly when it aligns with broader market data, as it has recently.

Muted Retail Interest Supports Institutional Narrative

Google Trends data adds another layer to this picture: retail interest remains subdued. Even as Bitcoin approaches previous all-time highs, search volume for “Bitcoin” continues to decline. A brief spike last November, likely tied to the Trump news cycle, quickly faded.

This supports the broader consensus that the current rally is being driven largely by institutional flows, not retail hype. Crypto awareness remains high, but enthusiasm hasn’t returned to mainstream levels. That absence of speculative froth suggests further upside potential.

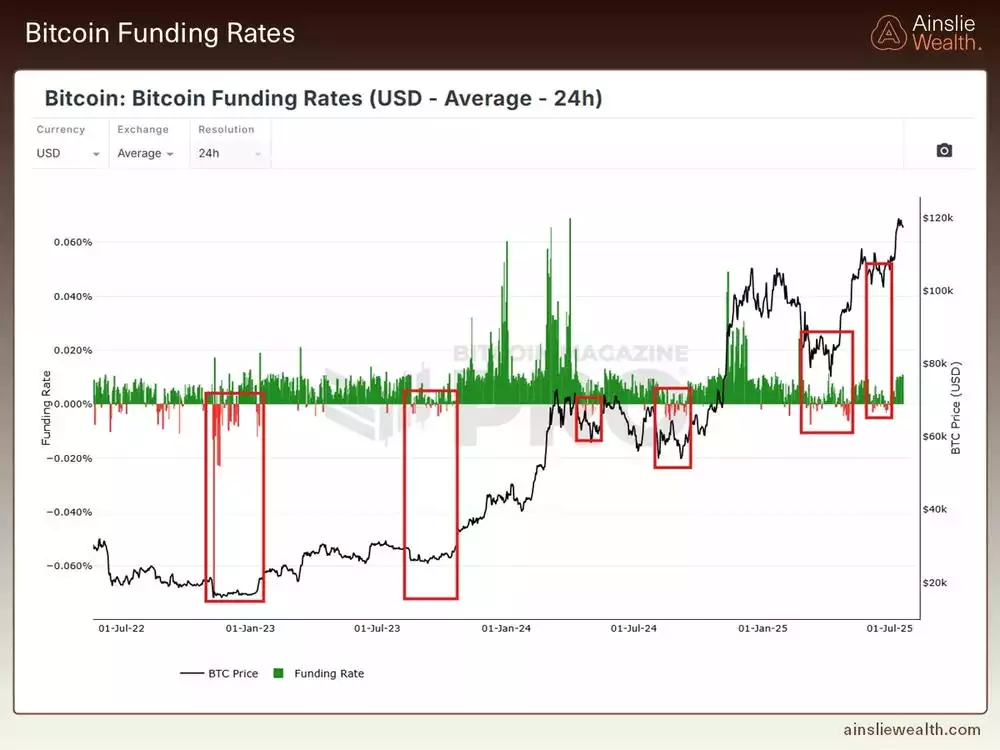

Funding and Positioning Tilt Bullish

Funding and Positioning Tilt Bullish

Funding rates have climbed again, signalling a shift out of the recent choppy phase. After briefly dipping negative—typically a bullish contrarian indicator—we saw a sharp upside move. Now, with funding firmly positive, bullish positioning appears to be returning.

Signs of growing long exposure are emerging, though not yet at levels typically associated with major corrections. The market seems to be transitioning from balanced consolidation toward a more directional stance.

Bitcoin rarely stays in low-volatility environments for long. The recent calm may have been the setup for a more dynamic move. While there are no guarantees, broader technicals and macro conditions continue to support an upside resolution.

Mid-Cycle Dynamics and Liquidity Divergence

Zooming out, the macro context suggests we’re still in a mid-cycle expansion phase. Liquidity is rising—albeit slowly—and that typically supports higher asset prices. However, a divergence has emerged: Bitcoin’s price has outpaced what current liquidity conditions would normally justify.

Back in March, the picture was more cohesive: rising liquidity, strong technicals, and cautious sentiment created a compelling setup. Today, while price has accelerated, liquidity hasn’t kept pace. That disconnect introduces a degree of caution.

The medium- to long-term view remains positive, but our near-term conviction has moderated compared to last month.

Technical Caution into Extended Weekly Cycles

Weekly cycles now appear somewhat extended. The Stochastic RSI is flattening near its upper band—historically a zone that often precedes increased volatility. We’ve seen this pattern before: while price can continue higher, sustaining momentum becomes more difficult at this stage.

The cycle has been remarkably rhythmic, but we’re now back in uncertain territory. A period of consolidation—or a healthy pullback—would be a natural development to reset the trend.

$110K Zone Gaining Technical Significance

From a volume profile perspective, Bitcoin is hovering around the $110,000 level. The longer it consolidates here, the more significant this zone becomes. Should price break higher, this region could act as strong support. If we retrace, it may instead become meaningful resistance.

Market Structure Supports Consolidation

Short-term structure remains bullish, with a pattern of higher highs and higher lows—an encouraging sign. The key question now is whether this structure holds. A break below the recent swing low would undermine the current setup and shift sentiment.

For now, the market appears to be leaning toward consolidation and the formation of a higher low. Waiting for confirmation here would be prudent before taking a more aggressive position.

Watch the most recent video presentation of Bitcoin Analysis: Beyond the Block where we share some of these explanations in a panel format, and join the discussion on our YouTube Channel here:

We will return with a more detailed analysis of everything Bitcoin next month, including more market analysis, on-chain metrics, sentiment, and technical analysis.

Isaac Ho

Independent Research Analyst

The Ainslie Group

x.com/IsaacsDevCorner