Bitcoin Price Breakout ‘Never Seen Before’ — 4 Key Points for BTC This Week

June 4, 2024

Bitcoin market commentators are increasingly confident that BTC’s price action is setting up for a historic breakout.

Bitcoin enters June in a strong position, with momentum targeting AU$103,349 (US$69,000) as traditional financial markets return to the scene. The main question for Bitcoin market participants is whether this week will finally see a breakout, as BTC/USD has been rangebound for nearly three months. While some argue that BTC is long overdue for an upside continuation, holders may need to wait a bit longer.

The coming days could provide the necessary fuel for bulls, with U.S. unemployment figures—recently a catalyst for risk-asset volatility—due at the end of the week. Meanwhile, on-chain indicators are aligning for a bullish comeback, and network fundamentals are inching back toward all-time highs. As price and sentiment slowly recover, let’s examine the major issues facing Bitcoin investors as June begins.

AU$103,349 (US$69,000) Critical Price

Following some volatility over the weekend, BTC/USD has ultimately come full circle by the weekly close. Data from Cointelegraph Markets Pro and TradingView show Bitcoin setting the tone for the Asia trading session on a high note, now back above AU$103,349 (US$69,000) at the time of writing.

Popular trader Skew highlighted the importance of the AU$103,349 (US$69,000) level in his latest analysis on X, describing it as “likely an important price this week.” He noted that while current spot demand is around AU$99,113 (US$66,000) to AU$97,907 (US$65,000), the market bid needs to see spot bids move higher toward AU$101,887 (US$67,000).

Unemployment Data Precedes FOMC Week

While this week may start quietly in terms of macroeconomic data, potential volatility for risk assets remains. U.S. initial jobless claims will be released on June 6, followed by further unemployment numbers the next day. Bitcoin and crypto markets have been particularly sensitive to employment data in 2024.

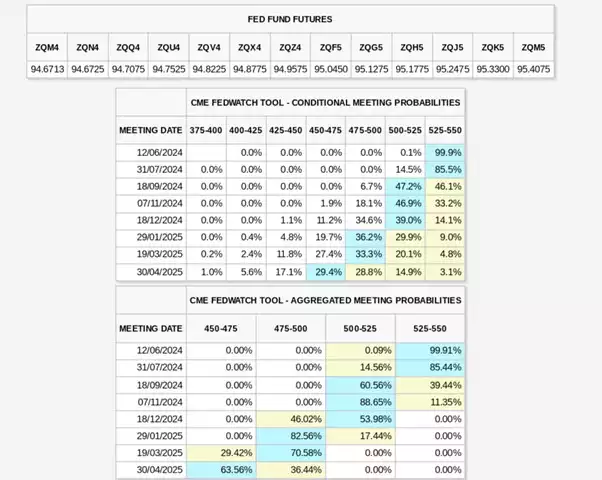

The latest data from CME Group’s FedWatch Tool suggests no significant chance of a rate cut until September or later. However, even a single rate cut this year could hold rates higher for longer, potentially benefiting the stock market.

BTC Price Prepares for Breakout from “Longest Consolidation Yet”

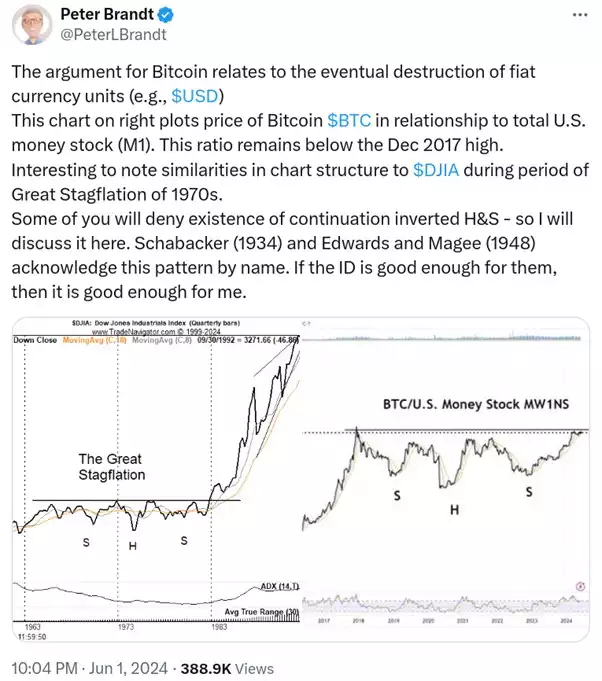

Bitcoin and global liquidity have always had a strong correlation. Currently, there is an “extremely bullish” comparison between BTC/USD and the U.S. M1 money supply. M1 supply refers to the sum of cash, demand deposits, and checks in the U.S. economy. As of June 2024, Bitcoin looks to be repeating its biggest-ever breakout against M1.

According to the popular trader and analyst TechDev, Bitcoin has only seen blow-off tops after breakouts against M1 money supply. The current breakout follows the longest consolidation yet, indicating a potential for a uniquely volatile move.

Veteran trader Peter Brandt put it best on X:

Difficulty Bounces as Miners Decrease BTC Exposure

Bitcoin network fundamentals are slowly bouncing back after a rapid cooling during early May’s downward price action. The latest data from BTC.com predicts a roughly 1.7% difficulty increase on June 6. This will build on a 1.5% jump from two weeks ago, helping mitigate the 5.6% drop that cost difficulty its all-time high position.

According to on-chain analytics firm Glassnode, miners face challenging conditions. As of June 2, miners’ net BTC holdings have declined by 2,500 BTC over the past 30 days. Despite this, the balance reduction is not as steep compared to the run-up to the halving in November 2023.

In conclusion, Bitcoin is delicately balanced at AU$103,349 (US$69,000), with pivotal support and resistance levels nearby. The potential for a significant breakout is there, but market participants are keenly watching for any developments that could push BTC to new highs.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.