Bitcoin Analysis: Beyond the Block – March 2025

Posted on 20/03/2025 | 865 Views

Today the Ainslie Research team brings you the latest monthly update on Bitcoin – including the Macro fundamentals, market and on-chain technical metrics and all the other factors currently driving its adoption and price. This summary highlights some of the key charts that were discussed and analysed by our expert panel. We encourage you to watch the video of the presentation in full for the detailed explanations.

Bitcoin and Global Liquidity

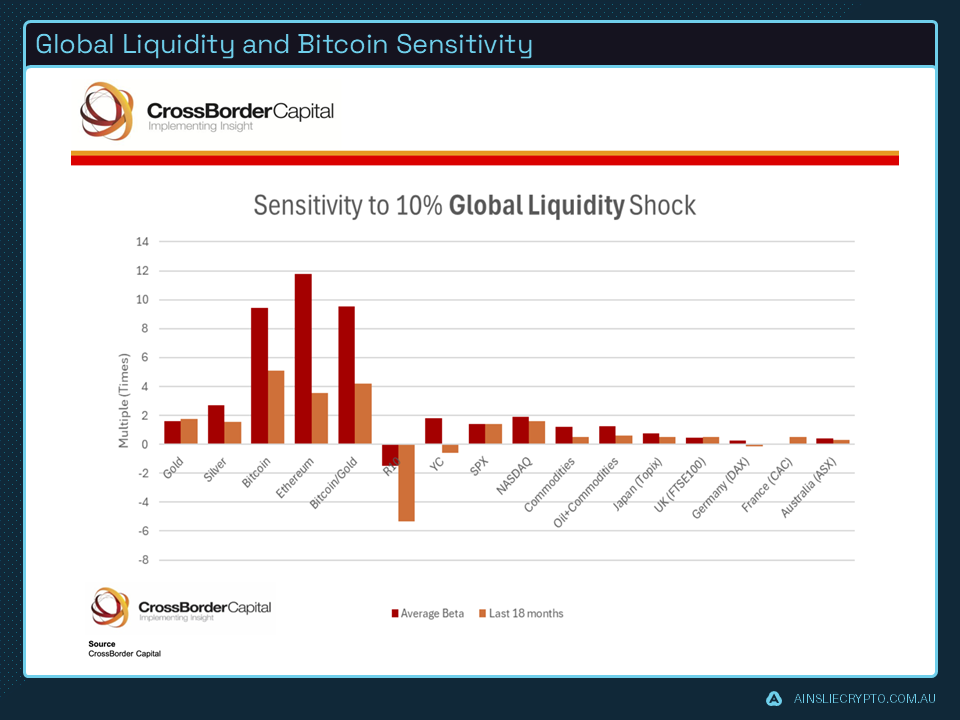

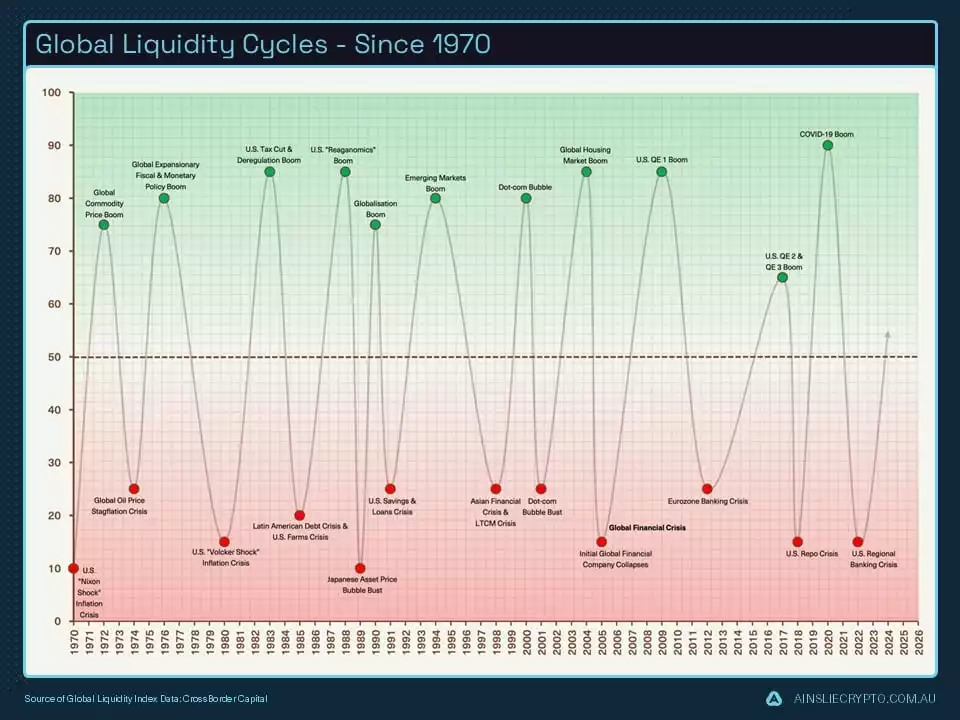

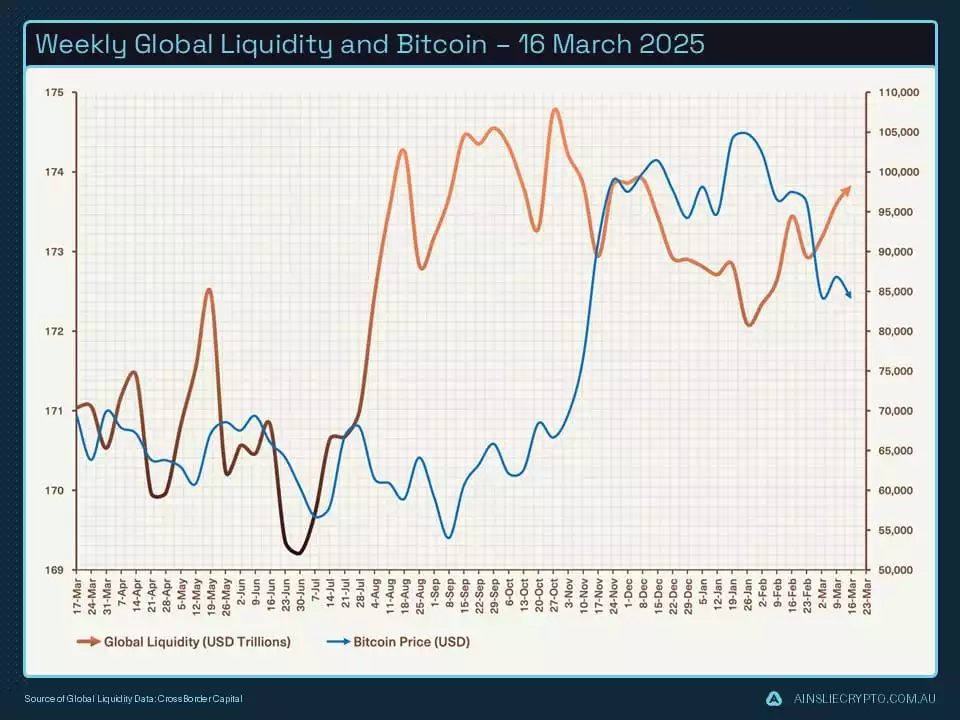

Bitcoin is the most directly correlated asset to Global Liquidity. Trading Bitcoin can be thought of as trading the Global Liquidity Cycle, but with an adoption curve that leads to significantly higher highs and lows each cycle. As such we look to buy Bitcoin during the ‘Bust’ phase or liquidity low, then rotate out of it during ‘Late Cycle’ where liquidity is over-extended and downside protection is required (our preference is to rotate into Gold). When correctly timing and structuring the rotation, it is possible to significantly outperform ongoing monetary debasement. The Bitcoin cycle low was in November 2022, and since then the returns have been unmatched by any other major asset.

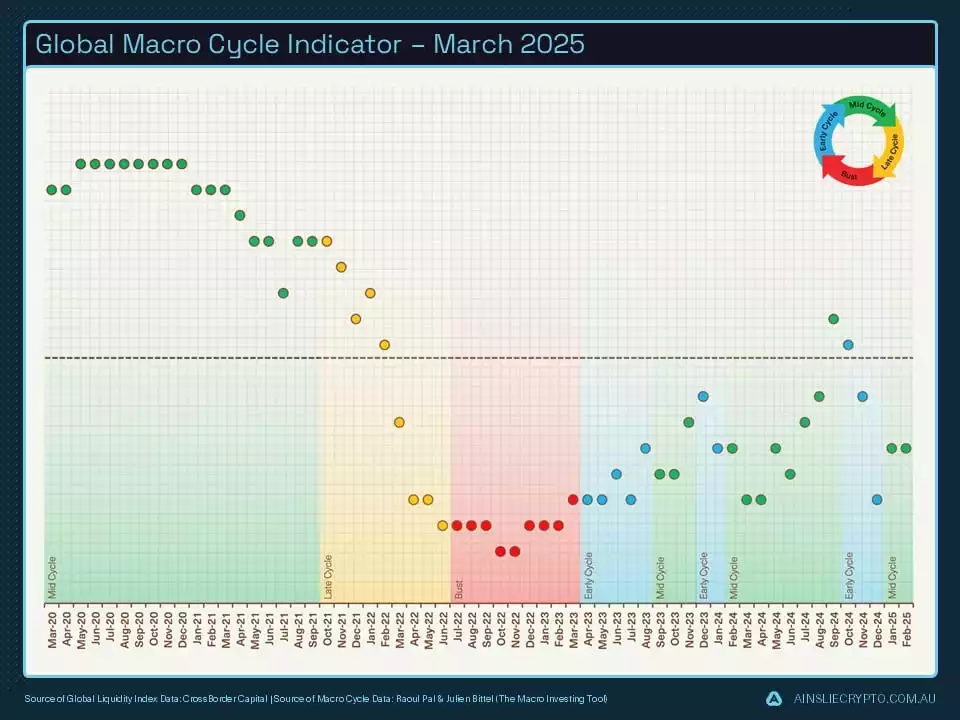

Where are we currently in the Global Macro Cycle?

Welcome to the March edition of Beyond the Block. We started off the year by acknowledging that 2025 may be far more difficult to trade than 2024, boy were we correct. Since February, risk assets such as the NASDAQ and Bitcoin have taken a real beating and to be fair, there are certainly enough reasons for the beating to be justified.

The Trump and Bessent administration have been quite active in the media in recent weeks, and they have not been afraid to publicly state their intentions of bringing down the deficit and balancing world trade in favour of the United States. Bessent has proposed an ambitious 3-3-3- policy which includes real GDP growth of 3%, reducing the budget deficit to 3% of GDP and boosting oil production by 3 million barrels per day by 2028.

Unfortunately, achieving or at least attempting to achieve these objectives causes uncertainty in the markets. These policies have a negative impact on the economy in the form of lower growth and inflation. What started off as tariffs being used as ‘negotiating tactics’ have quickly become more serious and long-lasting. Add into the mix Treasury Secretary Bessent making statements such as wanting to “detox the economy” and the “stock market is not the priority”, and you end up with a cocktail of uncertainty.

We believe the real reason behind these policies is to get bond yields down to a much lower level during the first year of the Trump presidency. There is close to US$9.3 trillion worth of debt maturing in the second half of 2025 and the government would like to refinance this debt with a longer duration debt instrument, instead of the abnormally large issuance of short-dated bills the Biden administration undertook over the past two years.

That being said, our macro indicator has remained in ‘Mid Cycle’ with liquidity, growth and inflation still at reasonably elevated levels. There may be some hiccups along the way, but we do not believe this Is the end of the cycle. More on this later.

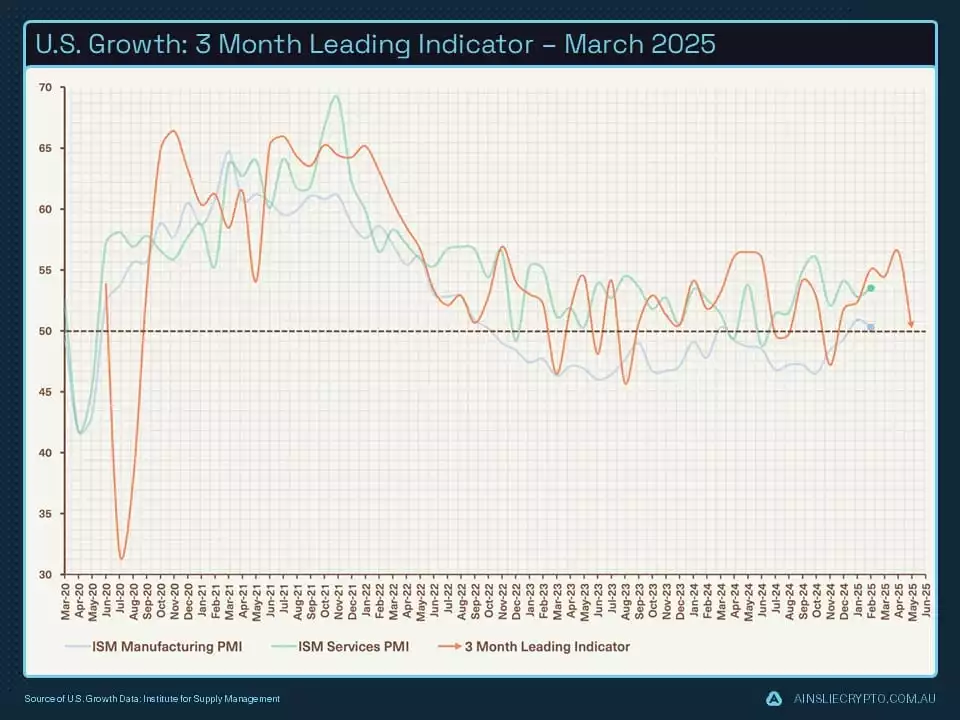

U.S. economic growth, as measured by the ISM data, is a useful tool to forecast the trajectory of the economy moving forward. Last month we saw a sharp rise in our leading indicator which was driven by front-loading of inventories before tariffs come into effect on April 2nd. The leading indicator has since collapsed back to near neutral where it will likely continue to chop around until business confidence grows. The worst-case scenario is likely already priced in with business confidence potentially getting close to a bottom.

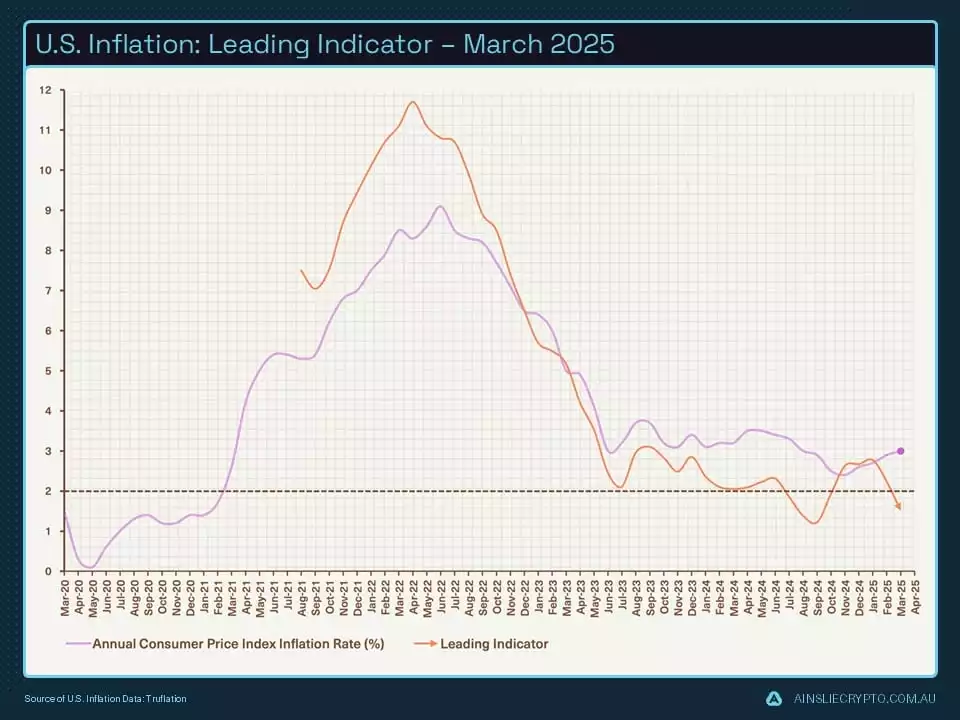

Inflation continues to fall on our leading indicator, we have maintained that inflation will not be a problem at this point in the cycle and with CPI and PPI coming in lower-than-expected last week we expect this inflation to remain subdued at least until the business cycle is back in full swing. Now some will argue that tariffs will lead to higher inflation, while this may be true, tariffs are a one-off price hike on consumers which is very different from an imbalance in supply and demand like what we saw through COVID-19. Additionally, factors such as falling consumer confidence and lower oil prices should more than offset the inflationary effects of tariffs as the economy slows.

Where are we currently in the Global Liquidity Cycle?

We’ve decided to include the Bitcoin sensitivity chart once again this month as a reminder of why we have selected Bitcoin as our investment vehicle. It shows the degree of sensitivity for every 10% expansion in liquidity. The S&P, which is the global benchmark for stock portfolios, moves around 12% for every 10% rise in liquidity so you’re only just keeping your head above water. Since its inception, Bitcoin has done a 9x multiplier (red bar) for every 10% rise in liquidity which is why we call it ‘the fastest horse’. The multiplier has been reduced over the past 18 months as Bitcoin’s market cap has grown into the trillions, now ‘just’ a 5x multiplier (orange bar) for every 10% growth in liquidity.

While markets are in turmoil, we still don’t believe this is the end of the liquidity cycle. Following our framework, liquidity is not exactly taking off, but it certainly isn’t collapsing to the downside. This gives us confidence the cycle top has not yet been reached. If we have already seen the top, it would be the shallowest cycle top on record, and we just don’t believe that’s what we are seeing.

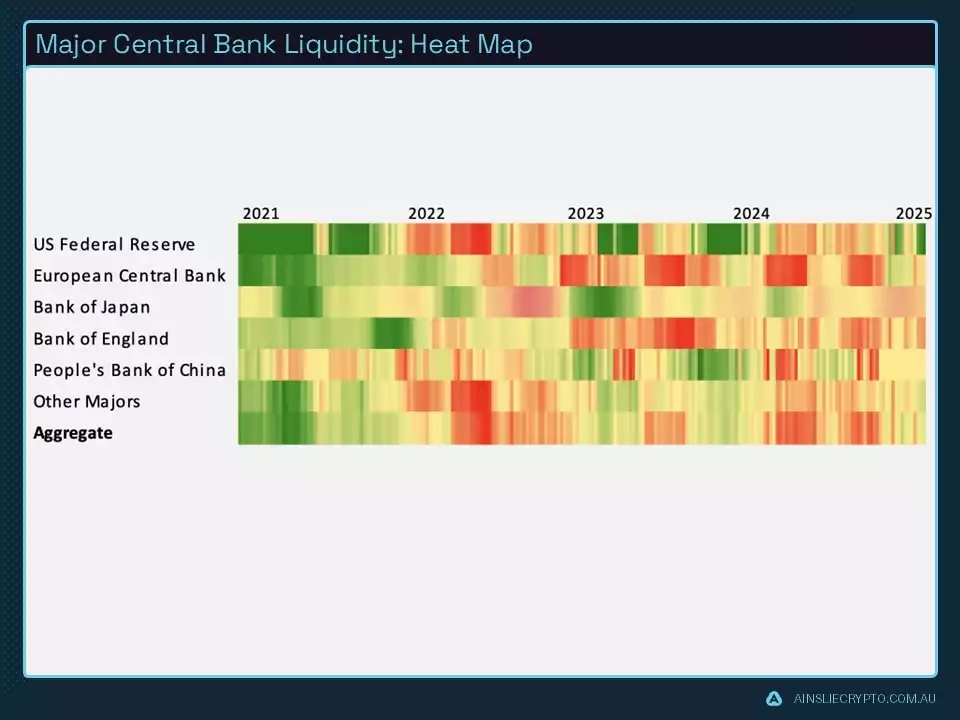

Following on from the previous statement, central banks have yet to play a major role in providing liquidity to global markets this cycle. We know that at some point, a truckload of debt needs to be refinanced, and central banks will need to step up their liquidity support. The question is, will this occur before or after a mini-crisis?

The Fed have recently been adding liquidity to the tune of US$360 billion via drawdown of the Treasury General Account. There is currently US$500 billion left in this account however with tax season in the U.S. just around the corner, we expect a negative liquidity impact as money moves from the banking system into the Treasury General Account.

On a positive note, our liquidity momentum indicator has also continued on its upward trajectory thanks mostly to a weakening U.S. Dollar in recent weeks. While we are quite sceptical that the large move to the downside in the U.S. Dollar will continue at this pace, it does allow breathing room for foreign governments like Europe and China to devalue and stimulate their own economies. This devaluation would provide a positive impact on Global liquidity, though it is important to remember the lag effect between when liquidity rises and its effects on asset prices.

As investors, this is where our resolve is tested. Global liquidity is reasonably stable, yet markets are clearly rattled by escalating uncertainty. Of course, there is always the possibility of another leg down, in fact, we are arguing that’s what needs to occur in traditional markets to see a policy change (more on that in the next section). In saying that, our future selves are highly likely to not be disappointed accumulating Bitcoin in the low 80 thousand region.

The market IS the economy

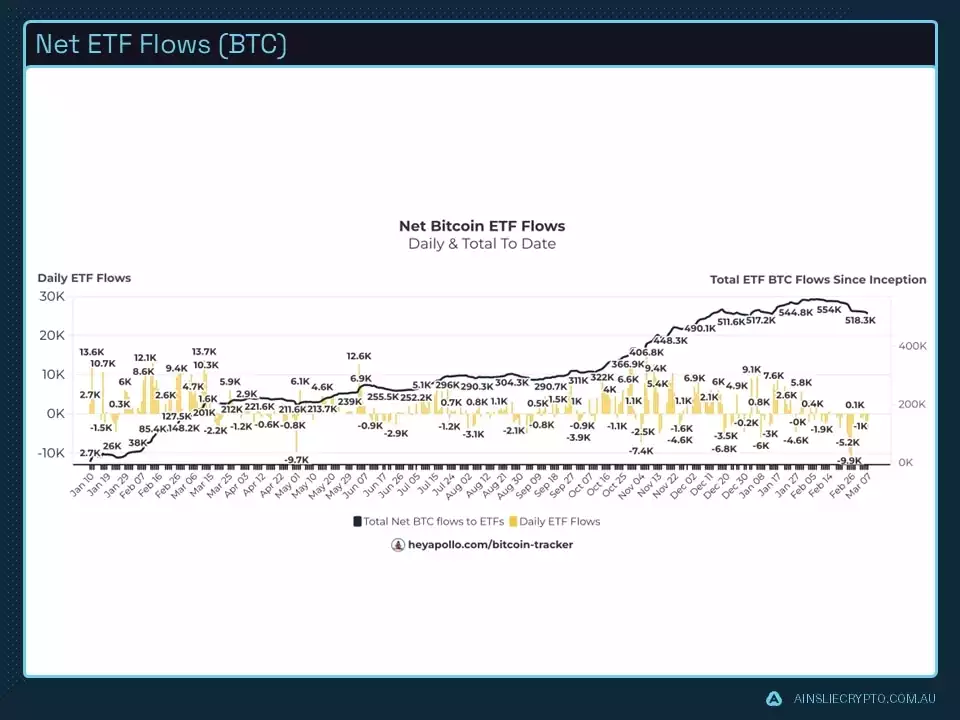

Bitcoin ETF data is back this month with some heavy outflows over the past couple of weeks, down from 560k to 510k net inflow. A falling price spot price has clearly shaken some investors, though we suspect most of those flows are due to the collapse in premiums and therefore the ‘basis trade’ unwind which we have discussed in previous articles.

Getting back to macro. The next few charts are less about Bitcoin and more so about the stock market's impact on the U.S. economy. Readers may ask why we are focusing so much time and energy on data that doesn’t have a clear connection with Bitcoin. It is important to remember that Bitcoin is very much a ‘macro asset’, more so now than it’s ever been before. In our eyes, macro is Bitcoin and Bitcoin is macro.

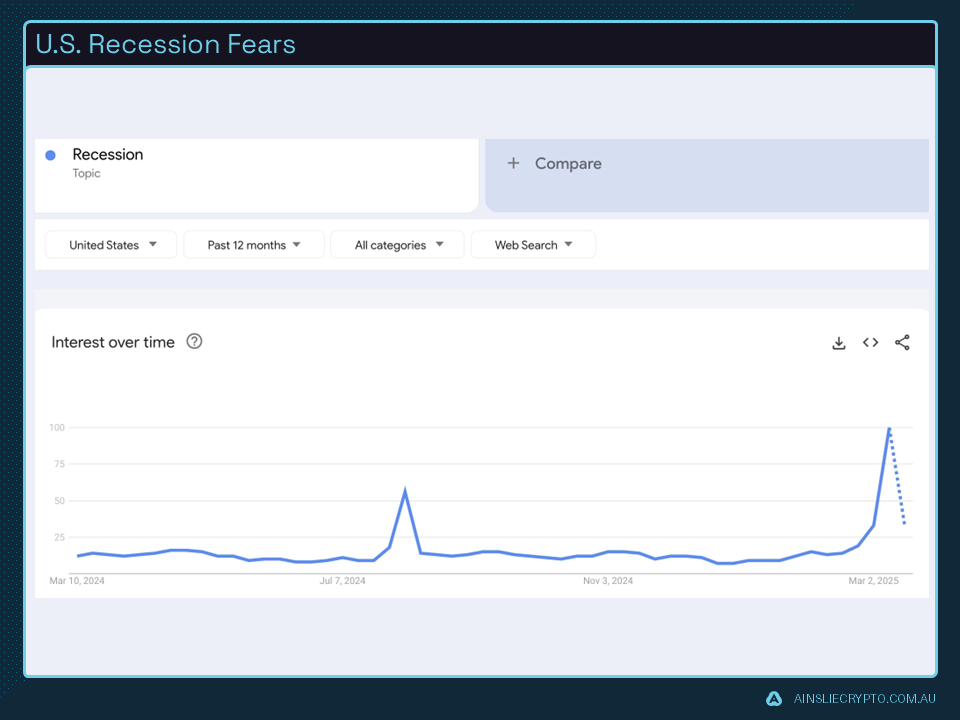

So, sentiment is saying there is a lot of fear in the economy as well as the markets with Google searches for “recession” exploding. To be clear, we don’t think the U.S. is going to go into recession, that would take a remarkable amount of job losses and economic pain which the Trump administration is highly likely not willing to tolerate. The question is, does an economic slowdown become a self-fulfilling prophecy as consumers cut back on spending, and can confidence be regained if the Trump administration decides to all of a sudden pivot back to stimulatory policies to get the economy going again?

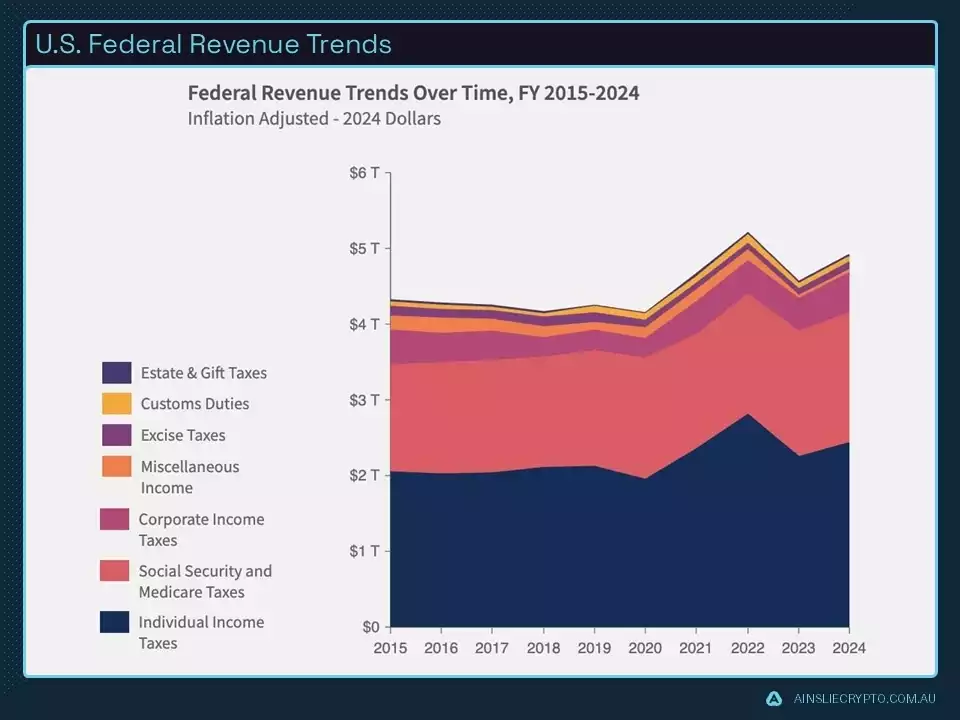

The correlation between tax receipts and asset prices is another reason we believe the U.S. economy won’t be allowed to fall into recession. A recession would be disastrous for the U.S. stock market, falling asset prices would have a hugely negative impact on income tax revenue which makes up 53% of all taxes collected. Just take a look at the large dip in early 2023 after the stock market peaked in late 2021 and fell all the way through 2022. Destroying financial markets and reducing revenue is not the most efficient way to ‘balance the budget’.

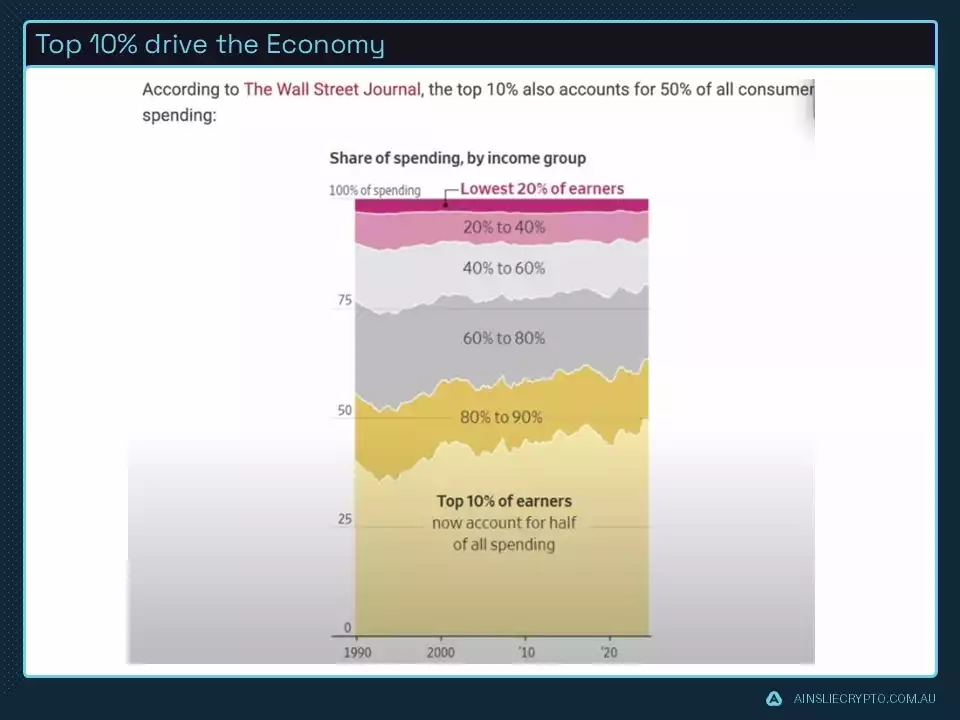

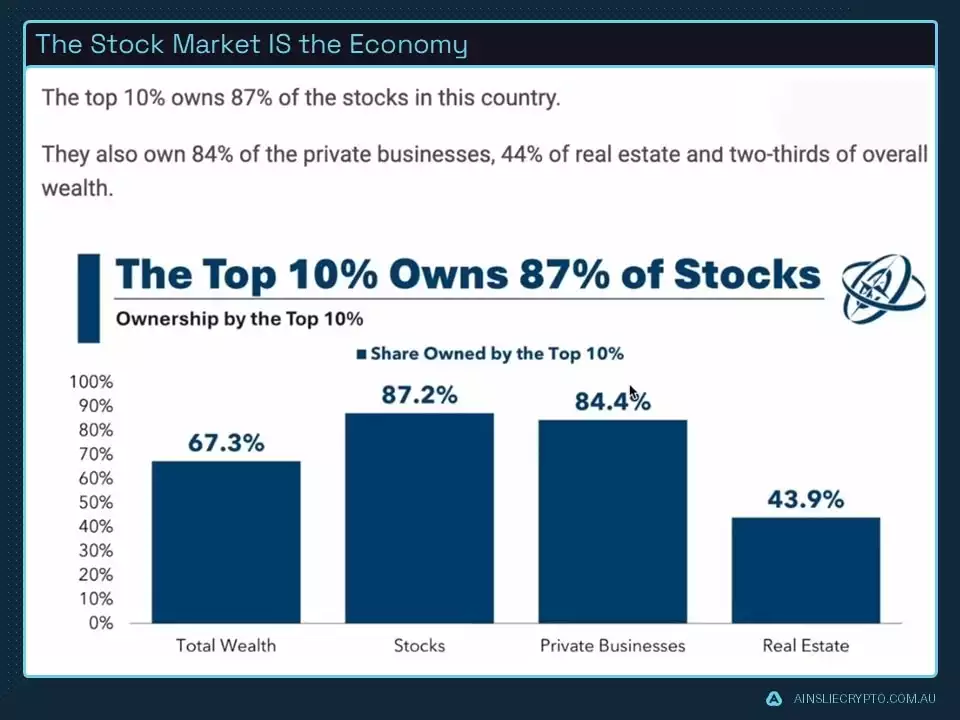

Making up nearly 50% of all consumer spending is the top 10% of earners. Whether we like it or not, a small cohort of the population is what’s driving the economy.

And guess what, these are the same people who own the majority of the stock market, 87% in fact! So, if the stock market is plummeting and the biggest consumers in the economy start seeing their net worth eroding away, I think it’s fair to say they are going to become more conservative in their spending habits which further exacerbates the negative impact on the economy.

Conclusion

With liquidity stable and likely to remain stable in the near future, where does this leave the Bitcoin market? For those with a long-term time horizon, post 30% correction is always a good time to add unless we’ve entered a bear market which we don’t believe to be the case. Are there still risks to the downside? Of course, particularly when the Trump administration appears somewhat unfazed by the recent sell-off in risk assets. What matters is how much more pain in the markets they are willing to tolerate before it starts to negatively impact the desired goal of reducing the government deficit. We happen to think IF there was to be another significant leg down in the markets, that’s where we would see a pivot from the Trump administration or possibly even the Fed. That would be the time to really be backing up the truck on risk assets.

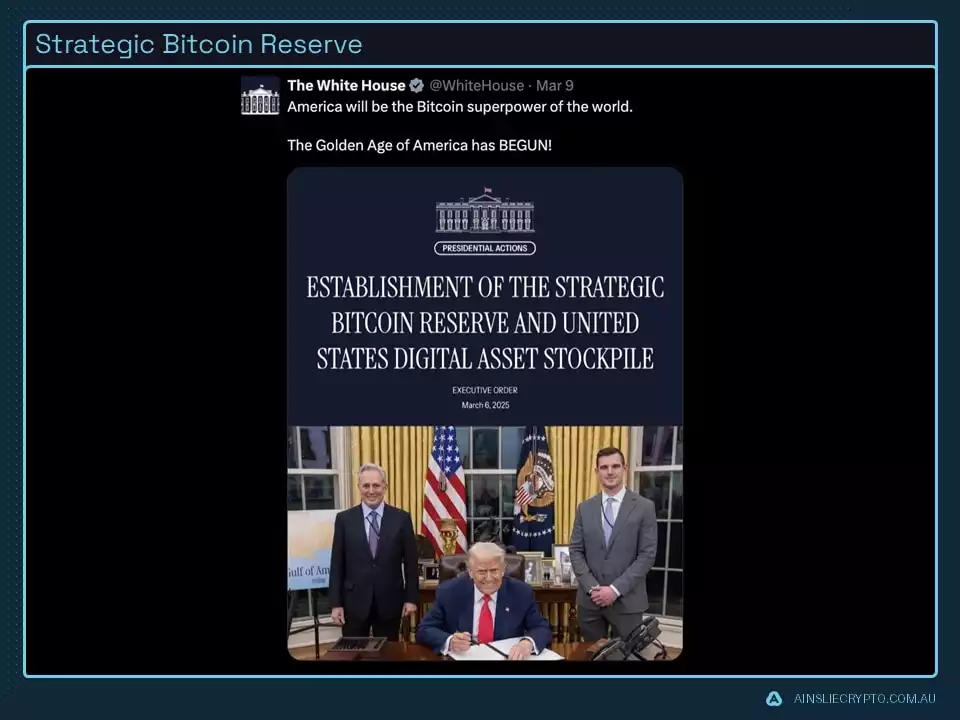

We leave you this month with a final observation. It wasn’t that long ago the anti-Bitcoin army's main argument revolved around Bitcoin itself being intrinsically worthless and the likelihood of governments banning it. With the introduction of the Strategic Bitcoin Reserve, it’s fair to say at least one if not both of those arguments have been completely dismissed, at least in the eyes of the U.S. government. The price action that followed this announcement was not what most investors had hoped for and has since driven sentiment to new lows. Do not be fooled, in the long run, the SBR is a huge deal. All regulatory risk has been stripped away, states within the U.S. are currently adopting their own Bitcoin accumulation strategies and the rest of the world is sure to follow. We are still in the early phases of mainstream adoption and though we may have a slightly bearish view in the short term, one thing is for sure, we are closer to the bottom than we are to the top.

Watch the full presentation with detailed explanations and discussion on our YouTube Channel here:

Until we return with more analysis next month, keep stacking those sats!

Joseph Brombal

Research and Analysis Manager

The Ainslie Group

x.com/Packin_Sats