BTC vs Gold: The Two Big Winners of 2023 with Bitcoin Leading the Charge

December 7, 2023

In this latter part of 2023, Bitcoin achieved a noteworthy milestone by crossing the significant US$40k mark. This achievement not only highlights the extraordinary year that Bitcoin has experienced but also cements its position as a standout performer in the global asset landscape.

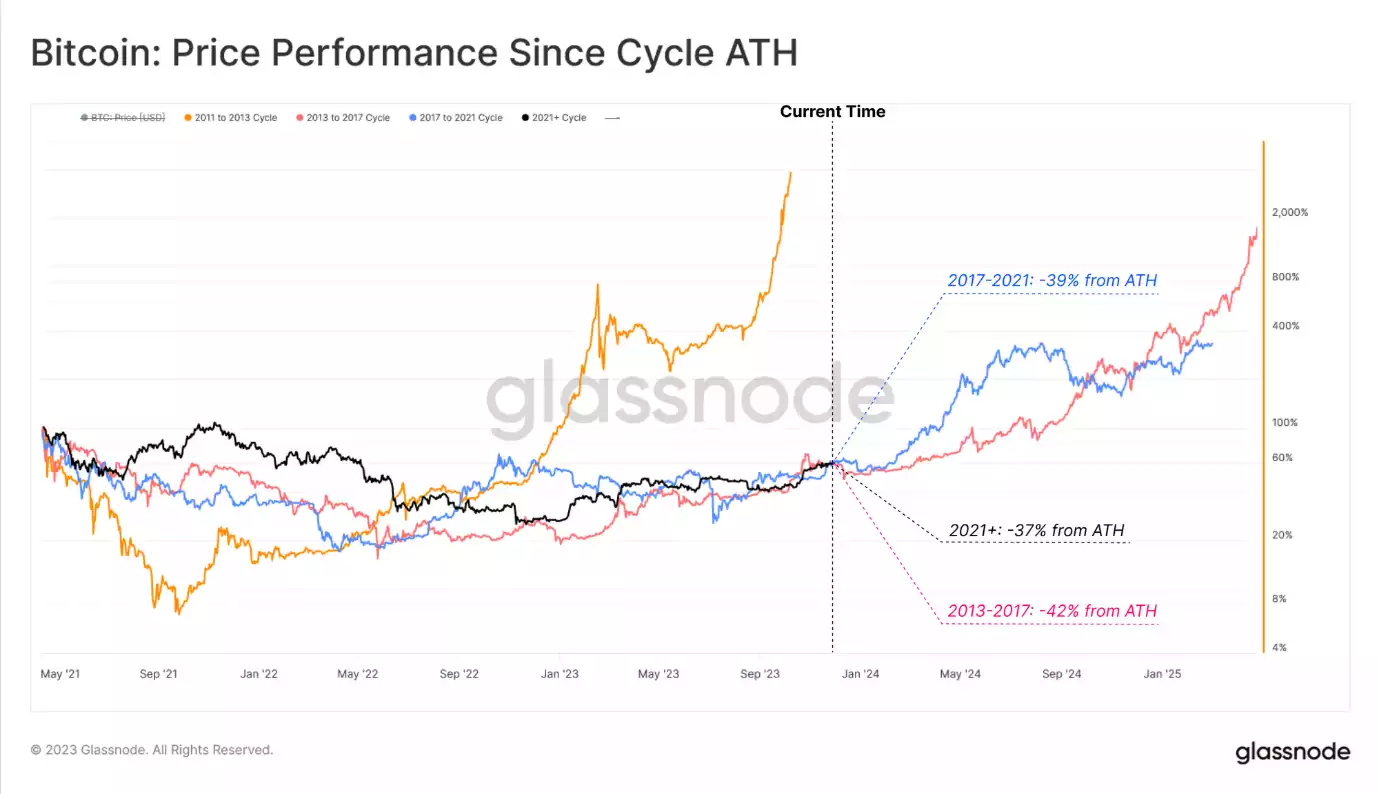

This year’s stellar performance closely echoes the recovery patterns and trajectory of past Bitcoin cycles, particularly those of 2015-17 and 2018-22. These similarities, especially in recovery duration and drawdown from the All-Time High (ATH), offer intriguing insights into Bitcoin’s market dynamics and resilience. This upswing has positively influenced investor sentiment, with a majority now enjoying profits. Market indicators are increasingly pointing towards an ‘enthusiastic uptrend’ phase, signalling a buoyant and optimistic mood in the Bitcoin investment community.

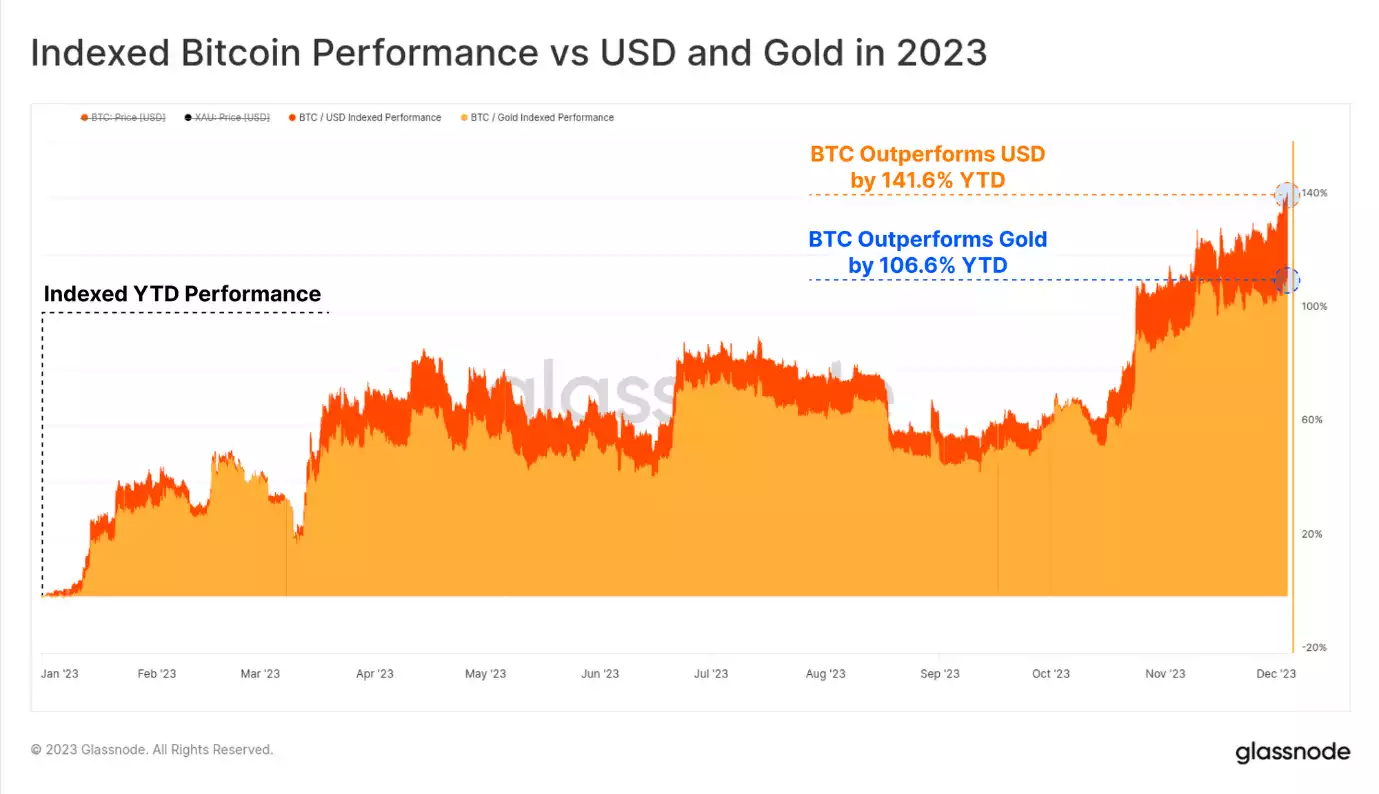

Today we wanted to take broader look at Bitcoin’s 2023 performance and draw comparisons with other assets and its own historical cycles. In this context, it’s interesting to note gold’s performance; it too reached new all-time highs by crossing the $2,110 mark against the USD, setting a historical peak for gold against all fiat currencies.

However, when we index Bitcoin’s performance to the beginning of the year, its outperformance becomes even more pronounced. Bitcoin’s rise against the USD stands at an impressive +141.6%, while against gold, it showcases a notable +106.6% increase.

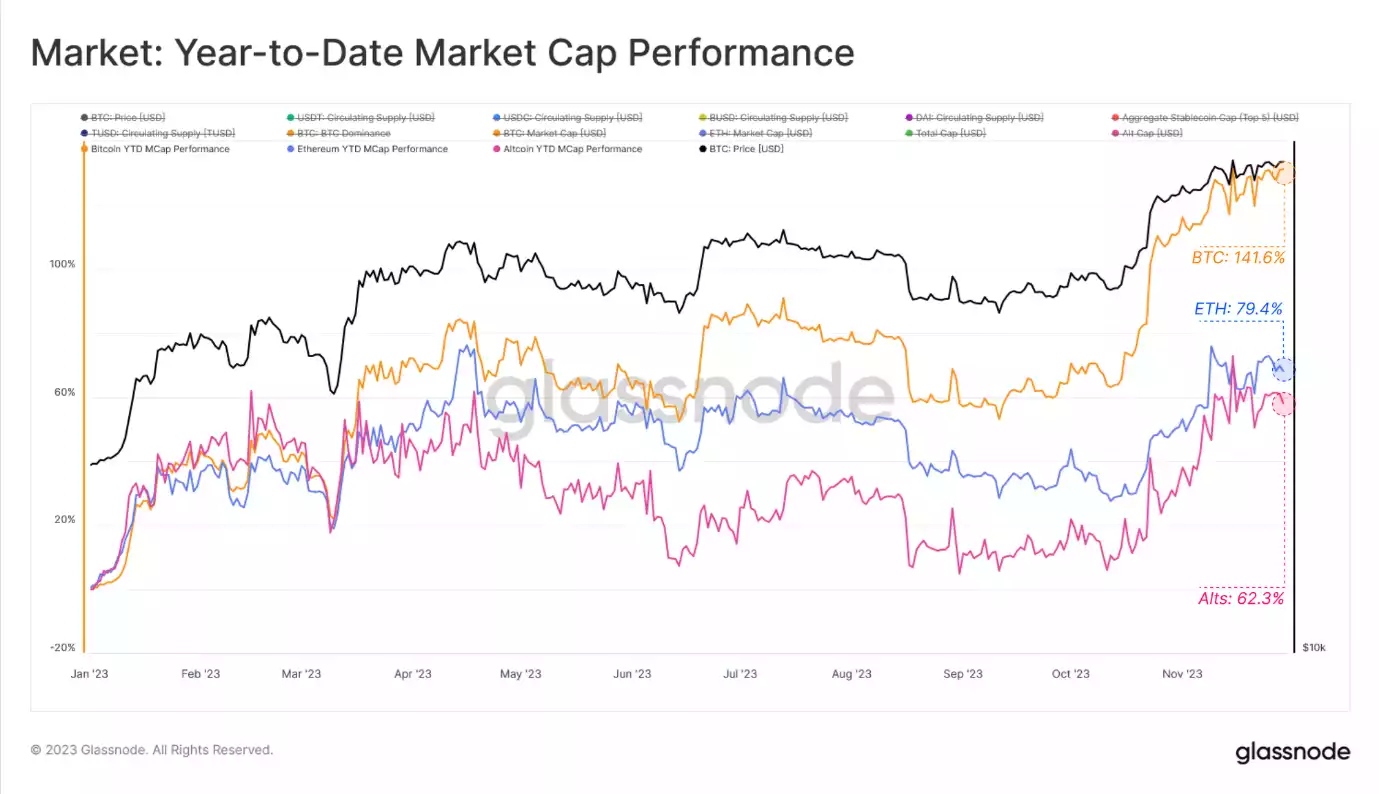

Looking to the rest of the digital asset sector; Ethereum, while also experiencing substantial growth, has not matched Bitcoin’s meteoric rise. It has recorded a commendable YTD increase of +79.4%, indicating significant investor interest and market confidence. However, this growth, while noteworthy, still lags behind the strides made by Bitcoin.

When we turn our attention to altcoins, excluding Ethereum and stablecoins, we witness another arena of notable growth. These assets have collectively posted a YTD increase of +62.3%. This growth, although not as staggering as Bitcoin’s, is indicative of a broader positive trend within the digital asset sector.

This particular point in time emerges as an important reference for several reasons. Firstly, this period is marked by heightened market sentiment, with investors and market observers displaying an overwhelmingly enthusiastic and positive outlook towards Bitcoin. This optimism was not just confined to seasoned crypto enthusiasts but was also increasingly evident among new entrants to the market.

April 2021 stands out as a significant moment for Bitcoin in terms of adoption rates. This period witnessed a remarkable surge in the number of Bitcoin users, signalling a shift towards mainstream acceptance. It wasn’t just the growing numbers but also the diversity of the new entrants that underscored Bitcoin’s widening appeal.

Since the lows experienced in November 2022, following the FTX crisis, Bitcoin has demonstrated a remarkable resurgence. Prices have soared by an impressive +146%, a significant recovery showcasing the asset’s resilience and enduring appeal.

When this performance is placed in the context of previous cycles, it becomes even more noteworthy. This +146% increase over approximately one year marks the strongest return in comparison to the last two cycles. To put it into perspective, during the 2015-18 cycle, Bitcoin witnessed a +119% increase from its cycle low. Similarly, in the 2018-22 cycle, it experienced a +128% rise. These figures, while substantial in their own right, are eclipsed by the latest surge in Bitcoin’s value.

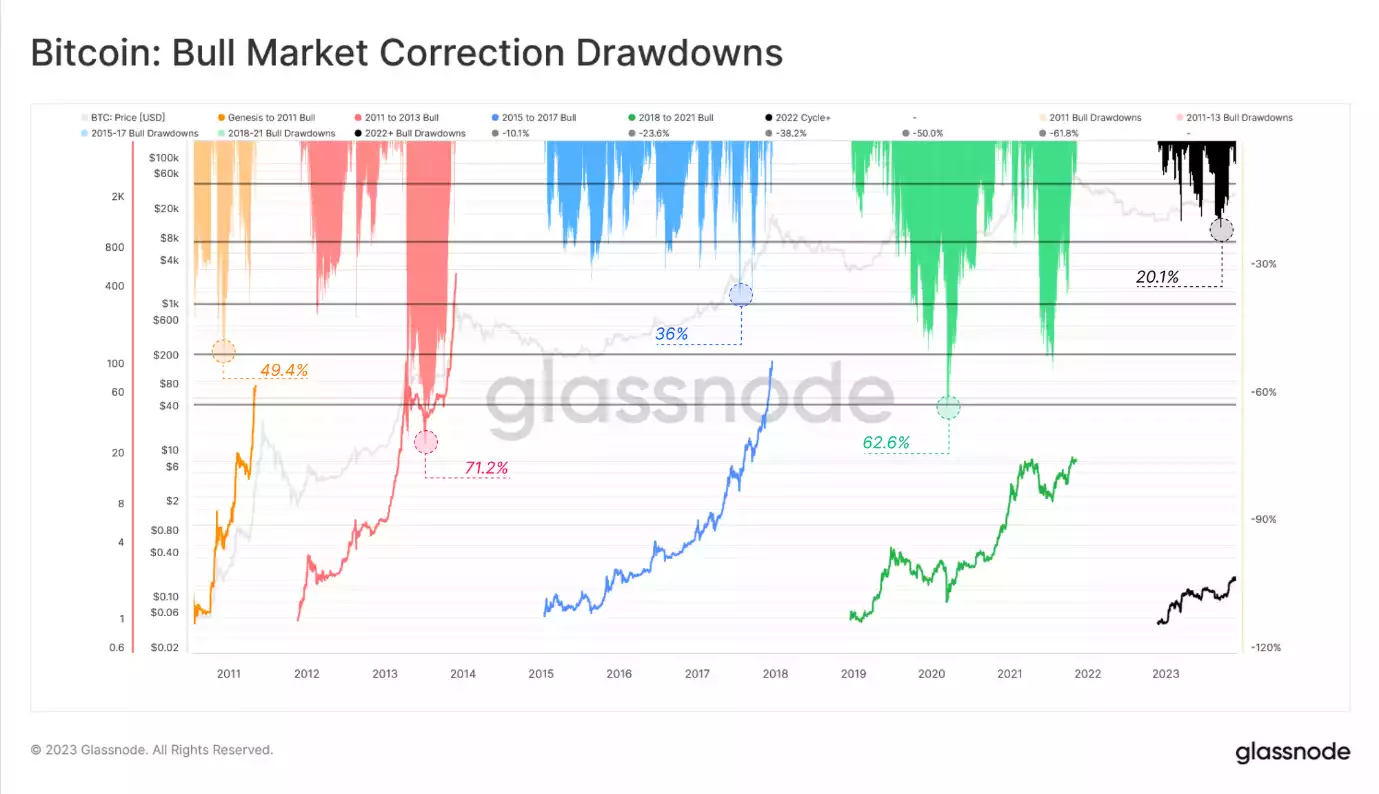

To put this into perspective, the 2016-17 bull market, a period known for its vigorous growth, experienced more significant corrections, often exceeding -25%. Even more striking was the 2019 market, where a notable pullback occurred, with the market retracting over -62% from its July high of around $14k.

The relatively shallow depth of corrections in 2023 indicates a robust underlying demand supporting Bitcoin’s price. This is further reinforced by the increasingly tight supply dynamics observed in the market.

To sum everything up, Bitcoin is placing itself ahead of traditional assets like gold and maintaining its edge over other digital currencies. This remarkable growth has more than doubled Bitcoin’s value compared to gold, reinforcing its position as a dominant player in the digital asset space.

In light of Bitcoin’s recent price surge, a vast majority of its holders are currently in a profitable position. A select group among these investors has begun to capitalise on this uptrend, realising their gains. This profitability trend among Bitcoin holders underlines the asset’s robust performance and its appeal as an investment.

The market’s momentum, as indicated by recent rally signs and on-chain metrics, points towards a significant shift. We’re witnessing a transition from what could be described as a ‘transitional recovery zone’ into a phase characterised by bullish enthusiasm.

These trends paint a promising picture for Bitcoin’s future, suggesting a market that is not only growing but doing so with increasing vigour and stability.

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Connect with Ainslie Crypto’s team at 1800 AINSLIE or via info@ainsliecrypto.com.au. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie have been a trusted dealer and custody provider for Gold 1.0 for 50 years and bring the same service to Gold 2.0, Bitcoin, since 2017.

In an era where traditional banking systems impose increasing limitations, Ainslie Crypto offers a forward-thinking payment solution with our Australian Digital Dollar (AUDD) platform. Developed by Novatti, AUDD allows you to navigate beyond the constraints of conventional financial systems, offering stability, security, and ease in your crypto transactions.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provide swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.