BTC Surges, On-Chain Profit-Taking Stays Subdued

November 23, 2023

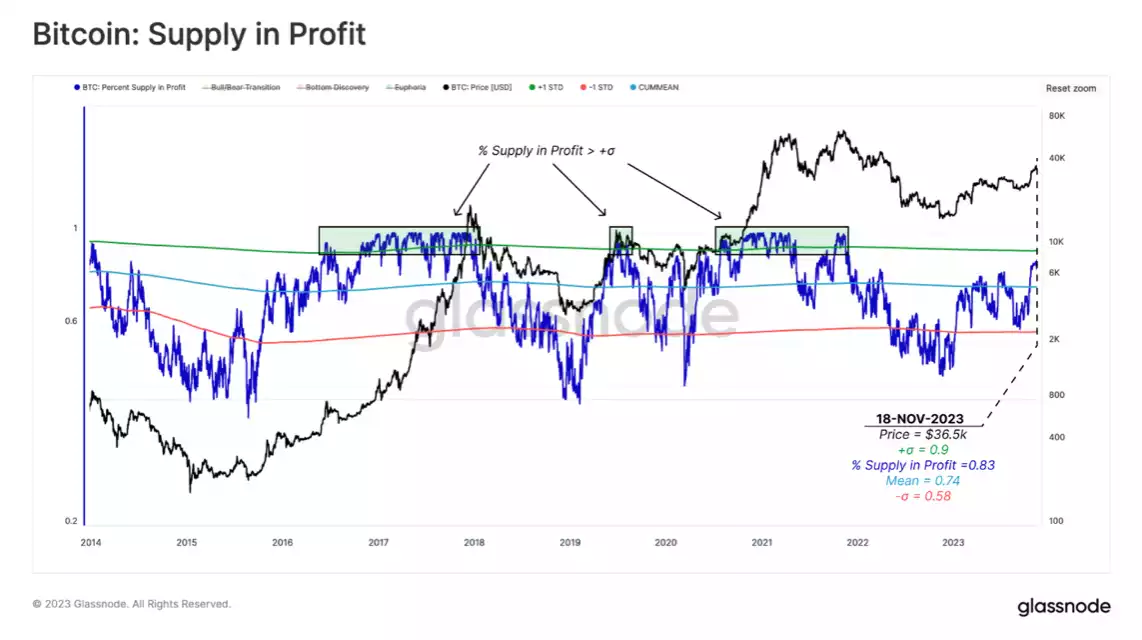

Currently, a staggering 83.6% of Bitcoin’s supply is in profit, a figure echoing the near-all-time highs of November 2021. This reluctance of long-term holders to liquidate their holdings at these levels indicates a prevailing sentiment of holding strong in the market. Complementing this, Bitcoin’s robust price performance, trading near year-to-date highs of over US$37.9k, fortifies its bullish position.

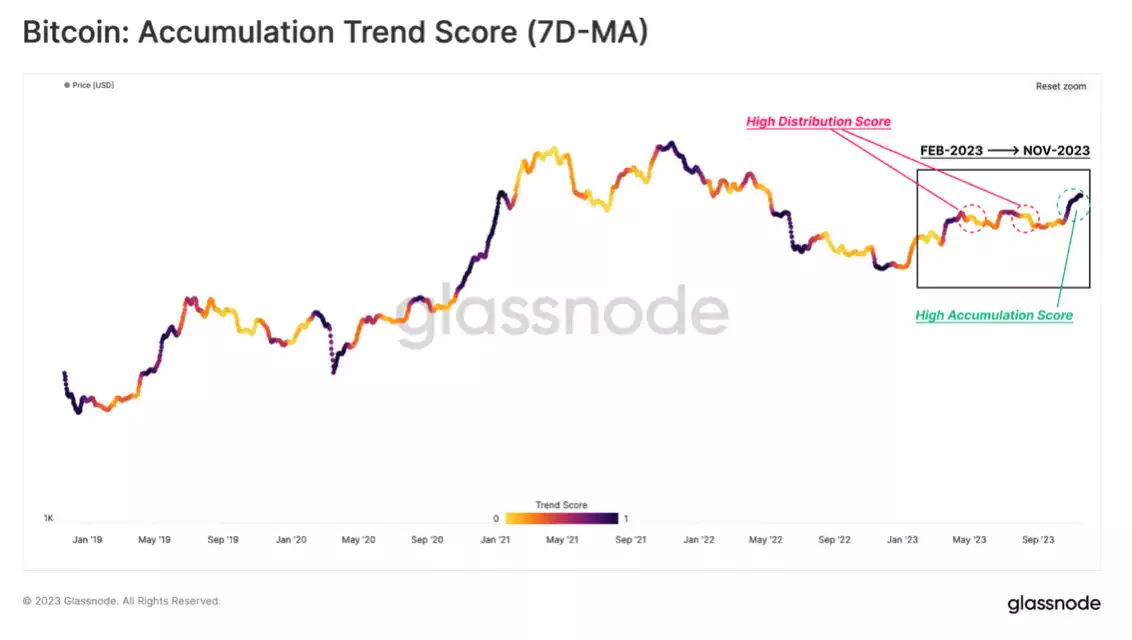

To gauge this behaviour more accurately, we utilise the Accumulation Trend Score. Interestingly, the current Bitcoin rally is marked by stronger accumulation patterns compared to earlier surges witnessed in 2023. This enhanced accumulation is a marked difference from the first two rallies of the year, suggesting a more robust and sustained investor interest. The Accumulation Trend Score indicates a significant regime of accumulation (denoted by darker shades in the metric’s visualisation) coinciding with the recent uptick in Bitcoin’s price. This trend aligns with the remarkable +39% price increase Bitcoin has experienced over the past 30 days, indicating that the current price surge is backed by solid investor commitment – buoyed by a clearer macroeconomic environment.

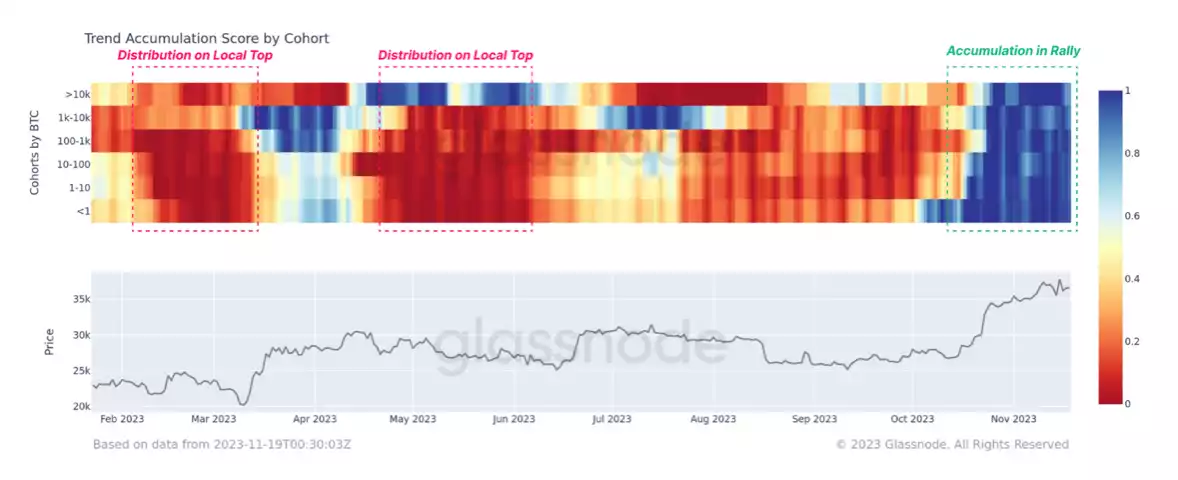

Since the tail end of October, there’s been a distinct uptick in holdings for investors of all wallet sizes, a trend visually represented by a series of blue indicators (below). This suggests a widespread, inclusive wave of accumulation across the board.

Interestingly, the recent broad increase in accumulation across all cohorts appears to be closely tied to the strong market performance witnessed lately. Additionally, the growing optimism around the potential approval of a spot BTC ETF in the U.S. has infused a new level of confidence among investors. These factors seem to be fuelling improved market sentiment and bolstering the belief in a continued upward trajectory for Bitcoin.

A notable aspect of this rally is the significant portion of Bitcoin’s circulating supply now held in profit – an impressive 83%. This figure is not just a number; it’s well above the all-time mean value of 74% and is inching closer to the upper band of +1 standard deviation, which is set at 90%.

Historically, when the percentage of Bitcoin’s supply in profit trades above the +1 standard deviation mark, it’s often seen as an early indicator of the market transitioning into what is termed the “Euphoric phase” of a bull market. This phase is characterised by heightened investor optimism and potentially aggressive market movements. The current trend could be signalling an optimistic period ahead for Bitcoin investors, suggesting that we might be on the cusp of another exciting phase in the cryptocurrency market. If that’s the case, strap in!

As we reflect on the recent price rally in the Bitcoin market. This scenario mirrors the situation seen two years ago, following the all-time high of November 2021. However, despite the positive movement in Bitcoin prices, it’s crucial to note that the magnitude of unrealised profits – the profits existing only on paper as the market price surpasses the purchase price – remains relatively modest.

This modest level of unrealised profits seems to be insufficient to persuade long-term Bitcoin holders to sell and secure these gains. This indicates a strong conviction among these investors, who appear to be looking beyond short-term gains towards a more substantial future growth.

The implications of this behaviour for the market are noteworthy. The steadfastness of long-term holders in not liquidating their holdings contributes to maintaining a tight overall supply of Bitcoin in the market. This, in turn, could play a pivotal role in influencing future price dynamics. Such a trend suggests a growing confidence in the long-term value of Bitcoin, potentially signalling a healthy and maturing market outlook.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.