Analysts Eye AU$402,950 Bitcoin Target Amidst Technical Signals

Posted on 09/05/2024 | 1503 Views

Analysts are projecting that Bitcoin could soar to AU$402,950 (US$265,000) once its current phase of consolidation concludes. This anticipation is derived from observations of Bitcoin's network fundamentals, which suggest the potential to triple its market cap relative to the last cyclical peak, according to Ki Young Ju, CEO of a prominent on-chain and market analytics firm.

On May 8, Young Ju highlighted on X the noteworthy rise in Bitcoin's hash rate to market cap ratio throughout 2024, indicating increased market activity and heightened investor interest. This ratio, which measures mining activity growth relative to market size, could underpin a stable Bitcoin value at AU$402,950 (US$265,000).

Source: Source: CryptoQuant

Source: Source: CryptoQuant

Exploring this further, the analysis draws attention to a substantial bullish pattern identified on Bitcoin's weekly chart—a large cup-and-handle formation. This classic technical pattern predicts a continuation of the bullish trend, projecting a potential rise to AU$416,810 (US$273,693). Such a target underscores an optimistic market sentiment, further fuelled by Bitcoin's recovery post-consolidation.

Source: Crypto Caesar

As of May 8, the discussion in the crypto community, particularly on platforms like X, revolves around these analyses. Crypto Ceaser, a notable analyst, aligns with Young Ju's interpretation, suggesting that the completion of this pattern could catalyse a rally toward unprecedented levels.

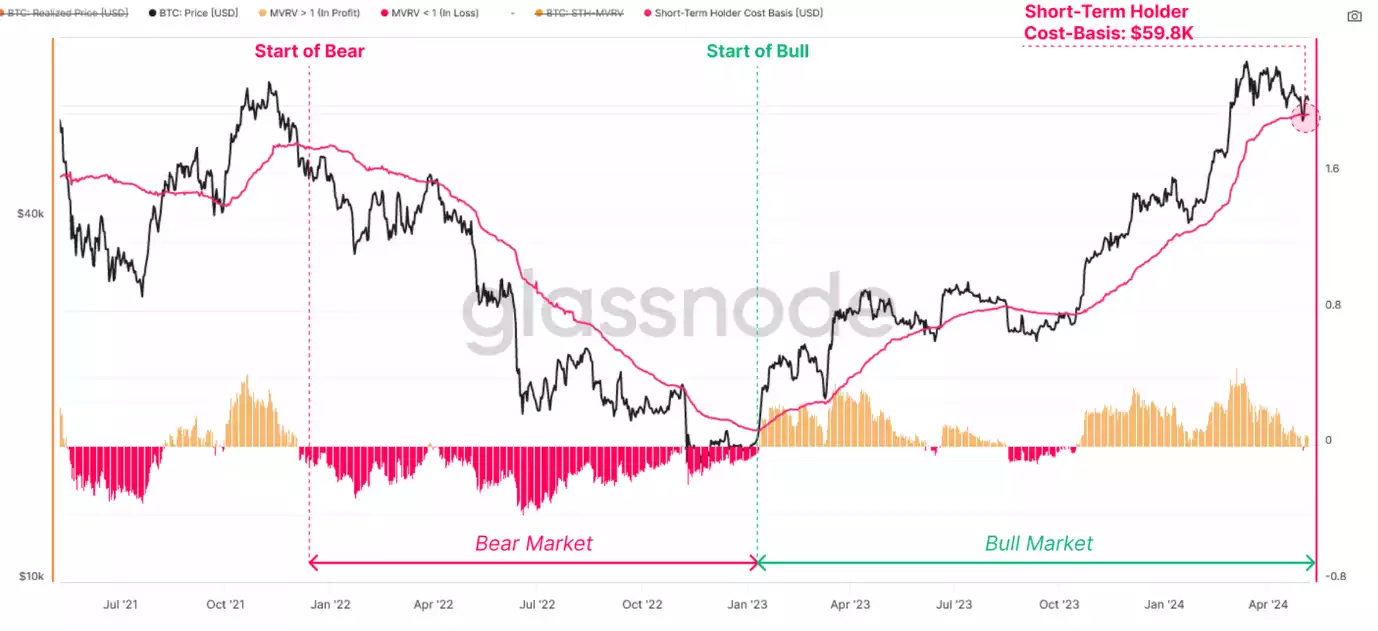

However, Bitcoin's ascent is contingent on maintaining key price supports. The cryptocurrency recently bounced back from a dip, stabilising around AU$93,400 (US$61,504). Analysts stress the importance of Bitcoin holding above the short-term holder price of AU$90,475 (US$59,500) to preserve its bullish stance. This level has historically acted as a strong psychological and technical support, bolstering Bitcoin during market corrections.

Further insights from Glassnode emphasise that Bitcoin's price corrections often find resilience at the short-term holder cost basis, a trend that has persisted over the past week. Bitcoin's ability to find support and rally after touching these critical levels could be indicative of underlying market strength and investor confidence.

Source: Source: Glassnode

Source: Source: Glassnode

In the broader context, the market anticipates the impact of upcoming economic indicators and Federal Reserve decisions, which could influence investor behaviour and market dynamics. As Bitcoin navigates these financial landscapes, the community remains watchful of key technical thresholds and macroeconomic triggers that could dictate the pace and extent of its next major price movement.

Analysts are closely monitoring Bitcoin’s ability to breach the AU$98,850 to AU$100,000 (US$65,000 to US$66,000) range, believing that surpassing this barrier could signal the start of a more substantial rally. They predict that if Bitcoin successfully overcomes these levels, it could swiftly climb towards AU$129,402 (US$85,000) and beyond before the end of the financial year.

This blend of technical analysis and fundamental insights paints a picture of a Bitcoin market at a critical juncture, poised for potential growth but dependent on several financial and economic variables that remain in flux.

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Join us here or connect with Ainslie Crypto's team at 1800 296 865 or via [email protected]. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie have been a trusted dealer and custody provider for Gold 1.0 for 50 years and bring the same service to Gold 2.0, Bitcoin, since 2017.

In an era where traditional banking systems impose increasing limitations, Ainslie Crypto offers a forward-thinking payment solution with the Australian Digital Dollar (AUDD) platform. Developed by Novatti, AUDD allows you to navigate beyond the constraints of conventional financial systems, offering stability, security, and ease in your crypto transactions.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provide swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.