WEEKLY CRYPTO ROUNDUP – XRP SEC CASE

July 20, 2023

Today, we delve into one of the most significant developments in the cryptocurrency arena – the ongoing Ripple case. This case has generated waves of discussion, as it shapes the understanding of digital assets and their regulatory standing.

Firstly, we dissect a recent Ripple ruling, shedding light on the current ambiguity of digital assets’ legal standing, as a result of legislative passivity. Celebrations by Ripple enthusiasts were observed last week as a verdict came in their favour in the three-year standoff against the SEC. Although the ruling bore some good news, its partial nature means it may not be applicable across the board; it doesn’t create a binding federal precedent and is likely to be appealed by the SEC. It also left many questions about digital assets unanswered.

The ruling tackled the ongoing question: do digital assets fall under existing securities regulations? The decision given was partial: sometimes they do. The enforcement actions by the SEC hinge on the Howey Test, a test that defines a security as an investment contract where buyers anticipate profiting from others’ efforts. Analisa Torres, a District Court Judge, ruled that not all XRP token sales by Ripple meet this criterion.

Torres indicated that while XRP sales to institutional investors fit the definition, as Ripple marketed it to them directly under that premise, XRP traded anonymously on crypto exchanges does not. The judgment offers a glimmer of hope for exchanges sued by the SEC for selling unregistered securities. Nonetheless, the court has not provided clear directions regarding the role of exchanges and custodians in the digital asset ecosystem under existing regulations.

Ripple CEO, Brad Garlinghouse, celebrated the ruling, claiming it dismissed the SEC’s allegations that nearly all tokens are securities and that it set a positive precedent for other digital tokens. Despite this, the ruling confirmed the SEC’s claim that Ripple sold $728MM of unregistered securities to institutional investors. This case is likely to proceed to trial.

The current state of affairs could lead to a multi-tier approach that protects sophisticated institutional investors but leaves retail investors unprotected, a cause for concern. A former SEC official, John Reed Stark, criticised the ruling for not adhering to the primary purpose of securities laws: to safeguard individual investors. Brian Quintenz, former CFTC Commissioner and now the head of global policy at ‘a16z crypto’, warns that this verdict results in more uncertainty for crypto entrepreneurs and builders. What is clear, though, is that comprehensive guidelines are needed as regulating crypto on a case-by-case basis could take years.

We also spotlight Google Play’s recent strategic move to include more NFTs. Google announced it would accommodate more blockchain-based digital content on Android-based apps and games — including NFT rewards — on Google Play. With an estimated 2.5 billion users, this broadens the scope for NFTs significantly.

In the roundup of crypto business developments, the U.S. SEC has agreed to review BlackRock’s Spot ETF proposal formally, a nod to the growing acceptance of cryptocurrencies in traditional financial institutions.

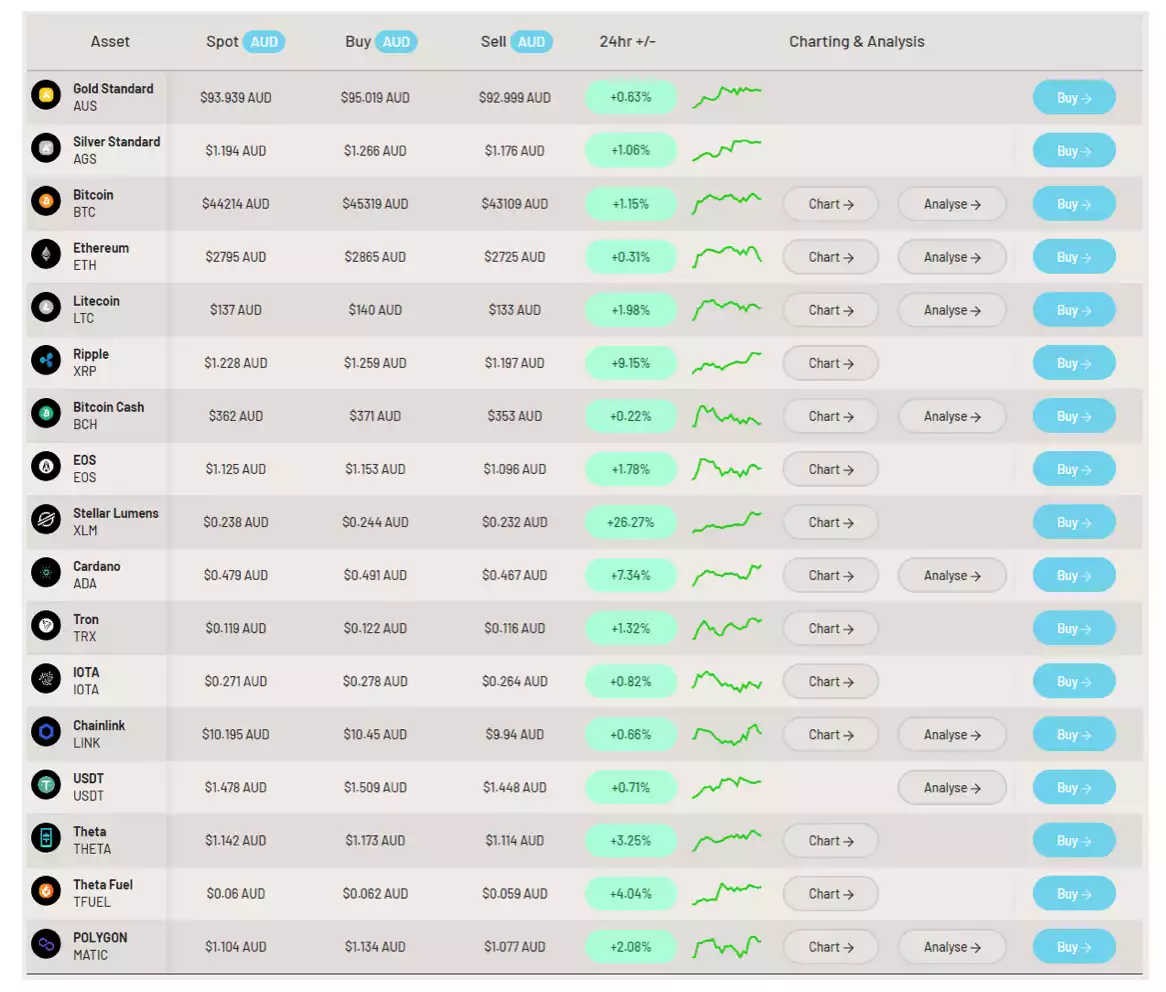

Finally, we take a look at the week’s market performance. While Bitcoin’s “BlackRock effect” waned, the “Ripple effect” saw investors and traders viewing the district court’s ruling as a bullish signal, pushing XRP up by 58.6%. Despite the short-lived rallies for BTC and Ethereum (ETH), altcoins like Chainlink (LINK) saw notable gains.

At Ainslie Crypto, we’re here to guide you through the dynamic, fast-paced world of cryptocurrency. We remain committed to being your trusted platform for buying digital assets, providing you with timely market insights and a secure, user-friendly environment for your crypto transactions. Stay tuned for more updates as we keep a finger on the pulse of the ever-evolving crypto world.

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.