UNVEILING THE QUIET STRENGTH OF THE 2023 CRYPTO MARKET

May 23, 2023

A Historic Narrow Trading Range

This week, the Bitcoin market remained surprisingly static, showcasing one of the most limited trading ranges in recent years, a phenomenon last observed in early 2023 and the post-COVID-19 recovery period in July 2020. Despite minor fluctuations, the trading price only swung between US$26.6k and $27.5k, marking a mere 3.4% difference.

Bitcoin’s on-chain trading volume has also seen a steep decline, all flows – aggregate, entity-adjusted, and exchange-related – hitting cyclical lows. Notably, a considerable part of Bitcoin’s supply has stayed inactive in investor wallets, which is suggestive of either a cautious or a long-term investment strategy. As a result, Bitcoin age bands, indicating the periods for which Bitcoin has been held, have hit all-time highs. This paints a picture of a serene yet steadfast Bitcoin market, reflecting deep-rooted investor confidence in the currency’s prospects in 2023.

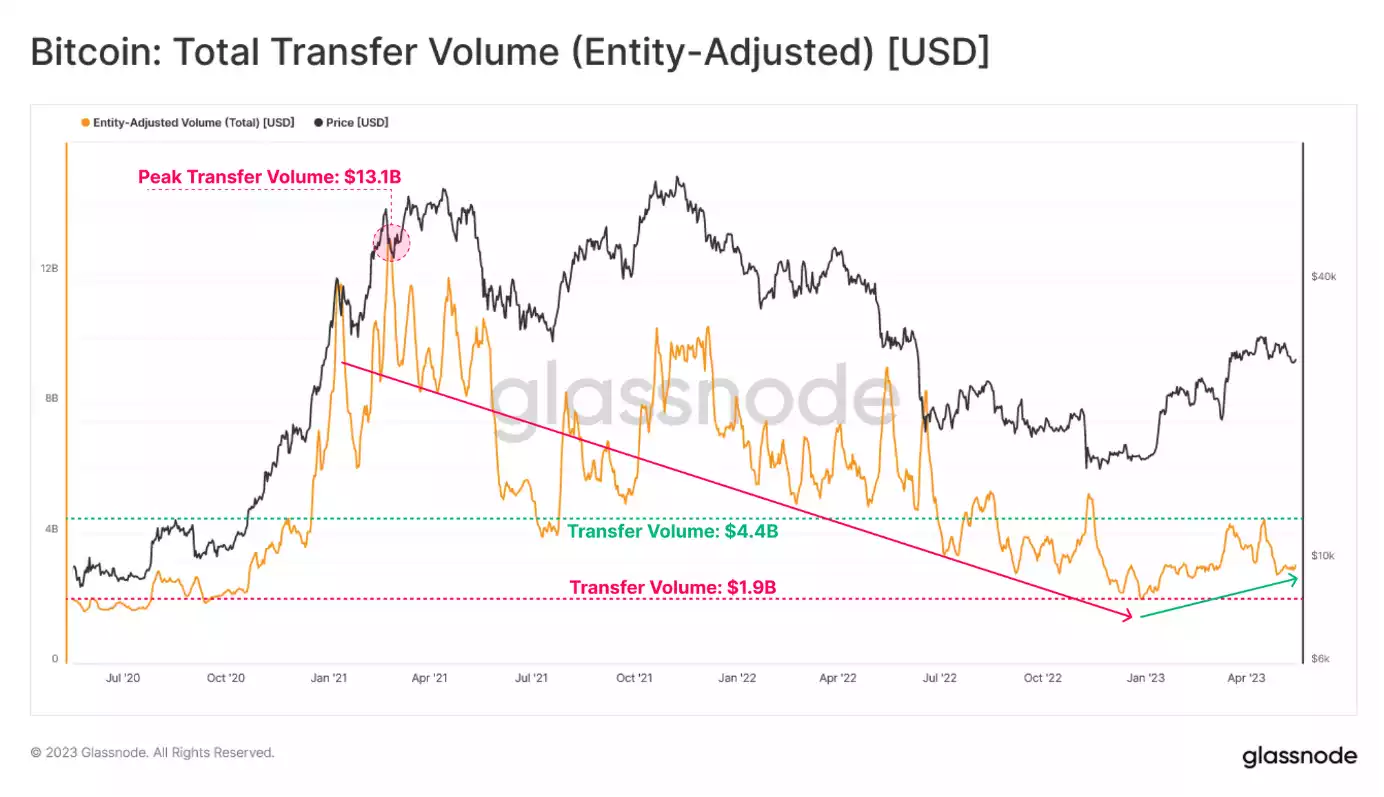

On-Chain Activity: Small Volumes, Big Moves

Despite the dwindling trading volume, Bitcoin’s on-chain activity is on the rise. The Bitcoin network is bustling with ordinals, inscriptions, and BRC-20 tokens (we discussed BRC-20 tokens in-depth here), even though they involve comparatively small Bitcoin volumes, typically around 0.0001 BTC. However, an overall decline in Bitcoin’s Transfer Volume over the past three years contrasts this surge in on-chain activity, dropping by 85.5% from a high of $13.1 billion in early 2021 to a low of $1.9 billion.

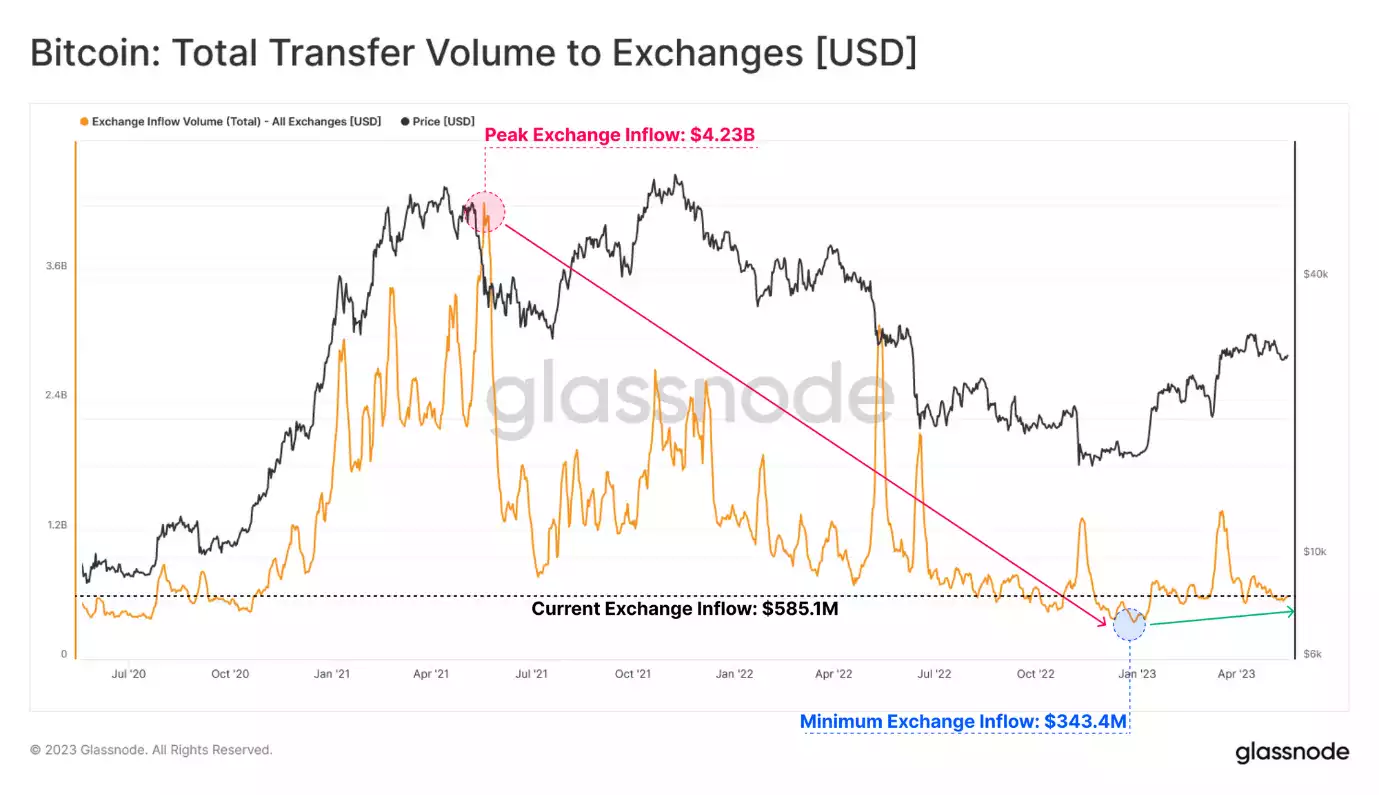

Bitcoin Exchanges: A Tale of Falling Deposits

Bitcoin exchanges provide critical insight into the market dynamics, particularly in terms of volume, market awareness, speculation demand, and investor confidence. However, there has been a remarkable 91.8% decline in the volume of Bitcoin deposits since it reached a peak of $4.2 billion in May 2021. The sharp decrease, now standing at a low of $343.4 million, suggests significant shifts in investor behaviour, warranting a deeper look into the implications of this trend on Bitcoin’s future.

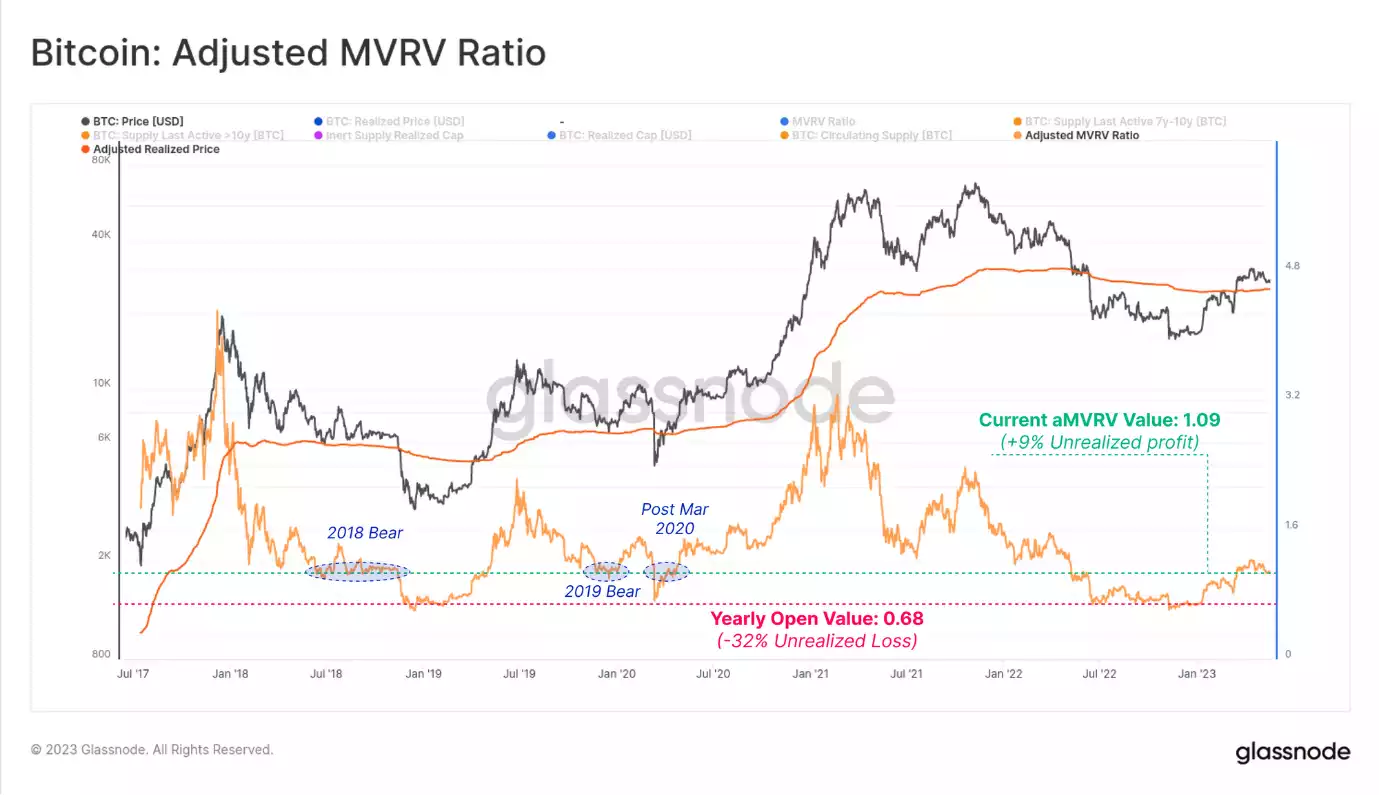

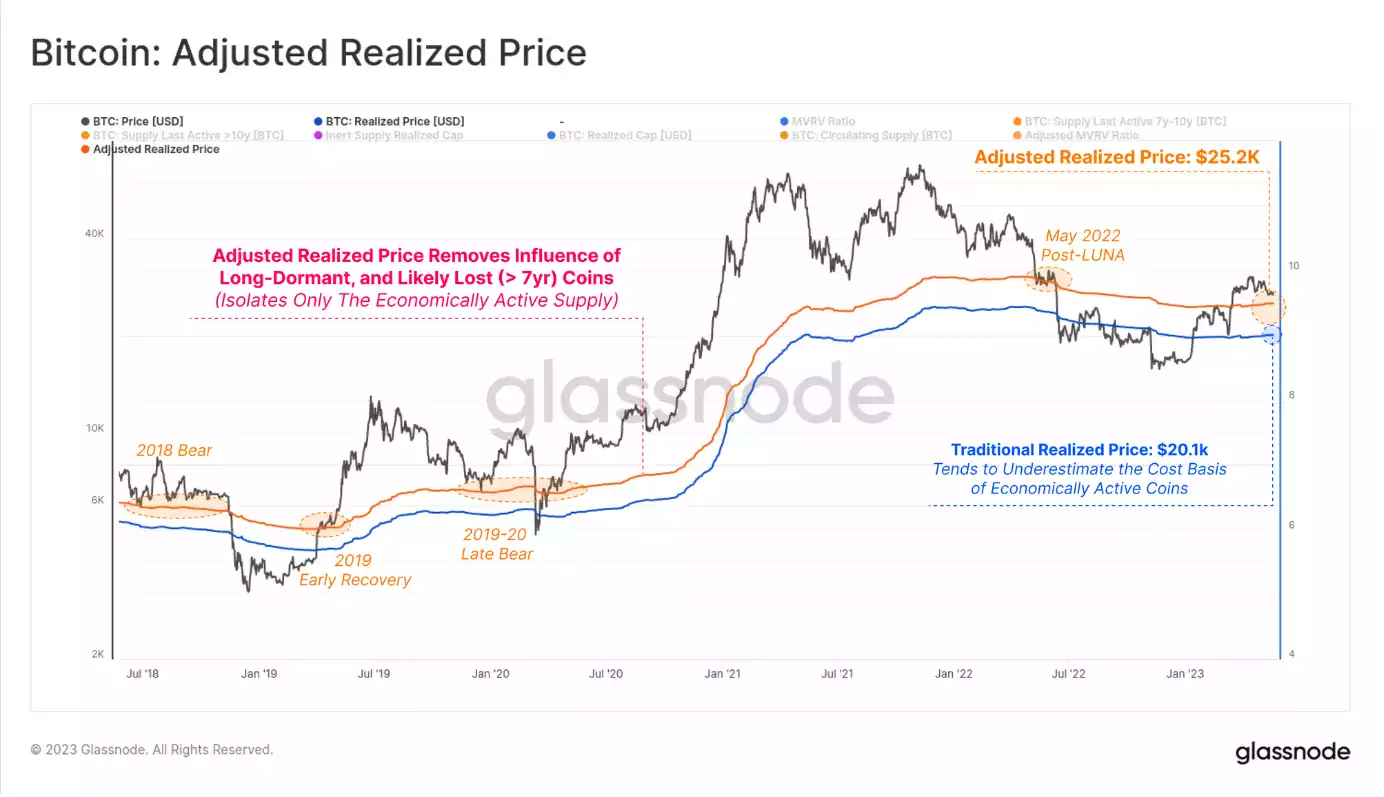

aMVRV Ratio: The Pulse of Unrealised Profits

The Adjusted MVRV Ratio, a critical metric for assessing market sentiment, currently signals potential buying opportunities. With the value standing at 1.09, it suggests a modest 9% unrealised profit in the market, aligning with the oversold levels during 2018, 2019, and March 2020 cycle lows. The aMVRV ratio offers a valuable tool for predicting potential market rallies or downturns, with a value below 1 indicating losses for average investors, while above 1 signals unrealised profit.

Bitcoin HODLing: A Rising Trend

Network Liveliness, a measure of network activity, is currently at its lowest since the December 2020 Bitcoin breakout above $20K. Decreasing Liveliness, combined with the Short-Term Holder (STH) cohort’s low ‘holding time,’ shows a predominant trend towards Bitcoin HODLing rather than spending. Such behaviour underscores a strong conviction among Bitcoin holders who seem reluctant to spend at the current price range.

The Bitcoin Holder Behaviour: Long-Term Conviction

On-chain analysis reveals that existing Bitcoin holders exhibit a high level of commitment, persistently holding their assets despite the dramatic market volatility and extensive deleveraging over the past two years. Volume throughput is currently low, implying a weak inflow of new demand. However, despite the decreased trading activity, the existing holder base appears to be growing more price insensitive, possibly due to their long-term investment strategies. These behaviours suggest a resilient Bitcoin holder base, many of whom seem prepared to hold onto their coins, weathering periods of extreme volatility and keeping their assets in cold storage wallets.

Strained Supply and Awaiting Demand

The substantial decrease in Bitcoin deposit volumes, coupled with a drop in on-chain transaction volumes, signifies a strain on Bitcoin supply. This condition, together with the marked increase in the number of coins held in long-term storage, hints at an imminent supply squeeze scenario. If demand increases, the reduced supply and low liquidity could trigger a sharp upward price movement.

While the low transfer volumes and diminished active trading scene suggest a weak inflow of new demand, the stagnant market activity could also indicate the calm before a storm. The consolidation of the current market scenario may potentially lead to a significant influx of new participants, leading to increased demand.

A Long-Term Perspective: The Resilient Bitcoin Holders

In conclusion, the current market dynamics represent the resilience and conviction of Bitcoin holders. Even though the overall economic throughput and trading activity have witnessed a slump, Bitcoin holders continue to hold their assets, reinforcing the belief in Bitcoin’s long-term value.

The Bitcoin market in 2023 is characterised by a dominant trend towards HODLing, a high Adjusted MVRV Ratio, and a decreasing Network Liveliness – all indicative of a market that may be poised for a rebound. The rising trend of long-term holding, low exchange deposits, and declining on-chain transaction volumes suggest a transition towards a more mature and stable market.

As Bitcoin continues to mature, the patience and resilience of Bitcoin holders may well be rewarded with higher prices and stronger market stability. Ultimately, only time will reveal the unfolding of these potential scenarios in the intriguing world of Bitcoin.

If you’re interested in an easy and personal way to buy cryptocurrency, don’t hesitate to contact Ainslie at 1800AINSLIE. Our team of friendly consultants are ready to guide you through the process, making your cryptocurrency buying journey effortless.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.