RIDING THE DIGITAL WAVE: THE RISING TIDE OF DEFI AND ONCHAIN ACTIVITY

August 1, 2023

Setting the Stage: The Digital Asset Industry in 2023

The year 2023 has witnessed a plethora of developments in the digital asset industry. The Decentralised Finance (DeFi) sector, in particular, has been the latest recipient of heightened interest from investors, sparking an exciting resurgence in DeFi tokens. This intensified interest has not gone unnoticed by market makers, who have responded by increasing liquidity in related pools. This adjustment sends a positive signal for future trading and price activities.

A fascinating aspect of this new wave of investment activity in the DeFi sphere is the role played by bots. Analysis of trading volume distribution on the popular decentralised exchange, Uniswap, indicates that a significant share of trading activity can be traced back to bots.

Navigating through Turbulence: The Evolution of Altcoin Markets

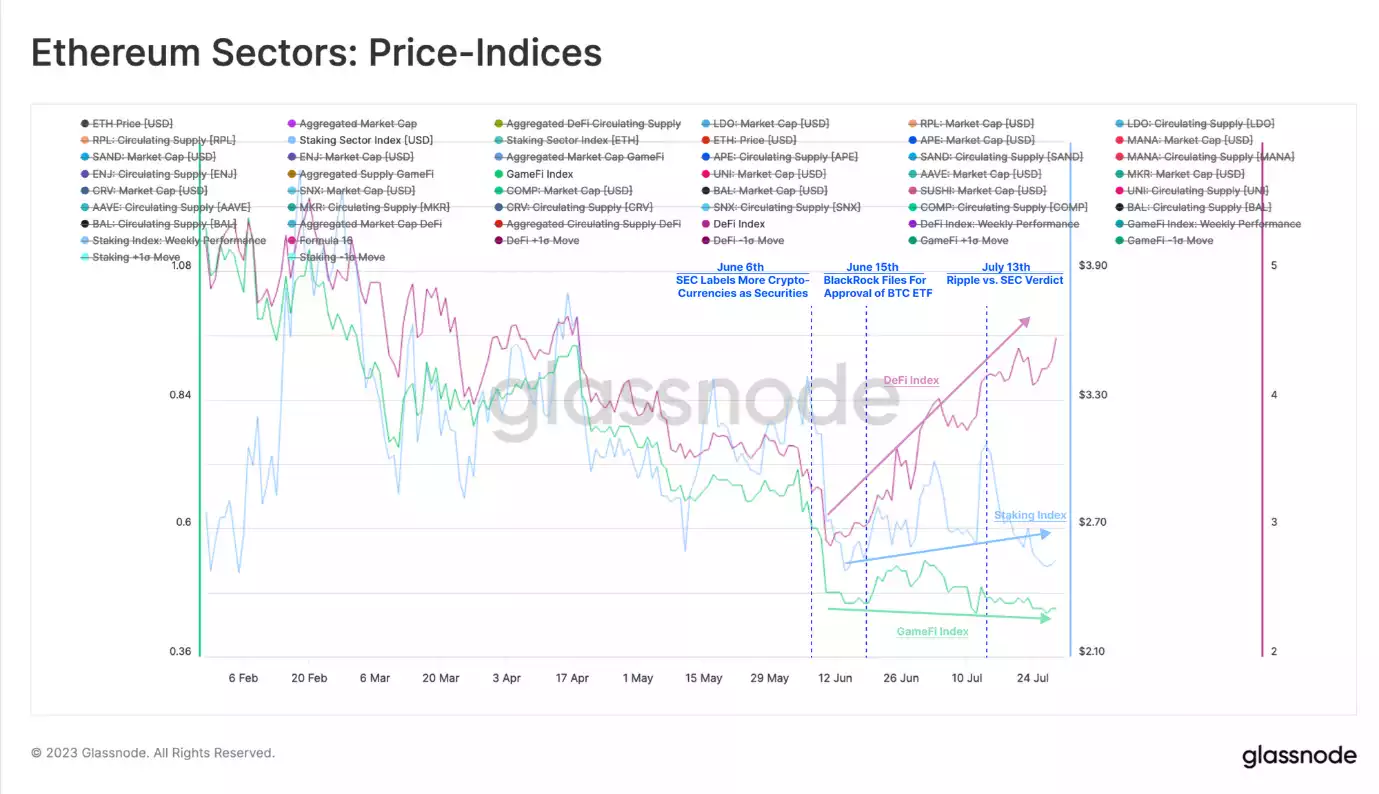

The altcoin markets have seen a rollercoaster of events over recent months. The dynamics are largely shaped by a handful of key developments that have rocked the digital asset space. In early June, a significant development occurred when the SEC identified 68 cryptocurrencies as unregistered securities, leading to a slump in market interest for altcoins outside the Bitcoin and Ethereum spheres.

The tide seemed to turn, however, when financial powerhouses such as BlackRock and Fidelity lodged filings for Bitcoin spot ETFs. This sparked a much-needed positive sentiment shift in the market that spilled over to the broader digital asset space. Additionally, the Ripple Labs vs. SEC case verdict in mid-July found that Ripple Labs had not violated federal securities laws through the sale of XRP on public exchanges. This decision sent a ray of hope across the industry and among altcoin investors, reducing fears of further regulatory actions.

In the midst of this, DeFi sector-related tokens have shown remarkable resilience, with the DeFi index price surging 56% since the low set on June 11. In contrast, other sectors like GameFi and Staking have lagged behind.

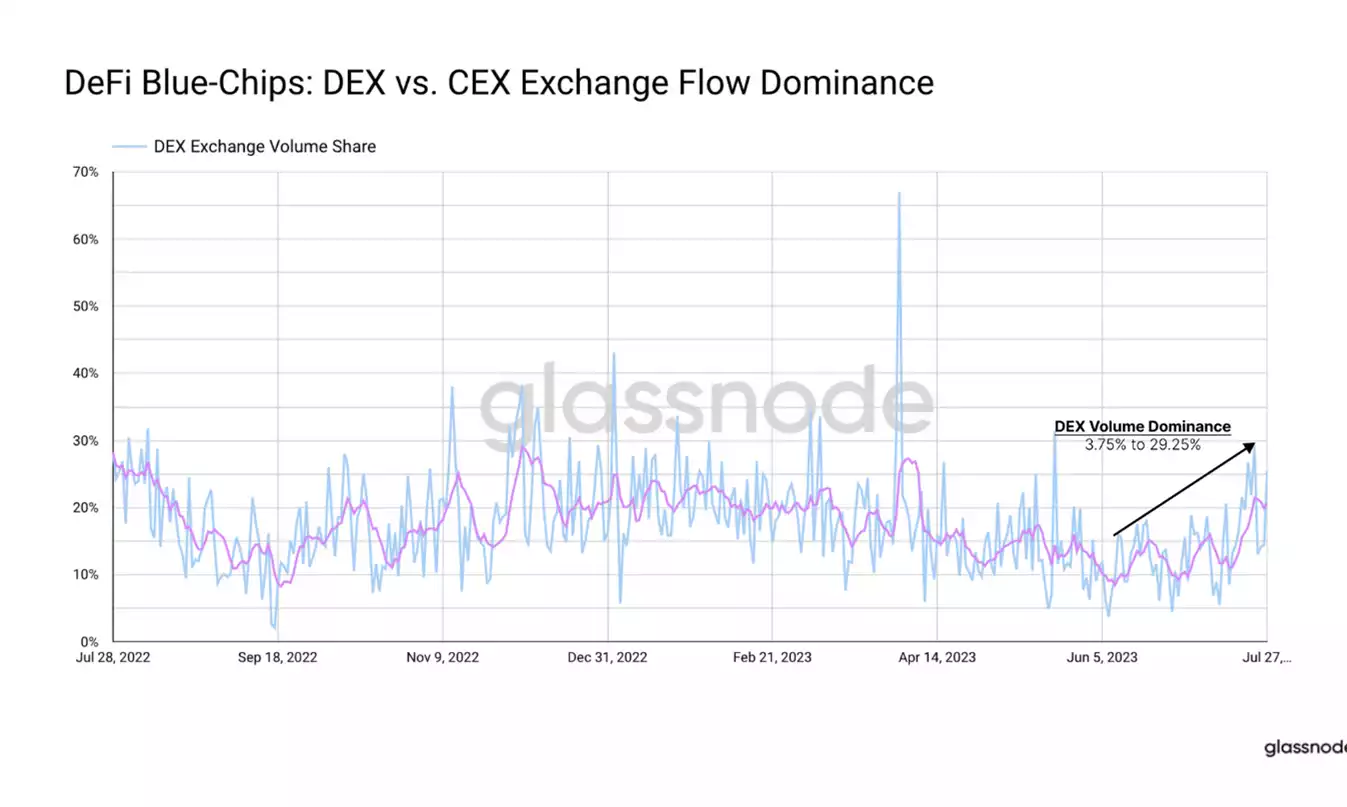

Rediscovering Decentralisation: A Resurgence in DEX Activity

Analysing the exchange flows between Decentralised Exchanges (DEX) and Centralised Exchanges (CEX) for the top eight DeFi tokens reveals an interesting pattern: a resurgence in DEX activity. The proportion of volume traded on DEXs has seen a substantial increase, rising from a mere 3.75% at the start of June to a noteworthy 29.2% to date. The current level of trading activity on DEXs is reminiscent of the highs experienced during the latter half of 2022, indicating a revival of interest and engagement in decentralised trading platforms.

Sifting Through the Sands: Implications for Uniswap and Stakeholders

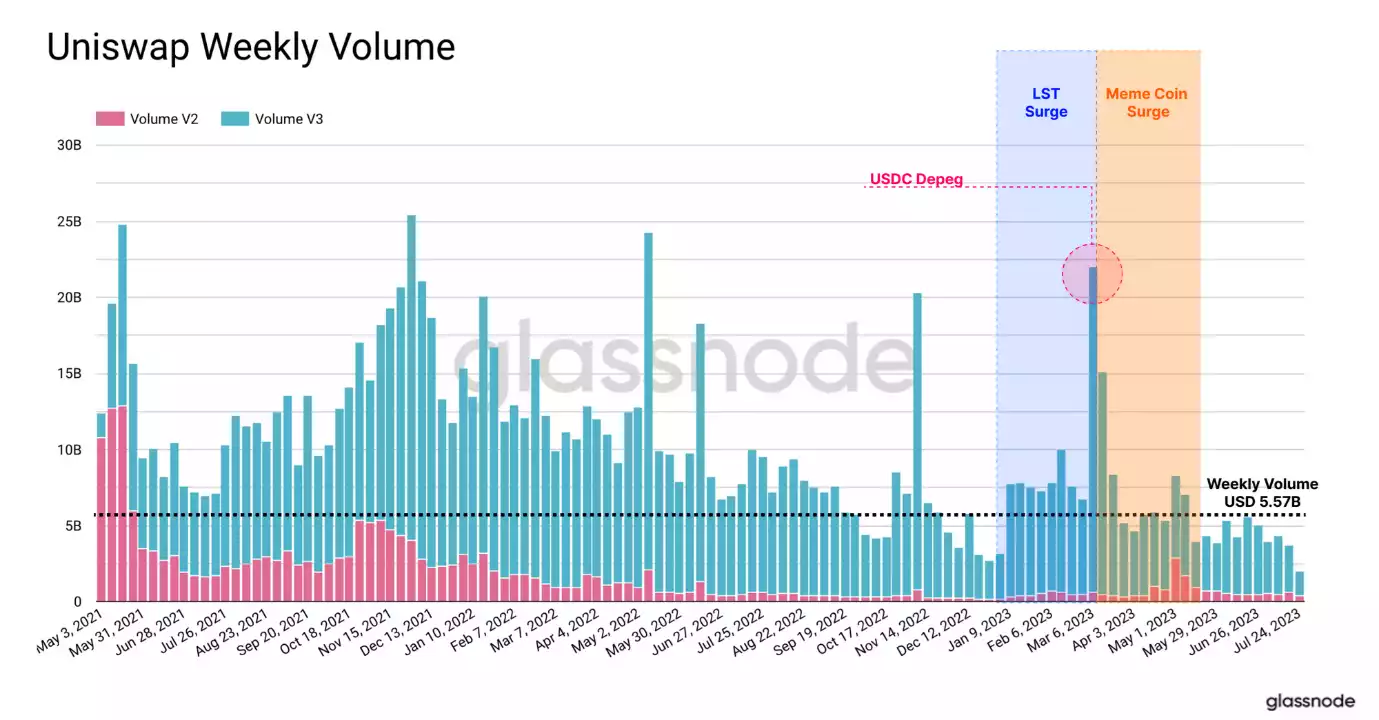

The recent surge in Decentralised Exchange (DEX) activity brings the focus to its implications for stakeholders, particularly in the context of Uniswap, the leading DEX. Uniswap has emerged as the primary consumer of gas over the past week, reflecting an increase in trading volume on the Ethereum network. However, this volume of $5.57 billion per week is significantly lower compared to previous years.

Despite recent positive developments like the Bitcoin ETF filings and the Ripple vs. SEC verdict, there hasn’t been a substantial increase in trading activity on Uniswap. This discrepancy might be explained by a growing segment of trading volume occurring on Layer-2 solutions like Arbitrum, along with a dwindling presence of human traders. This reduction in human trading activity has led to a lower level of arbitrage and sandwich bot activity.

Final Thoughts: A Promising Outlook Amidst the Flux

Navigating through the digital asset landscape in 2023 is akin to riding a wave, with crests and troughs representing a dynamic interplay of multiple factors. Despite the challenges and uncertainties, the optimism around DeFi tokens, bolstered by recent positive developments, underscores the potential that still resides in this sector.

Interestingly, the increase in DEX activity signals a potential paradigm shift in how digital assets are traded. The resurgence in interest towards decentralised trading platforms such as Uniswap can be attributed to the growing appreciation of their inherent advantages, such as transparency, accessibility, and reduced reliance on intermediaries. Although the trading volume on Uniswap may currently be lower than in previous years, the significant increase in the proportion of volume traded on DEXs suggests a potential for future growth.

Looking forward, the regulatory landscape for digital assets will continue to play a crucial role in shaping market dynamics. The recent Ripple Labs vs. SEC verdict has demonstrated the potential for regulatory developments to influence market sentiment and trading activity significantly. With the regulatory environment in flux, staying informed about these developments is key for market participants.

Despite the turbulence, the digital asset industry in 2023 presents an optimistic picture. The resilience of the DeFi sector and the growing interest in decentralised trading platforms underscore the potential for future growth. As the industry continues to evolve, investors and stakeholders who stay well-informed and adaptive will be best positioned to ride the digital wave. The rest of the year promises to be an exciting time for all those involved in the world of digital assets.

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.