NAVIGATING THE CRYPTO CALM: AN OPTIMISTIC WEEK IN REVIEW

June 6, 2023

Crypto Market Resilience Amidst Risk-off Rotation

Even as the cryptocurrency market’s surface stagnation hints at uncertainty, it’s the quietest seas that often run the deepest. Trading volumes have noticeably dipped, and an emerging preference for stablecoin capital indicates a potential pivot towards safer digital assets.

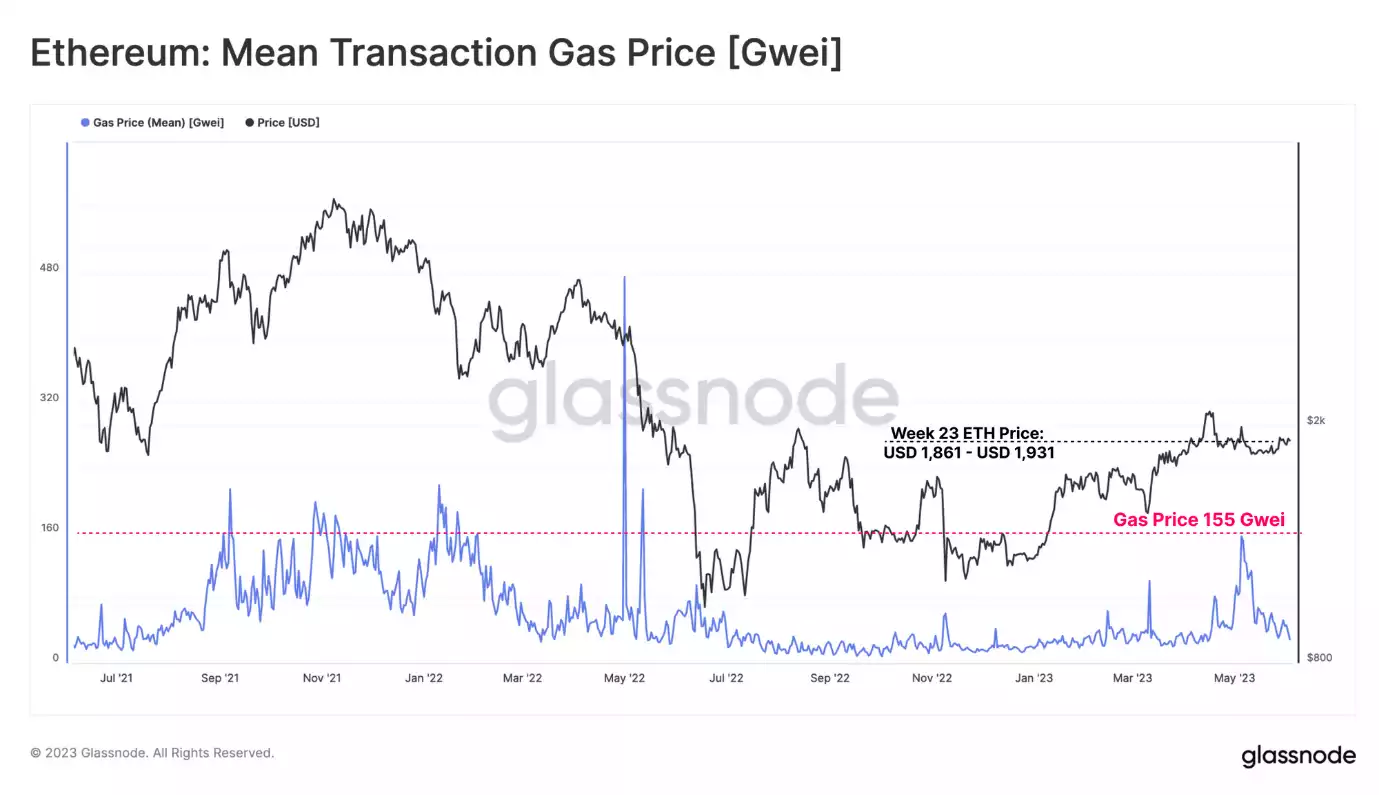

Ethereum Network’s Dynamic Cost Structure

Ethereum prices have been steady, staying within a defined range without significant upward or downward trends. However, gas prices, the lifeblood of the Ethereum network, are seeing a stark increase. Average gas prices rose to 76 Gwei in May, translating to $1.14 for a standard ETH transfer. Early May even saw a peak at 155 Gwei, nearing the record high during the 2021-22 bull cycle. This trend underscores the dynamic nature of the Ethereum network, whose cost structure can fluctuate independently of ETH prices.

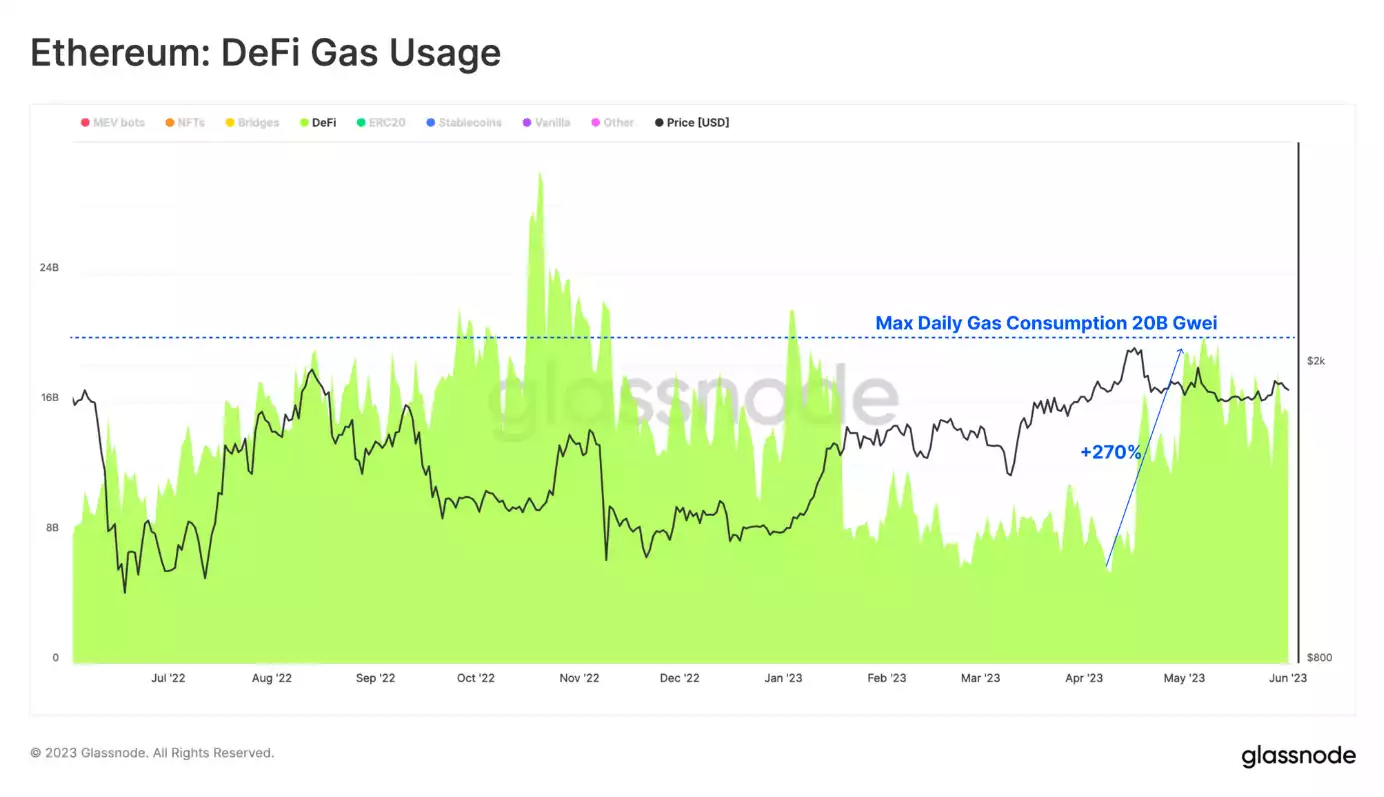

Surging DeFi Gas Usage Sparks Higher Costs

Interactions with smart contracts are far more gas-intensive than simple transfers, leading to substantially higher costs. DeFi protocols saw an impressive 270% increase in gas usage in late April, resulting in daily gas usage exceeding 20 billion units. This rapid rise in gas consumption highlights the growing popularity and use of DeFi platforms.

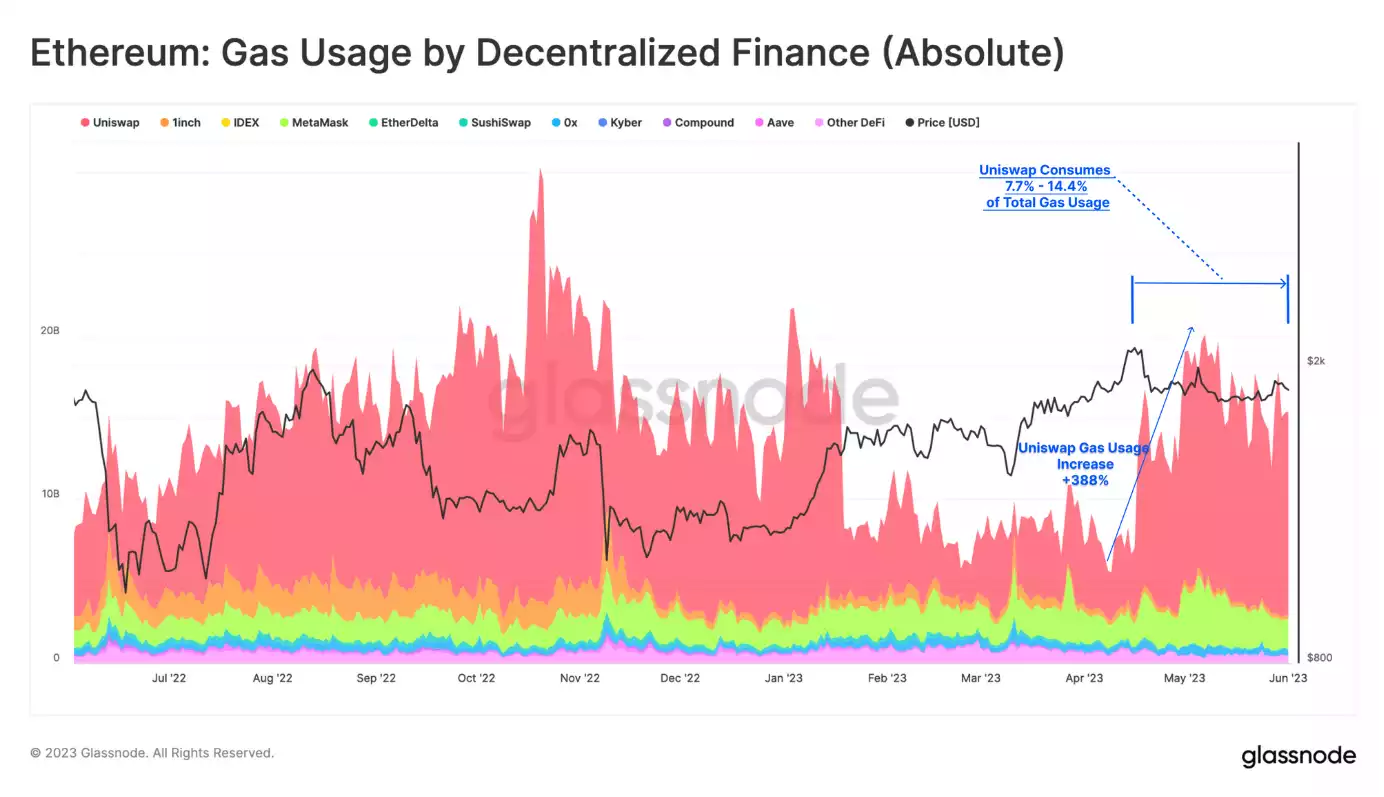

Uniswap’s Domination Fuels Ethereum Gas Demand

Trading activity on decentralised exchanges (DEXs), particularly Uniswap, fuels the major surge in Ethereum gas usage. Since April, Uniswap’s gas usage has increased by a whopping 388%, cementing its dominance in the Ethereum ecosystem, accounting for between 7.7% and 14.4% of total Ethereum gas demand.

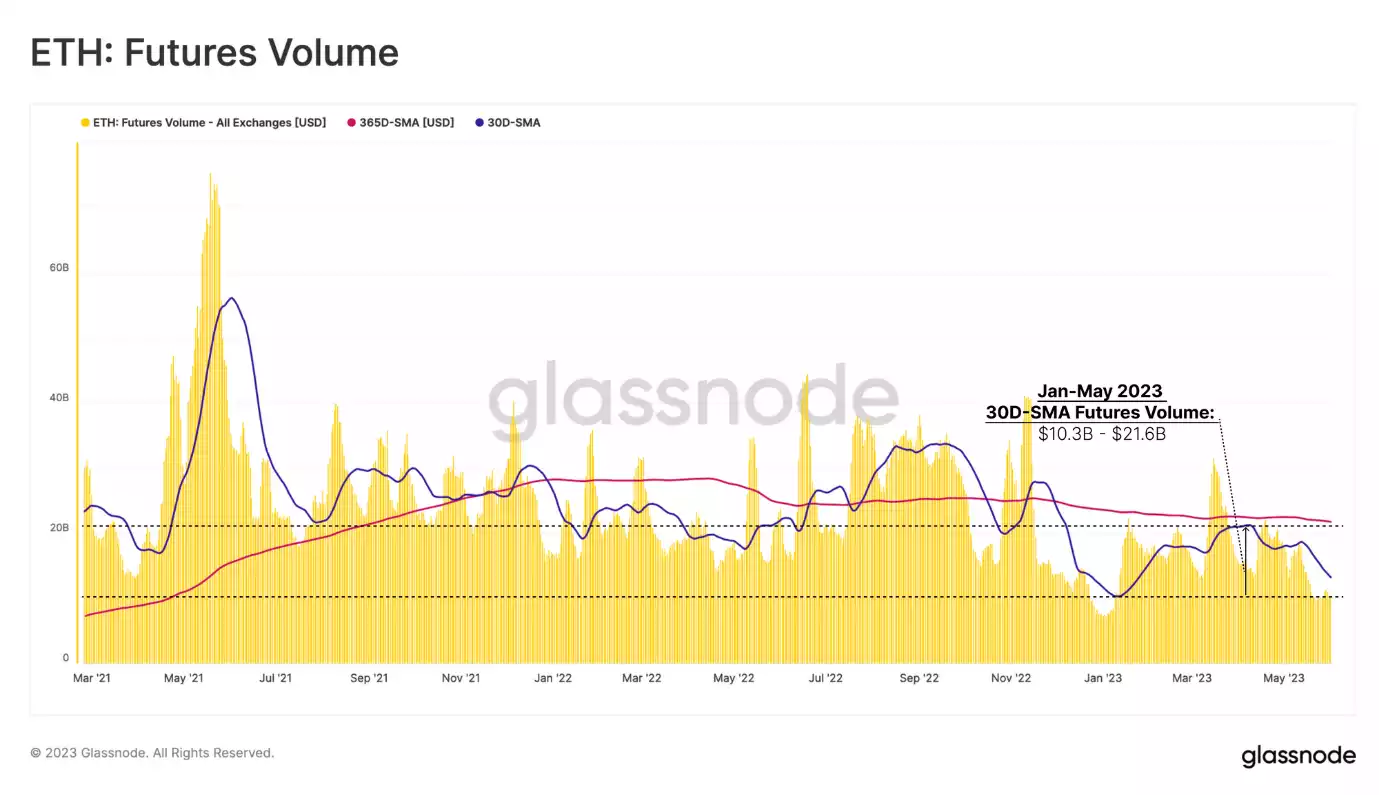

Market Liquidity Shifts Towards Lower-Risk Assets

As market liquidity wanes, capital appears to be gravitating towards lower-risk assets like stablecoins and Bitcoin. Post the FTX collapse, futures trading volume fell drastically, and despite some recovery in 2023, the volumes remain subdued, suggesting lingering weak institutional trading interest. This trend contrasts with the increase in Uniswap trading activity and indicates a broader shift in market preference.

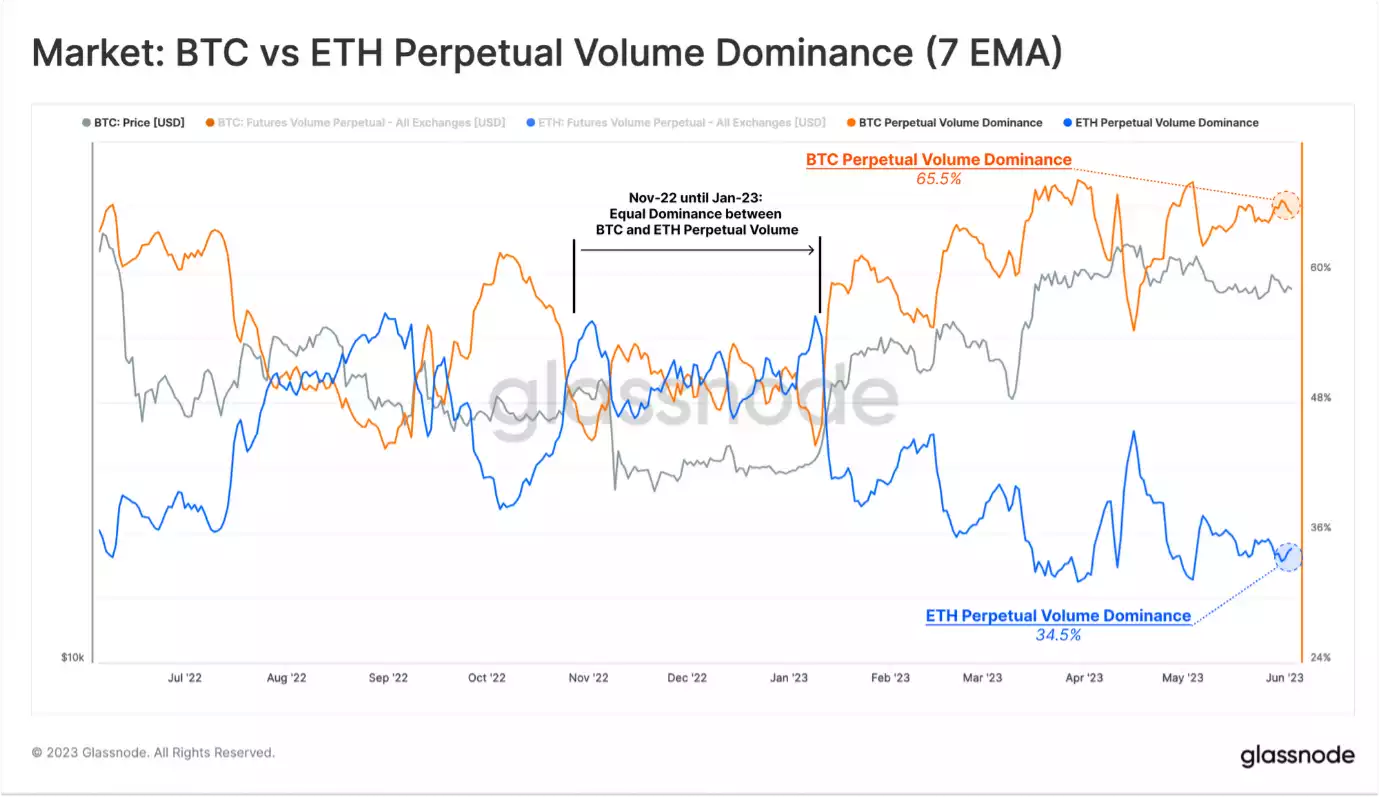

Liquidity Leans Towards Bitcoin in Perpetual Swap Markets

The relative volume dominance between Bitcoin and Ethereum in perpetual swap markets reveals an intriguing shift in liquidity. After reaching parity in late 2022, Ethereum’s share of futures volume significantly declined in 2023, indicating that traders might perceive Bitcoin as a less risky asset.

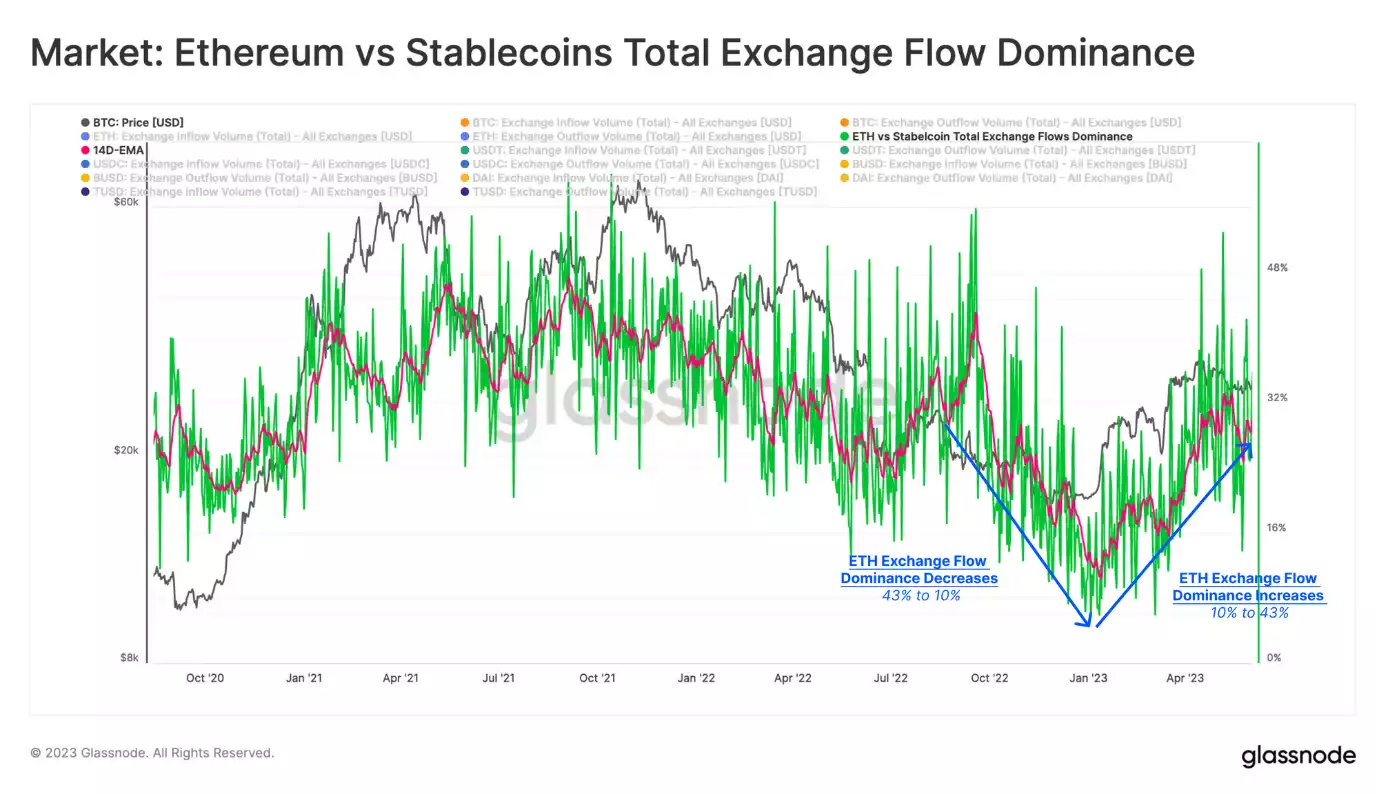

Rebalancing Capital Flows: Ethereum and Stablecoins

The flow of Ethereum and stablecoins in and out of exchanges tells a story of investor preference shifts. In 2022, during a substantial deleveraging phase, Ethereum’s dominance in capital flows shrunk dramatically. While 2023 saw a rebound, the trend plateaued in early May, suggesting investors enjoying Q1’s substantial returns might be redirecting their capital towards stablecoins.

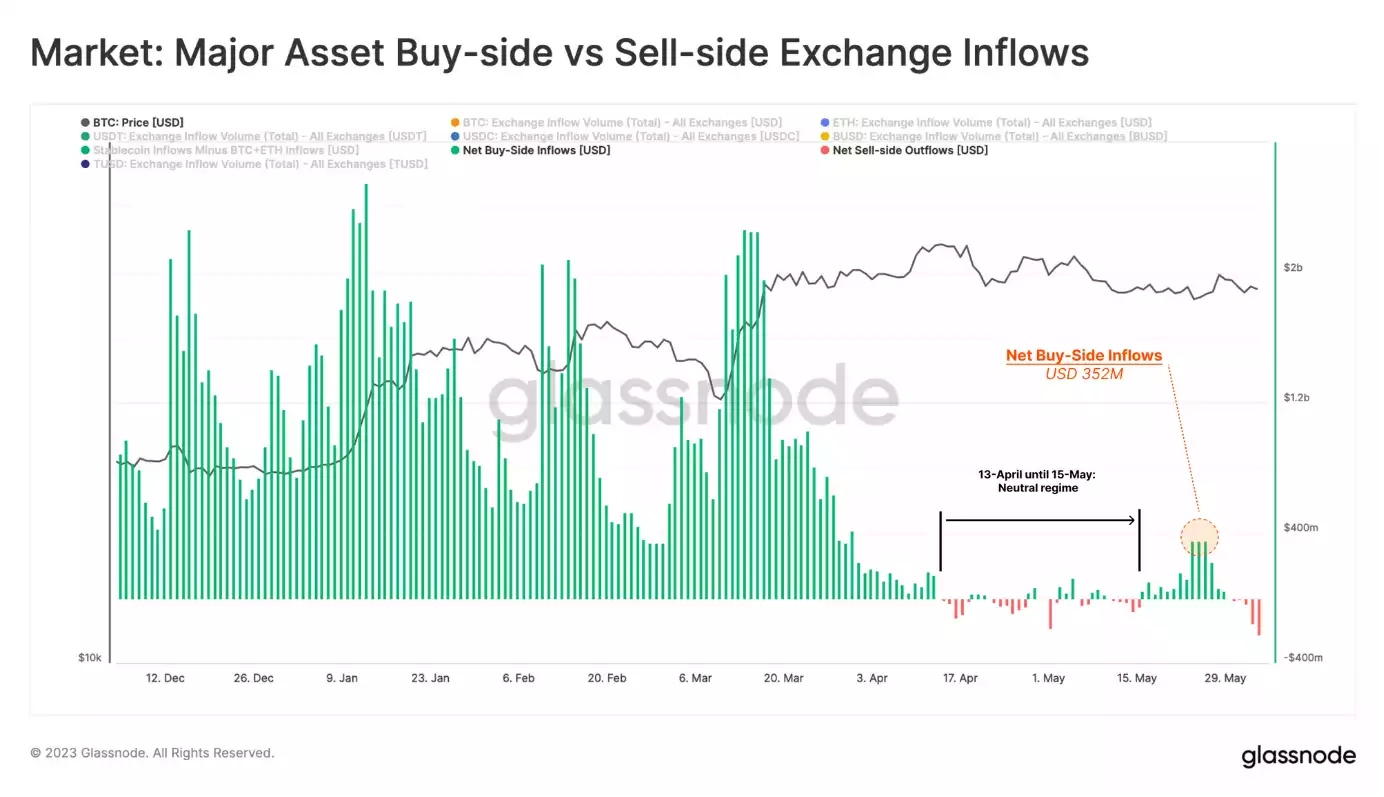

Analysing Buy-Side and Sell-Side Pressures

Comparing daily exchange inflows of different assets can provide insight into the market’s buying and selling pressures. The inflows of Bitcoin and Ethereum to exchanges symbolise sell-side pressure, whereas inflows of stablecoins indicate buy-side pressure. Notably, a net sell-side regime has been in effect since the start of April 2023, as the inflows of Bitcoin and Ethereum began to outpace those of stablecoins. This shift, contrasting the substantial buy-side pressure experienced in Q1 2023, coincides with the onset of the current market correction, suggesting a shift in market dynamics from predominantly buying to selling pressure.

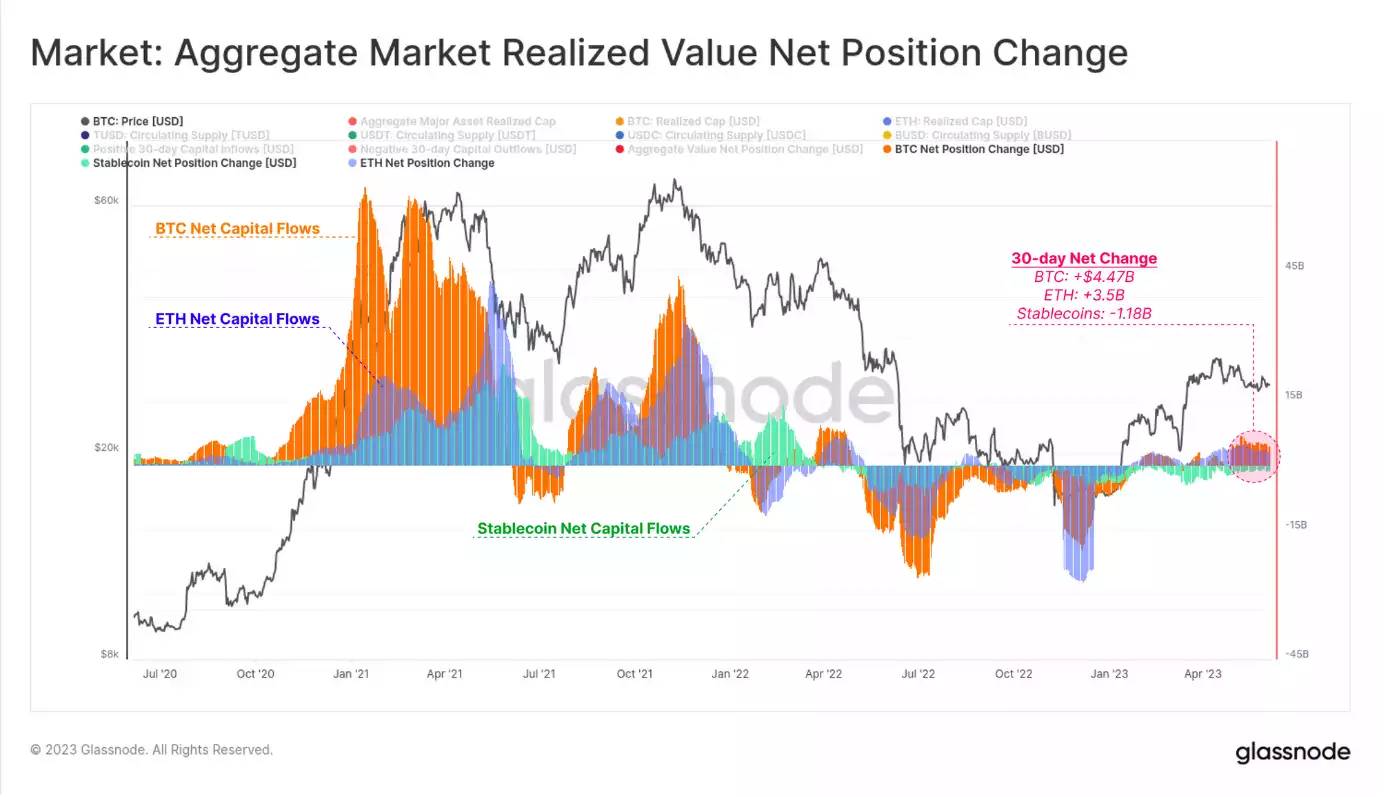

Tracing Capital Flows: Bitcoin, Ethereum, and Stablecoins

Capital typically enters the digital asset market via two primary cryptocurrencies—Bitcoin and Ethereum—or through stablecoins. By comparing the Realised Cap for Bitcoin and Ethereum, which represents the net change in value for coins moved on-chain, and the circulating supply of stablecoins, one can discern the overall direction of capital flows. Recent data reveals that Bitcoin leads the capital influx into the crypto market, followed by Ethereum. Despite this, capital outflows from stablecoins partly offset the increases, due to significant redemptions.

Stablecoin Dynamics in Changing Market Conditions

With U.S. interest rates now exceeding 5%, non-interest-bearing stablecoins may become less appealing, particularly to investors with access to U.S. capital markets. Tether, however, has seen broader adoption in markets outside the U.S., particularly in regions where national currencies are weaker and access to USD is less common. As regulatory scrutiny intensifies in the U.S., capital appears to be redirected from the West to the East in the digital asset sector.

A New Market Environment

In conclusion, the current market climate is veering towards a generally risk-off approach by investors. However, this seemingly cautious behaviour is nuanced. While there’s a shift towards safer, liquid major cryptocurrencies and an increased preference for stablecoin capital, the market’s dynamism remains. The ebb and flow of capital across various digital assets highlight the crypto market’s resilience and its adaptive responses to changing economic climates.

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.