Looking Towards The Next Crypto Surge

September 12, 2023

As we analyse the present state of the digital asset market, we notice a conspicuous liquidity dip. While trading volumes have seemingly retracted, reaching a notable low, this can be viewed as a resetting phase, a momentary pause that precedes a powerful resurgence. It’s critical to note that moments like these often lay the groundwork for potential upward surges, fostering a market that is ripe for growth and expansion.

The current scenario has cultivated a breed of resilient long-term holders, staunchly holding onto their assets with an unshaken belief in their future potential. Their steadfast stance is a silver lining, embodying hope and confidence in the market’s inherent strength and prospective recovery.

Despite the shrinking supply of various stablecoins, Tether (USDT) stands tall, maintaining its stronghold and further asserting its reliability and safety in this period. This stability amid the fluctuations sends out a positive signal, indicating a certain resilience in the crypto sector, and potentially serving as a firm foundation for future growth.

While the short-term holders are indeed facing a test of nerves with assets acquired at higher prices, this phase might just be nurturing the next generation of seasoned investors, who learn and grow with the market’s ebbs and flows. The current scenario presents an invaluable lesson in patience and strategy refinement, paving the way for more mature and well-thought-out investment decisions in the coming times.

The market has entered a phase marked by a narrowed trading range and reduced volatility, indicating a time of reflection and perhaps consolidation. Though sentiments echo a temporary lull, characterised as a phase of “extreme apathy and boredom,” it could potentially be the calm before a storm of activity and excitement. It’s a period that encourages investors to regroup, re-strategise, and prepare for the next big wave in the digital asset marketplace.

Focusing on the Heavy Hitters: Bitcoin, Ethereum, and Stablecoins

Today we focus on the pivotal players in the digital market space: Bitcoin (BTC), Ethereum (ETH), and stablecoins. Diving deeper, we aim to uncover why these assets continue to dominate the market, offering readers a clear and unembellished insight into their significant roles.

Understanding the Stablecoin Supply Dynamics

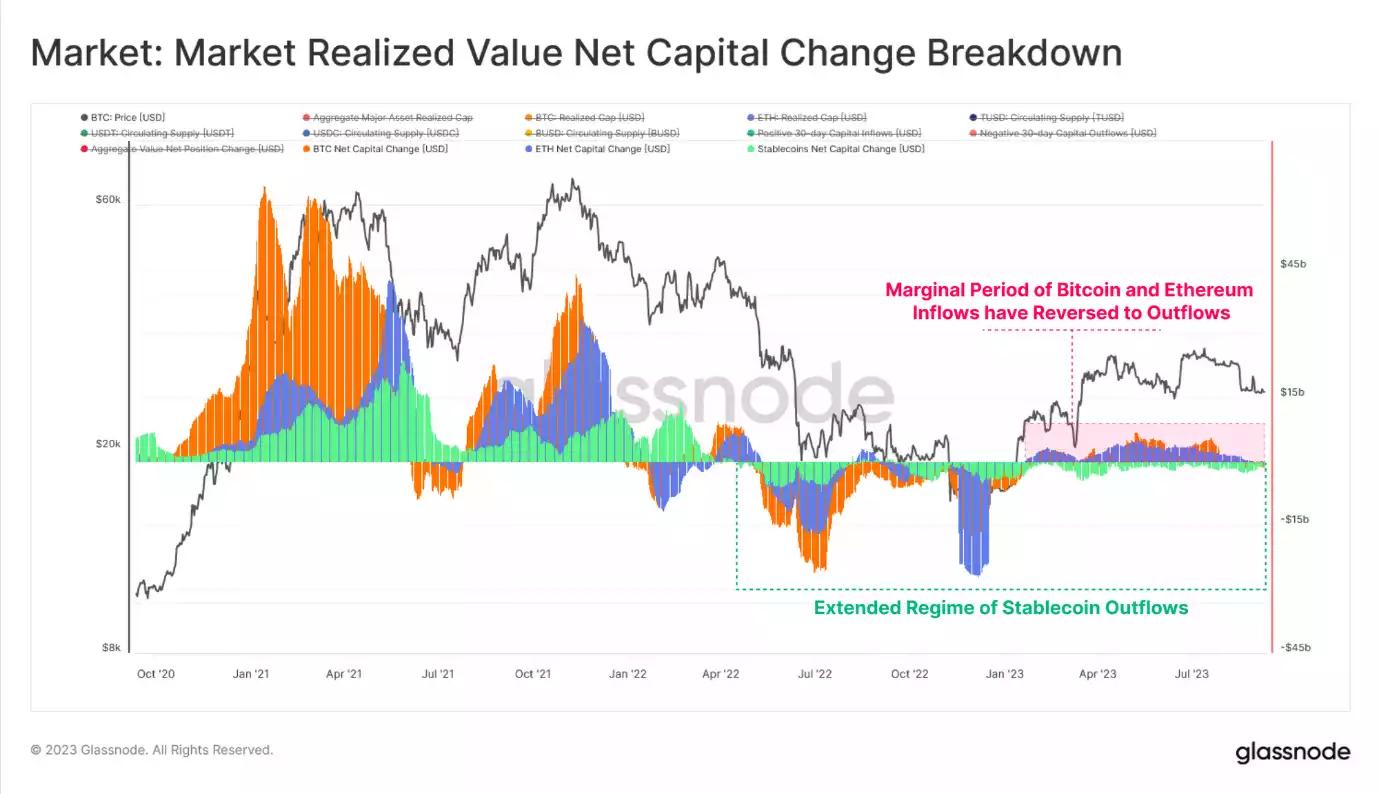

An important aspect to discuss is the recent dip in the supply of stablecoins, traced back to April 2022, notably influenced by the LUNA-UST stablecoin incident.

A Surge of Positivity for BTC and ETH

Bright spots emerge as we notice a substantial net capital inflow into the realms of Bitcoin and Ethereum in the monitored period. Illustrating this upbeat trend with graphical data, we highlight the encouraging climb these assets have enjoyed, emphasising the steady capital increase reaching peaks of $6.8 billion and $4.8 billion per month, respectively.

Observing Recent Volatility Spikes

We recently witnessed a significant sell-off that reached $25k USD, ushered in by a spike in volatility. This shift, notably influenced by Grayscale’s triumphant legal skirmish against the SEC, marks a moment of heightened activity and potential opportunities in the market.

Realised Volatility Trends: A Prelude to Exciting Times

Even with recent fluctuations, it’s worth noting that the overall realised volatility remains at a substantial low. Historically, such calm periods have served as the calm before a storm of exciting market movements, suggesting that we might be on the brink of a potentially vibrant phase in the crypto market.

Liquidity and Volatility at Present: A Breeding Ground for Significant Movements

Currently, the market portrays a scene of reduced liquidity and low volatility. For those who have been watching the market, this could be seen as a tell-tale sign of more substantial price swings on the horizon, as history has often shown us.

Bitcoin Network Settlement Volumes: A Phase of Reset

Currently, we are witnessing a dip in the USD volume of coins being traded, a reflection of a quieter phase in market activities. With the daily figures hovering around cycle lows of $2.44 billion, it seems like the market is taking a breather, perhaps gearing up for a resurgence reminiscent of the vibrant days observed in October 2020.

Market Dynamics Overview

As we navigate the current phase of the crypto market, we notice a considerable calm permeating both on-chain and off-chain sectors. This tranquillity is accompanied by a dominant holding (HODLing) pattern, particularly among long-term investors, signifying a steady and robust investor base that seems to be eyeing the future with a patient strategy.

Long-Term Holder Cohort: A Stable Backbone

In an encouraging turn of events, the long-term holder cohort is seeing a record all-time high (ATH) in supply retention, amassing 14.74 million BTC.

Short-Term Holder Cohort: A Window for Revitalisation

Meanwhile, the short-term holder segment has observed a sharp decline, showcasing the lowest engagement since 2011. This significant dip points towards a potential opportunity for rejuvenation and increased activity, as newer investors might step in to fill the void created by the lesser engagement of short-term traders.

Liveliness Metric Analysis: A Shift Towards Holding

The liveliness metric serves as a valuable compass for understanding the current market pulse. Notably, 2021 saw a surge in activity as older coins re-entered circulation, perhaps indicating profit-taking ventures. However, as we stepped into 2022, a clear shift towards a holding-dominated market became evident, especially from May to December 2021. This phase marked a pivotal shift in market dynamics, emphasising a stronger holding pattern among investors.

Current Trends and Future Projections: A Time of Accumulation

As we navigate through the present, we see the liveliness metric retracing back to the conditions witnessed in late 2020, highlighted by a pronounced downtrend. This pattern suggests that the collective investor holding time is extending, possibly indicating a growing hesitance to part with their assets. This trend might be signalling a phase of accumulation, as investors tread cautiously amidst market uncertainties, perhaps anticipating potential growth in the future.

In Conclusion: A Budding Horizon in the Crypto Landscape

As we wrap up, it’s evident that the crypto market is experiencing a period of low activity, reflected in decreased volatility, liquidity, and trade volumes. This seems to be a phase where the industry is catching its breath, possibly paving the way for more thoughtful and strategic investments in the near future.

Despite the prevailing sentiment of apathy and caution, long-term holders are holding firm, showcasing a resilient belief in the future potential of their assets. This contrasts starkly with the short-term holders who are navigating a precarious path, closely watching price barriers that haven’t yet been breached. Their stance remains more cautious, potentially poised to make swift decisions based on forthcoming price movements.

In essence, this period mirrors a formative stage, hinting at an underlying potential for growth and renewed vigour in the market. The steadfast nature of long-term holders could very well be a beacon of optimism, lighting the way to a promising future in the crypto arena.

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company, or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.