How Banking Woes are Paving the Way for Crypto

May 11, 2023

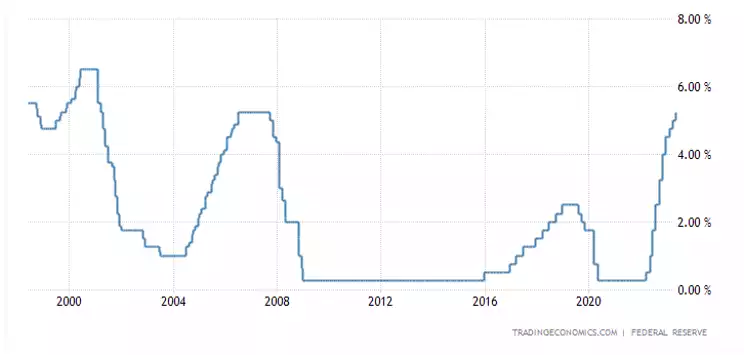

The Federal Reserve has recently raised interest rates by an additional 25 basis points, setting the interest rate range to between 5% and 5.25%, the highest it has been in 16 years. Alongside the White House’s proposal of a 30% excise tax aimed specifically at cryptocurrency mining companies and Democratic presidential candidate Robert Kennedy Jr.’s attribution of recent disruptions in the U.S. banking sector to a “war on crypto”, the cryptocurrency market, particularly Bitcoin (BTC), experienced a slowdown in price growth after two weeks of volatility. Over the week, Bitcoin gradually traded up to a high of US$29,820. However, increased selling pressure over the weekend resulted in Bitcoin closing the week at a lower value of US$27,603, representing a 1.4% fall over the last seven days.

Ordinals Inscriptions: A Ray of Hope Amidst Uncertainty

Despite the market stagnation, the trend of Ordinals inscriptions continued from the previous week, with over 400,000 daily inscriptions registered on Sunday. These inscriptions contributed to more than 600,000 daily Bitcoin (BTC) transactions on the same day, generating over US$2.7 million in fees paid to miners. The successful launch of Ordinals on the Bitcoin network has unlocked new use cases, is expected to bring in additional liquidity, attract new users and developers, and may help drive mass adoption through an improved user experience.

Ethereum (ETH) Holds Steady Through the Storm

Ethereum (ETH) showcased resilience, following a similar trading pattern to Bitcoin (BTC) over the past week.

Shapella Upgrade: Boosting Investor Confidence in Ethereum Staking

Almost a month since the implementation of the Shapella upgrade, the Ethereum network has witnessed intriguing dynamics. The Shapella upgrade, a significant development, enabled the withdrawal of staked ETH, a feature that was locked since the introduction of staking over two years ago. Contrary to expectations, the net flow of ETH being staked turned positive post the Shapella upgrade, suggesting that more investors are currently depositing their ETH for staking rather than withdrawing it. This net positive flow of staked ETH may indicate an increase in investor confidence in the staking product. We wrote much more extensively about this in our article earlier this week.

Crypto Market Resilience: Bitcoin (BTC) and Ethereum (ETH) Stand Tall

The cryptocurrency market saw significant downturns over the past week, with only Bitcoin (BTC) and Ethereum (ETH) holding on to their gains. In contrast to BTC and ETH, other market sectors experienced losses, with currencies overall down by 4.3% in the last seven days. The GameFi sector took the hardest hit, registering a week-on-week loss of 11.3%.

Regulatory Developments: Navigating Through the DAME Tax Proposal

As mentioned, the White House published a report detailing a proposed 30% excise tax on crypto mining companies, referred to as the Digital Asset Mining Energy (DAME) tax. The administration believes the imposition of this tax will bring benefits to American communities and the environment. If accepted, the DAME tax, set to come into effect in 2024, would be calculated based on the electricity expenses of crypto mining firms, starting at a 10% rate and gradually increasing each year until it reaches 30%. First introduced as part of the 2024 budget in March, the DAME tax has the potential to help reduce the government deficit, with predictions indicating that it could potentially reduce the deficit by US$74 million in the first year, and up to US$444 million by the fiscal year 2033.

Banking Sector Disruptions: A Potential Blessing for Cryptocurrencies?

The U.S. banking system is under pressure as regional banks’ share prices, such as PacWest in California, Western Alliance in Arizona, and First Horizon in Memphis, are plummeting due to an increased rate of withdrawals. Bank deposits up to US$250,000 are insured by the US government, but any amount beyond that is not covered, which has led to a rise in withdrawals. A recent Gallup poll suggests that 48% of Americans are concerned about the safety of their funds in banks.

The Hoover Institution, a think tank, has released an analysis that warns of potential risk for impairment to 186 banks if half of the uninsured savers were to withdraw their money. This potential risk, however, must be seen in the broader context of the U.S. banking system, which consists of approximately 4,700 banks.

Despite the widespread concern, a piece published in the Telegraph suggests a more dire scenario, claiming that “half of America’s banks are potentially insolvent” and warning of a possible credit crunch. The coming weeks will determine whether these disruptions in the banking sector will translate into a shift towards cryptocurrencies.

In conclusion, this week in the crypto world has been characterised by a mix of regulatory moves, market fluctuations, and technological advancements. The Federal Reserve’s interest rate hike, the proposed DAME tax, and disruptions in the U.S. banking sector have all contributed to the market’s volatility. However, amidst these changes, Bitcoin and Ethereum have shown resilience and new developments like the Ordinals on the Bitcoin network hint at an exciting future for the crypto space. The unfolding events underscore the importance of staying informed and adaptable in this fast-paced, ever-evolving industry. As always, we’ll continue to provide you with the latest insights and analysis to help you navigate your crypto journey.

If you’re interested in an easy and personal way to buy cryptocurrency, don’t hesitate to contact Ainslie at 1800 161 383. Our team of friendly consultants are ready to guide you through the process, making your cryptocurrency buying journey effortless.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.