Following Bitcoin’s Path? Ethereum ETFs Approval Decision This Week

May 21, 2024

The price of Ether (ETH) surged overnight as traders speculated that the SEC might approve Ethereum ETFs soon, following rumours of a major SEC reversal. ETH recently traded with gains exceeding 10%, reaching the AU$5,300 (US$3,500) range.

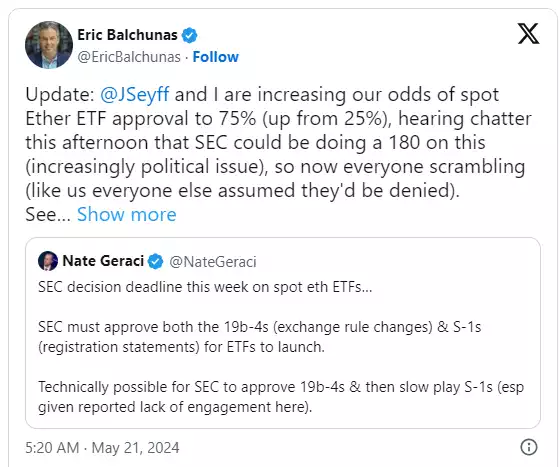

Bloomberg ETF analyst Eric Balchunas tweeted on X that he and fellow analyst James Seyffart increased their odds of approval to 75% after hearing speculation of an SEC “180-degree turn.”

With deadlines to approve, deny, or extend some ETF applications approaching on Thursday, approval could be imminent.

Prior to these latest rumours, most anticipated that the SEC would reject Ethereum ETFs, especially since the SEC has been considering classifying Ether as a security in recent months.

Will the SEC Approve Ethereum ETFs?

Bloomberg analysts Balchunas and Seyffart have a strong track record of predicting crypto ETF approvals. They advocated for spot Bitcoin ETF approvals in 2023 despite market scepticism at the time.

Unsurprisingly, a major repricing is currently underway in the Ether market. Investors are increasingly betting that the SEC will approve spot Ethereum ETFs, pushing the price significantly higher. Why?

The approval of Ethereum ETFs would provide institutional investors with much easier access to Ether, likely boosting the Ether price substantially over the long term, as seen with Bitcoin.

Where Next for ETH?

The recent surge in Ether’s price has broken it out of a downward trend channel that had been in play since mid-March. ETH has cleared its major moving averages and found strong support at its 2024 uptrend.

Technical analysis suggests that the near-term outlook for Ether’s price is bullish. The next upside target is the April highs above AU$5,668 (US$3,700). Beyond that, a near-term test of March highs above AU$6,120 (US$4,000) is probable.

A $6,120 (US$4,000) Ether Price Is Likely If the SEC Approves Ethereum ETFs

The approval of Ether ETFs would coincide with already improving market sentiment. Recently released U.S. jobs and CPI inflation data for April reduced fears of an overheating economy, boosting hopes that the Fed might cut interest rates multiple times this year.

Nvidia earnings and FOMC minutes could also provide catalysts for further upward movement.

Before Monday’s surge, Ether had been lagging behind Bitcoin. However, a continued improvement in market sentiment, combined with the approval of Ethereum ETFs, could be the perfect mix to propel Ether back to its record highs near AU$7,347 (US$4,900).

This Path Has Been Trodden Before

This scenario echoes Bitcoin’s journey, where initial scepticism about ETF approval was followed by court-forced approvals and remarkable price increases. Bitcoin, having become the most successful ETF in history, saw a price increase of 70% year-to-date. ETH is likely to follow a similar trajectory, albeit possibly with some delays, proving the strength and potential of Ethereum ETFs in the market.

As investors consider diversifying their portfolios, it’s worth noting the parallels between Bitcoin and Ethereum. Just as Bitcoin ETFs revolutionised institutional investment in cryptocurrency, Ethereum ETFs hold the potential to do the same for Ether.

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Join us here or connect with Ainslie Crypto’s team at 1800 296 865 or via info@ainsliecrypto.com.au. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie has been a trusted dealer and custody provider for Gold 1.0 for 50 years and has brought the same service to Gold 2.0, Bitcoin, since 2017.

In an era where traditional banking systems impose increasing limitations, Ainslie Crypto offers a forward-thinking payment solution with the Australian Digital Dollar (AUDD) platform. Developed by Novatti, AUDD allows you to navigate beyond the constraints of conventional financial systems, offering stability, security, and ease in your crypto transactions.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provides swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.