ETHEREUM’S SHANGHAI TWIST

July 4, 2023

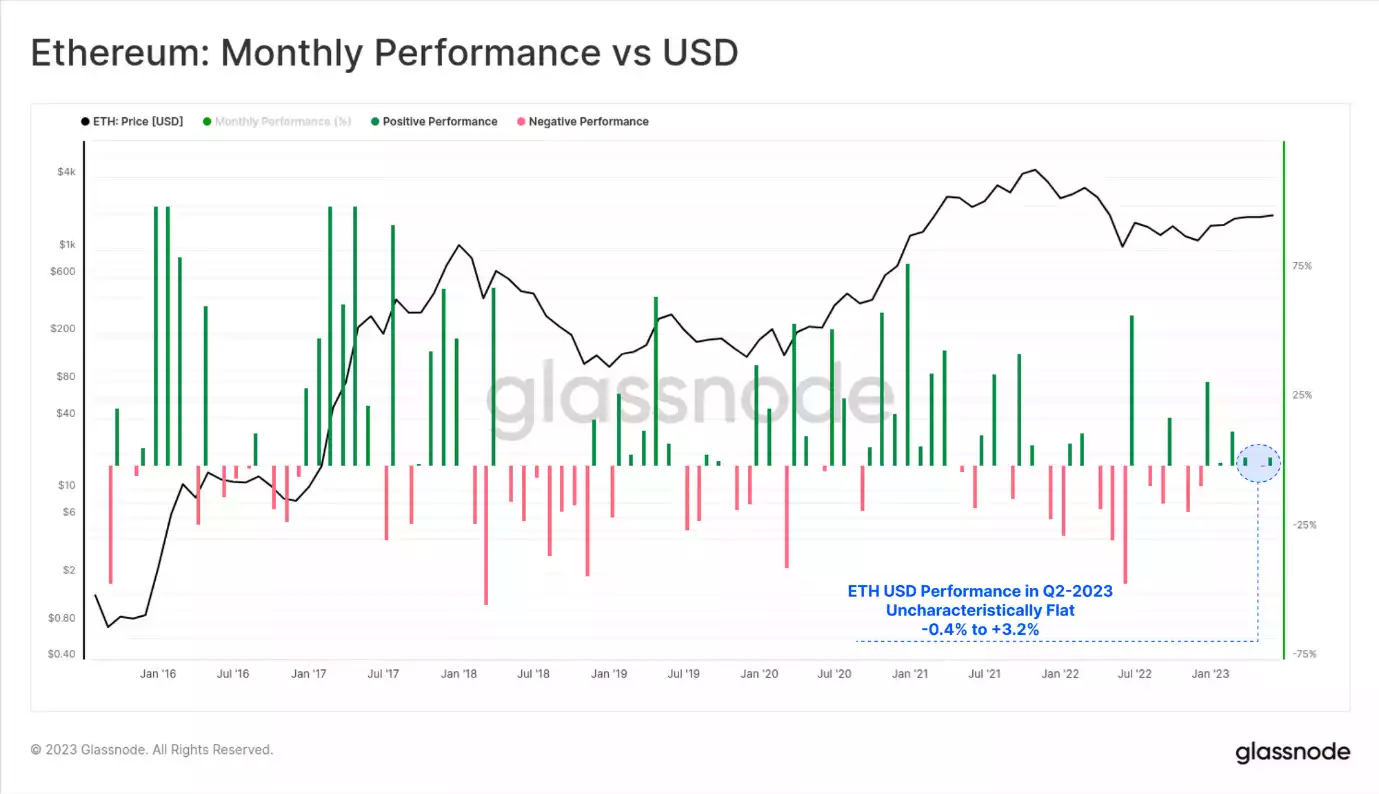

Following the Ethereum Shanghai upgrade, a trend of preference for liquid staking tokens has emerged in the cryptocurrency marketplace. Lido’s stETH is leading this pack, holding onto its dominant position amid the changes. This trend stems from the recent introduction of Ethereum’s staking withdrawal functionality in mid-April, sparking a growing interest in the fluidity and dynamism of liquid staking tokens. Lido’s stETH is exemplifying this interest, exhibiting robust supply, liquidity, and integration network effects. Meanwhile, DeFi has seen a decrease in the value locked in liquid staking-related liquidity pools as capital migrates towards use as collateral in lending protocols. Amid these dynamics, the digital asset market has been sailing through a plethora of spot Bitcoin (BTC) Exchange-Traded Fund (ETF) applications, with Bitcoin noticeably outperforming the broader market. While Ethereum (ETH) experienced an initial 11.2% price boost following BlackRock’s ETF filing, it concluded Q2 with a comparatively modest 6.4% increase over its April opening price.

Evaluating the ETH/BTC Ratio Amid Rising Ethereum Prices

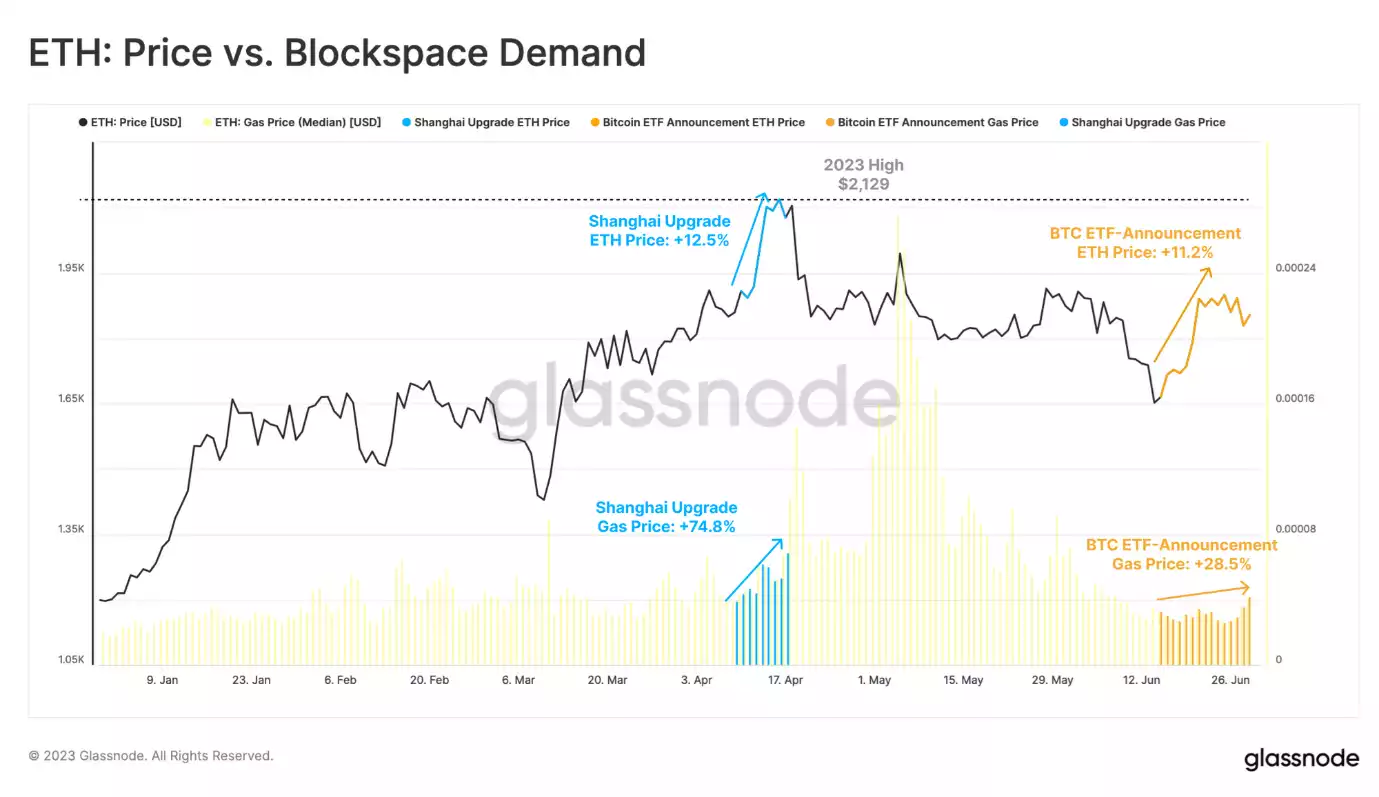

In 2023, a slew of digital assets, including Ethereum (ETH), faced a relative decrease against Bitcoin. The ETH/BTC ratio dipped to a 50-week low of 0.060, but showing resilience, it rebounded to 0.063 at the start of July. Despite the surge in Ethereum prices in 2023, there has not been a substantial impact on network activity. Gas prices, a key indicator of blockspace demand, remained comparably low, particularly following the flurry of Exchange Traded Fund (ETF) filing announcements. In comparison, the Shanghai upgrade in April led to a 78% increase in gas prices, which was echoed by a similar Ethereum market upswing.

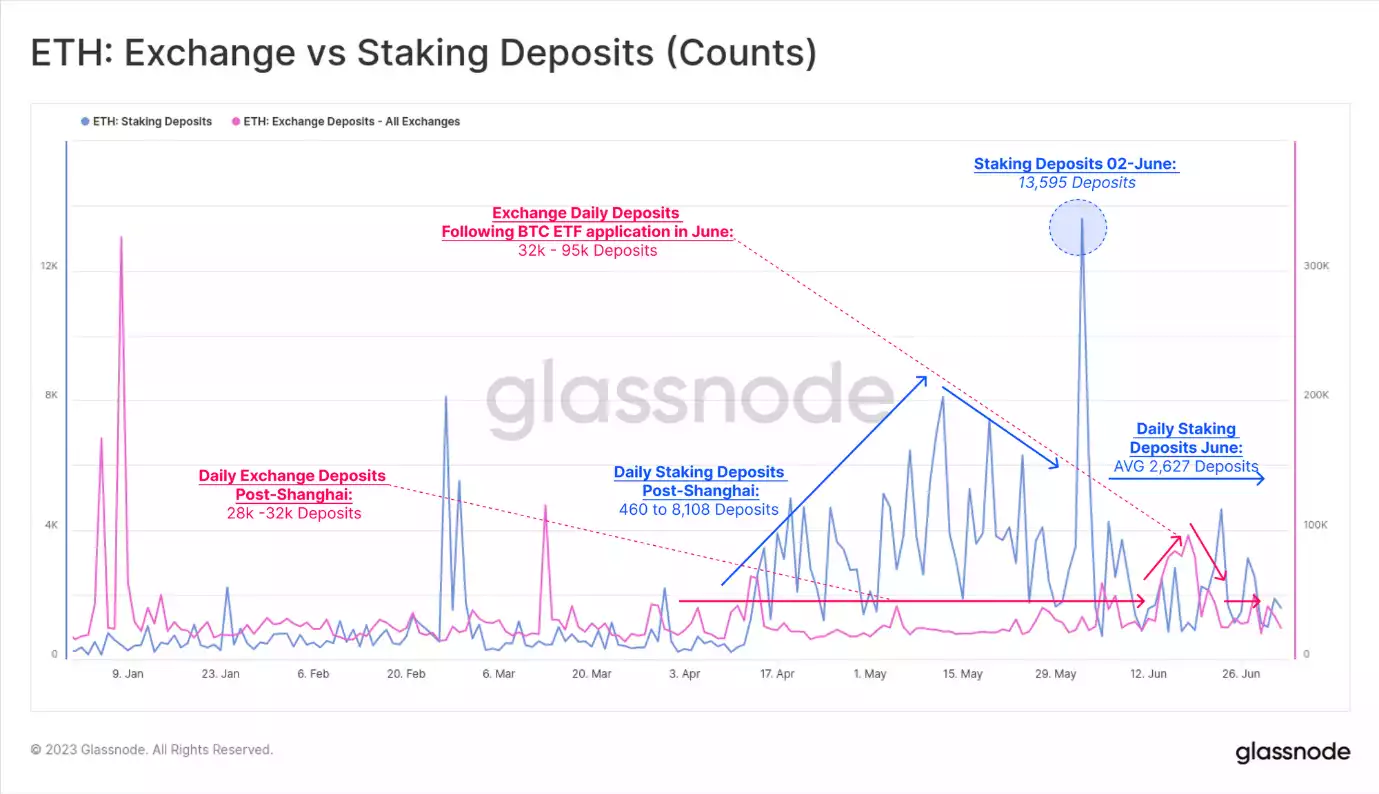

Staking Operations Reinforced Post Shanghai Hardfork

The Shanghai hardfork, which enabled staked Ether (ETH) to be withdrawn from the Ethereum consensus mechanism, introduced a significant shift in the network’s staking operations. Far from prompting widespread withdrawals, the upgrade spurred a fresh wave of deposits. The peak of this activity was seen on June 2, with over 13,595 new deposits translating to over 408,000 ETH. In contrast, the number of ETH deposit transactions on exchanges during this period remained relatively constant, indicating a significant increase in staking activity following the hardfork.

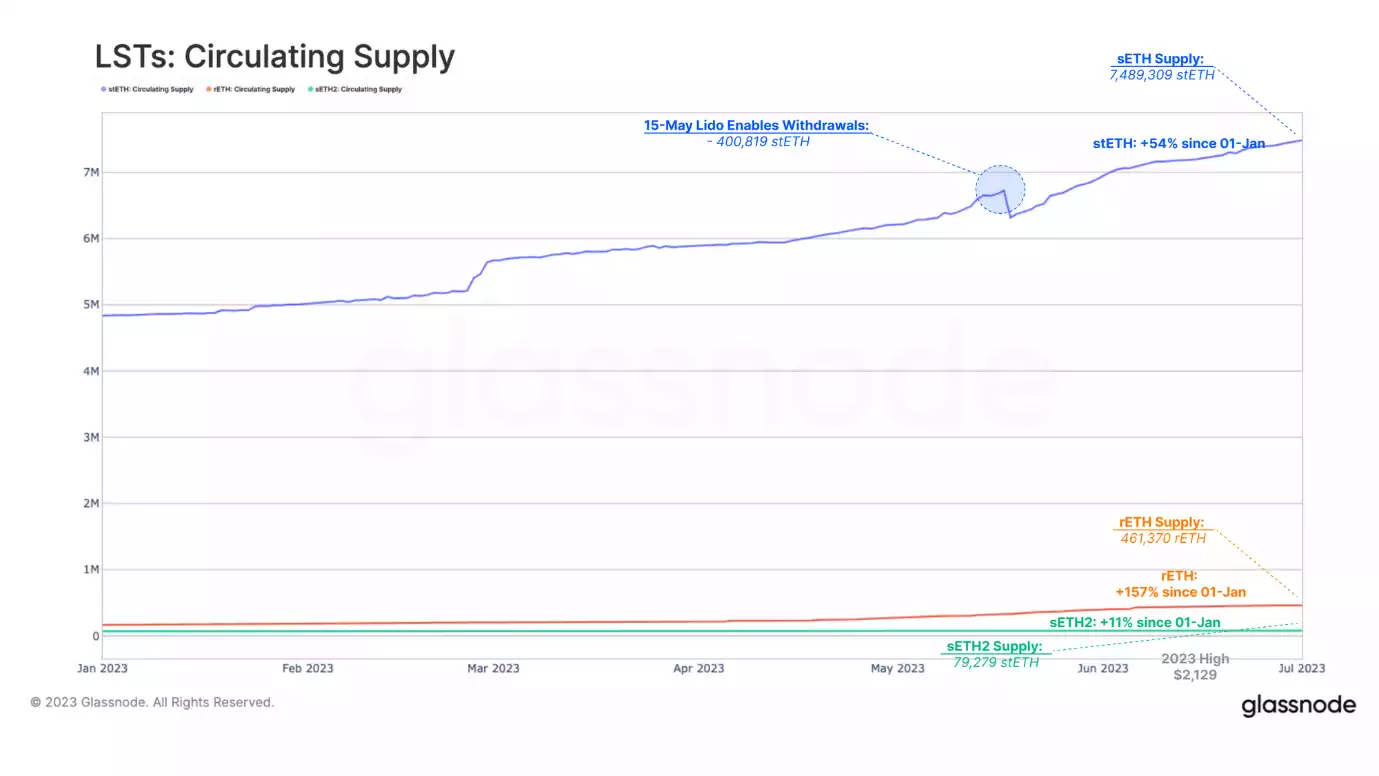

Lido V2: Boosting Liquid Staking Tokens’ Demand

The market is manifesting a growing demand for liquid staking tokens (LSTs), such as Lido’s stETH, which allows users to withdraw staked ETH. The release of Lido’s V2 update led to a redemption of 400,000 stETH, equivalent to $721 million, causing a dip in stETH supply. Yet, the influx of new ETH deposits compensated for the supply decrease, pushing the stETH supply to a new all-time high of 7.49 million. In the face of competition, Lido stands as the clear market leader, with its supply outpacing its nearest competitor by 16 times.

Exploring the Downtrend in Annualised Yield (APR) and Liquidity

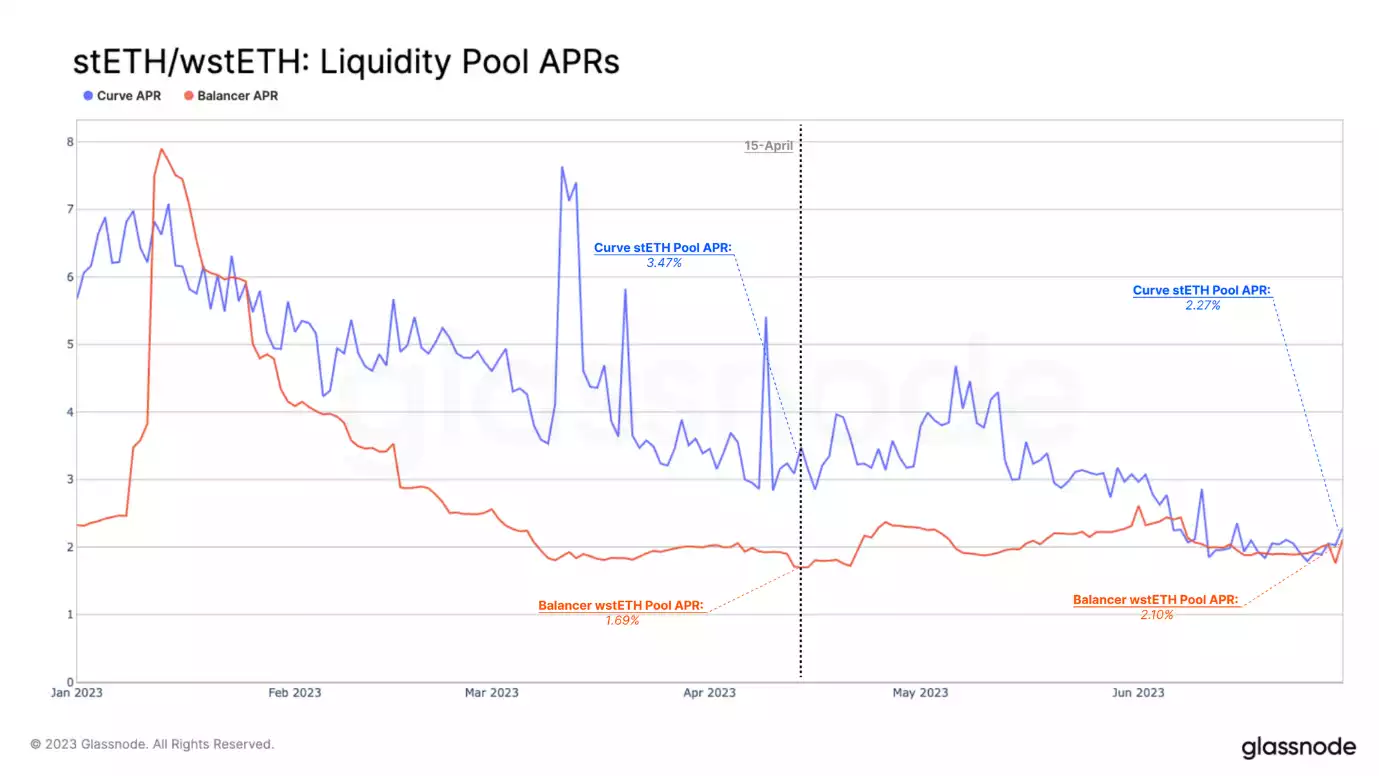

Throughout 2023, we have observed a consistent downtrend in the annualised yield (APR) of two prominent pools, the Curve stETH-ETH pool and the Balancer pool. Our analysis uses April 15th as a reference point. This date corresponds with the start of a significant surge in new staking deposits, which interestingly, coincided with a decline in liquidity on the relevant Decentralised Exchanges (DEXs).

The APR for the Curve stETH-ETH pool, as a case in point, decreased from 3.47% on April 15th to a current 2.27%. On the other hand, the APR for the Balancer pool dipped to its lowest at 1.69% in April and has since mildly rebounded to 2.10%.

It’s worth noting that these APRs for liquidity pools aren’t standalone figures; they comprise different reward structures paid in various tokens. To illustrate, the Lido project incentivises Curve liquidity providers with additional LDO tokens, a program set to conclude on June 1st.

However, the contrasting APR trends on both platforms aren’t entirely accounted for by the changing reward structure. This discrepancy indicates that other underlying factors are contributing to the decline in liquidity.

One possible explanation lies in the changing relevance of APRs for Lido Staking Token (LST) pools since the initiation of withdrawals. Before the Shanghai upgrade, liquidity pools served as the sole source of liquidity for stakers. Yet, with the upgrade enabling users to directly mint or redeem with the platform, the need to trade between stETH and ETH on DEXs has diminished.

This development hints at a broader trend: market makers might be witnessing dwindling return opportunities as DeFi liquidity providers. Such a shift could be influenced by the withdrawal of several major market makers in response to heightened regulatory scrutiny in the USA. As the dynamics of the crypto market continue to evolve, these trends underscore the necessity for adaptive strategies and vigilant market observation.

As we conclude our exploration of the recent market trends, it’s vital to reflect on what all this could mean for regular ETH holders. The increasing use of stETH in DeFi protocols as collateral for loans could result in more transactions and interactions within the Ethereum network. This network effect is a reflection of Metcalfe’s Law, which states that the value of a network is proportional to the square of the number of its users. As more users interact with stETH, the entire Ethereum network, including ETH, stands to gain in terms of value and utility. The shift in staking behaviour post the Shanghai upgrade, coupled with the growth of liquid staking tokens like stETH, underscores the potential for exponential growth in network value. Regular ETH holders can anticipate exciting times ahead as these dynamics continue to shape and influence the Ethereum ecosystem.

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.