BITCOIN’S CURRENT STATE OF INVESTOR APATHY

June 20, 2023

Bitcoin’s volatility, volumes, and realised values are currently at their lowest in years, painting a picture of a market characterised by investor apathy. Yet, despite the indifference, Bitcoin accumulation by long-term holders (HODLers) remains consistent. There is a steady outflow of BTC supply from exchanges, miners, and whale wallets towards HODLer entities of various sizes, suggesting a healthy rate of Bitcoin acquisition.

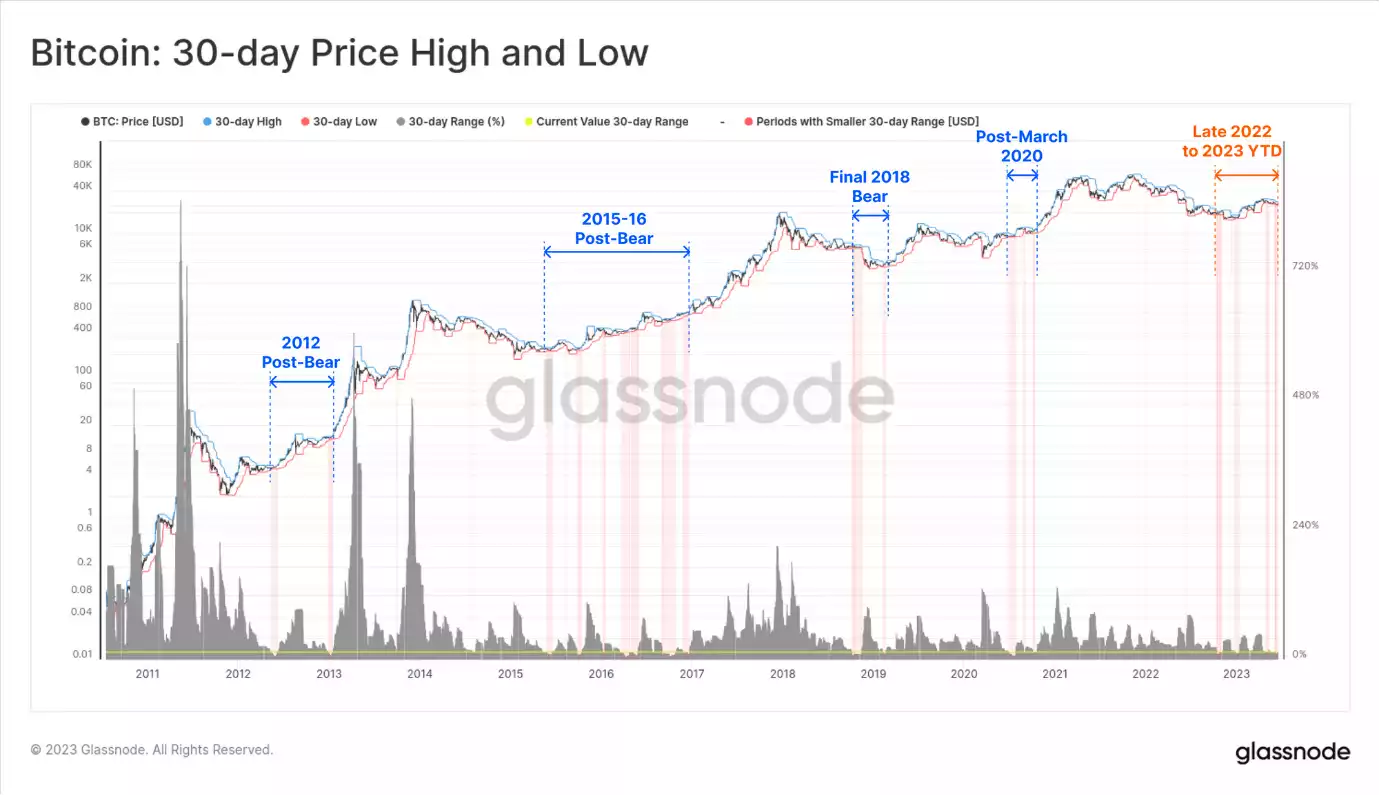

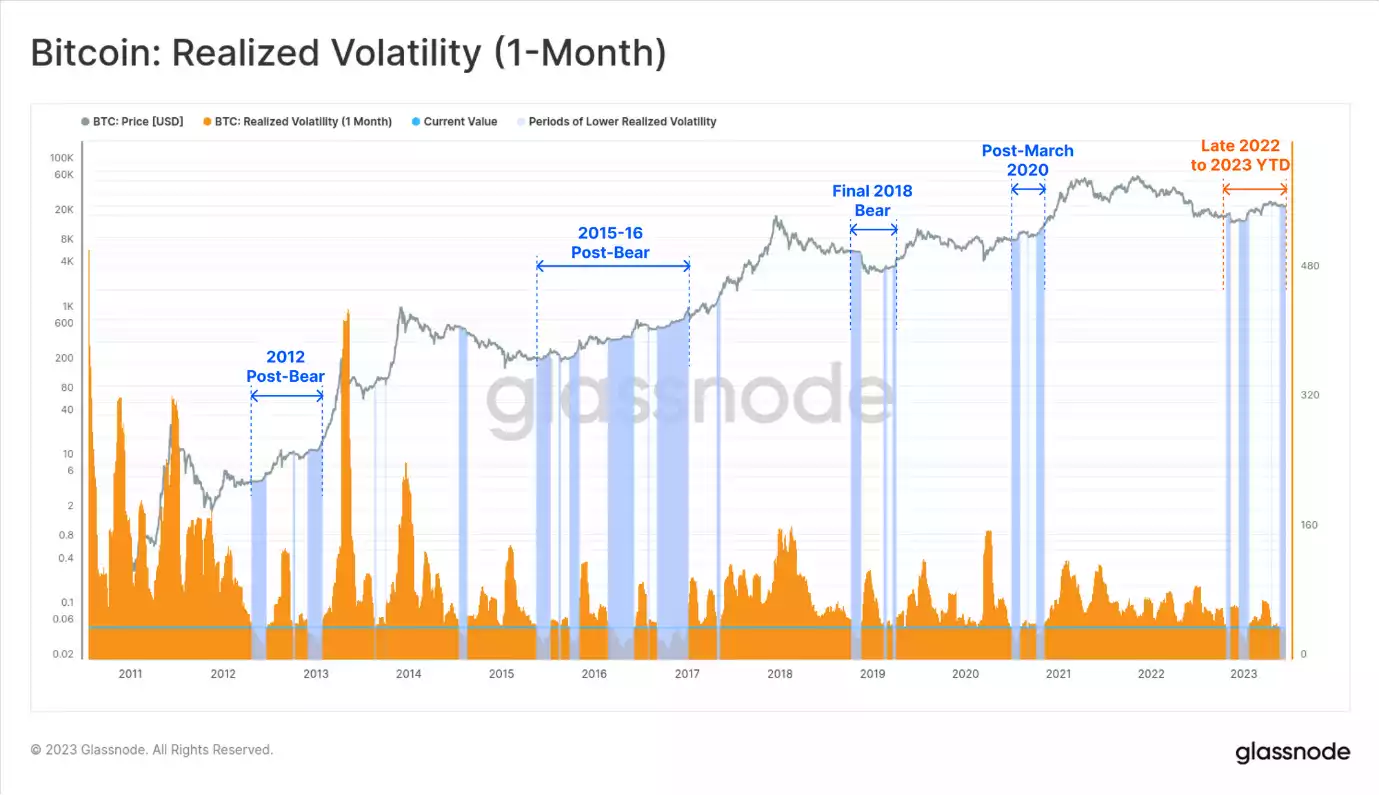

Historical analysis identifies similar periods as transitional phases marked by investor disinterest. In the current context, Bitcoin is merely 305 days away from its next halving event. Despite significant swings throughout the week, Bitcoin’s price settled near its opening value, confirming the market’s ongoing stagnation. Previous occurrences of such quiet periods have followed bear markets, further solidifying the current sentiment of market apathy.

The Calm After the Storm: Crypto Market Volatility Takes a Dip

A drop in the cryptocurrency market’s 1-month Realised Volatility to 39.6% signifies one of the lowest recordings since the bull market of 2021. This reduction typically occurs during protracted periods of sideways market movement, suggesting the market is stabilising following an extended bearish trend.

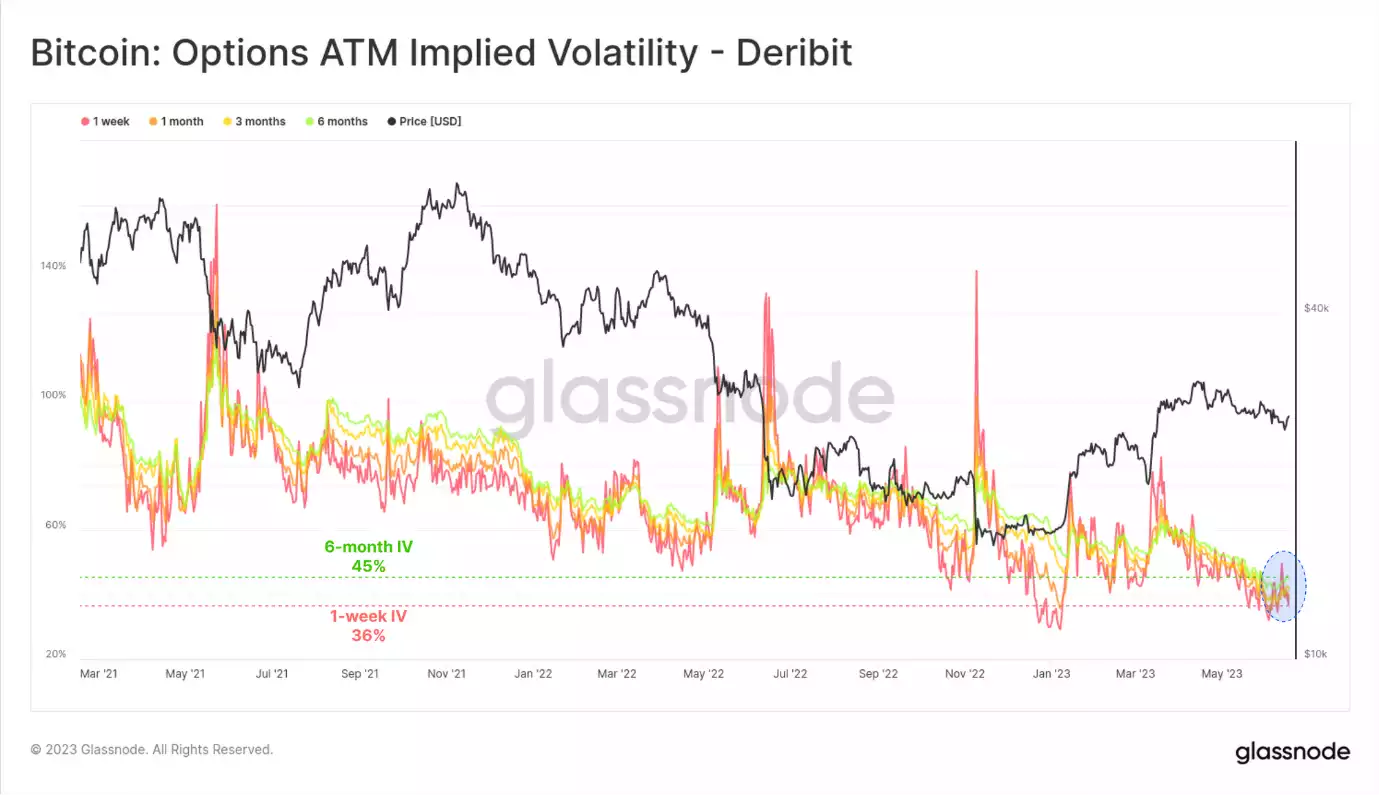

In Quiet Waters: A Subdued Expectation of Future Market Fluctuations

Implied volatility across various option contracts, ranging from 1-week to 6-months, has reached cycle lows. This trend indicates reduced expectations of market movements, with the near-term 1-week implied volatility standing at its second-lowest recorded value of 36%. Simultaneously, the 3-month and 6-month contracts also hint at historically low volatility over these periods.

Cold Storage and HODLers: Analysing Market Participant Behaviour

Currently, digital asset liquidity is exceptionally thin, both on-chain and off-chain. The metric of ‘Liveliness’ provides insight into this trend, demonstrating a multi-year macro downtrend that reached its peak during the bear market’s onset in May 2021. This pattern mirrors the 2018-2020 cycle, characterised by Bitcoins slowly migrating into cold storage, withdrawn from the market by the HODLer group.

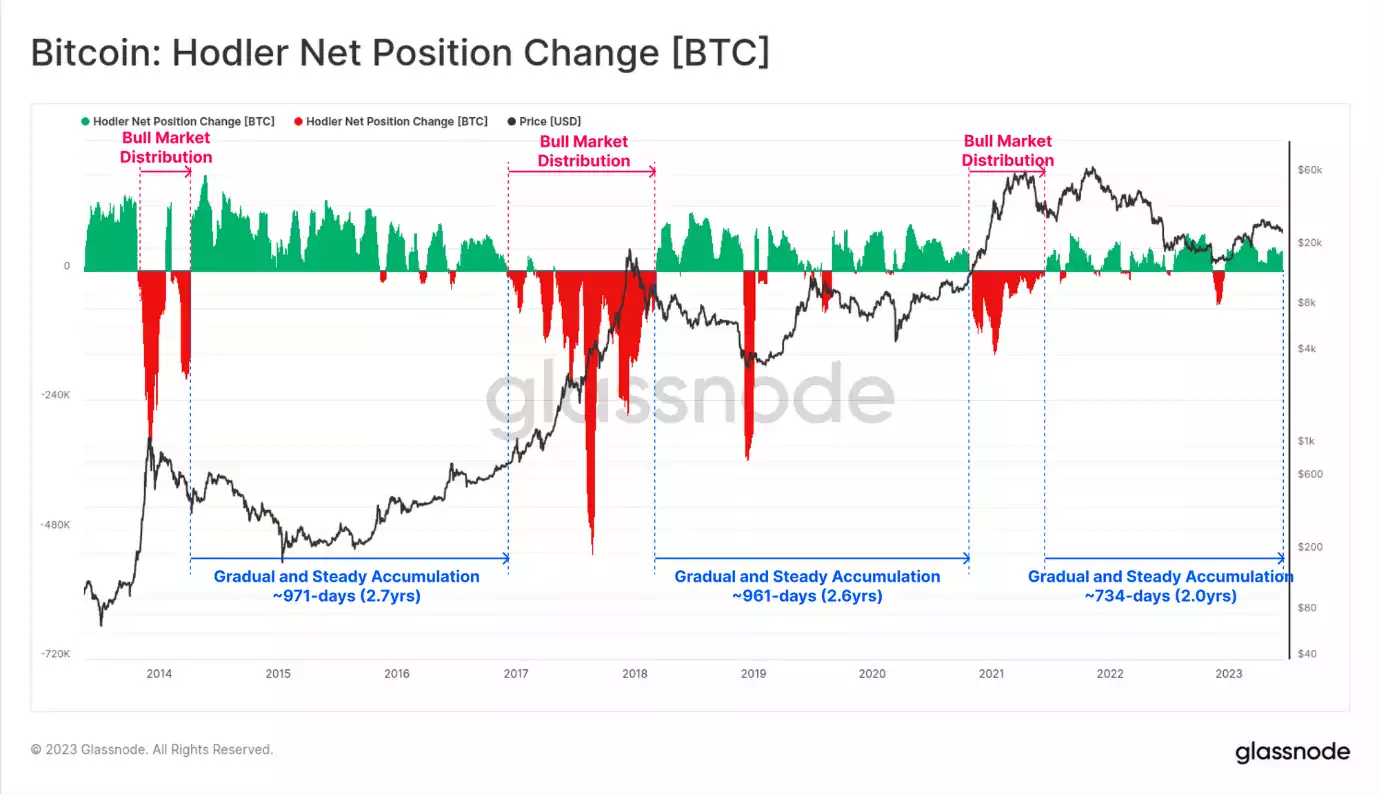

The Persistent Accumulators: The Role of HODLers in the Market

HODLers, the unflappable Bitcoin holders, continue their trend of significant Bitcoin acquisition, currently at a rate of about 42.2k BTC per month. When juxtaposed with previous market cycles, it’s clear that this phase of steady accumulation began just over two years ago.

Holding vs Trading: The Bitcoin Balance Game

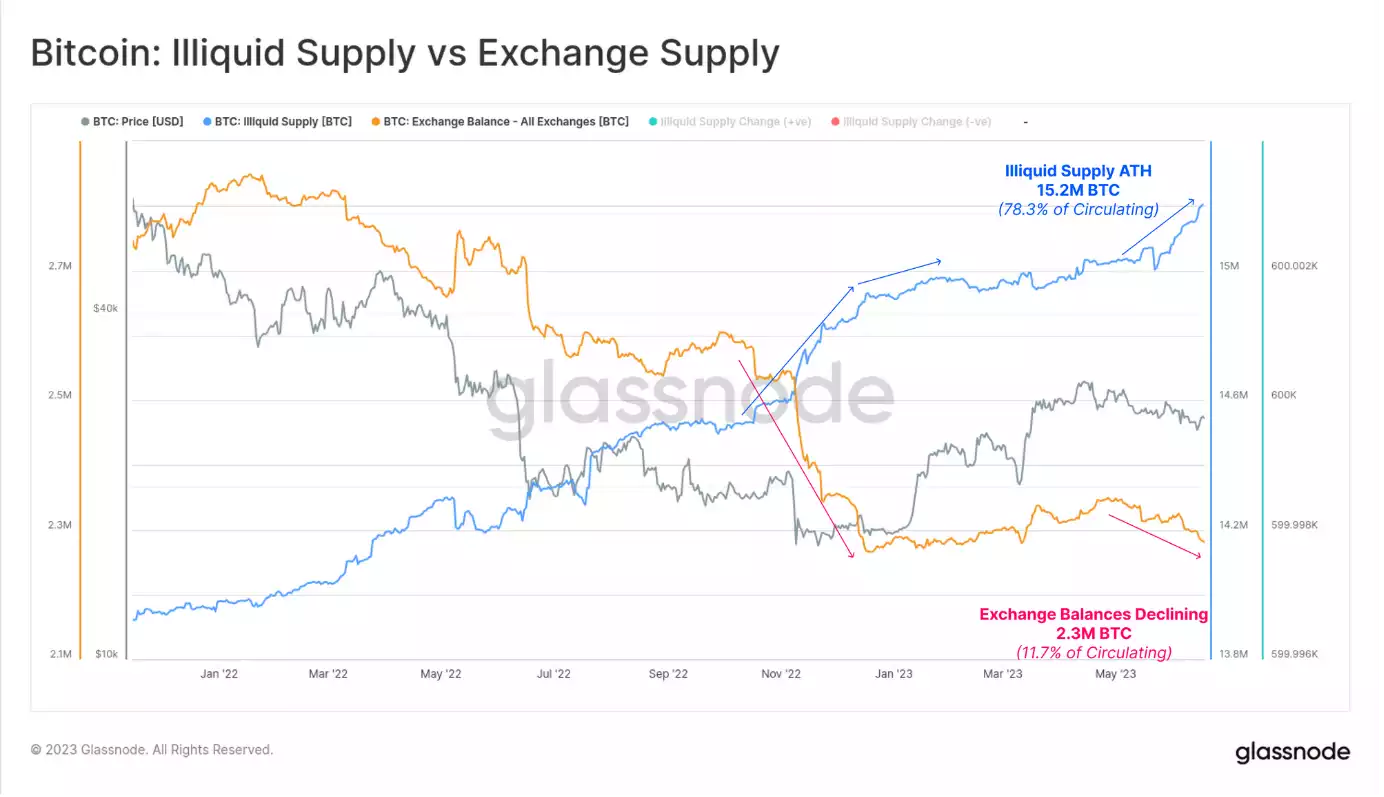

The divergence between exchange balances and the volume of coins held in illiquid wallets further underscores the market’s sentiment. As the illiquid supply hits a new all-time high, exchange balances drop to their lowest levels since January 2018. This divergence indicates a stronger inclination towards holding Bitcoin rather than trading or selling it on exchanges.

The Market’s Crystal Ball: Anticipating Future Trends

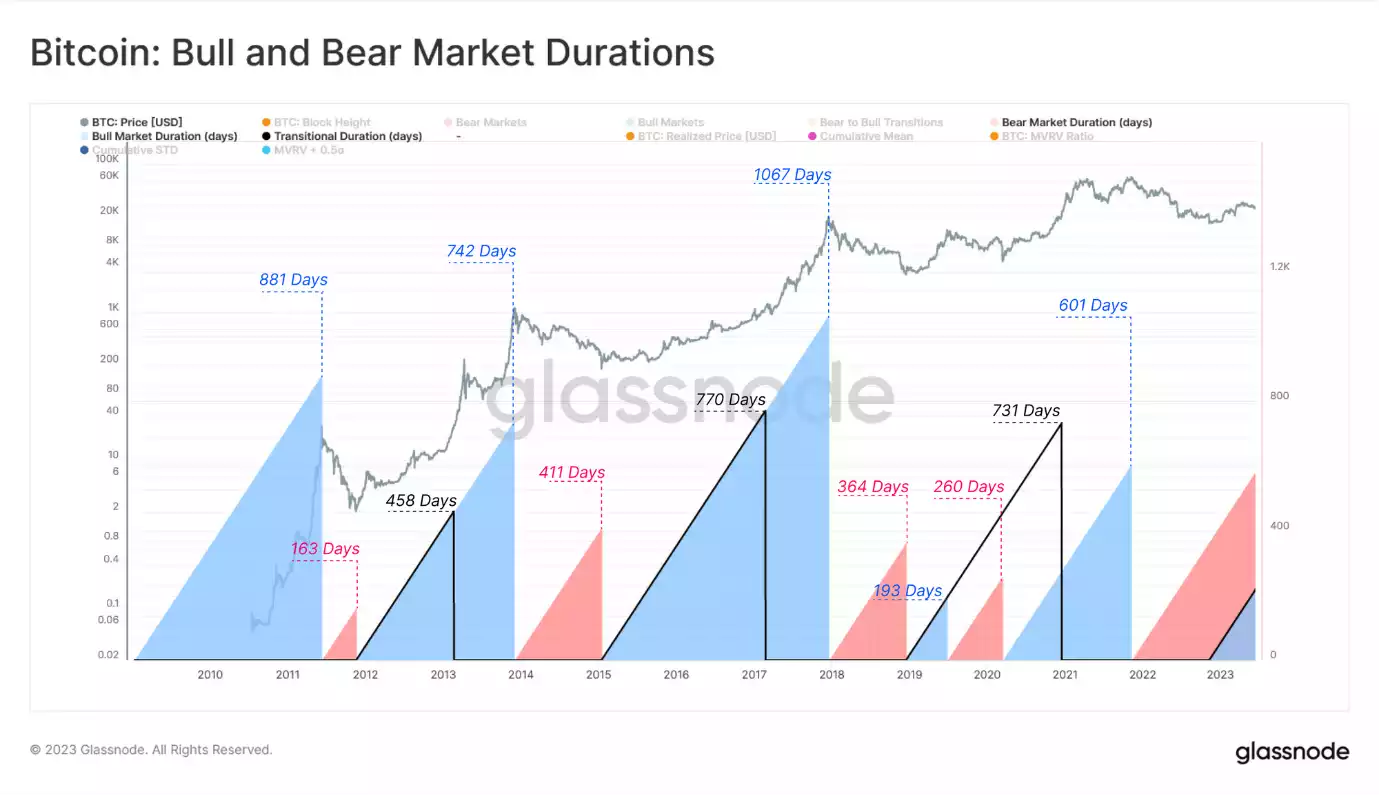

When attempting to anticipate future trends in the cryptocurrency market, it’s useful to divide the market timeline into distinct phases: the Bull Market, Bear Market, and Transition period. Based on historical patterns, if the market lows set in November 2022 continue to hold, it could be argued that the market has been in a transitional phase for 221 days.

Evaluating the Bitcoin Epochs: Price Performance Post-Halving

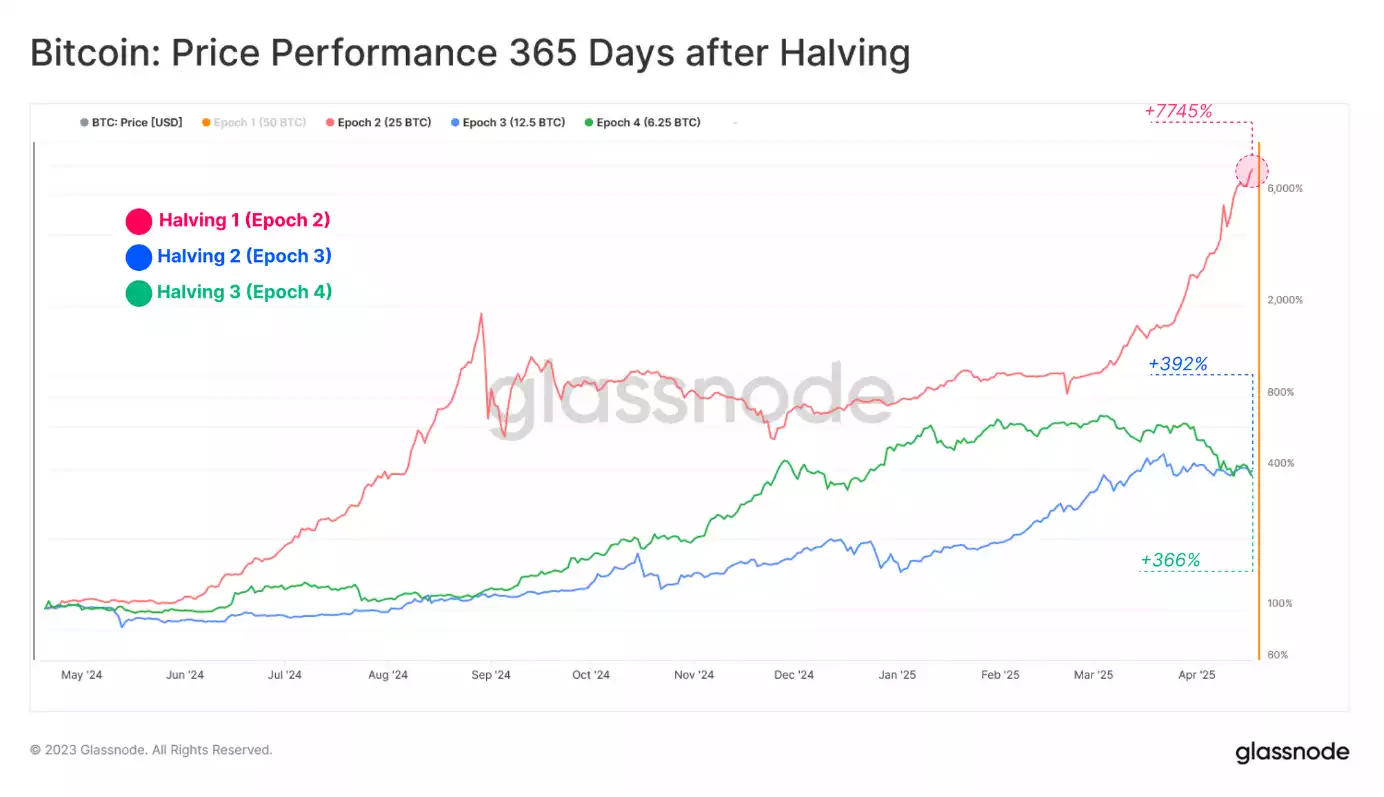

The analysis wouldn’t be complete without examining the price performance following Bitcoin’s halving events, also known as “epochs.” During Epoch 2, the price performance saw a significant increase of +7358%, despite experiencing a maximum drawdown of -69.4%.

In the following Epoch 3, the price performance was slightly subdued but still high at +393%, with a maximum drawdown of -29.6%. During the most recent Epoch 4, the price performance was a “moderate” +366%.

An Unassuming Market: The Current State of Digital Assets

At present, the digital asset markets are showing low activity or enthusiasm across most measures of market energy. Metrics such as volatility, volumes, and realised value have all hit multi-year lows, pointing to a shift from investor excitement to indifference.

Despite the current quietude in the market, the steady accumulation of Bitcoin, particularly by the HODLers, hints at underlying optimism. The market is likely consolidating and building a strong base before the next significant move. The relatively low volatility levels, historically associated with periods of market stabilisation after an extended bearish trend, also point to this possibility.

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.