RECORD-BREAKING BITCOIN SURGE: THE BRC-20 WAVE

May 16, 2023

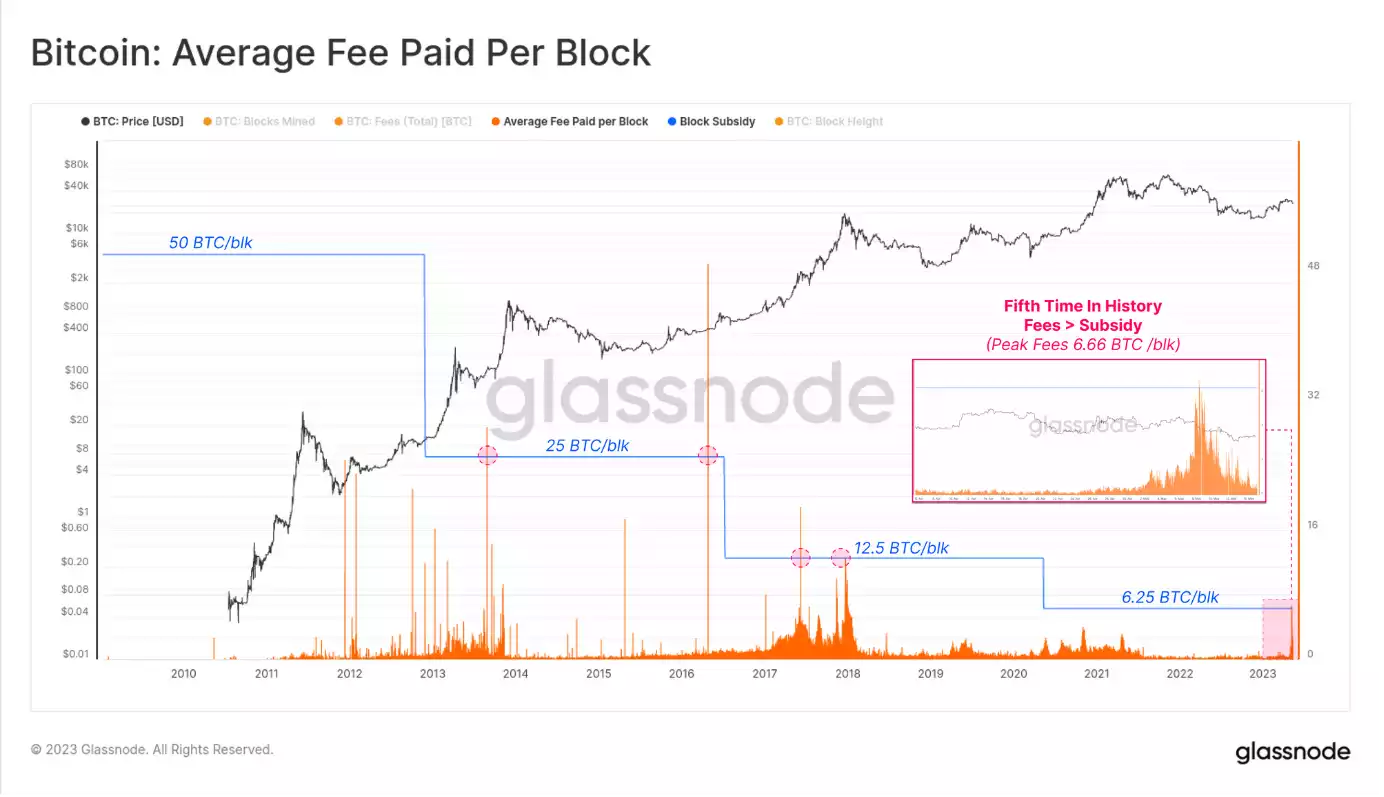

In an unprecedented development, the demand for Bitcoin blockspace surged in the past week, driven primarily by speculators eager to mint BRC-20 tokens through text inscriptions. This rush led to a significant rise in transaction fees, pushing miner fee revenue towards all-time highs and for the fifth time in history, surpassing the 6.25 BTC block subsidy. Consequently, Bitcoin transactions reached an all-time high, and the average fee paid per block to miners exceeded the block subsidy. Despite the uncertain future of BRC-20 tokens, the temporary surge in mining revenue has provided much-needed relief for miners following the harsh bear market of 2022.

BRC-20 Tokens Drive Unprecedented Bitcoin Blockspace Demand

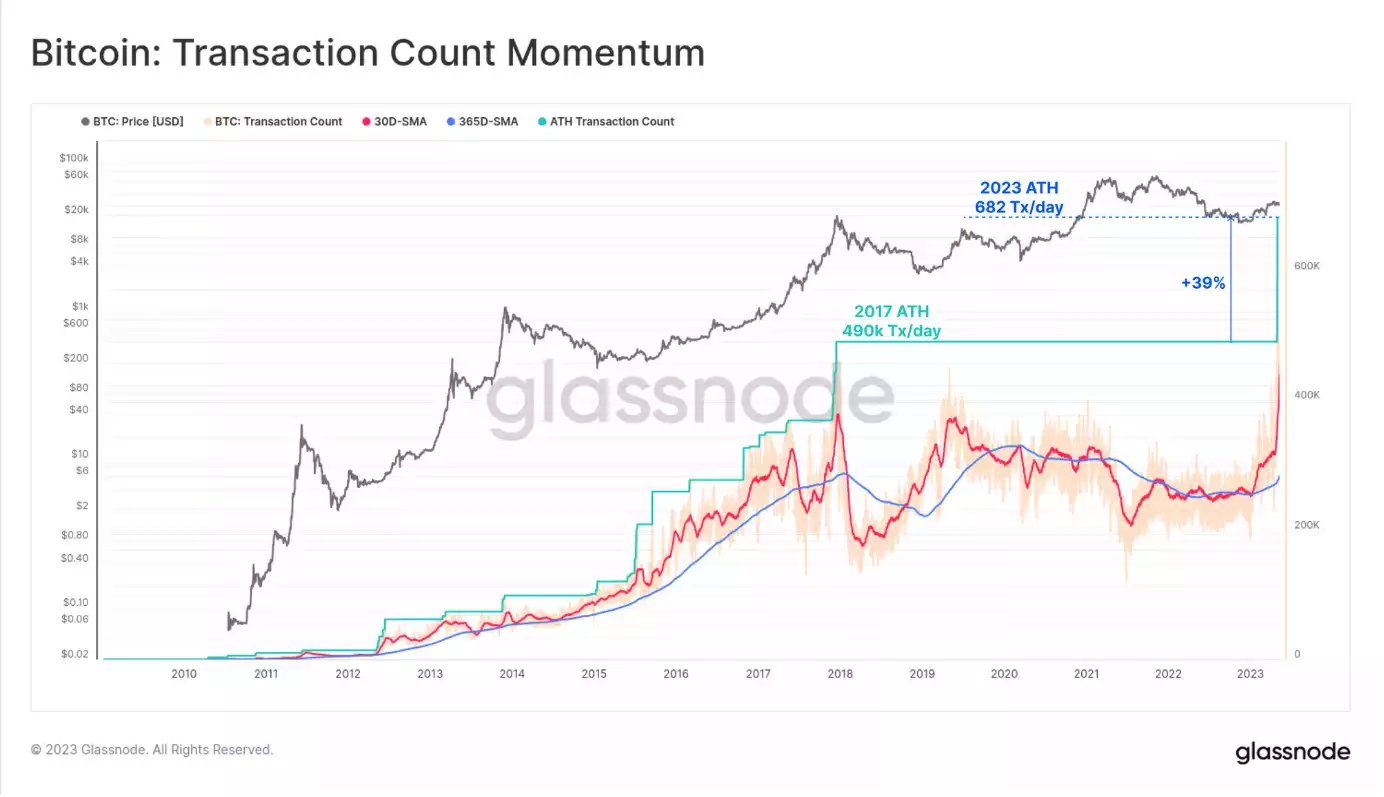

The Bitcoin network witnessed a significant rise in blockspace demand due to the emergence of BRC-20 tokens. Implemented by inscribing JSON text files into the blockchain, BRC-20 represents a proposed mechanism for issuing tokens on the Bitcoin ledger using ordinal theory. Despite the small data footprint of these inscriptions, the large fees that BRC-20 users were willing to pay enabled miners to fill blocks with an unprecedented number of transactions, reaching a new all-time high daily transaction count of 682,000. This marks the historically largest inflow of demand for blockspace on the Bitcoin network and indicates a promising start for the BRC-20 mechanism and its potential impact on Bitcoin’s blockspace demand and usage.

Doubling Transactions Per Block: A Leap in Bitcoin Network Efficiency

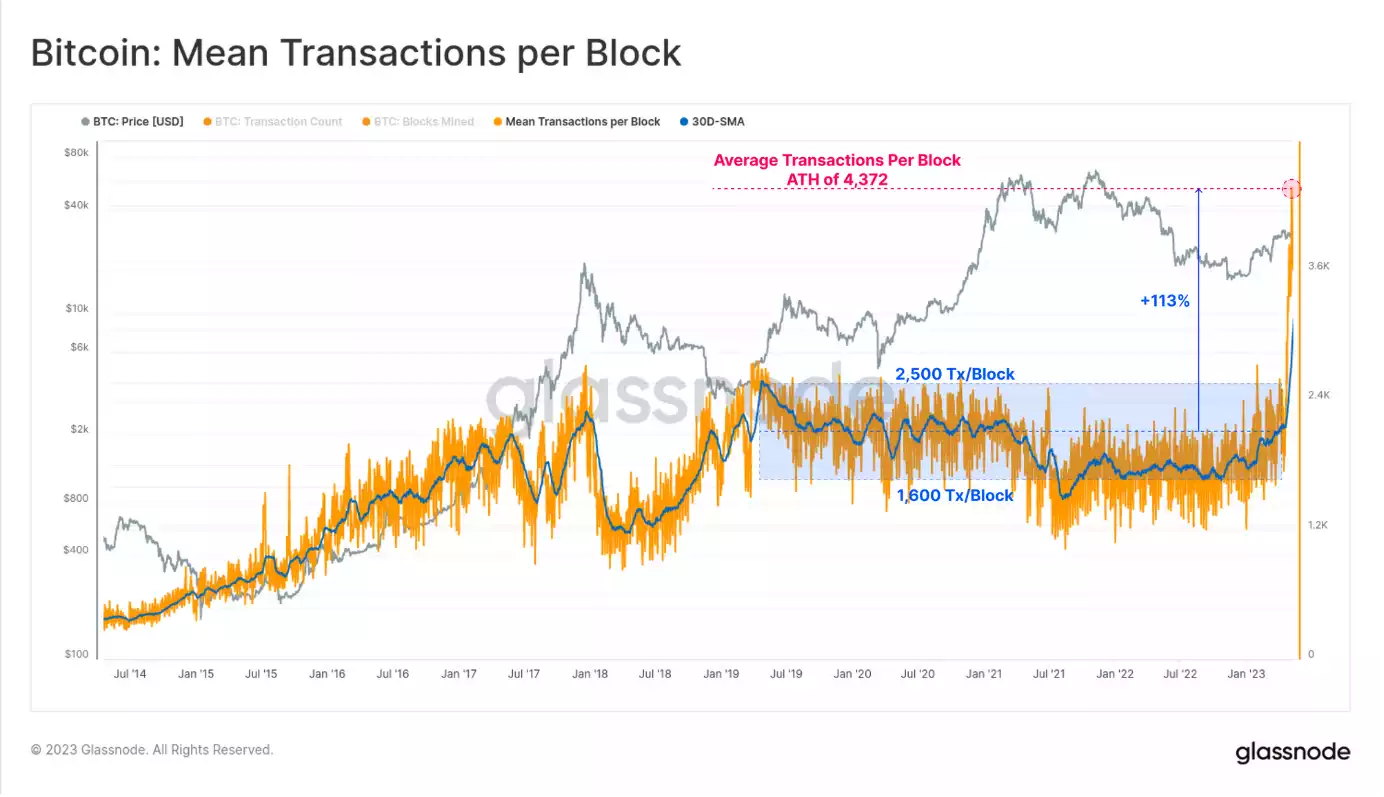

In a dramatic turn of events, the average number of transactions per block on the Bitcoin network more than doubled, rising from around 2,000 to over 4,300 transactions per block. This remarkable surge is attributed to the efficient utilisation of available block capacity through the application of a 75% discount on witness data, as employed by inscriptions. This strategy optimises the block space, allowing for more transactions to be processed within the set blocksize limit. This innovative approach demonstrates the potential for more efficient use of the Bitcoin network’s block capacity, potentially revolutionising the network’s scalability and transaction processing speed.

Active Bitcoin Addresses Dip Despite Transaction Surge

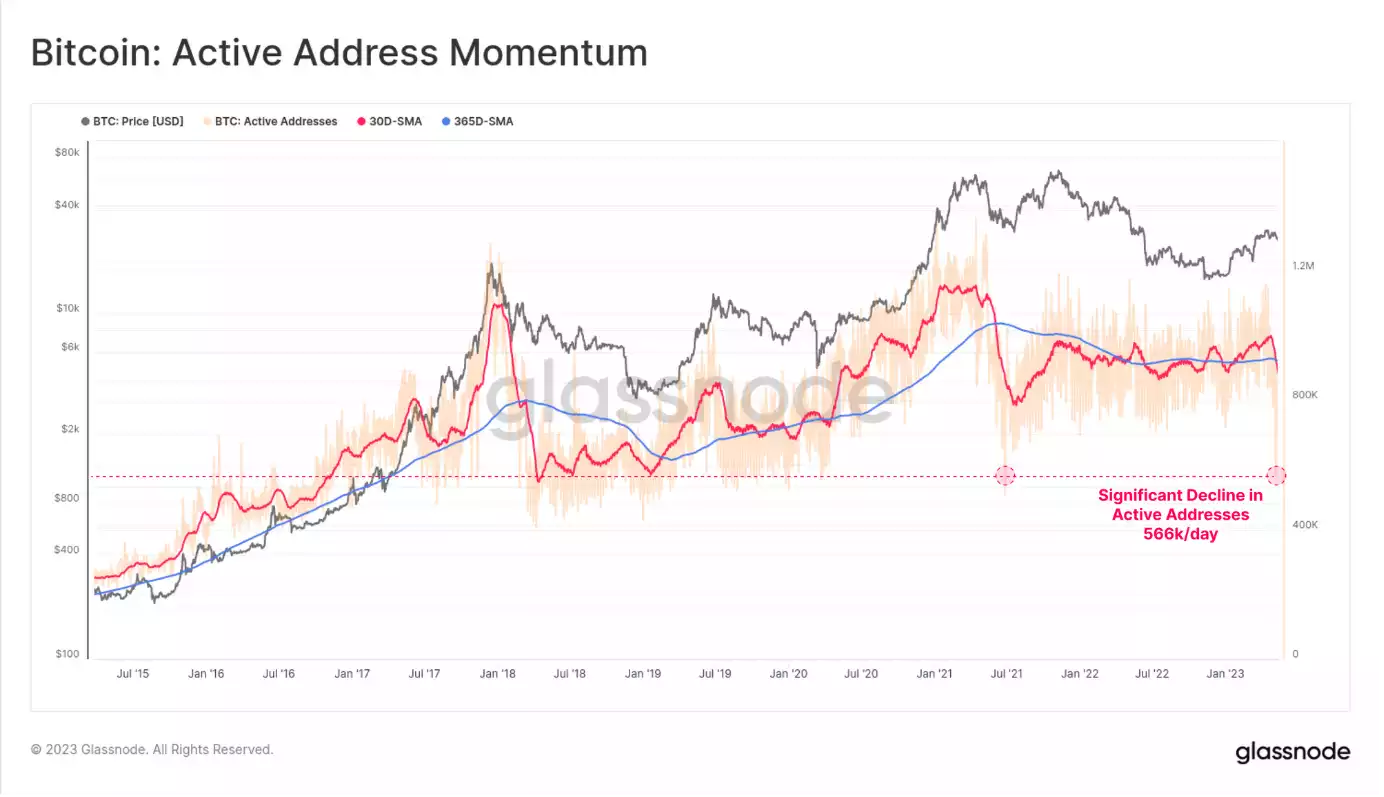

Contrary to the surging transaction activity, the number of active Bitcoin addresses dropped to cycle lows of 566k addresses per day. This trend suggests that many BRC-20 users are reusing their Bitcoin addresses instead of generating new ones for each transaction. This pattern of behaviour aligns more with account-based blockchain systems, like Ethereum or Solana, indicating a potential gap in user understanding or comfort with the Bitcoin UTXO system.

BRC-20 Inscriptions: A Move Towards Efficient On-Chain Data Footprint

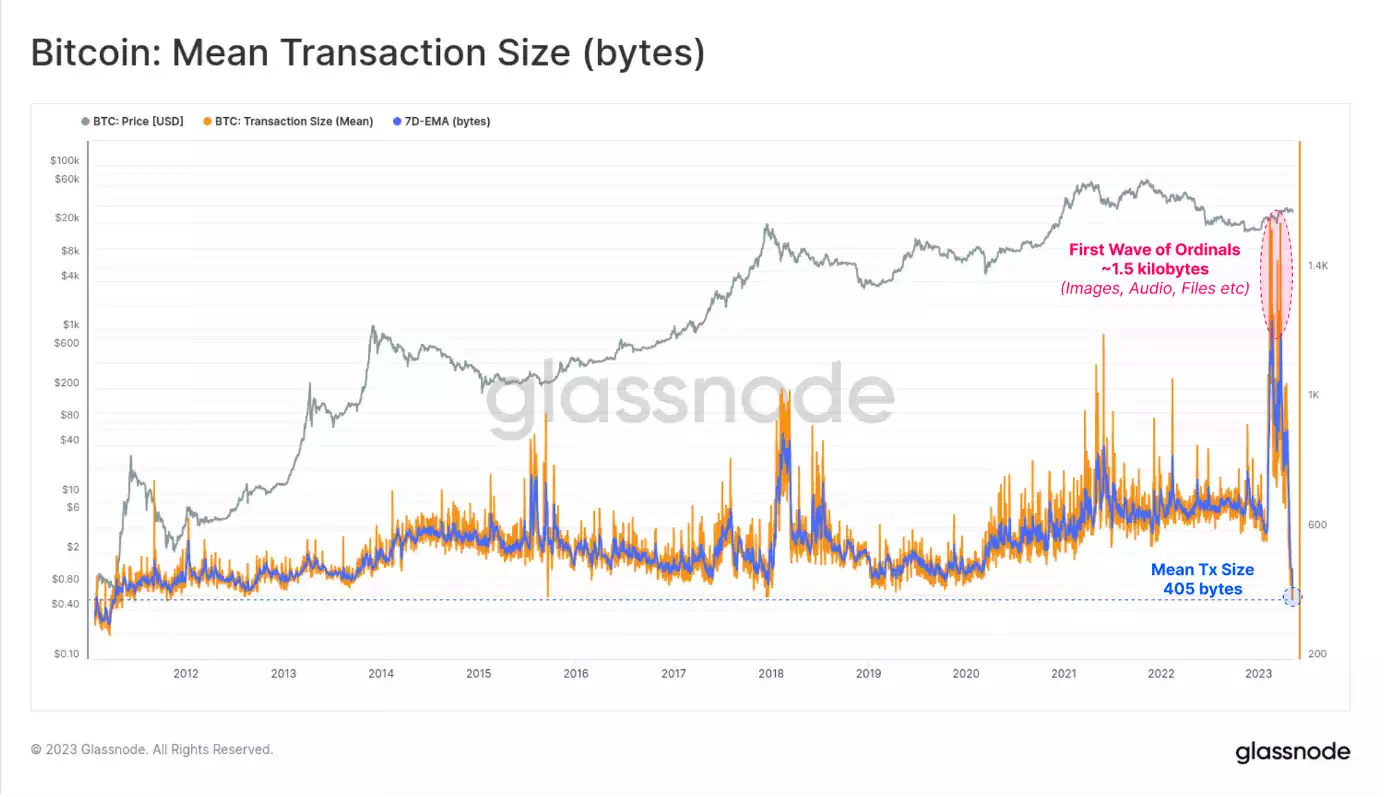

The introduction of BRC-20 inscriptions has led to a drastic decrease in the average transaction size, bringing it almost to an all-time low. These small JSON text files leverage the 75% SegWit discount on witness data, significantly reducing their on-chain data footprint. This marks a stark shift from the first quarter, where primarily image-based inscriptions led to transaction sizes reaching new all-time highs. The switch to text-based BRC-20 inscriptions demonstrates the efficiency of text over image files in blockchain transactions.

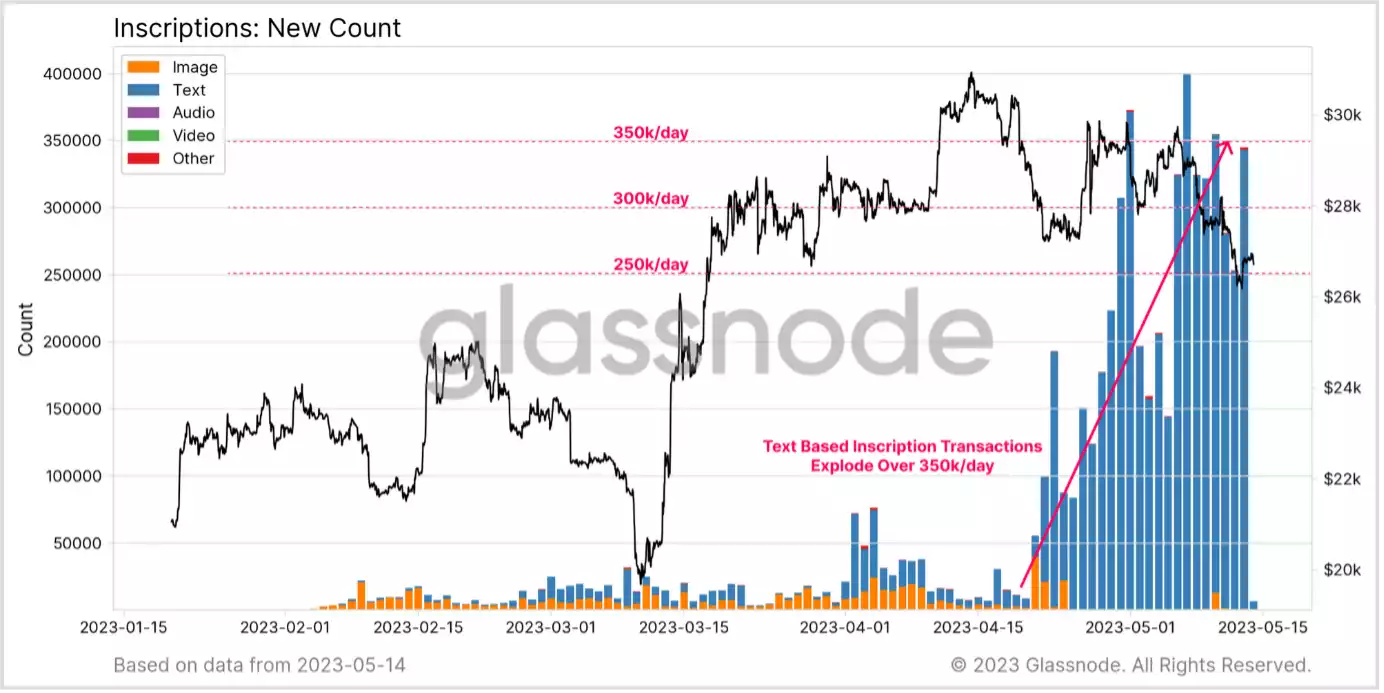

Text Inscriptions Reign Supreme on the Chain

The encoding of text-based inscriptions on the chain has seen a significant surge, overshadowing the first wave of image and file encodings. In multiple instances in May, the daily count of text inscriptions encoded to the chain exceeded 350,000, highlighting the dramatic growth. This sustained high volume of daily text inscriptions suggests a shift in use or adoption trends, with text-based inscriptions becoming the dominant form of encoding on the chain.

BRC-20 Transactors Navigate Bitcoin Mempool Congestion

The urgency of BRC-20 transactors is vividly illustrated by the substantial fees they were willing to pay due to congestion in the Bitcoin mempool, leading to a significant increase in fee pressure. Remarkably, this marked only the fifth instance in history where the average fee paid per block exceeded the block subsidy, with the last such occurrence during the 2017 market peak. At the height of the BRC-20 frenzy, the average block mined commanded a fee of 6.66 BTC, providing a total reward of 12.9 BTC per block, approximately equivalent to US$348,000.

Concluding Thoughts: A Fresh Perspective on Bitcoin Blockspace Demand

The advent of Ordinals, Inscriptions, and BRC-20 tokens has sparked a flurry of surprise, intrigue, and robust discussion within the Bitcoin ecosystem. These innovative technologies have introduced a new demographic of buyers for Bitcoin blockspace, affecting both the lower and upper bounds of fee rates paid. Over the past week, total fees paid exceeded the block reward for only the fifth time in Bitcoin’s history, nearly setting a new all-time high (ATH) in USD-denominated fee revenue of $17.8 million per day. This has provided a crucial revenue boost for miners, especially following the challenging year of 2022.

While it remains uncertain whether Inscriptions and BRC-20 tokens will maintain their relevance and usage in the long run, these innovations have certainly provided a fresh lens through which to examine the demand for Bitcoin’s settlement assurances. They stand as a testament to the dynamism and adaptability of the crypto industry, constantly evolving and presenting new opportunities for growth, innovation, and profit.

If you’re interested in an easy and personal way to buy cryptocurrency, don’t hesitate to contact Ainslie at 1800 161 383. Our team of friendly consultants are ready to guide you through the process, making your cryptocurrency buying journey effortless.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.