Evidence Blockchain Tech is the Chosen One

May 1, 2025

Traditional and Crypto Institutional titans are making strategic moves ahead of imminent crypto regulations coming to the USA. If you are not paying attention and getting ahead of the restructuring of the world’s financial system with crypto assets and blockchain technology, you may be missing the opportunity of a lifetime.

For those that have not heard of the DTCC, the Depository Trust and Clearing Corporation, they are a major financial market infrastructure company and is the parent company for many other US based clearance entities and well as 15 other facilities, data centres and offices globally… Basically THEY ARE BIG.

It’s estimated that they currently do US$2-3 quadrillion per year in post trade clearing and settlement, exchanging of securities, and reporting of trades for financial market participants.

In a recent deep dive by Generation Infinity through the US Patents Office, it was discovered that as of March 2025 the DTCC lodged a patent which outlined a new financial system that was blockchain based, legacy controlled and interoperable with existing network support for Bitcoin, Ethereum, XRP, HBAR, ATOM, BNB, TRX and XTZ, with ability to expand to other chains and hybrid chains.

And this makes sense regarding a multi chain approach as each blockchain, and their related digital assets perform very different roles in what would need to be an exhaustive and interoperable technology stack. Some chains perform better settlement functionality like XRP, whereas data and reporting information and tokenization of securities (stocks) may be better suited to the ETH or HBAR blockchains.

The key takeaway from this discovery is that the world’s financial markets are in a state of change. The rewiring has been going on silently for years with crumbs being left by the big players that crypto sleuths have diligently searched for and discovered. DTCC projects like “WHITNEY” in 2020 using Chainlink (LINK) for data and interoperability or “ION” in 2022 for shorter settlement times pointed to bigger things that seem to be playing out now.

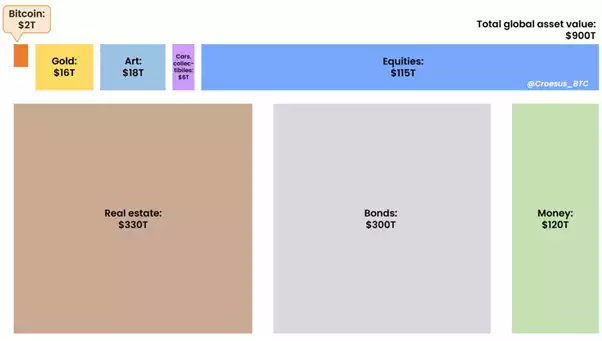

As mentioned in our recent Ainslie webinar called “Ainslie Crypto Basics and Banter” the value size of the world’s asset classes are massive compared to what currently exists in the Bitcoin or larger crypto market cap ecosystem. We’re talking multiple 100’s of trillions of dollars’ worth of value, that could potentially be tokenized and run over blockchain. (As highlighted by the DTCC’s patent and intention). The world’s largest asset manager Blackrock is looking to also create a tokenized blockchain-based stock exchange.

As a visualisation, if the value of the world’s asset classes are an Olympic sized swimming pool of liquidity, and the intention of the new financial system creators is to have that pool tokenized and run through blockchain, then blockchain, with its US$3 trillion-dollar bucket needs to grow significantly to cope with the liquidity that is about to be poured into it. The question remains, how will you participate?

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.