Bitcoin ETFs: A Surprising Market Catalyst for Ethereum, Solana and Altcoins

January 25, 2024

The recent approval of Bitcoin ETFs has unexpectedly spurred Ethereum and altcoins into the spotlight. Ethereum, particularly, has seen a resurgence, outperforming Bitcoin for the first time since October 2022. This shift suggests a broadening of investor interest beyond Bitcoin, with increased activity in Ethereum’s derivatives market.

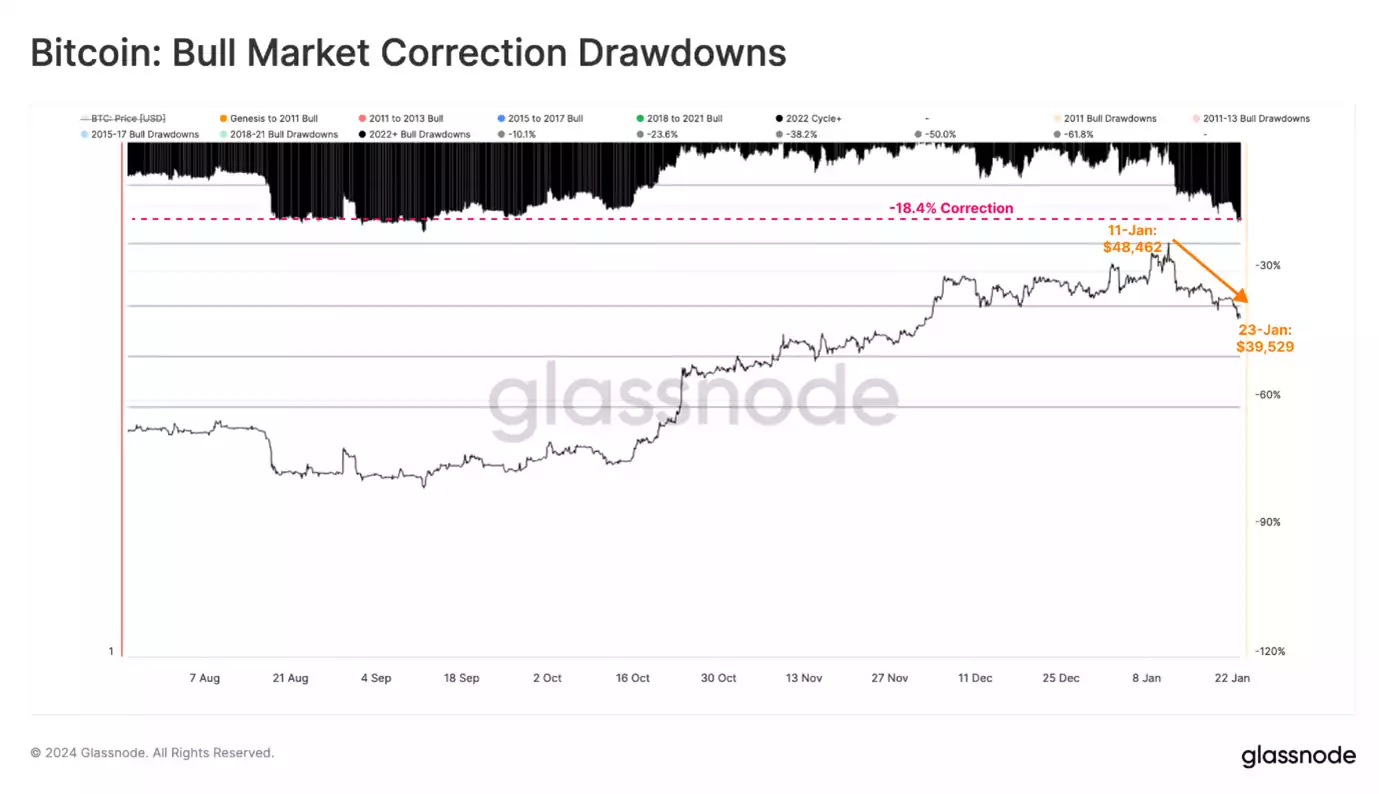

The market’s attention is also turning towards other players like Solana and various scaling tokens, gauging the appetite for risk beyond the established giants of Bitcoin and Ethereum. Despite Bitcoin’s price retreat post-ETF approval, speculative questions have emerged: will Ethereum ETFs be the next market mover, can Solana maintain its edge, or are smaller-cap tokens poised to take the lead in this evolving landscape?

Since BlackRock initiated its ETF filing, Bitcoin’s market capitalisation swelled by 68.8%, with the total market cap of altcoins mirroring this rise, increasing by 68.9%. Ethereum, however, hasn’t kept pace with this growth, lagging the broader altcoin market by 17%.

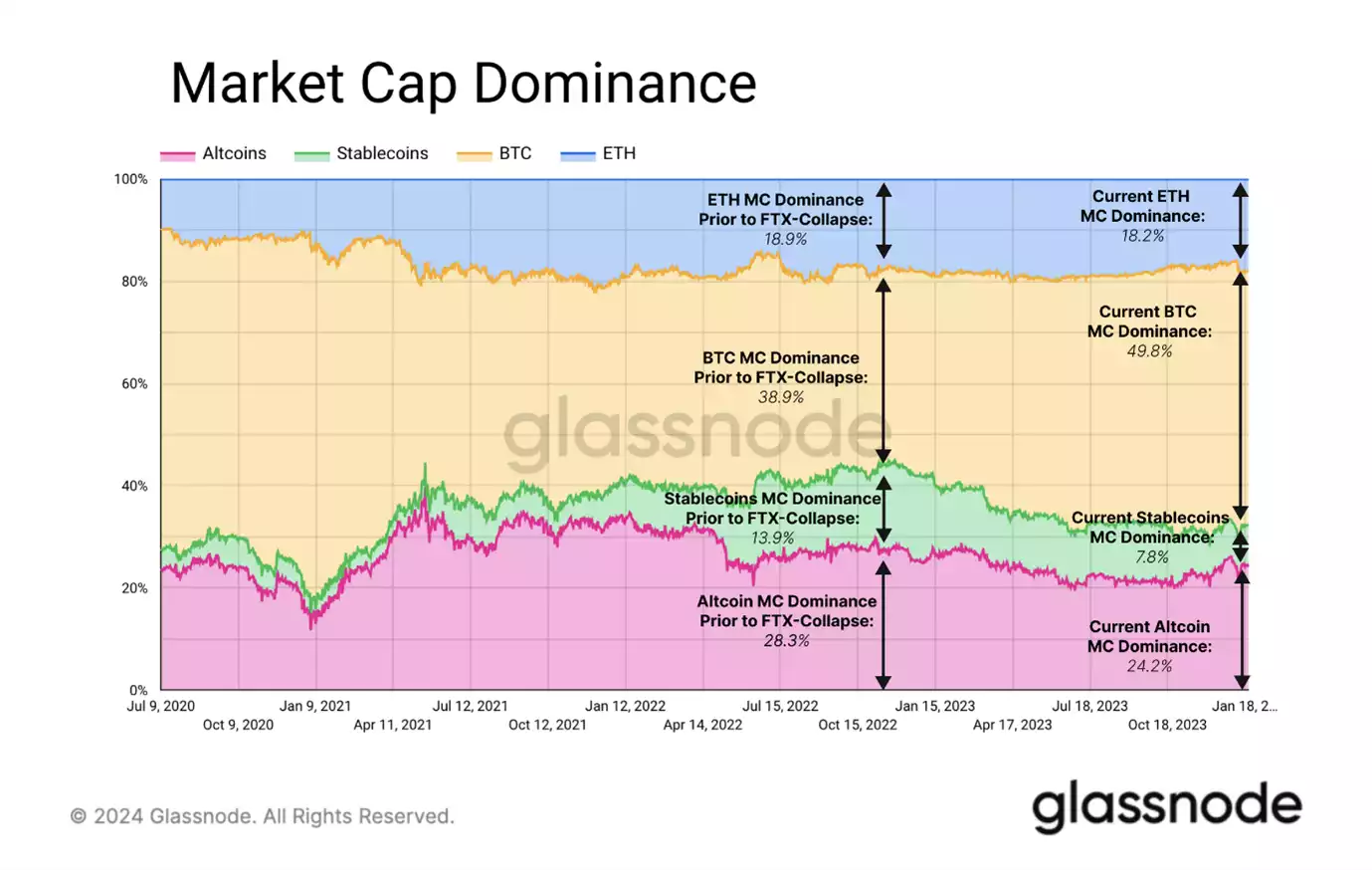

A broader view of the market shows Bitcoin’s increasing dominance, particularly after the FTX collapse in November 2022. Bitcoin’s market cap dominance jumped from 38.9% to 49.8%, asserting its growing influence in the crypto space. Ethereum, in contrast, has held steady in terms of market cap dominance, fluctuating slightly between 18.9% and 18.2%. It’s primarily the altcoins that have seen a reduction in market share, dropping from 28.3% to 24.2%, while stablecoins also experienced a decline from 13.9% to 7.8%, reflecting a reshaping of market preferences and investor confidence.

Following the green light for Bitcoin ETFs, there’s been growing speculation about the potential launch of an Ethereum (ETH) ETF. Despite regulatory hurdles, considering the SEC’s potential classification of Ether as an investment contract, the market is showing signs of enthusiasm.

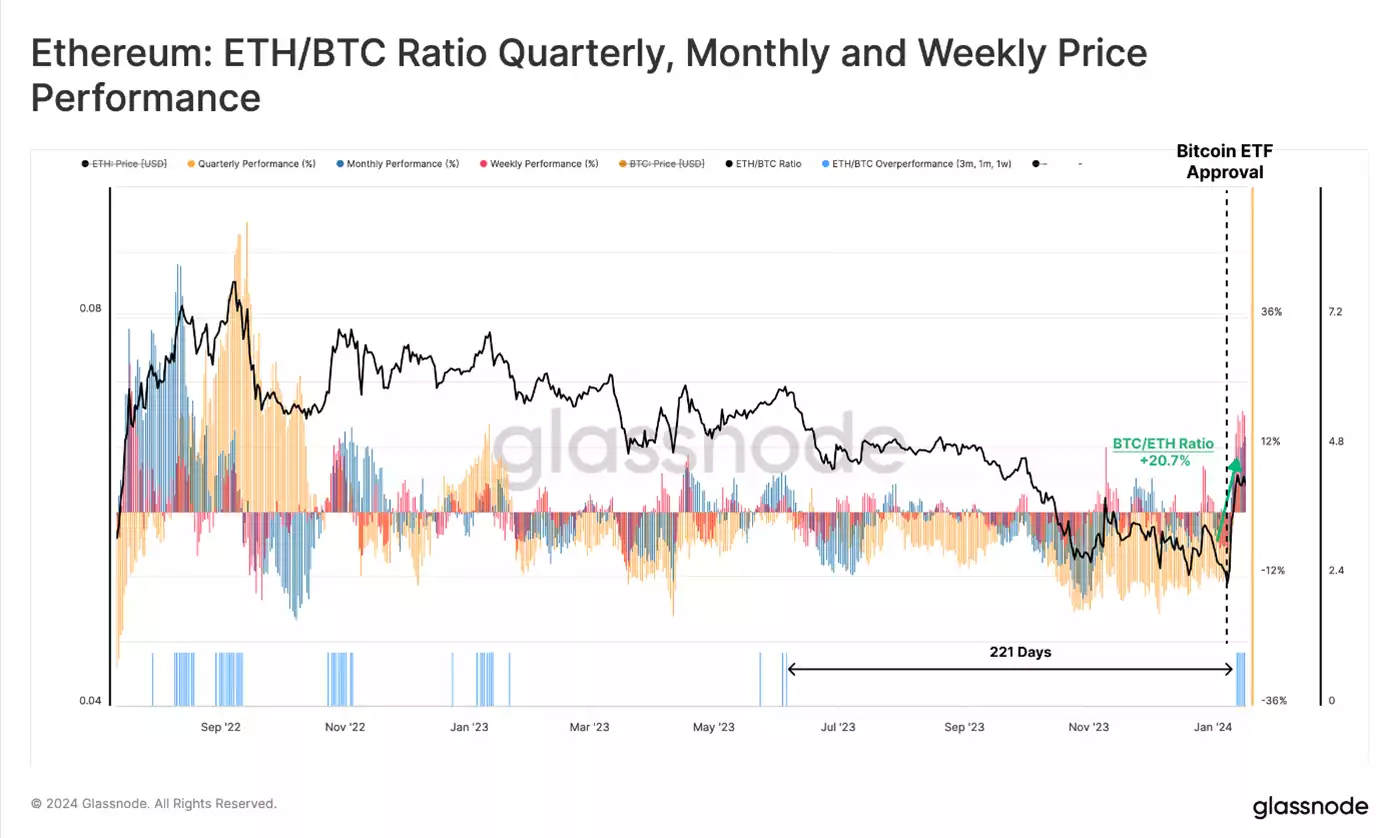

ETH’s price has impressively soared more than 20% against Bitcoin in recent weeks. This surge, the strongest since late 2022, is observed on a quarterly, monthly, and even weekly scale. This rise has led to a slight rebound in market cap dominance for both Ethereum and the wider altcoin market. Specifically, Ethereum has bolstered its market cap dominance by 2.9% compared to Bitcoin.

In parallel, the volume of net profits realised by ETH investors has reached new heights, unseen in several years. Since mid-October, there has been a notable increase in profit-taking, with a peak exceeding AU$1.36 billion (US$900 million) around January 13th. This peak indicates investors capitalising on the recent market dynamics.

Adding to this bullish trend is the Net Unrealised Profit/Loss (NUPL) for short-term ETH holders. For the first time since November 2021’s all-time high, the STH-NUPL has crossed above 0.25, signalling increasing optimism in the market. However, such levels also often precede a market consolidation phase as profits are distributed. Historically, shifts in sentiment among short-term holders have often coincided with local highs during broader upward market trends.

Ethereum (ETH) isn’t just vying against Bitcoin for investor attention; it’s also navigating a competitive space with other Layer 1 blockchain tokens. Among these, Solana (SOL) has emerged as a formidable contender in 2023. Despite facing challenges linked to its association with FTX, SOL has showcased remarkable price performance over the past year.

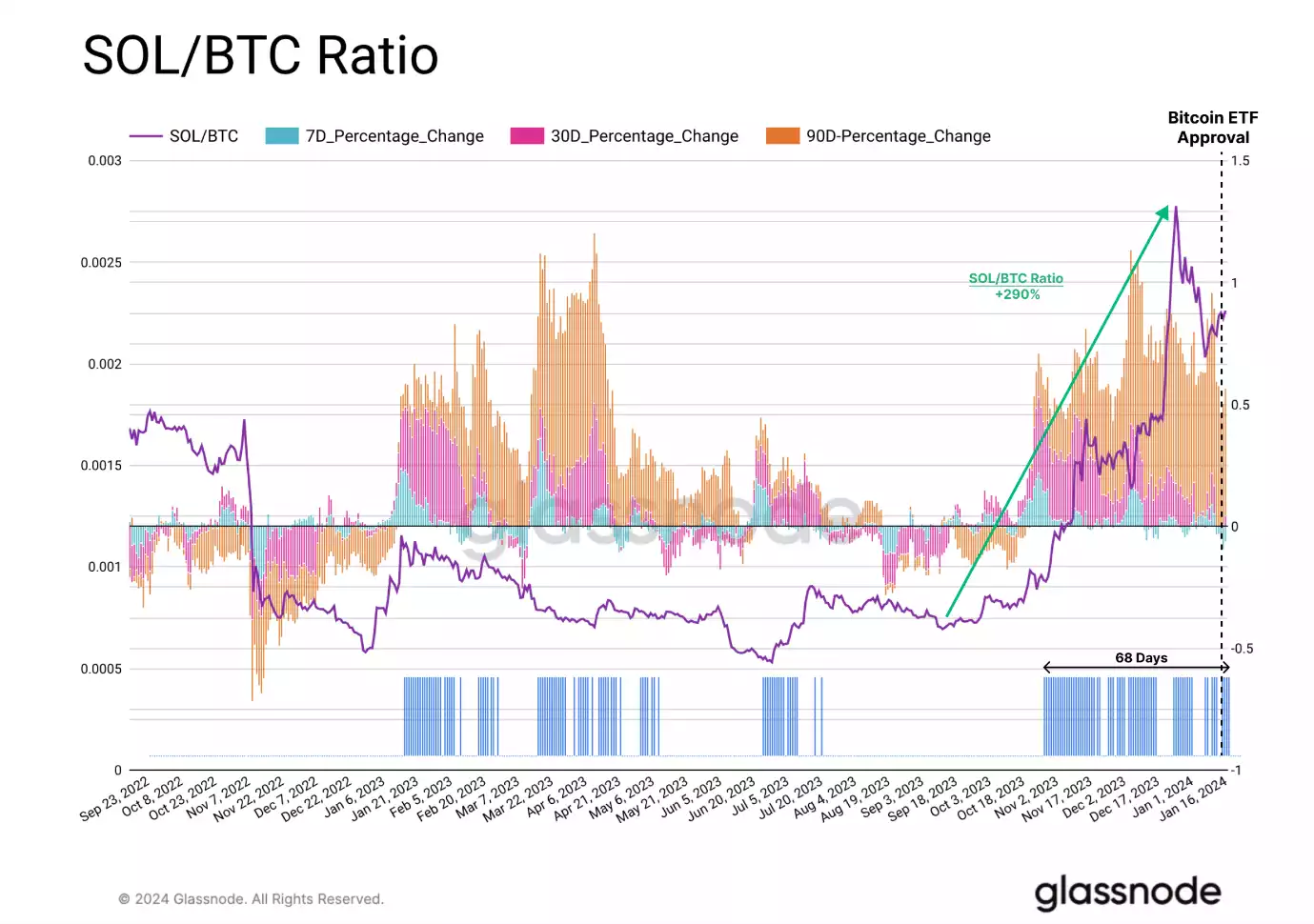

The market share of Solana has seen a notable increase, reflected in the SOL/BTC ratio’s fluctuation. Over the last twelve months, this ratio has ranged from 0.0011 to 0.0005 SOL/BTC. Significantly, since October 2023, the SOL/BTC ratio has surged by an impressive 290%, outpacing ETH in the same period. This marks a striking contrast to ETH, which didn’t see a similar uptick in value following the approval of the Bitcoin ETFs.

To summarise, post the Bitcoin ETF approval, all crypto sector indexes saw a marginal uplift, signalling a revived risk appetite even as Bitcoin experienced a sell-off. This market reaction highlights the nuanced dynamics at play following major regulatory decisions.

The Bitcoin ETFs marked a ‘sell-the-news’ event, ushering in a period of market volatility. Ethereum (ETH) took the lead in this turbulent period, demonstrating robust short-term growth and achieving multi-year highs in net realised profits. This trend suggests a market ready to capitalise on speculative trades, particularly in anticipation of a potential Ethereum ETF.

Solana, a key player in the Layer 1 blockchain space, also made significant strides throughout 2023. However, it did not show marked strength in the aftermath of the Bitcoin ETF approvals. Meanwhile, the broader Altcoin sector capitalised on the ETF excitement, hinting at investors’ eagerness to get ahead of another speculative surge.

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Join us here or connect with Ainslie Crypto’s team at 1800 AINSLIE or via info@ainsliecrypto.com.au. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie have been a trusted dealer and custody provider for Gold 1.0 for 50 years and bring the same service to Gold 2.0, Bitcoin, since 2017.

In an era where traditional banking systems impose increasing limitations, Ainslie Crypto offers a forward-thinking payment solution with the Australian Digital Dollar (AUDD) platform. Developed by Novatti, AUDD allows you to navigate beyond the constraints of conventional financial systems, offering stability, security, and ease in your crypto transactions.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provide swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.