BTC Supply Squeeze Amid Increasing Demand

November 9, 2023

In the current market, Bitcoin’s supply is tighter than ever, with Long-Term Holders clutching onto their coins, signalling a period of significant accumulation. Key on-chain metrics such as Illiquid Supply, HODLed Supply, and Long-Term Holder Supply have reached levels we haven’t seen before. This tightening of supply, particularly after Bitcoin crossed the pivotal $30k threshold, suggests we’re witnessing a shift in market dynamics that could define future trends.

The US$30k mark is not just another number—it is where bullish investors are rallying, creating a vacuum or ‘air-gap’ in cost basis that underscores the intensity of market interest at this level. As we look ahead, the Bitcoin halving event looms just 166 days away, potentially serving as a major market catalyst alongside the increasing likelihood of a U.S. spot ETF approval—events that could further fuel the already buoyant investor sentiment.

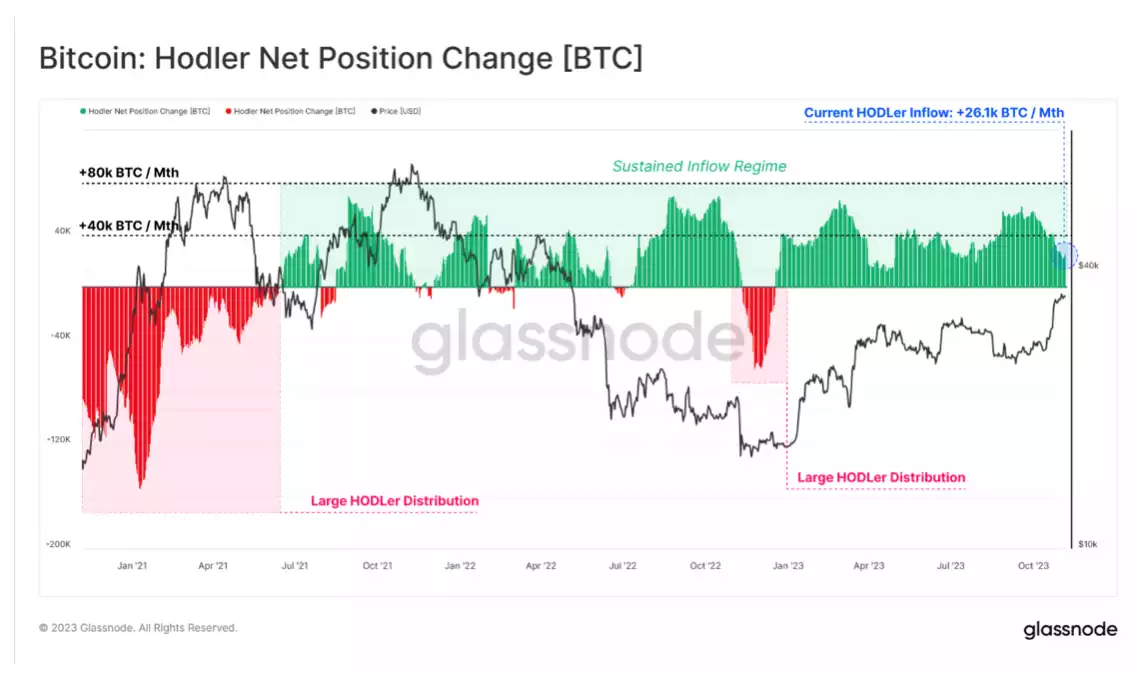

An essential aspect is how much Bitcoin is actively circulating compared to what’s being held. The unwavering confidence of long-term Bitcoin investors is crystal clear, as we see a substantial part of Bitcoin’s circulating supply being held steadfastly for prolonged periods. This HODLing behaviour is not only a testament to the faith these investors have in Bitcoin’s value proposition but also a strong indicator of market maturity.

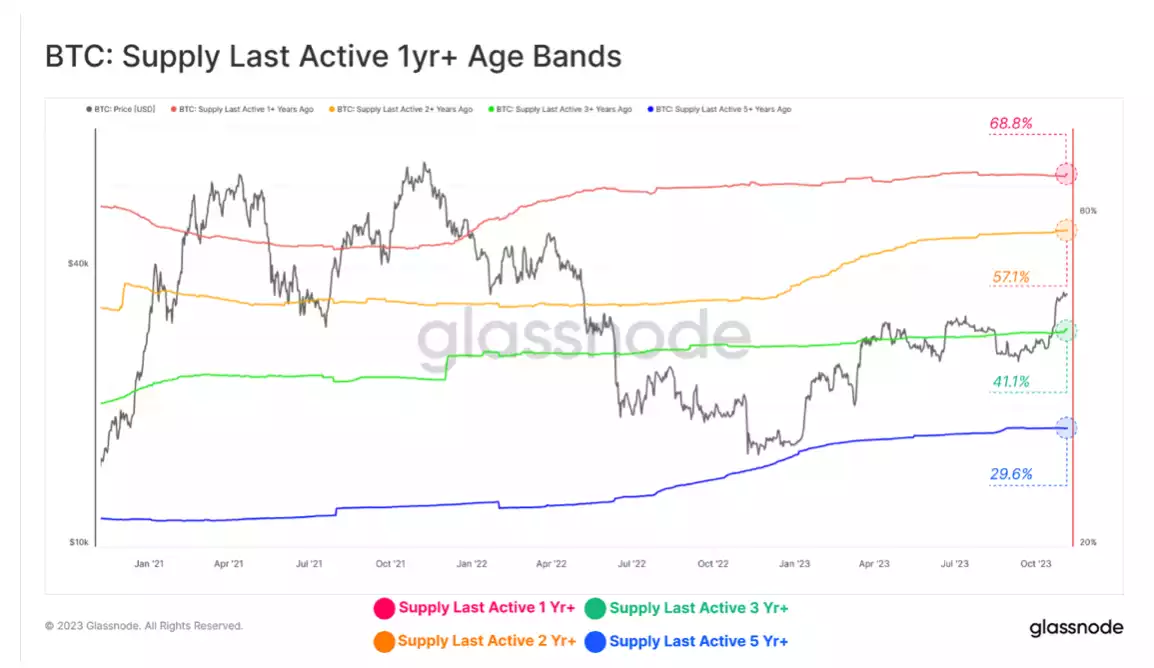

Delving into Bitcoin’s supply age bands, the numbers are telling. An impressive 68.8% of Bitcoin’s circulating supply hasn’t moved in over a year, with 57.1% staying put for over two years, 41.1% for three years, and nearly a third of the supply, at 29.6%, remaining stationary for over five years. These figures are at all-time highs, showcasing the depth of commitment within the Bitcoin community and hinting at a potential scarcity that could influence future price trajectories. This pattern of holding reflects a collective vision of Bitcoin not just as an asset but as an integral component of a long-term investment strategy.

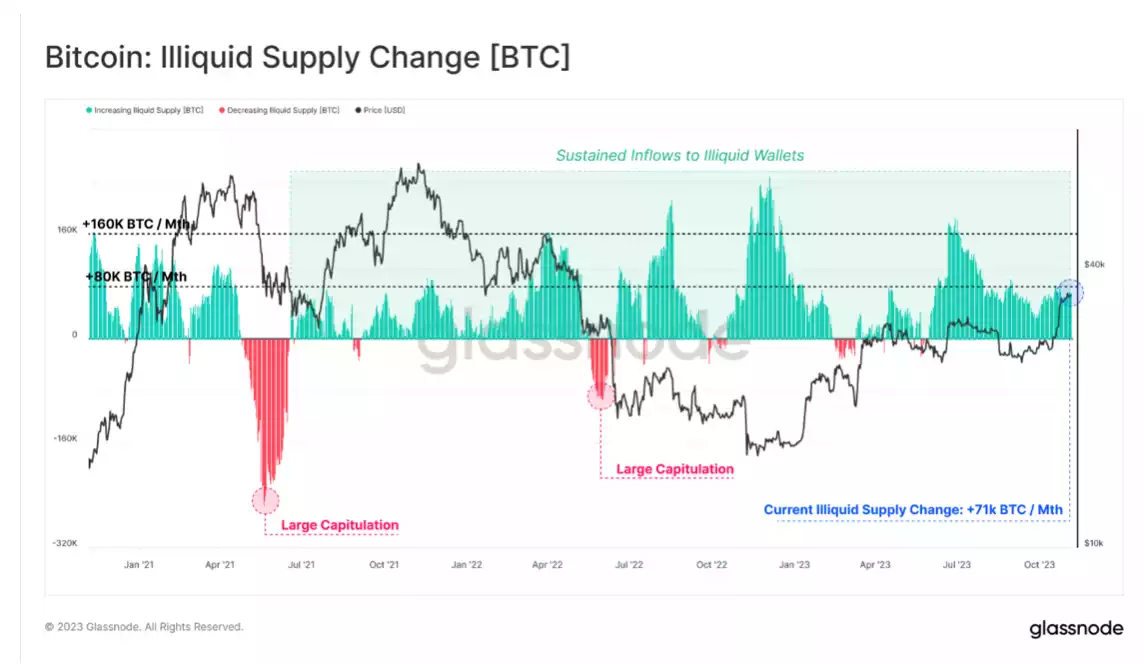

The significance of Bitcoin’s illiquid supply metric cannot be overstated. This metric, which gauges the amount of BTC held in wallets that seldom engage in selling, has hit a new all-time high, with 15.4 million BTC now categorised as illiquid. This milestone isn’t just a number; it’s yet another potent sign of the unwavering conviction within the Bitcoin community.

This increase in illiquid supply often moves in tandem with patterns of exchange withdrawals, painting a clear picture of investor behaviour. From a market perspective, this burgeoning illiquid supply signifies a strong holding sentiment that permeates the investor base. This trend suggests reduced sell pressure in the market, as more investors are choosing to hold rather than trade. Such a landscape could potentially pave the way for a more stable and less volatile market, as the circulating supply becomes increasingly tight.

Currently, on a multi-year uptrend, we’re seeing an additional 71,000 BTC per month moving into the illiquid category, signalling a robust phase of accumulation. Investors are not just buying; they’re holding.

What does this mean for the market? It suggests that confidence in Bitcoin as a long-term investment is solidifying. With long-term holders sitting tight on their assets, we might see a squeeze in market liquidity, as less BTC is available for daily transactions. This developing culture of holding within the Bitcoin community bodes well for its stability and maturity, indicating that Bitcoin is increasingly being viewed not just as a digital asset, but as a digital gold of sorts for the modern investor.

Looking ahead, the Bitcoin landscape is brimming with potential catalysts. The much-anticipated halving event in April traditionally constricts new coin production, historically serving as a precursor to price appreciation. Meanwhile, the winds of regulatory progress are stirring, with the potential approval of a Bitcoin spot ETF in the U.S., poised to further streamline market participation and liquidity.

In light of these developments, the upcoming months look promising for Bitcoin investors. The market outlook is not just positive; it’s charged with the potential for significant opportunities.

For those keen on navigating the ever-evolving blockchain and cryptocurrency realm, ensure to subscribe to our newsletter and connect with us on our social channels for regular, timely insights. Exploring personal and simplified methods to trade, buy, or swap cryptocurrencies? Reach out at 1800 AINSLIE. Our dedicated consultant team is on standby, eager to guide you, your business, or SMSF seamlessly through your crypto acquisition journey. We proudly offer a crypto custody solution, complemented by real-time internal audits, solidifying the integrity of your investments.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.