THE SHANGHAI/CAPELLA UPGRADE’S IMPACT ON THE ETHEREUM MARKET

May 9, 2023

On 12th April 2023, the Ethereum network underwent a major Shanghai/Capella hardfork, enabling the withdrawal of staked ETH funds. This development has given stakers the opportunity to receive accumulated rewards, exit staked positions, or change their staking setup. Today we will explore the consequences of the 1.55 million withdrawn ETH and the reshuffling of stake between stakers, staking service providers, and sell-side pressure. Despite initial concerns, the Ethereum market has demonstrated stability, with prices climbing to US$2,110 before reverting to $1,920 due to the general decline in the digital asset market, a remarkable sign of strength for the ETH market.

Investigating the Real Outcomes and Revisiting Predictions Post-Shanghai/Capella Upgrade

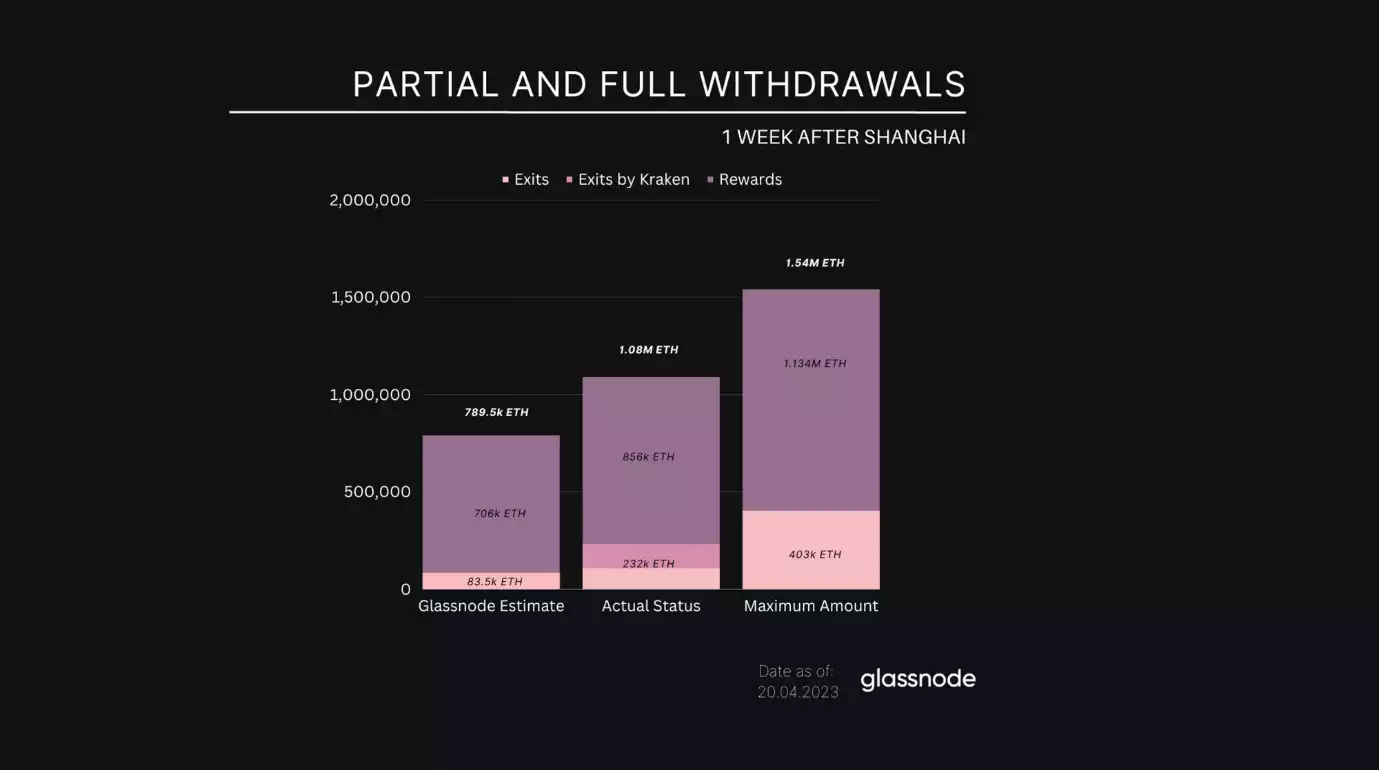

To evaluate the actual consequences of the Shanghai/Capella upgrade, we closely examine withdrawals, deposits, and the entities behind these actions. Prior to the update, it was estimated that 789.5k ETH would be withdrawn, with 170k ETH sold post-Shanghai/Capella. However, the actual numbers surpassed these predictions, with 856k ETH rewards and 232k ETH unstaked during the first week alone. Interestingly, Kraken (an exchange) withdrew 125,088 ETH within the first week due to SEC pressure to close its US-based staking service.

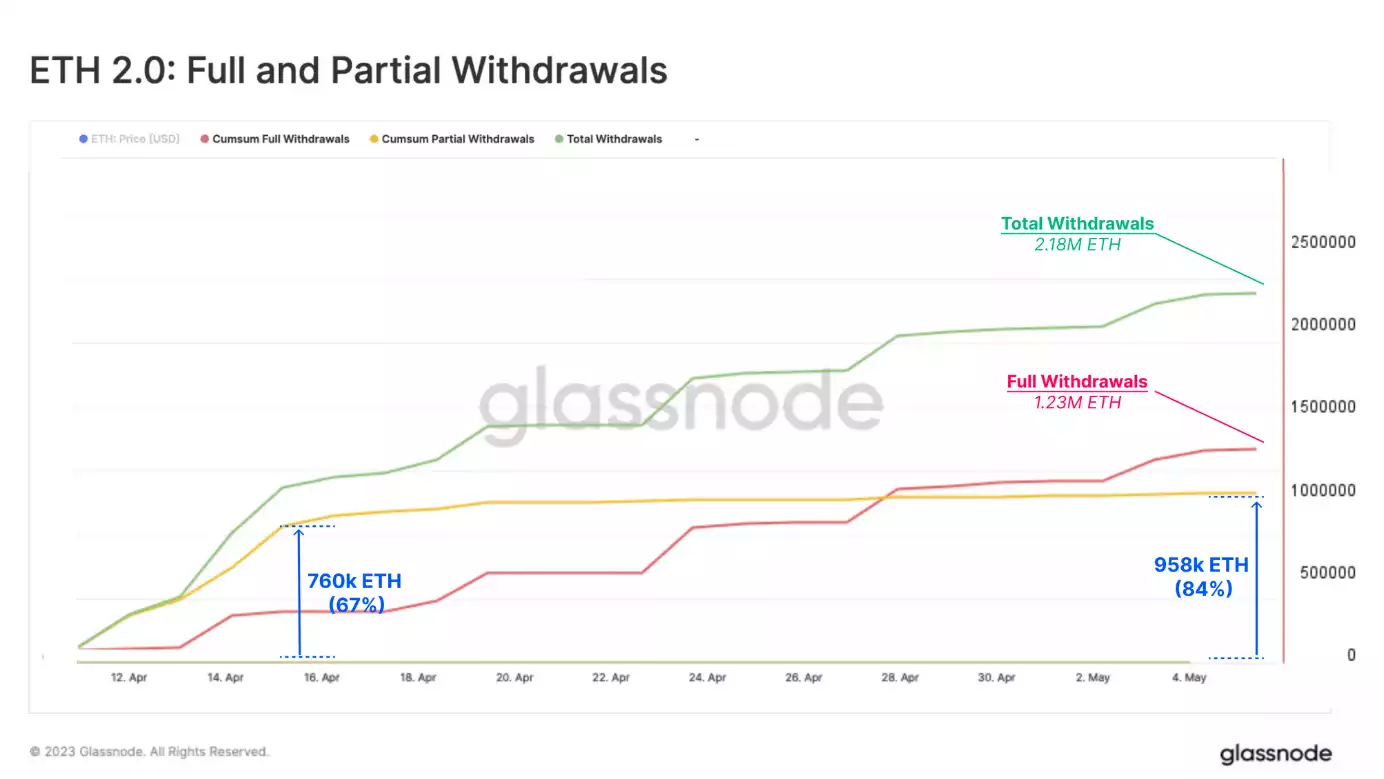

Contrary to initial predictions that focused on rewards as the primary source of sell-side pressure, full withdrawals have overtaken partial withdrawals in unstaked volume. The withdrawal process has taken the intended 4.5 days, and as of now, 98% of stakers have updated their withdrawal credentials for staking pool rewards. Post-upgrade, the demand for exits reached its maximum, with withdrawn stake capped at 57,600 ETH due to the Churn Limit. Since 28th April, exited stake has surpassed withdrawn rewards.

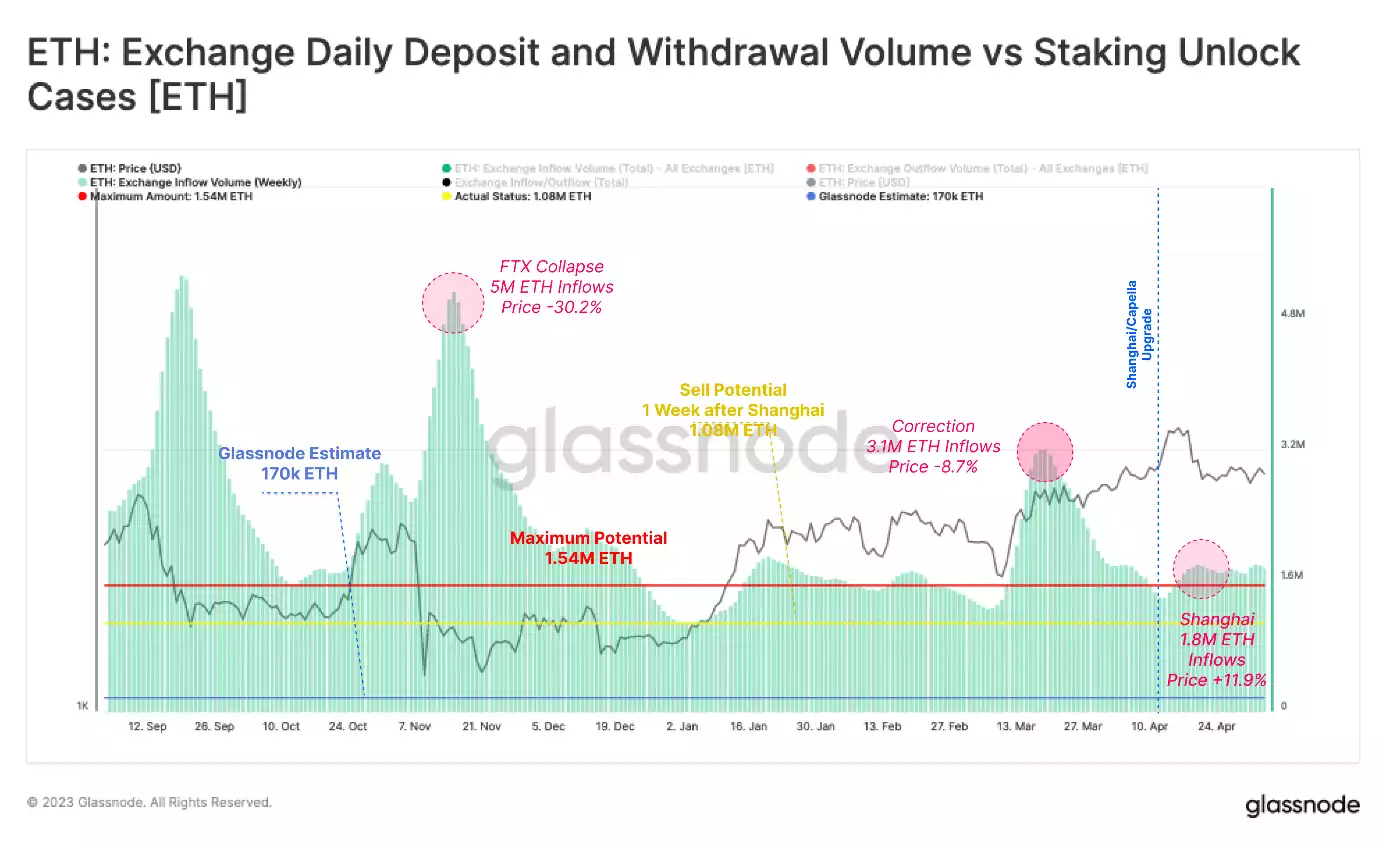

Assessing the Impact of Shanghai Sell-side Pressure on Trade Volumes

Following the Shanghai upgrade, there was no appreciable increase in inflow volume. Up to 1.8 million ETH of exchange inflows were recorded in the first seven days after the upgrade, with inflow numbers smaller compared to past major sell-side events. This data suggests that the Shanghai sell-side pressure didn’t lead to a significant increase in day-to-day trade volumes, as inflow patterns remained in line with typical trends.

Examining the Withdrawal Process and the Evolution of Staking Effectiveness Post-Shanghai

The Shanghai/Capella upgrade brought about changes in the staking withdrawal process, introducing both partial and full withdrawals. For partial withdrawals, rewards are automatically withdrawn every 4.5 days. Full withdrawals, on the other hand, entail the staker shutting down their validator(s) and retrieving their staked ETH capital through a multi-step process.

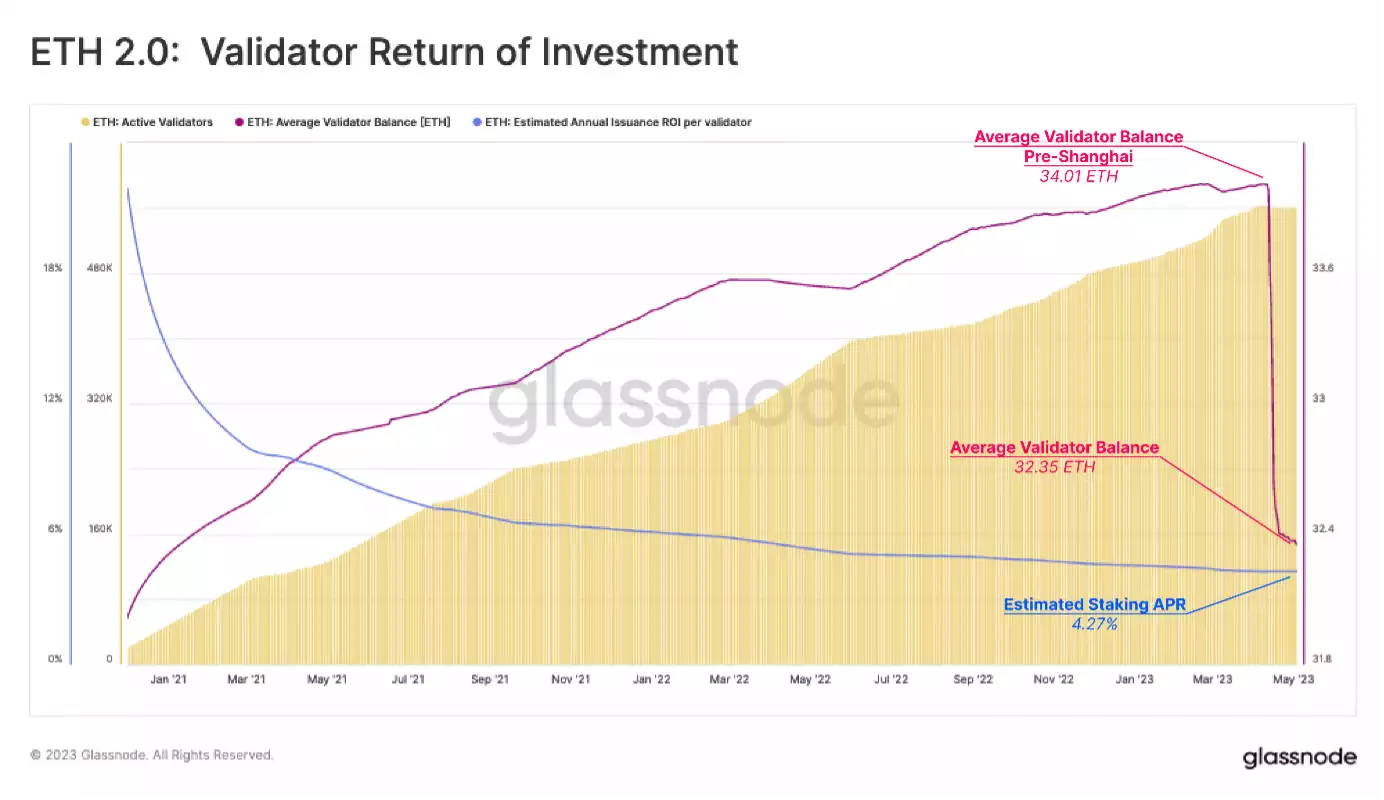

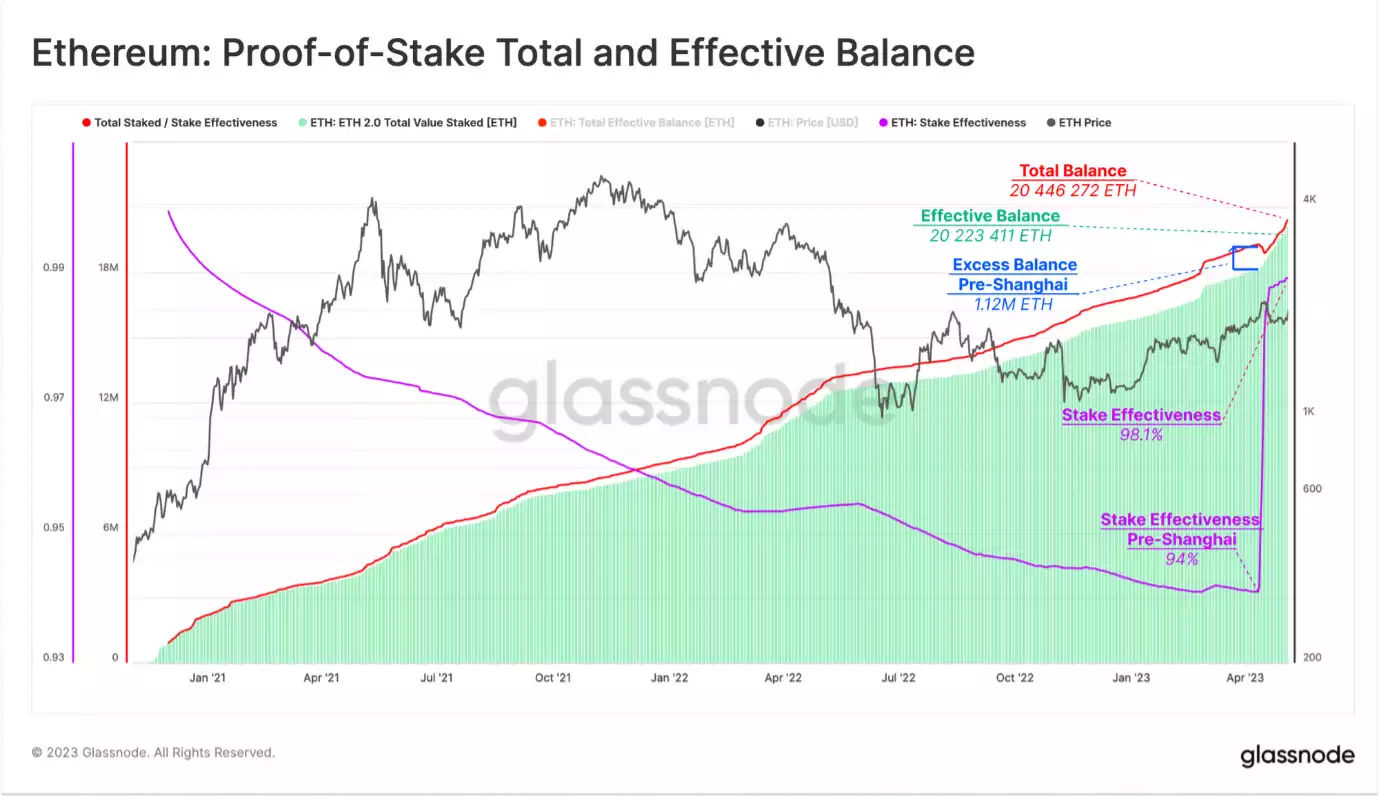

Before the upgrade, the average balance per validator was 34 ETH, with 2 ETH left inactive due to the staking protocol’s 32 ETH limit on maximum effective balance. After the upgrade and the first round of automatic reward withdrawals, the average balance decreased to 32.39 ETH. As rewards are automatically transferred back to the staker, the average balance is expected to remain around 32.39 ETH. Consequently, with 98.1% of the stake now efficiently used for network security, staking effectiveness has seen a marked improvement.

The regular skimming and transferring of rewards back to the Ethereum mainnet has played a crucial role in enhancing stake effectiveness. Prior to the Shanghai upgrade, the ineffective balance was 1.12 million ETH, but it has since significantly decreased to 223k ETH. As a result of these improvements, 98.1% of the stake is now efficiently utilised for network security, contributing to a more robust and resilient Ethereum ecosystem.

In conclusion, the Shanghai/Capella upgrade led to significant stake withdrawals, with over 48,000 validators leaving the Ethereum Staking Pool and 1.55 million ETH withdrawn. Despite this, market prices have not been significantly impacted due to high demand for deposits during this period, with unstaked and distributed ETH offset by deposits, resulting in an expected net positive flow into the staking pool. The stake dominance distribution among providers has remained stable, with increased activity for both exiting and depositing validators. The Ethereum consensus mechanism continues to function as intended, demonstrating the effectiveness of the Proof-of-Stake mechanics. This upgrade has successfully de-risked longstanding engineering challenges and yielded net positive effects on both network security and the economy of the network.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.