WEEKLY ROUNDUP FROM AINSLIE CRYPTO

May 25, 2023

Let’s begin with the current state of the cryptocurrency markets. The dynamism synonymous with cryptocurrencies seems to have taken a slight pause, with a rather dull environment prevailing lately. Market volatility has been on the low side, and drama has been missing from the usual crypto narrative. Amid this lull, Bitcoin has been gradually drifting downwards, forming a descending wedge since mid-April. Consequently, the total market capitalisation for cryptocurrencies has dwindled down to A$1.69 trillion (US$1.125T). Analyst Marcel Pechman predicts that this bearish formation could last until mid-July. Veteran trader Tone Vays echoes these sentiments, terming the situation a “frustrating consolidation”, but also forecasts that a rebound to US$34K (A$51.1K) could be on the horizon as the Bitcoin halving event is less than a year away.

That said, it’s important to note that not all coins are following the same trend. Despite a 1.7% decrease over the week, Bitcoin still held ground at around A$41,000 (US$27,300). Ethereum remained steady at A$2,800 (US$1,850). However, the week wasn’t entirely bearish; Ripple recorded an 8% gain.

Earlier this week we covered the quiet strength hidden in crypto on-chain data – you can read that full article here.

Moving from the micro to the macro, the broader economic landscape continues to exhibit a host of factors affecting the cryptocurrency world. US 2yr bonds have been gradually inching higher, now trading at 4.34%, up from a May low of 3.80% just over two weeks ago. US debt ceiling negotiations are in full swing, with a June deadline looming ominously. The Federal Open Market Committee (FOMC) remains divided on the potential for another rate hike at the upcoming meeting on June 14th, keeping investors on the edge.

The Australian scenario adds another layer to this intricate economic mosaic. The Reserve Bank of Australia (RBA) has voiced concerns over persistently high core services inflation. It’s becoming increasingly apparent that the cash rate in Australia, currently at 3.85%, looks out of place relative to other major economies with similar or lower inflation levels. The US, New Zealand, England, and Canada have higher cash rates of 5.5%, 5.25%, and 4.5% respectively. Coupled with near 50-year low unemployment rates (currently at 3.7%), net migration forecasts for the 2022-2023 financial year standing near +700k, and ongoing public sector wage negotiations, the pressure on the RBA is mounting.

This week brings with it a slew of important economic data:

- The Reserve Bank of New Zealand’s interest rate decision – increasing by 0.25% on Wednesday.

- The US Federal Open Market Committee Minutes, which occurred this morning at 4:00am AEST.

- Australian Retail Sales data for April, releasing on Friday at 11:30am AEST.

- US PCE Inflation data for April, set to be published on Friday at 10:30pm AEST.

In the realm of crypto headlines, the community commemorated the 13th anniversary of Bitcoin Pizza Day this week, celebrating the first documented real-world transaction involving Bitcoin (BTC). It marks an important milestone in the history of Bitcoin and showcases the early adoption and value appreciation of the cryptocurrency. On May 22nd, 2010, a programmer named Laszlo Hanyecz made a post on the Bitcointalk forum offering 10,000 bitcoins in exchange for someone to deliver him two pizzas.

In another noteworthy event, cryptocurrency hardware wallet provider Ledger faced backlash for introducing an update that allows users to back up their seed phrases with third-party entities. Despite initial worries and misunderstandings, Ledger’s co-founder and ex-CEO, Éric Larchevêque, assured users that the company remains secure and that the use of the recovery service is entirely optional.

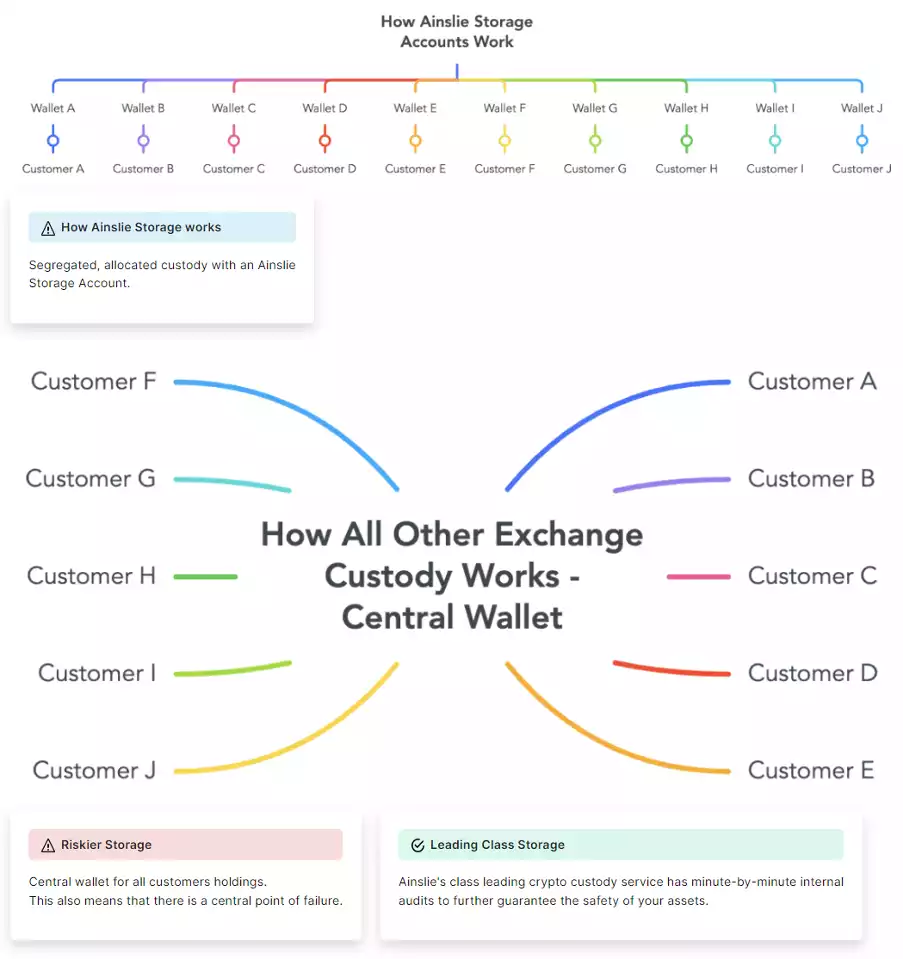

In a surprising development late last week, Binance Australia announced a suspension of their AUD services, causing a stir amongst its user base. This incident underscores the critical importance of engaging with a trusted platform for your cryptocurrency dealings, and the heightened risk associated with storing funds on crypto exchanges. Ainslie Crypto offers a solution to this concern, providing an environment where risk-free, person-to-person cryptocurrency transactions can be conducted, with funds delivered directly to your personal wallet or to our fully segregated cold storage wallets. It’s another reason why choosing a platform like Ainslie Crypto for your cryptocurrency activities can provide the peace of mind that comes with a secure and reliable service.

The legal landscape saw a surprising development as Ripple, the firm being sued by the SEC for selling unregistered securities, scored a small win. The judge presiding over the case denied the SEC’s motion to seal records of internal deliberations concerning a speech by former director William Hinman. This ruling could reveal differing opinions within the SEC on the classification of certain cryptocurrencies as securities, potentially helping Ripple’s case and setting a precedent for future litigation in the cryptocurrency industry.

In international news, the Monetary Authority of Singapore and the Federal Reserve’s New York Innovation Centre joined forces to test distributed ledgers for cross-border payments. The results of Project Cedar Phase II x Ubin+ (Cedar x Ubin+) showed that distributed ledger technology can efficiently handle cross-border payments involving multiple currencies. This experiment signals the potential for central banks to use wholesale CBDCs to facilitate efficient cross-border payment flows, including for less liquid currencies, without the need for a common infrastructure.

The sphere of politics wasn’t left untouched by cryptocurrency. President Joe Biden’s recent comments have stirred up conversations about tax regulations surrounding cryptocurrency trading, even as two younger Presidential candidates, Robert F Kennedy Junior and Vivek Ramaswamy, have announced that they will accept Bitcoin donations via Lightning for their campaigns.

Remember to subscribe to this newsletter and follow us on socials for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.