NAVIGATING THROUGH TURBULENCE: THE ASSERTIVE U.S. REGULATORY CLIMATE AND CRYPTO MARKET RESPONSE

June 13, 2023

Regulatory Thunder: The SEC Charges Binance and Coinbase

The SEC recently filed successive legal complaints against Binance and Coinbase, the two largest cryptocurrency exchanges. The charges revolve around the listing and trading of tokens, deemed by the SEC to be unregistered securities. The accusations also extend to the ‘earn’ and ‘staking’ services offered by the exchanges, which the SEC believes violate securities laws.

Binance has come under more extensive scrutiny, with allegations of wash trading and improper mixing of customer funds between on-shore and off-shore entities.

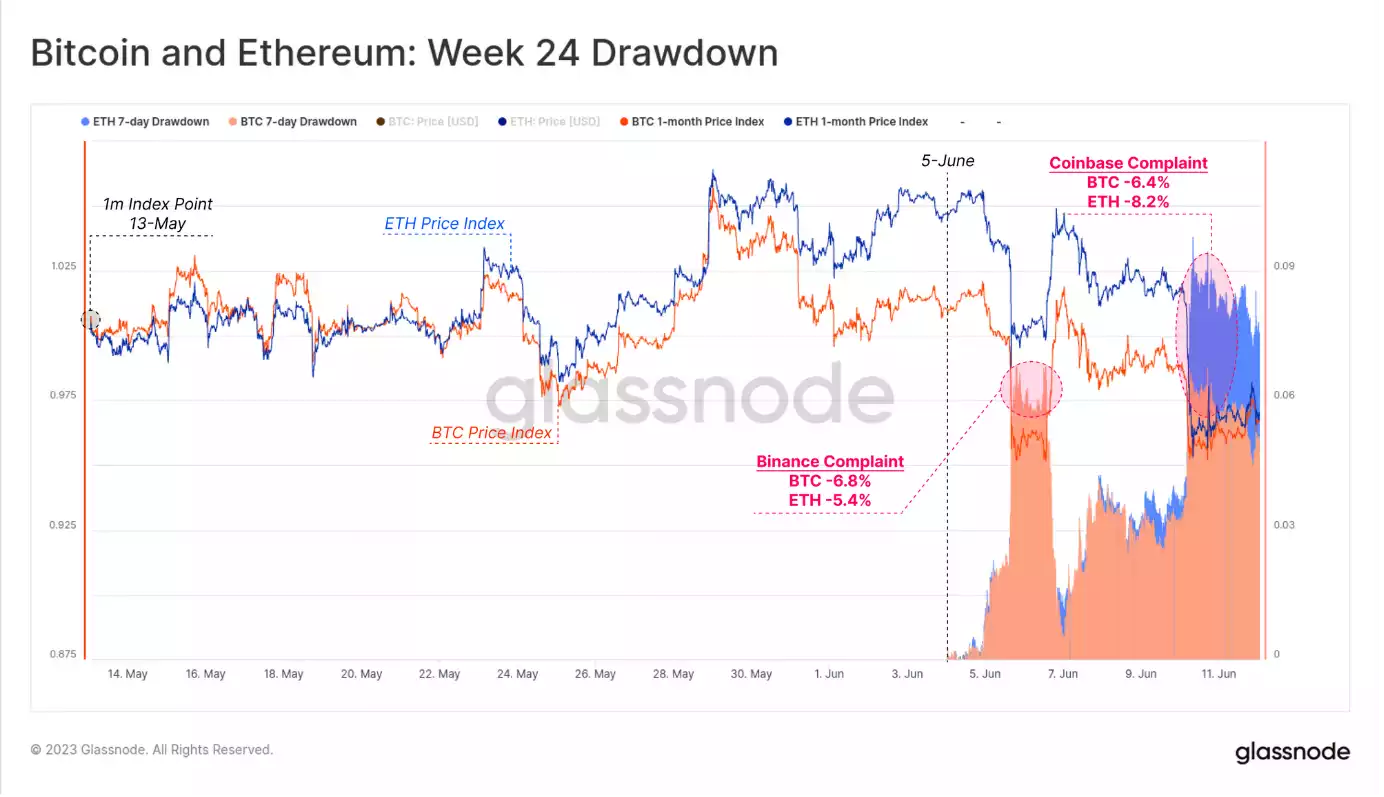

The news of the SEC charges created waves in the digital asset market. On June 5, when news of the charges against Binance broke, Ethereum (ETH) and Bitcoin (BTC) dropped -5.4% and -6.8%, respectively. However, both assets managed to recoup these losses when the news about Coinbase emerged on June 6. By the end of the week, ETH had suffered an additional sell-off, declining by -8.2%, while BTC ended the week down by -6.4%.

Given the severity of the charges against these prominent exchanges and the increasing regulatory hostility in the U.S., it is essential to look at the investor response, focusing specifically on exchange activity.

The Shaken Sanctuary: Analyzing Exchange Activity Following the Charges

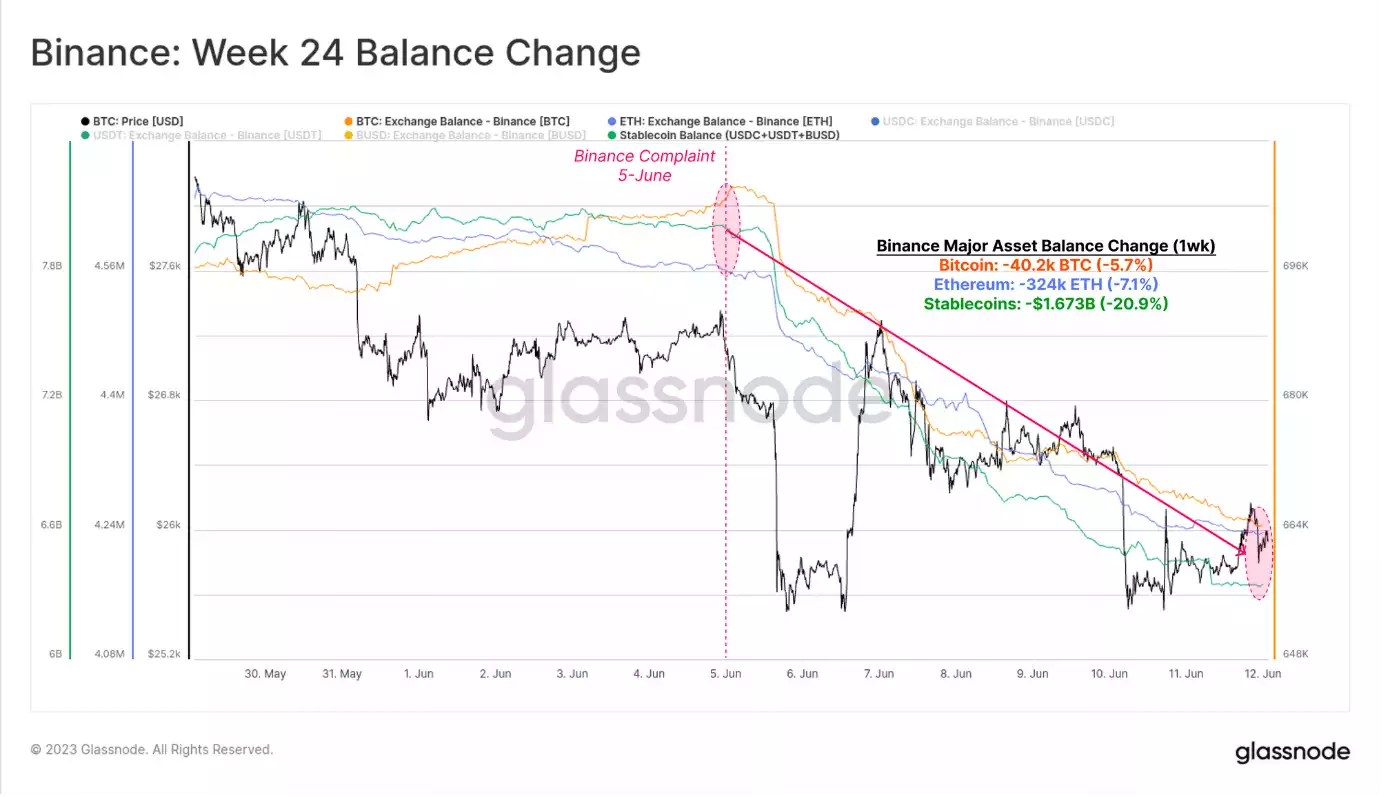

News related to Binance’s charges led to a significant outflow of coins from the exchange. In a two-week view, Binance’s exchange reserves for major assets – Bitcoin (BTC), Ethereum (ETH), and stablecoins (Tether (USDT), USD Coin (USDC), Binance USD (BUSD)) – depict a consistent outflow.

Over the past week, the total stablecoin balance has decreased by more than $1.6 billion, which is a 20.9% drop in the total Binance balance. BTC and ETH reserves have also fallen but at a more moderate pace: BTC reserves decreased by 5.7%, and ETH reserves fell by 7.1%.

Investor Tendencies: The Divergence in Investor Behaviour

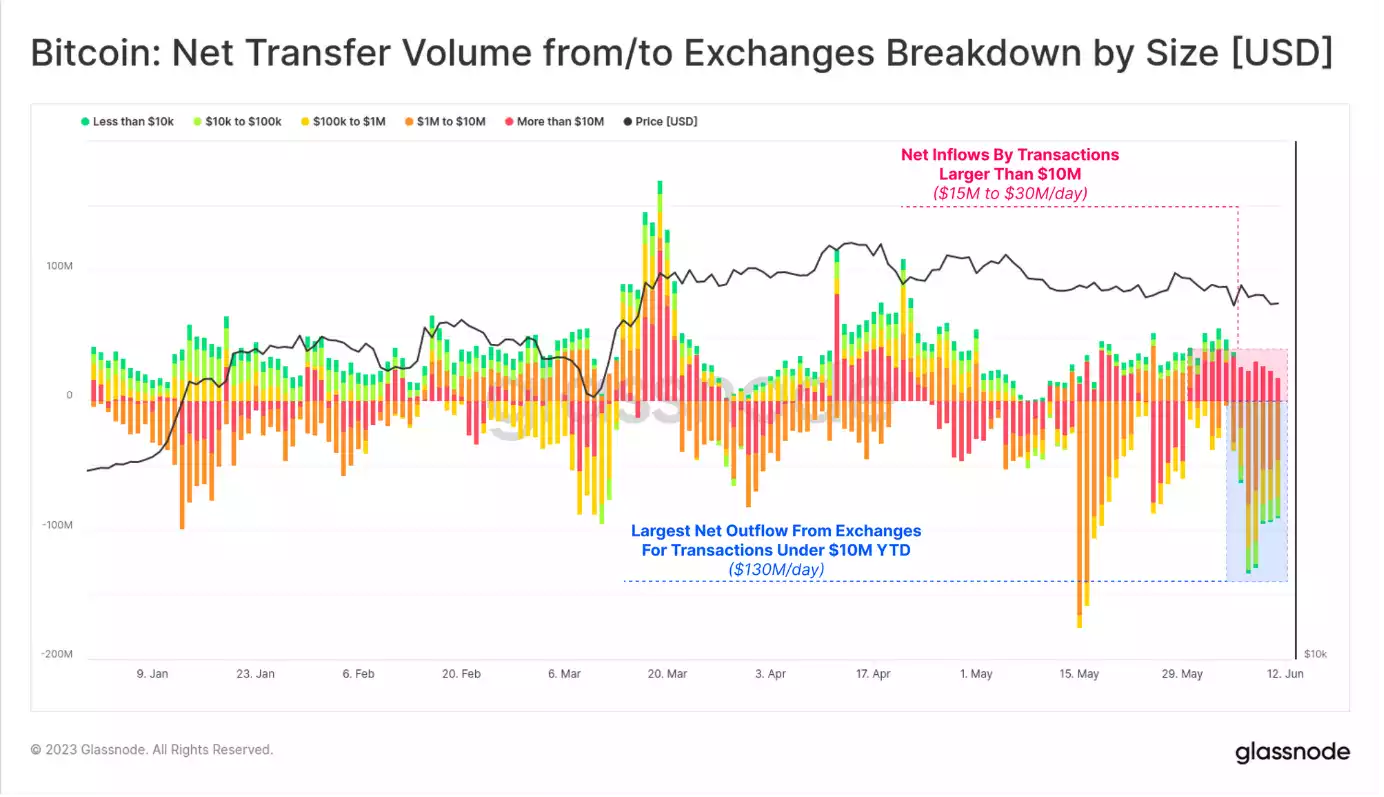

An interesting divergence in investor behaviour has emerged when analysing exchange withdrawals by USD size. Transactions under $10M have consistently shown withdrawals, maintaining a net outflow of over $130M per day throughout the week. Transactions over $10M, however, have seen regular deposits, with inflow rates varying from $15M to $30M per day.

This pattern suggests that larger entities, such as institutional investors, are reacting more substantially to the recent SEC news compared to smaller entities. While it remains uncertain if this divergence will become a more enduring trend, this situation requires close monitoring to gauge the potential long-term impacts on exchange deposits by different cohorts.

Self-Custody in Spotlight: The Prefered Strategy

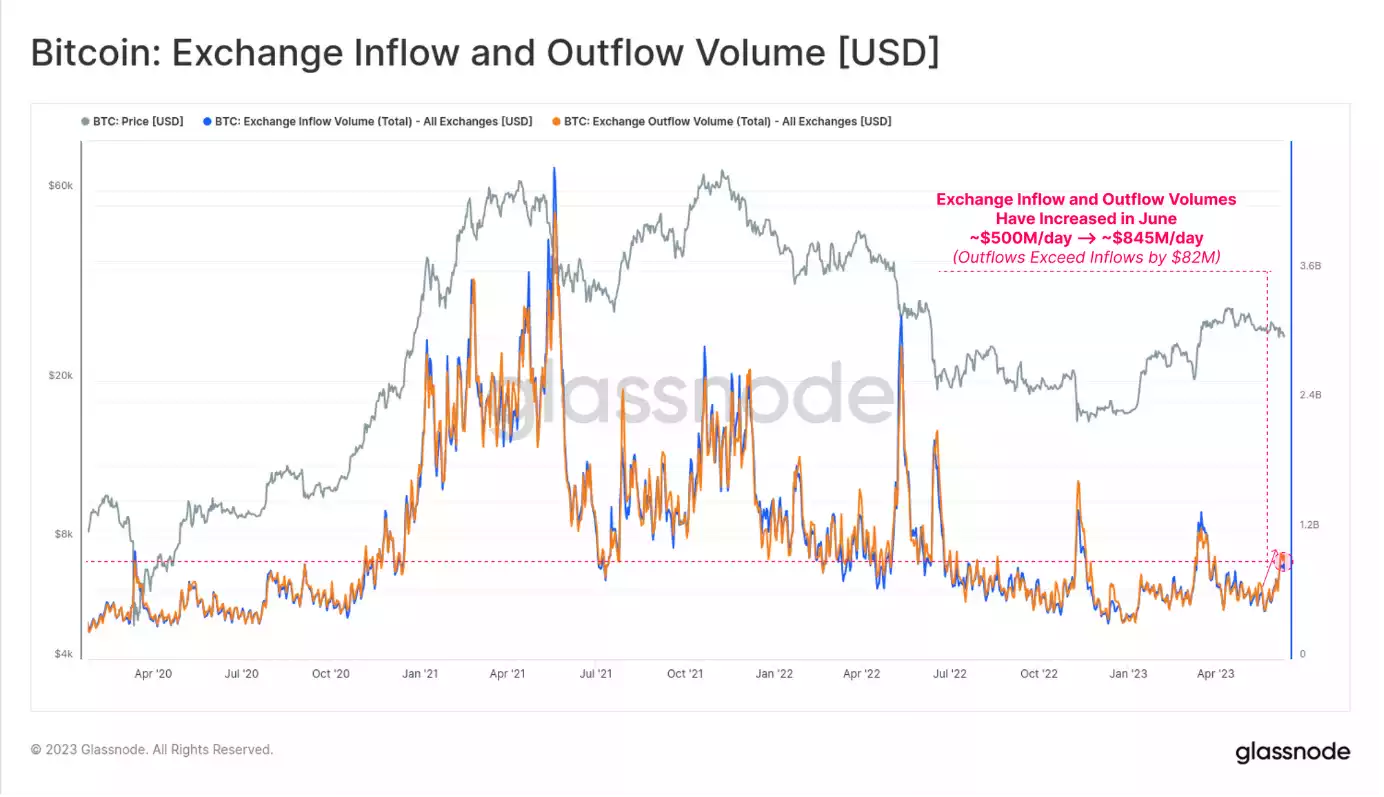

An analysis of Bitcoin (BTC) exchange deposit and withdrawal volumes typically shows a close mirroring of each other. This trend continued this week, with inflows and outflows both increasing approximately 70% to $845 million per day. Interestingly, withdrawals have exceeded deposits by about 10% this week, suggesting that self-custody is still the preferred strategy for most investors.

This trend was also seen during the previous major exchange-related incident, the collapse of the FTX exchange. This reoccurring pattern reinforces the notion that investors lean towards self-custody during times of regulatory uncertainty.

The Echo of Investor Categories: Unravelling the Deposit Volumes

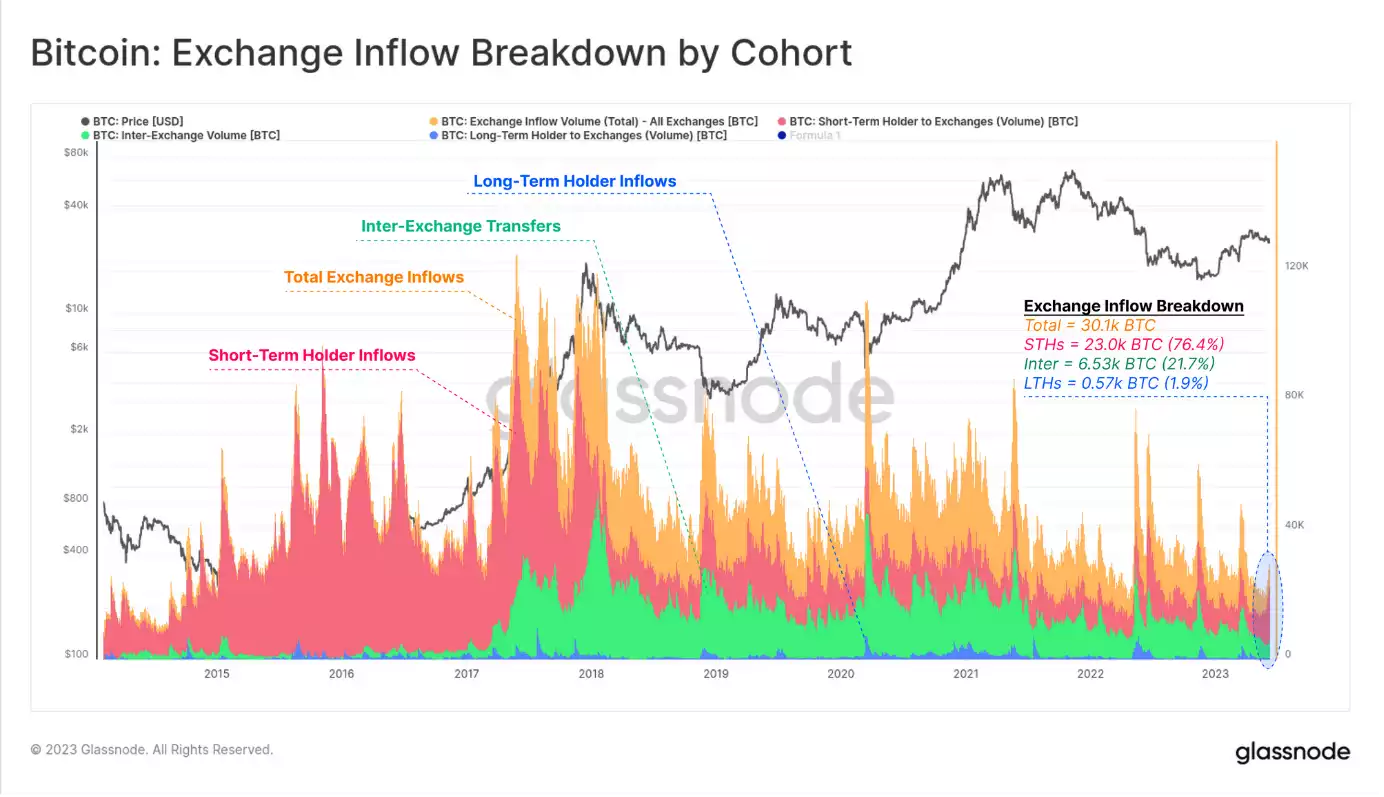

Looking at the aggregate deposit volumes provides insights into the behaviour of different investor categories in light of the recent news.

Short-Term Holders (STHs) constitute the largest portion of the deposit volume, accounting for 76.4% or 23.0k BTC. Long-Term Holders (LTHs), conversely, only account for a minimal part of the deposit volume, around 1.9% or 570 BTC. Inter-Exchange Transfers represent 21.7% of the deposit volume, equating to 6.53k BTC.

The historical norm for STHs is approximately 60% of deposit flows. This data suggests that recent buyers have been particularly active in the past week. Typically, Inter-Exchange Transfers make up about 35% of the flows, implying that current investors are leaning more towards self-custody of their digital assets rather than transferring coins to a different exchange.

Diving Deeper: Confidence, Apathy, or Indifference?

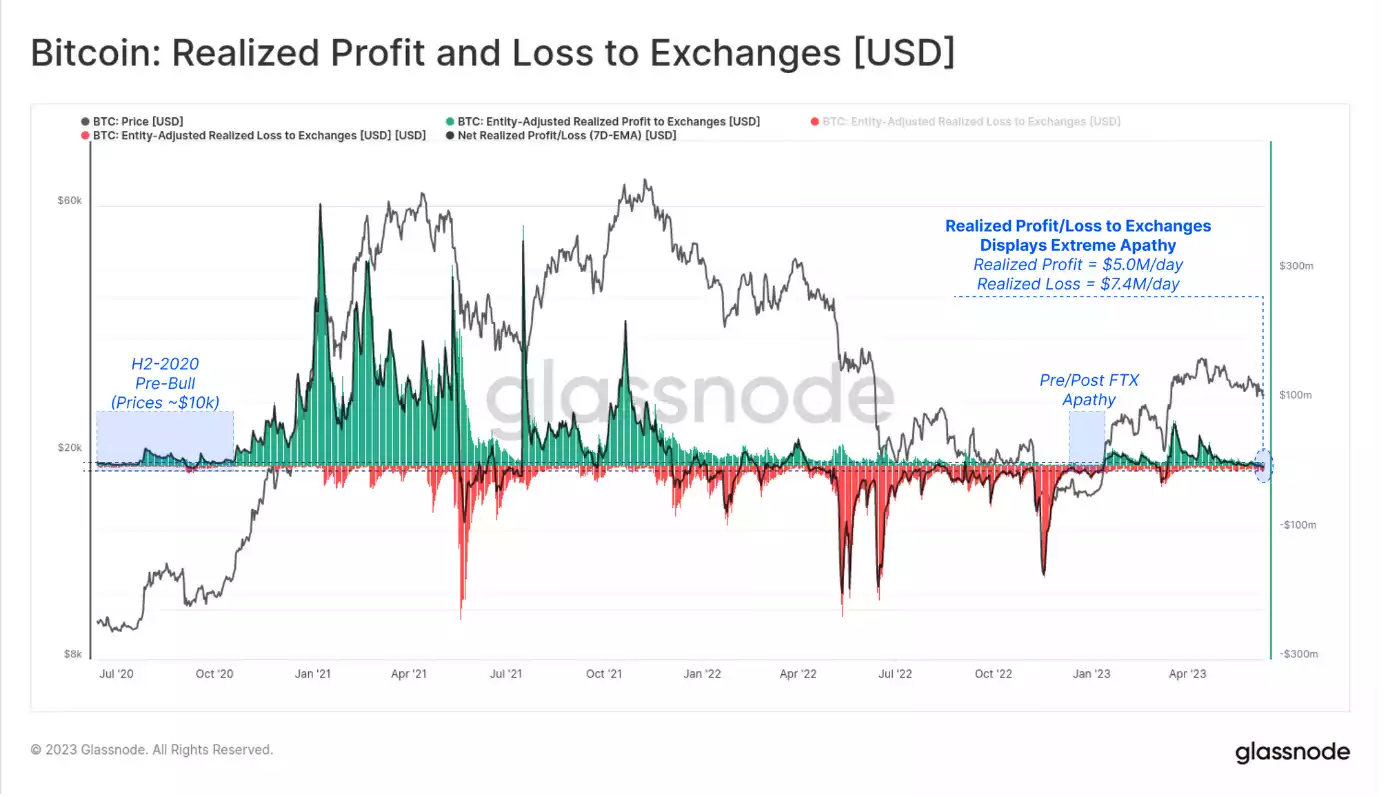

While recent charts indicate that a subset of recent buyers has been depositing coins into exchanges this week, a deeper analysis reveals intriguing insights. The total Realised Profit or Loss locked in by exchange deposits reveals that both the profit and loss sides are relatively small. This suggests that most of the coins flowing into exchanges were acquired at a price very close to the current spot rate, indicating that recent buyers dominate the market.

This observation sheds light on an impressive level of confidence amongst investors. They appear to remain relatively unfazed by the news in aggregate, likely due to the recent acquisition of these coins. However, it also hints at a level of indifference or apathy, as the current price range does not provide sufficient incentive for investors to transact significantly.

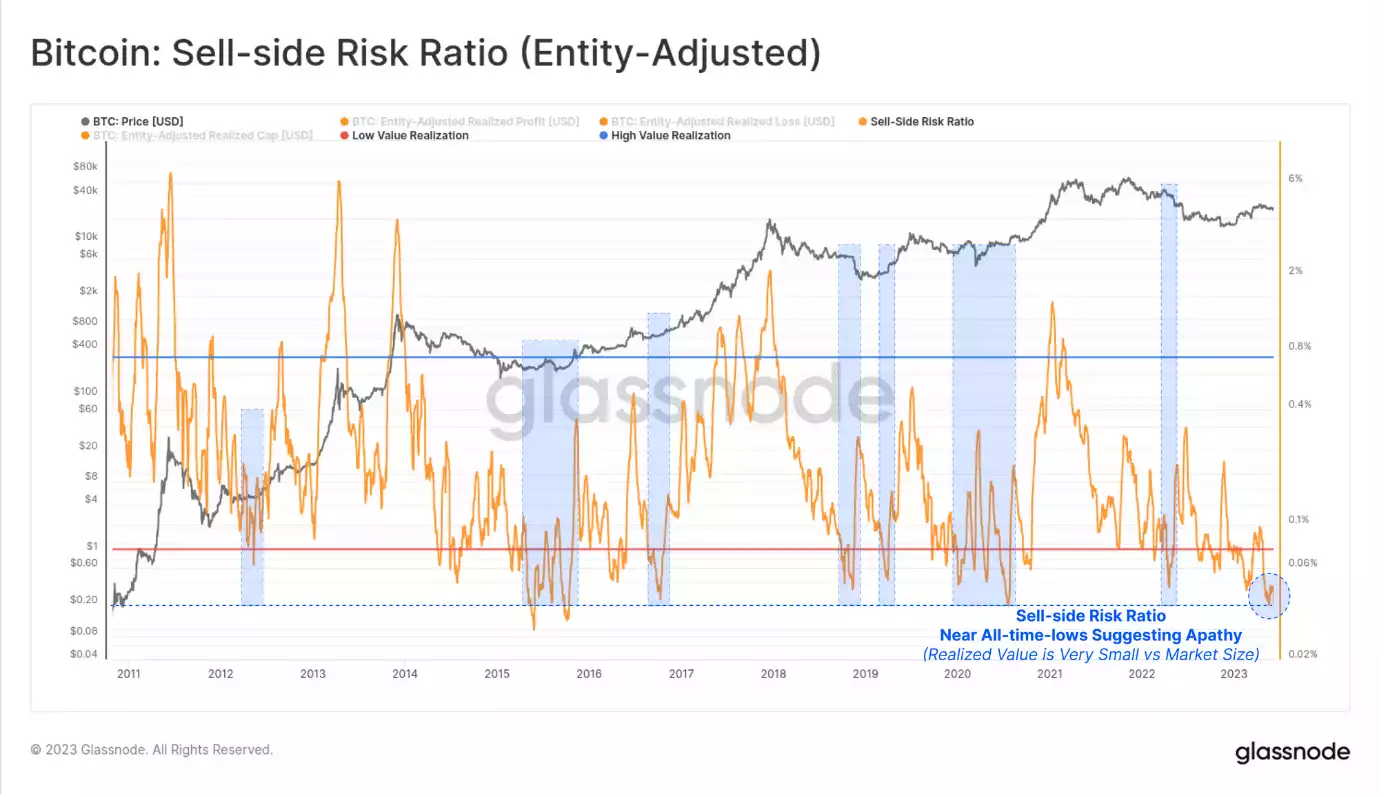

Sell-Side Risk Ratio: A Lens into Investor Indifference

The sell-side risk ratio, a measure of the aggregate profit/loss locked in by the market relative to the asset size (also known as the Realised Cap), has dropped to nearly all-time lows due to incredibly low realised profit or loss. The total value of profit and loss being realised is exceptionally small compared to the current Bitcoin Realised Cap of $391 billion.

Historically, such low values of the sell-side risk ratio have been observed during periods of increased investor indifference, usually following deeply bearish trends.

Navigating The Waves: Final Thoughts

In conclusion, the U.S. continues to maintain a hostile regulatory environment for cryptocurrencies, with the SEC filing significant charges against the two largest exchanges, Binance and Coinbase. The asset balances on these two exchanges have seen a decrease this week, likely due to some customers withdrawing out of concern over the legal challenges. Except for the stablecoins at Binance, these declines are within normal patterns.

The future impact on investors remains uncertain and will become clearer as the lawsuits against Binance and Coinbase unfold. In the immediate aftermath, many recent Bitcoin (BTC) buyers, referred to as Short-Term Holders (STHs), have transferred their coins to exchanges, presumably for selling, to mitigate their risk exposure.

Interestingly, despite these actions, the extremely low realised profit and loss that has been locked in, coupled with the nearly non-existent reaction from Long-Term Holders (LTHs), suggest that many investors were not taken by surprise by the news.

In a turbulent sea of regulatory scrutiny, the resilience and strategic responses of the crypto market are a testament to its maturing landscape.

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.