UNCOVERING THE SILENT ACCUMULATION AMID BITCOIN’S ETF FEVER

June 27, 2023

In the past week, the crypto market buzzed with the flurry of applications for a Bitcoin Exchange-Traded Fund (ETF). Amid this climate of heightened anticipation, a critical question emerges: How many Bitcoins are genuinely up for sale? We dive deep into the available supply of Bitcoin, unravelling the influence of demand on market valuations across past cycles.

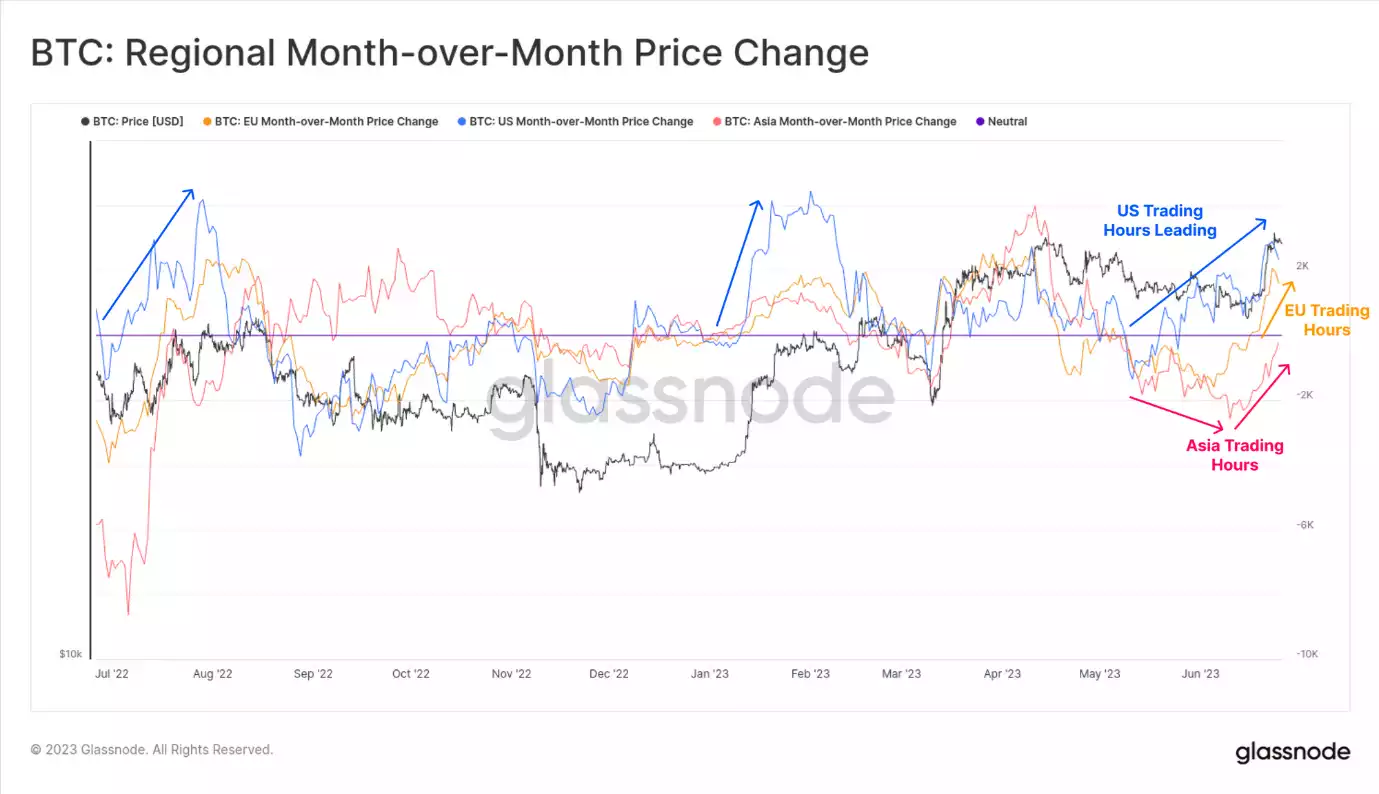

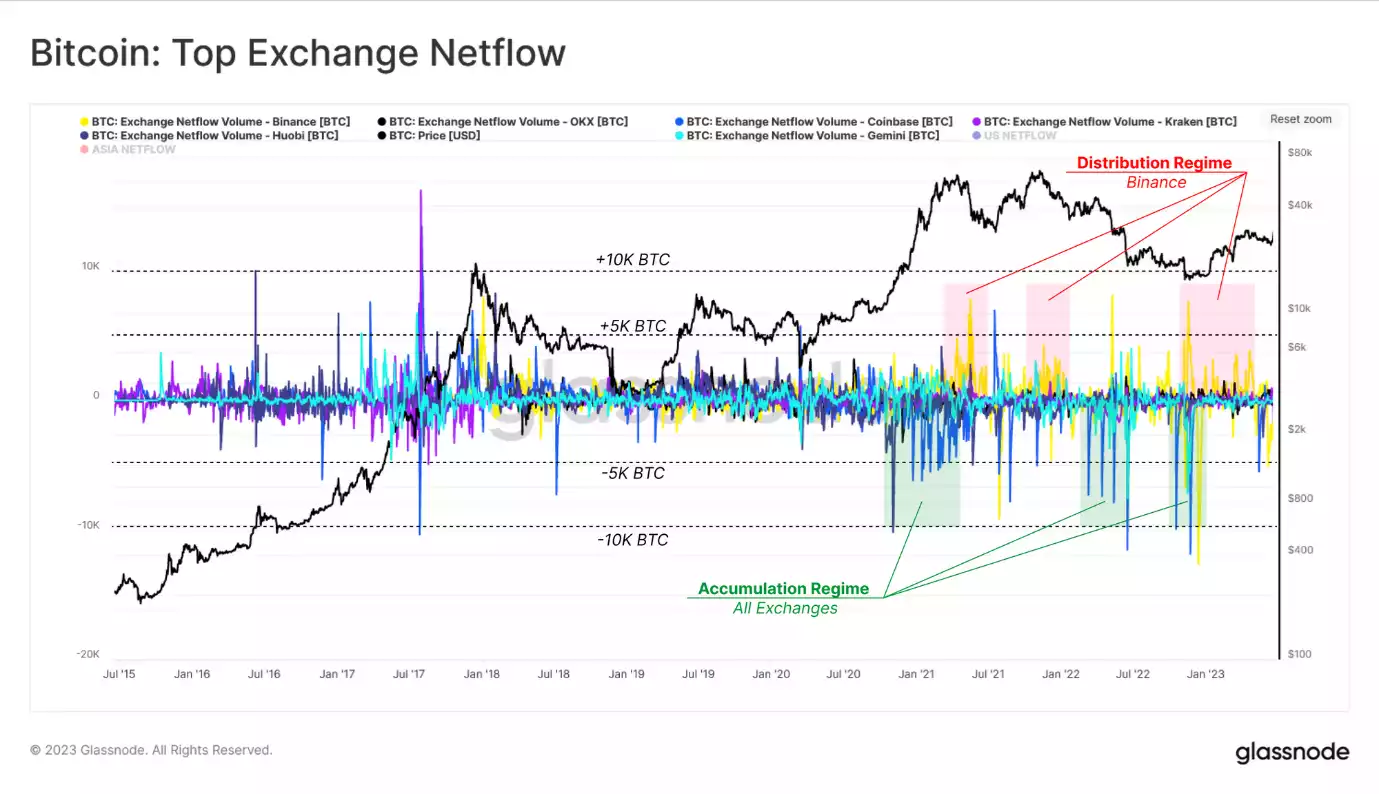

Simultaneously to the ETF applications, a fascinating trend came to light. An analysis of fund flow between major US and Asian exchanges exposed a robust accumulation during Asia’s trading hours, contrasting with the relatively weaker demand from US markets throughout 2023. To make sense of these periods of demand expansion or contraction, we can look to the concept of ‘hot supply,’ isolating the volume of coins actively participating in price discovery. This approach has illuminated a significant shift in market psychology from the bearish sentiment of 2022, as short-term Bitcoin holders in 2023 serve as an effective support level.

Navigating the Regulatory Pressures Amid a Bitcoin Rally

Recently, the Securities and Exchange Commission (SEC) in the U.S. has turned up the regulatory heat on the two leading cryptocurrency exchanges. Despite these actions, or perhaps in response to them, we witnessed a surge of spot Bitcoin ETF applications spearheaded by Blackrock, the world’s largest global asset manager. The resulting rally saw Bitcoin prices ascend from US$25,000 to over $31,000, a new peak for the year.

Decoding Regional Shifts in Digital Assets

To fathom these regional shifts in digital assets, we assessed coin flows via fiat on-ramping entities, primarily exchanges. Selecting the top three exchanges from the U.S. and Asia regions, you can scrutinise the weekly average Bitcoin netflow, revealing intriguing patterns. Particularly noteworthy was Binance’s behaviour, often contrary to other exchanges, possibly attributed to investors migrating their holdings away from perceived riskier exchanges.

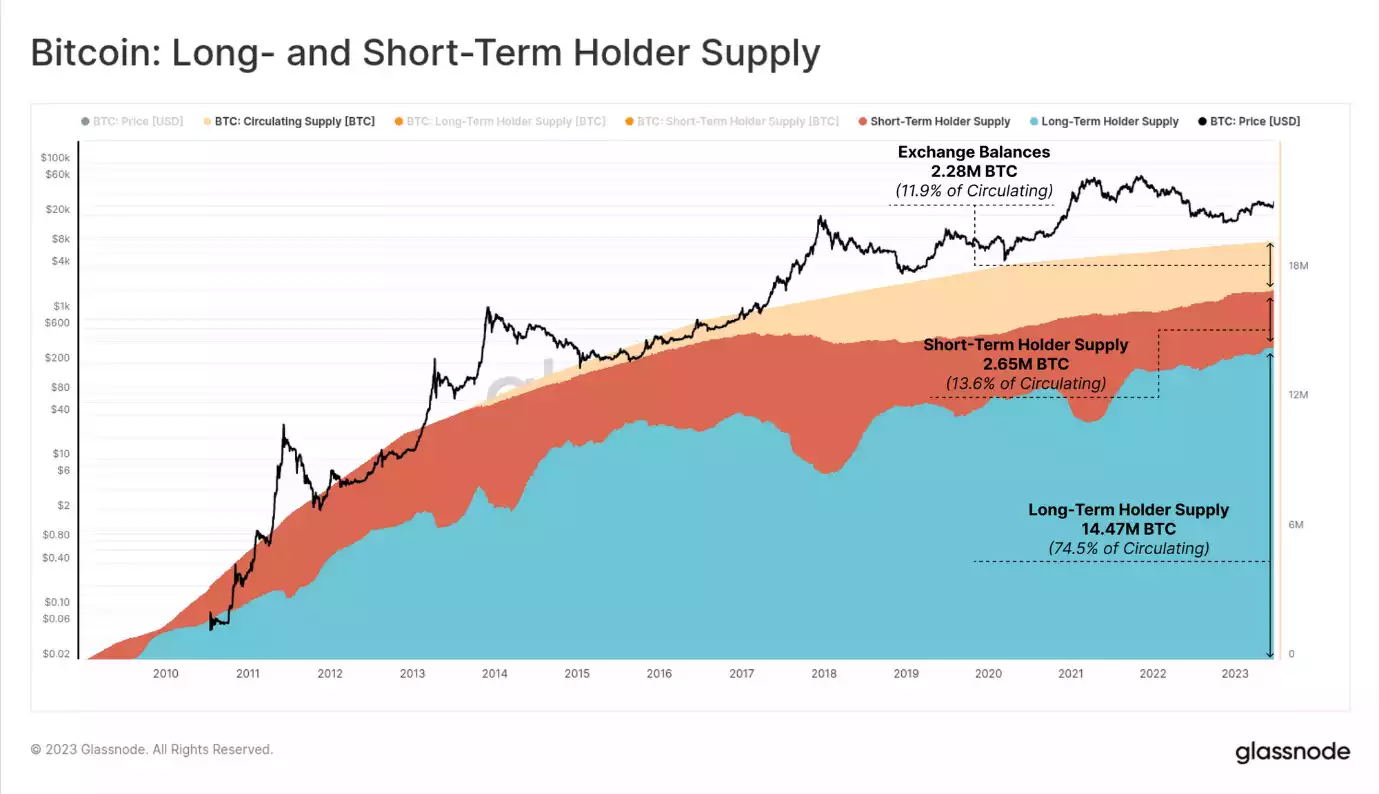

Reading the Signs of Increasing Illiquidity

The discussion around the ongoing wealth transfer from high-time-preference investors towards Bitcoin HODLers has been heated. When examining the increasing illiquidity trend that characterises all previous Bitcoin bull markets and how ‘supply shock’ can favourably impact price discovery, provided new demand enters the market.

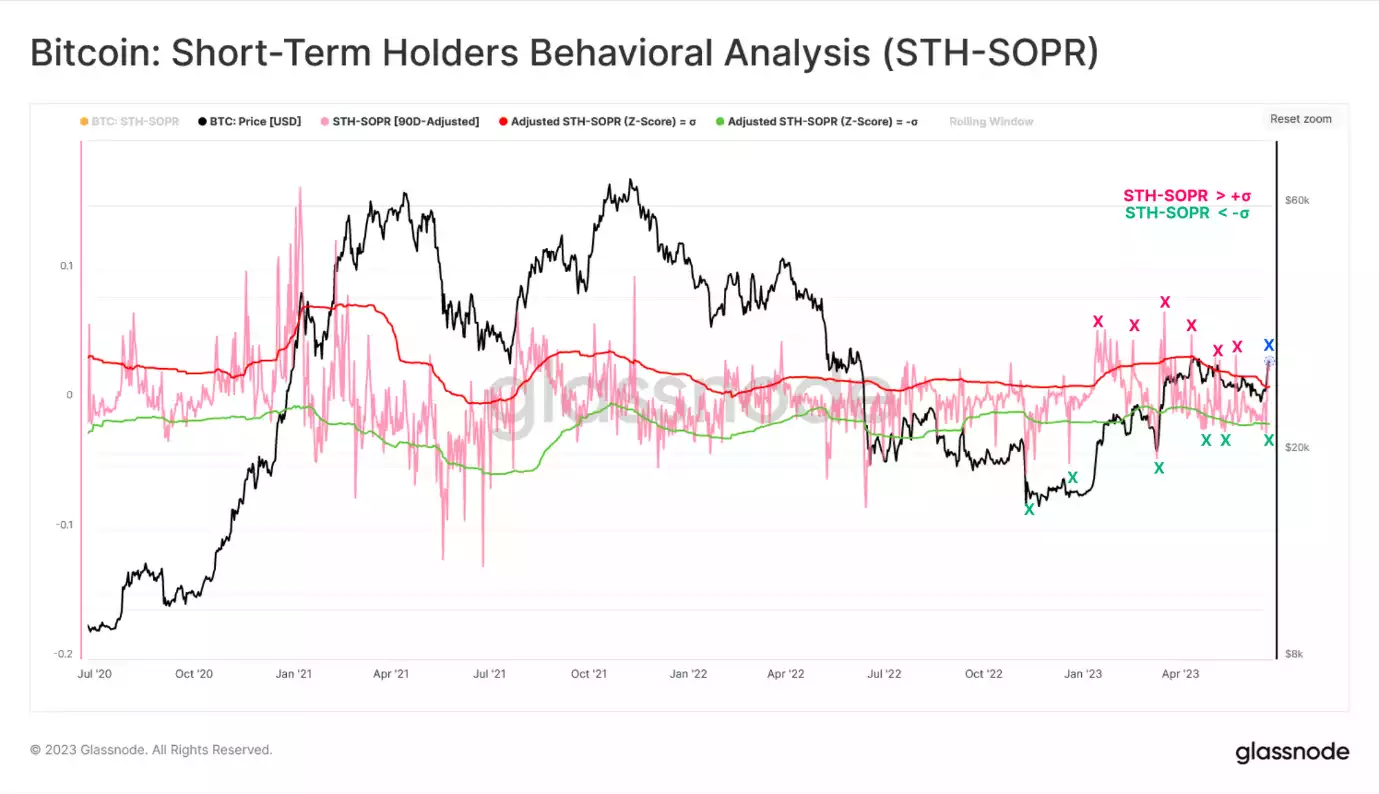

Unravelling Short-Term Holder Behaviour and Market Turning Points

Significant market turning points often hinge on the behaviour of short-term Bitcoin holders. Two critical intersections between price and the Short-Term Holders-Cost Basis (STH-Cost Basis) have formed robust support for the market throughout 2023. This pattern reflects a shift in investor psychology from the bearish mindset of 2022, viewing break-even levels as opportunities to build positions instead of exit strategies.

Analysing the Spend Behaviour of Short-Term Holders

As we delve deeper into the spending behaviour of short-term holders (STH), we turn to the STH-SOPR (Spent Output Profit Ratio) indicator, a revealing tool that identifies points where the market may react. Recent weeks have displayed multiple instances of seller exhaustion, marking a crucial turning point for market recovery.

Decoding the Resurgence of Institutional-Grade Demand

Finally, the surge in institutional-grade Exchange Traded Fund (ETF) applications in the U.S. points to early indications of a revival in U.S.-led demand. As we tracked the market behaviour of short-term holders (STH), we can see a shift away from the bear market sentiment of 2022. The crypto market now seems to perceive ‘break-even’ levels as an opportunity to augment holdings rather than seek exit liquidity, indicating renewed confidence among market participants.

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.