Under the Surface: How Bitcoin Whales are Influencing the Crypto Market

July 25, 2023

A Glimpse into the World of Whales

In the world of cryptocurrencies, “whale entities”, those holding more than 1,000 Bitcoin (BTC), often wield a considerable influence on the performance of Bitcoin’s price. This holds true even in the current crypto landscape, where there has been a remarkable uptick in whale activity.

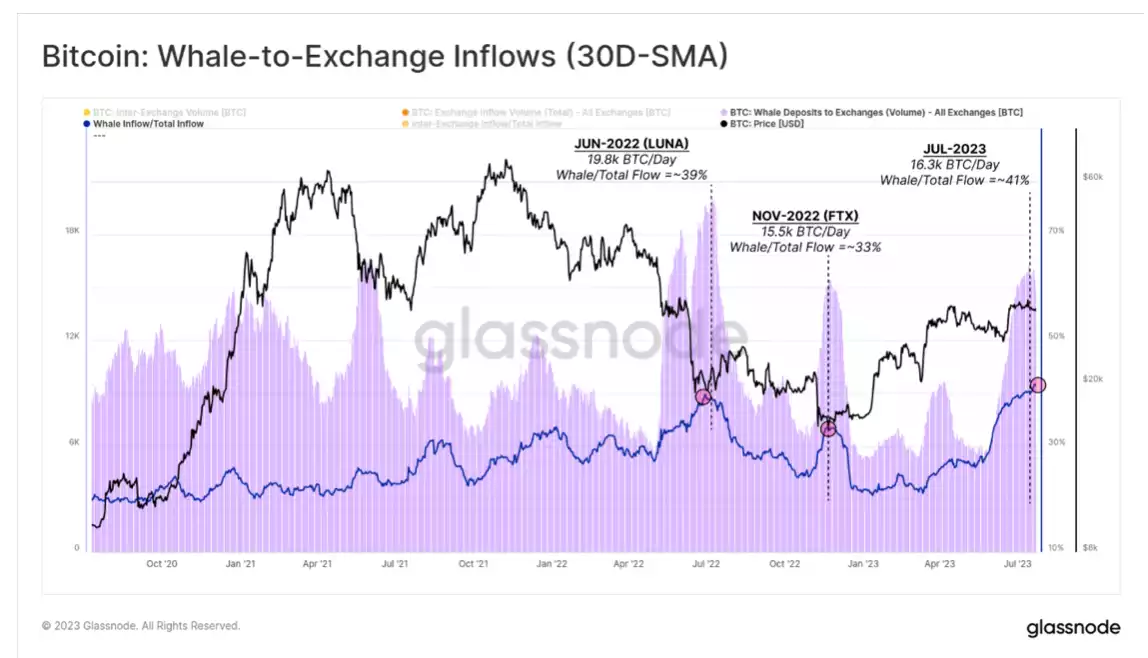

The volume of whale inflows to exchanges is not just significant but staggering, accounting for nearly 41% of the total. Further breaking down this inflow reveals that over 82% of it is destined for the industry’s largest exchange. Interestingly, a considerable proportion of these active whale entities can be classified as Short-Term Holders (STHs), showcasing significant activity around the local market peaks and troughs.

From Distribution to Accumulation: How Wallet Cohorts are Shaping the Market

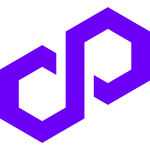

A careful examination of the Bitcoin market reveals that most wallet size cohorts initiated a distribution period from mid-April, during the first rally to $30k, that lasted until mid-June. However, a noticeable change in this pattern began to emerge with the second rally to $30k in late June.

By way of the Trend Accumulation Score by Cohort, we can determine that there has been a significant reduction in spending by entities holding less than 100 BTC within the last month. The story, however, takes a divergent turn when it comes to larger entities or the “whale” subdivisions. Whales holding over 10k BTC have started distributing their holdings, while those holding between 1k and 10k BTC have been accumulating at a substantially higher rate.

These fascinating patterns offer invaluable insights into the market behaviours of different Bitcoin wallet size cohorts. Unravelling these could serve as a foundation for future predictions about price movements and accumulation trends.

Decoding the Mysterious Whale Cohort

To gain a clearer understanding of the Bitcoin market, it is crucial to define ‘Whale entities’. In this context, they are inclusive of exchanges, large, centralised holdings such as ETF products, Grayscale Bitcoin Trust (GBTC), Wrapped Bitcoin (WBTC), and corporate holdings like MicroStrategy. However, to eliminate exchanges from the data set, the focus has been narrowed down to the flow of coins solely between whale entities and exchanges.

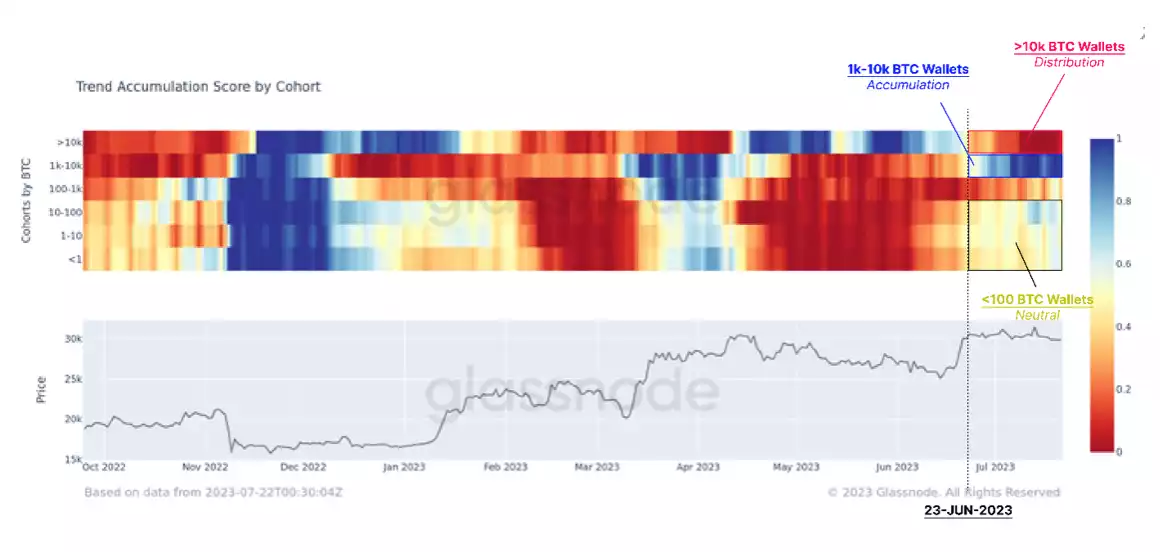

What this reveals is a significant decrease of 255k Bitcoin in the aggregate balance of Whale entities since May 30. This decrease is unprecedented, marking the most significant monthly balance decline in history, peaking at -148k BTC/month.

Subtle Shifts in Balance: The Curious Case of Whale Reshuffling

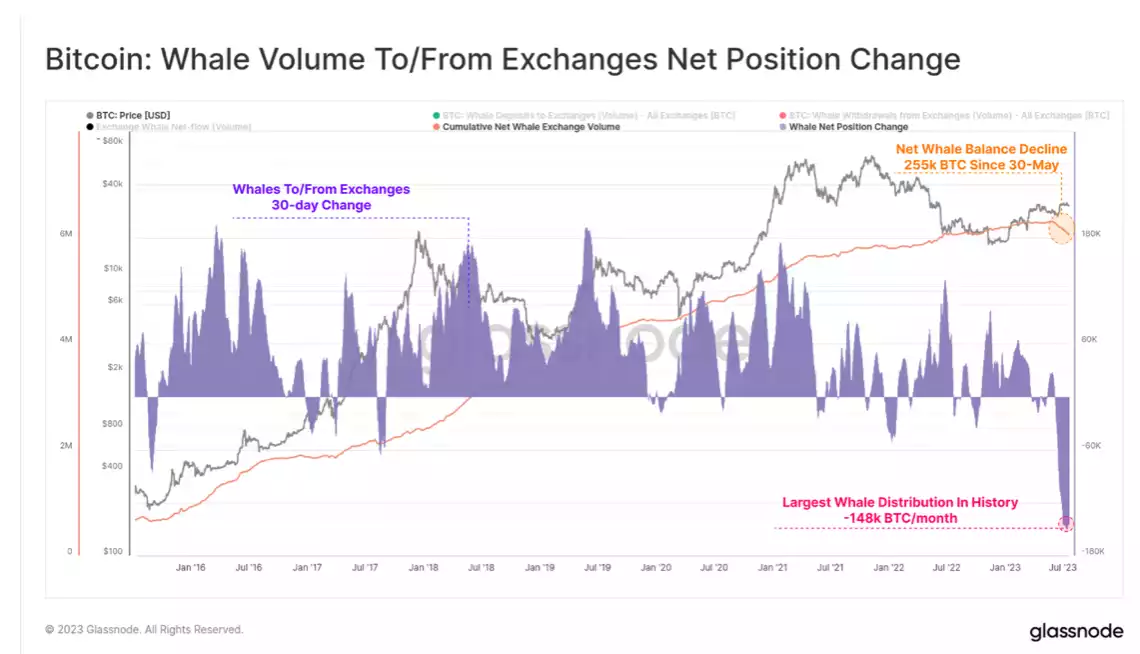

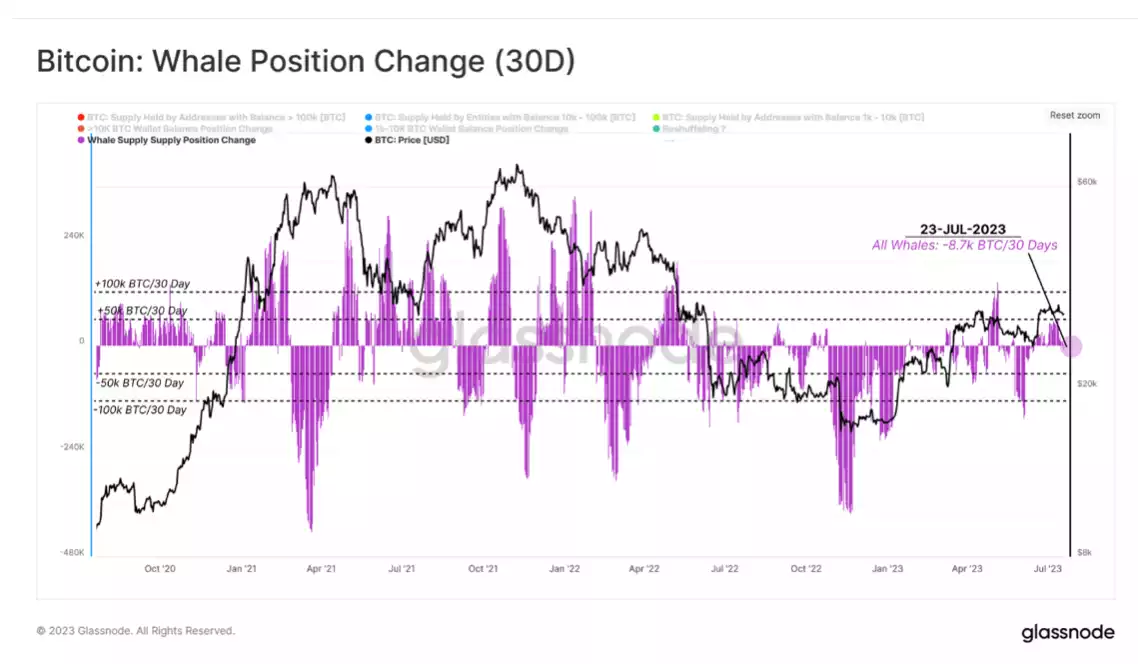

While the overall aggregate change across all whale groups (including exchanges) shows a mere reduction of -8.7k BTC, the shifts within the sub-cohorts are considerably more dramatic.

Despite this seemingly static aggregate balance change, significant internal adjustments are happening both among whale sub-cohorts and via exchange flows. This intriguing phenomenon is best described as ‘Whale Reshuffling,’ reflecting the considerable internal movements and balance shifts taking place within the whale cohort.

Testing the Waters: Investigating the Whale Reshuffling Hypothesis

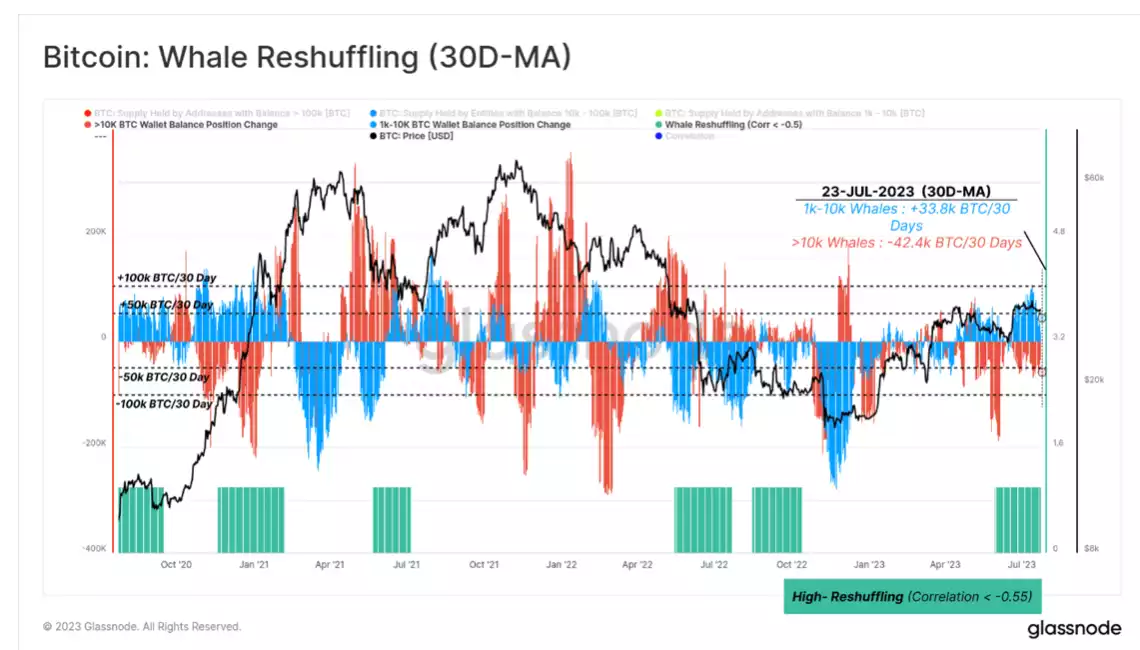

The hypothesis of “Whale Reshuffling” was put to the test by investigating the 30-day position change for whale subdivisions, particularly those holding over 10k BTC and those between 1k-10k BTC. The aim was to identify periods where a balance increase in one group is matched by a similar decrease in the other.

This investigation found periods with a strong inverse correlation of -0.55 or less, suggesting “reshuffling” activities. A noteworthy period of this inverse correlation coincides with the recent surge in the market towards the $30k range. Despite the aggregate balance change appearing relatively neutral, it seems whales are more involved in reshuffling their holdings via exchanges than drastically adjusting their overall positions.

Whale Activities and Exchange Dynamics: An Intriguing Relationship

The activities of Bitcoin ‘whale’ entities can significantly impact the market, especially regarding exchanges.

The recent market rally brought with it a substantial increase in the volume of whale inflow to exchanges, reaching an impressive +16.3k BTC per day. This surge in whale activity accounts for a whopping 41% of all exchange inflows, a dominance level comparable to other significant market events such as the LUNA crash and the failure of the FTX exchange. The influence of Bitcoin whales on market dynamics is undeniable, with their activities capable of driving significant shifts in exchange inflows.

Whale Dominance: Unmasking the Colossal Influencers

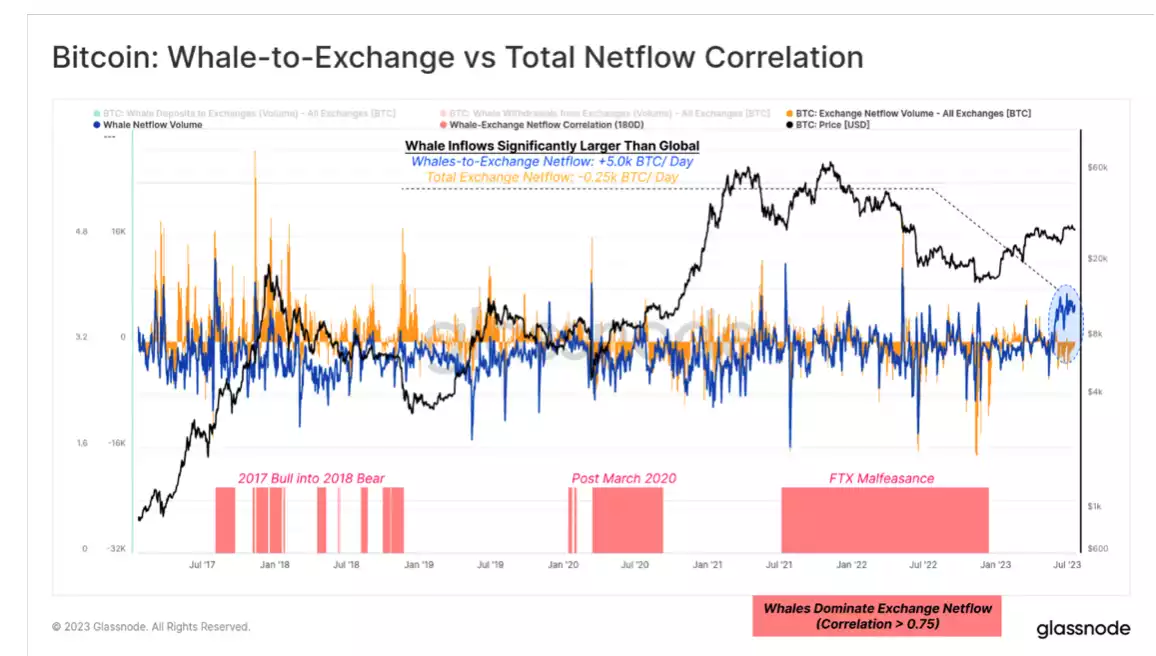

Three significant periods of high correlation (0.75 or more) emerged, each one demonstrating that whale behaviour, characterised by a strong inflow bias, diverges significantly from the rest of the market, which typically shows a modest outflow bias.

These periods of whale dominance underline the significant influence that these large-scale Bitcoin holders wield on market price movements. A substantial 42% of exchange inflows are linked to these whale entities, with the majority of these inflows directed towards the cryptocurrency exchange platform. It’s also worth noting that most of these active whale entities can be classified as Short-Term Holders, indicating their propensity to hold their Bitcoin for relatively shorter periods before selling or trading.

Wrapping up the Tale of the Whale: Seizing Opportunities in Flux

Bringing all these dynamic elements together, the world of Bitcoin ‘whales’ paints a captivating picture of the crypto market that continuously evolves. While these large-scale entities and their activities might at first seem intimidating or unpredictable, the narrative woven by our in-depth analysis tells a story of resilience and adaptive intelligence. Amid the turbulence, the whales manoeuvre, reshuffle, and strategically alter their positions to meet the market’s ebb and flow.

The fluctuations witnessed in recent times – marked by significant inflows, intense reshuffling, and strategic accumulation – hint towards a careful and calculated orchestration of moves by the whales. Even the decline of 255k Bitcoin in the aggregate balance of whale entities since May 30, while substantial, doesn’t overshadow the optimism embodied by these entities.

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.