Deciphering Bitcoin’s Stagnant Waters

August 8, 2023

The Great Volatility Conundrum

Long established as a symbol of volatility, Bitcoin is presently undergoing an unparalleled phase of volatility compression. This poses a tantalising question: has Bitcoin shed its volatile skin, or are we due for volatility?

A Synopsis of the Current Climate

The narrow confinement of Bitcoin’s current trading range is startling, with a mere 5% of trading days reflecting such bounds. Observing the futures markets, the trade volumes for pivotal players, Bitcoin and Ethereum, teeter on historic lows. This might sound alarm bells for some, especially with cash-and-carry yields perched just above the market’s risk-free rate at 5.3%. Venture into the options arena, and the tale is similar — plummeting volatility and premiums that have halved since 2021-22. The all-time low readings of the put/call ratio and 25-delta skew potentially flag an upcoming calm in the market.

Probing Bitcoin’s Current Stasis

The serenity gracing the Bitcoin market currently, when juxtaposed with its tumultuous past, is nothing short of extraordinary. Bitcoin’s spot price, despite the lull, remains buoyant, breezing above vital long-term moving averages. These figures, ranging from a cool US$23.3k to an optimistic $28.5k, coupled with historical precedents, might be heralding an impending bullish onslaught.

Diving Deep into Realised Prices: Understanding Market Cohorts’ Cost Basis

Analysing on-chain realised prices offers an insightful lens, allowing us to gauge the cost basis for different segments of the market. By segmenting the market into distinct cohorts, we can dissect and better appreciate the nuances in investment strategies and behaviours.

Three Prominent Cohorts Explained:

- The Entire Market’s Overview 🟠: Representing the holistic realised price, this sheds light on the entire market’s cost basis, providing a comprehensive view of the average acquisition cost across all participants.

- The Short-Term Strategists 🔴: Specifically focusing on coins younger than 155 days, this cohort unravels insights into the behaviour of the more recent entrants to the market. Whether they’re opportunists or new enthusiasts, this segment provides a window into the strategies of short-term players.

- The Marathoners or Long-Term Visionaries 🔵: By honing in on coins that have aged beyond 155 days, we delve into the mindset and patterns of investors with a more extended holding perspective. This segment underscores the behaviours of those who view Bitcoin as a long-term play, and their acquisition costs reflect deeper strategies or convictions.

Spotting the Nuances in Spot Price: Interestingly, our analysis highlights that the current spot price is trading above the realised prices of all three cohorts. This observation implies a possible bullish sentiment. It suggests that the broader market currently values Bitcoin more than the average cost at which these distinct cohorts have acquired it.

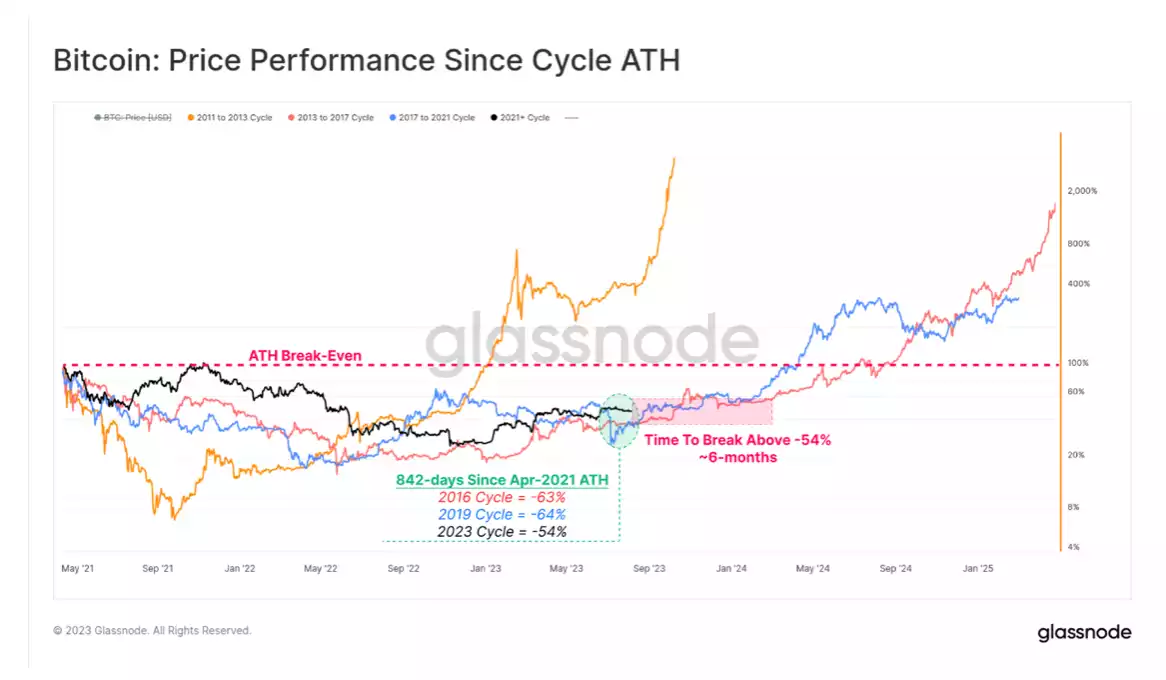

Time Travel: Comparing Peaks and Valleys

It’s been a considerable 842 days since Bitcoin basked in its last bull market zenith in April 2021. When placed under the lens of history, 2023’s recovery seems to exude a certain robustness. Trading 54% below its all-time pinnacle, it far outpaces the historical 64% dip post-peak. With history as our guide, perhaps we’re gearing up for an encore of the ‘sideways boredom’ of 2015-16 and 2019-20 before a sharp rally.

2023’s Ebb and Flow

The dawn of 2023 painted a rosy picture with Bitcoin soaring, only to witness its momentum gradually taper off. Such patterns, though, are not without precedent. The initial euphoric ascent invariably gives way to a plateau, paving the path for the ‘re-accumulation’ phase — a possible precursor to bullish trends.

Unravelling Bitcoin’s Volatility: A Historical Perspective

The dramatic downturn of Bitcoin’s realised volatility throughout 2023, has not been observed since a distant December of 2016. Delving deep into historical data reveals that 2023 isn’t an isolated anomaly, but rather the fourth occurrence of such a significant volatility compression in Bitcoin’s storied timeline. Let’s travel back in time to understand the trends and events that have shaped Bitcoin’s volatility narrative.

Historical Milestones of Bitcoin’s Volatility:

- The transition from 2015 to 2016:

- At the close of 2015, Bitcoin was clawing its way out of a bearish grip, only to transition into a re-accumulation phase as 2016 dawned. This period served as an earlier illustration of a volatility squeeze, setting the stage for the future of the cryptocurrency.

- Tumultuous 2018:

-

- This year was a rollercoaster for Bitcoin enthusiasts. The tail end of 2018 saw a harrowing 50% sell-off in November. But the narrative wasn’t all bleak; a silver lining emerged in April 2019, when Bitcoin’s price soared from $4,000 to an astonishing $14,000 within a mere three months, showcasing its resilient nature.

- The 2020 Saga – Under the Shadow of COVID-19:

-

- The world found itself in the throes of the COVID-19 pandemic in early 2020. Global markets, including Bitcoin, entered a consolidation phase, processing the myriad of challenges thrown up by the health and subsequent economic crisis. During this year, Bitcoin’s volatility patterns mirrored the uncertainty of the global landscape.

- Twilight of 2022:

-

- The end of 2022 brought with it the weighty implications of the FTX debacle. This period saw another instance of pronounced volatility compression.

Foreseeing Bitcoin’s Horizon: Stability or Storm?

As we gaze upon the intricate journey of Bitcoin, its present phase appears both intriguing and mystifying. Currently, Bitcoin’s monthly trade ranges scarcely surpass the 10% mark, suggesting that we may be navigating uncharted territory. Parallelly, futures’ cash-and-carry yields dance between 5.3% and 8.1%, hovering slightly above the risk-free parameters established by short-term US T-bills. And with the options market currently in its most quiescent phase of volatility, we stand at a crucial juncture:

Is this the dawn of a new epoch characterised by unwavering stability for Bitcoin? Or might we be in the misleading lull that precedes turbulence of volatility?

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.