Unravelling the Crypto Market’s Shift

August 22, 2023

Today we explore the recent dramatic turn of events in the Bitcoin and broader cryptocurrency market. After months of stability, an unexpected flash crash and other significant shifts have left traders, investors, and analysts alike grappling with a radically changed landscape. From the mechanics of the flash crash to the implications on different market segments, we take an in-depth look at what transpired over the past week in the crypto market…

The Abrupt Market Turbulence

Bitcoin Flash Crash Overview

Bitcoin, the flagship cryptocurrency, experienced its largest single-day sell-off of the year, plunging below $25,000. This shocking downturn, especially after an extended period of historically low volatility, has sliced through vital price support models, turning the tables on bullish perspectives and leaving many to ponder what lies ahead.

Futures Markets Deleveraging

One of the main catalysts behind the flash crash appears to be a deleveraging in the futures markets. A colossal shift, resulting in over $2.5 billion worth of open interest being wiped away in mere hours, has drastically shaken the market dynamics, leaving investors and traders to reassess their positions.

Short-Term Holder Impact

The crash’s effects are severe, leaving an overwhelming 88.3% of Short-Term Holder (STH) supply at an unrealised loss. This startling statistic emphasises the scale of the sell-off and the ripple effects it could have on market sentiment, particularly among newer or more speculative participants.

Options Markets Reaction

The aftermath of the crash saw the options markets sharply reprice volatility premiums from historical lows. Despite this recalibration, open interest in options remains remarkably robust, hinting at an adaptive response from the trading community.

Spot Market Conditions

With the spot markets now notably ‘top heavy,’ characterised by a significant portion of holdings at unrealised losses, further caution among traders could hamper the recovery process, adding a layer of complexity to the market’s immediate future.

Long-term Implications

The flash crash, while alarming, opens a window into the multifaceted interplay of market forces such as leverage, derivatives, and investor behaviour. The lessons learned may shape future risk assessment, and trading strategies, and even guide regulatory considerations.

A New Era in Market Dynamics

Dramatic Shift in Market Dynamics

After a lull since July, the digital asset market experienced a sudden and violent sell-off. This abrupt shift marked an end to a stagnant period where Bitcoin’s price action recorded record lows in terms of volatility.

Bitcoin Price Behaviour

Trading just above $29.3k for weeks, Bitcoin suddenly broke through crucial long-term moving averages, closing the week around $26.1k. This dramatic drop signals a pivotal moment that warrants close observation and strategic realignment.

Evaluating the Sell-off and Price Impact

Sell-off Impact

The market’s significant sell-off has pushed prices below the STH cost basis, a level that has historically acted as support during strong upward trends. This new positioning poses intriguing questions about future price trajectories.

Realised Price and Long-Term Holder Cost Basis

With the Realised Price and Long-Term Holder cost basis trading considerably lower, specifically at $20.3k, the potential consequences of these shifts on both short-term and long-term investor behaviours merit scrutiny.

Understanding the Weekly Price Action

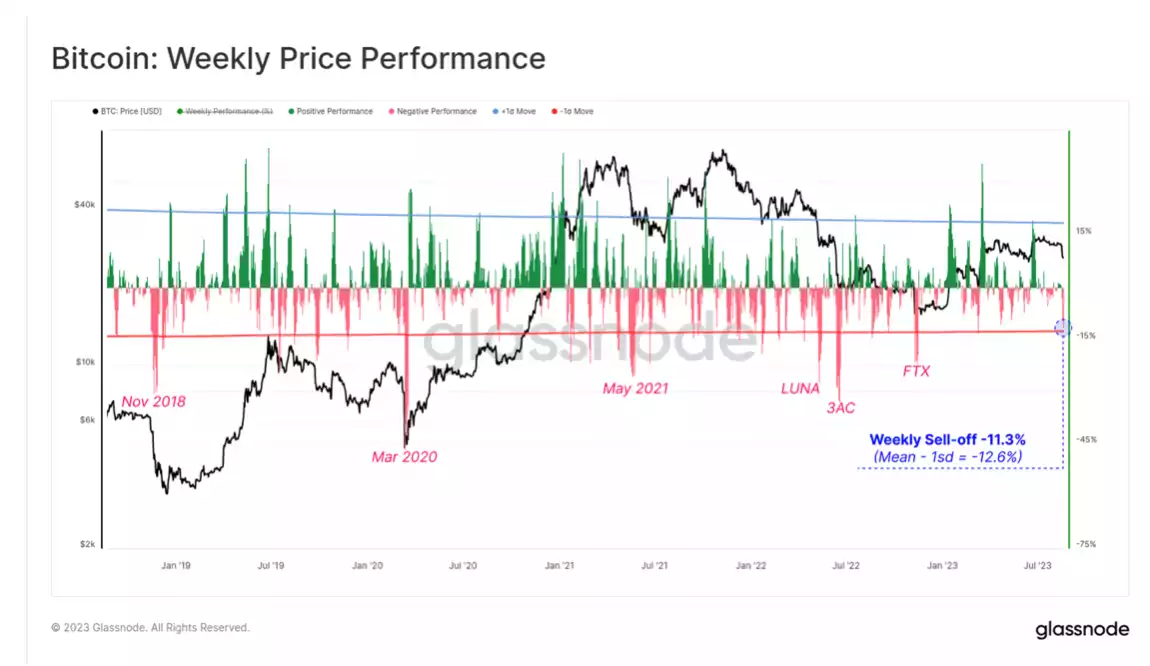

Weekly Price Action

The weekly price action saw a significant decline of -11.3%, not the largest in recent years but substantial nonetheless.

Comparison with Standard Deviation

This price decrease, when compared with the long-term one standard deviation move of -12.6%, offers a statistical lens to assess the magnitude of the current price change.

Historical Reference

Reflecting on major capitulation events, such as collapses of entities like FTX, 3AC, and LUNA, provides a historical context that can help gauge the significance of the current price action relative to past market behaviours.

Conclusion

The crypto market experienced an extraordinary week, with a single-day drop of 7.2% in Bitcoin, marking the largest single-day decline Year-to-Date (YTD). Various indicators suggest an upcoming deleveraging, reflecting a potential shift away from high-leverage investment strategies. While Long-Term Holders (LTH) remained mostly steadfast, Short-Term Holders (STH) were significantly affected, with an acceleration in realised losses and key technical support loss. These developments have put bullish investors on the defensive and injected uncertainty into the market’s near-term direction.

In a world where market dynamics are constantly evolving, recent events serve as a wellspring of invaluable insights and opportunities for growth. While the previous narrative of stability may have been tested, it has opened up new horizons, encouraging fresh perspectives, innovative strategies, and positive expectations in the crypto space. Far from a warning sign, these developments are a clarion call to new opportunities, paving the way for an exciting future full of promise for the vigilant and adaptive market participant.

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.