A Resurgence of Excitement in the Cryptocurrency Sphere

September 5, 2023

The Comeback of Market Fluctuations in the Digital Realm

In the dynamic sphere of digital assets, the prevailing theme currently seems to be the return of volatility, giving a fresh lease of life to markets that had settled into a phase of relative tranquillity. Notably, the Ethereum blockchain, along with various other tokens, is encountering a phase of significant value corrections, drawing the attention of investors and market enthusiasts alike.

A whirlwind of activity has enlivened the sector, largely propelled by a duo of critical events that have left an indelible mark on the market psyche. The first of these was a sudden market slump witnessed on August 17, triggering a cascade of sell-offs that saw the prominent cryptocurrencies Bitcoin and Ethereum plummet by 11% and 13% respectively. Barely had the ripples from this event subsided when the market was buoyed by the exhilarating news of Greyscale triumphing over the SEC in a landmark legal case on August 29. This event initially breathed fresh life into the market, driving prices upward, although this was followed by a correction in the succeeding trio of days.

Derivative Markets: A Shift in Liquidity Dynamics

The derivatives markets, too, are in the throes of a significant transition, characterised by a persistent drainage of liquidity. This phenomenon is conspicuously manifest in the Ethereum futures, a testament to the shifting capital towards niches perceived as safer or presenting a heightened risk-reward profile on the curve.

This flux in liquidity can be perceived as a barometer of investors’ reactions, adapting and responding to the revitalised bouts of market volatility, and possibly heralding a new era of investment strategies and orientations.

The Wake-Up Call: Key Events Stirring the Market

The digital asset market seems to have shaken off its slumber, stirred by a couple of pivotal events that have reset the market’s pulse. These events have spurred a period of recalibration, with investors and stakeholders keenly attuning themselves to the evolving narratives and potential trajectories that might unfold in the coming days.

A Critical Junction: Evaluating the Current Market Stance

In the present landscape, both Bitcoin and Ethereum are navigating a phase of stagnation, with their valuation hovering around the figures witnessed in the earlier parts of August. This phase seems to be one of reflection and adjustment, as the market collectively tunes its strategies and outlooks in response to the recent waves of volatility and unfolding events.

As we forge ahead, it will be crucial to maintain a close vigil on these developments, potentially signposting a phase of strategic realignment and adaptation, setting the stage for the next chapter in the thrilling saga of the digital asset marketplace.

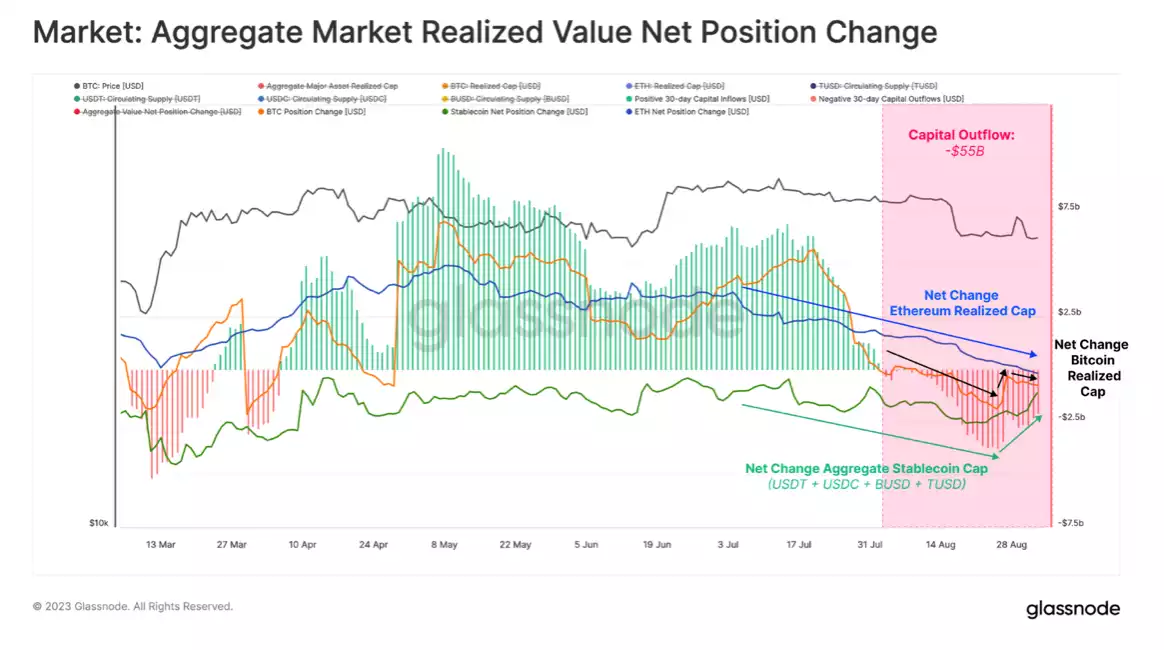

Spotlight on the Aggregate Realised Value Metric: A Key Indicator of Cryptocurrency Flows

The focal point of the discourse centres around the pivotal Aggregate Realised Value metric, a nuanced instrument pivotal for charting the complex web of capital movements pervading the cryptocurrency sector. Let’s delve deeper to understand the constituting elements of this metric and the wider repercussions it signals for the industry.

Unveiling the Metric Components:

- BTC and ETH Realised Cap: Foremost in the components of this metric are the realised capitalisations of the spearhead cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), serving as substantial indicators in tracking the financial pulse of the crypto market.

- Dominant Stablecoins Supply Dynamics: Equally crucial in shaping the metric are the supply intricacies of the market’s premier stablecoins, a list topped by USDT, USDC, BUSD, DAI, and TUSD. These elements are vital in sketching a full picture of the market dynamics at play.

- The onset of Capital Exodus in August: A critical revelation accentuated in the discussion is the onset of a pronounced capital exodus commencing in early August, a trend discernible even preceding two monumental events not elucidated in the present segment.

- The magnitude of Capital Departure: The August narrative is dominated by a stark retraction within the digital asset arena, witnessing a staggering $55 billion capital flight. This fiscal shift emerges as an essential facet to scrutinise while deciphering the prevailing health and directional cues within the sector.

Key Assets Influencing the Trend:

- Bitcoin (BTC): Holding a pivotal position in the narrative is Bitcoin, a flagbearer in the digital currency spectrum, whose significant capital retreat forms a considerable part of the overarching declining trajectory.

- Ethereum (ETH): Sharing the spotlight with Bitcoin is Ethereum, another heavyweight in the cryptocurrency domain, undergoing capital drainage that has cast ripples on the aggregate realised value metric.

- Stablecoins: Beyond the primary cryptocurrencies, the sector observed a capital retreat from stablecoins, these digital assets maintain a value anchorage to conventional currencies, indicating a broader spectrum of adjustments in the market.

Conclusion

In recent months, the crypto market has seen both highs and lows, with a marked increase in activity and a few setbacks. Ethereum and Bitcoin, although faced with setbacks, are holding steady, hinting at a resilient core in the crypto space.

Recent developments, including shifts in the derivatives markets and increased attention on key metrics, signal a market that’s adapting and maturing, ready to harness growth opportunities in its next phase.

As we move forward, it’s clear that the industry is stepping into a period of renewed potential, with lessons from the past fuelling smarter strategies for the future.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.