Navigating the Digital Assets Tides

September 26, 2023

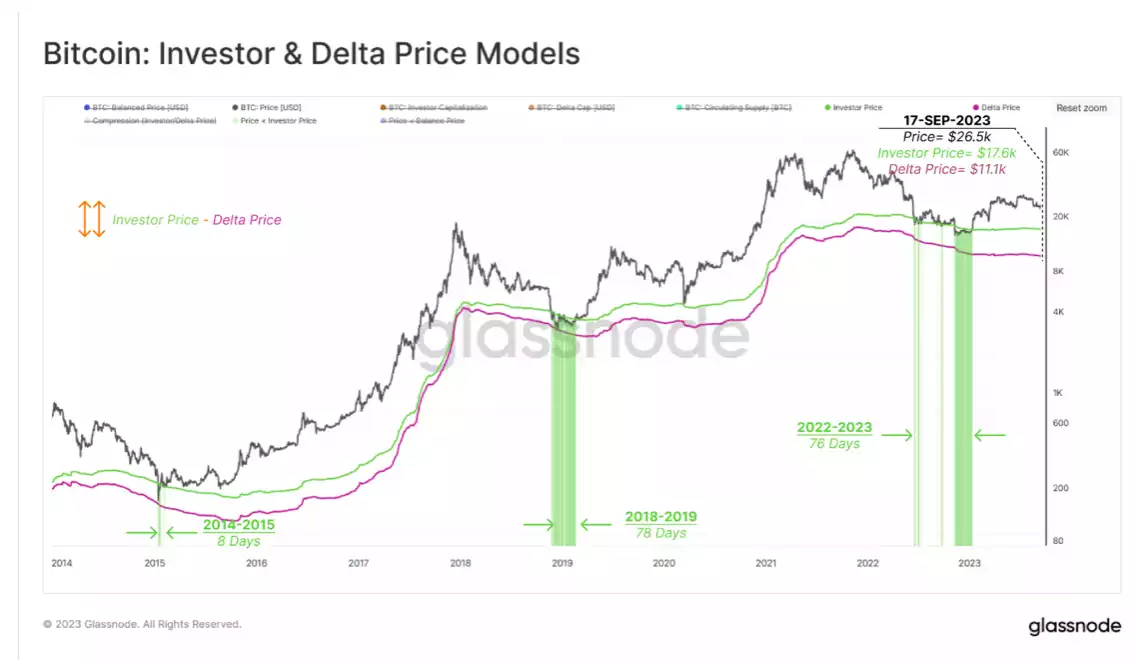

The current market position is thoroughly analysed concerning two significant on-chain pricing models that historically intersected during past cycle lows, and notably, in the March 2020 sell-off. This analysis offers a robust historical context, enabling a clear understanding of the present market conditions.

Our exploration spotlights the crucial alignment of accumulation and distribution patterns with local peaks and troughs. The on-chain data robustly substantiates this alignment, furnishing valuable insights that could be pivotal in anticipating prospective market shifts.

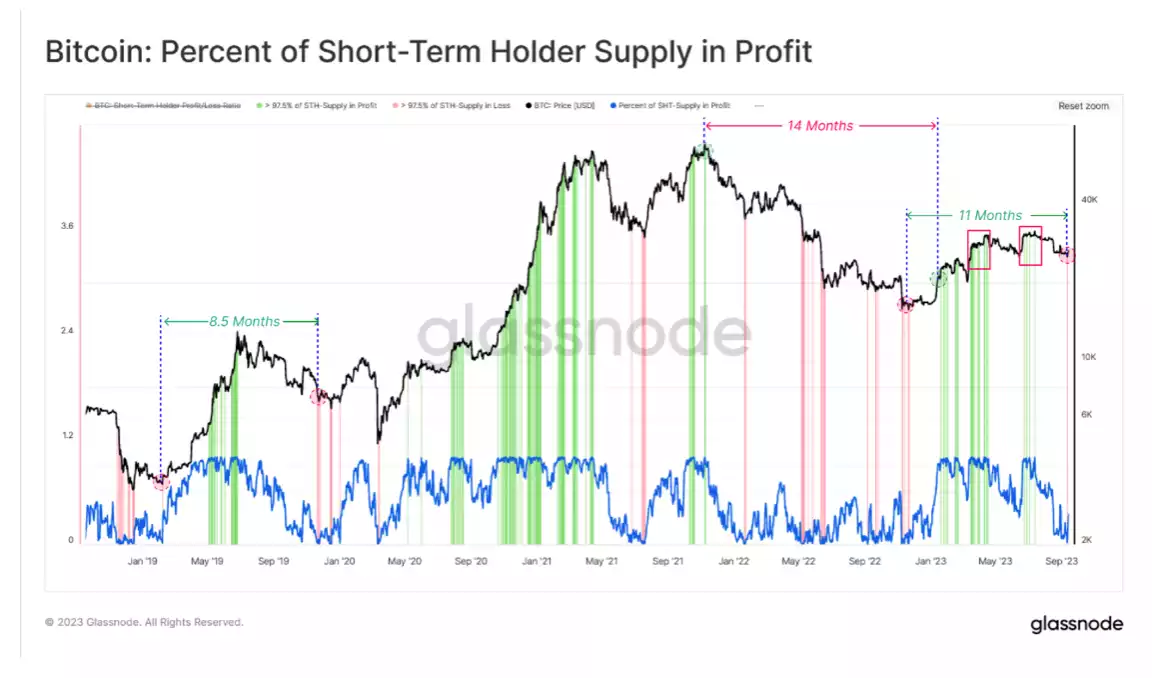

Despite the prevailing scenario where a significant majority of Short-Term Holders find themselves underwater, we introduce a fresh indicator. This novel metric emphatically highlights the prevailing negative sentiment, while concurrently offering insight that could play a crucial role in creating future market dynamics.

Current observations place the Bitcoin market at around $26k, after unsuccessful attempts to sustain above the approximate cycle midpoint of $31.4k. This scenario, illustrated by endeavours in April and July, has culminated in a pronounced double-top pattern in prices.

We identify signals suggestive of an embryonic shift in market psychology and confidence. This assessment is mirrored in the recent price failures and the prevailing circumstances of Short-Term Holders, offering a multifaceted view of the market’s ongoing dynamics.

Two Essential Pricing Models

We present two cardinal pricing models for a comprehensive analysis:

- Investor Price ($17.6k): This model portrays the average acquisition cost for all coins, excluding miner-obtained ones, echoing the dynamics of secondary market acquisitions.

- Delta Price ($11.1k): A comprehensive model amalgamating on-chain and technical data, instrumental for modelling cycle floors.

Drawing parallels with historical data, we notice a consistent price action across the 2018-19 and 2022-23 cycles. Notably, both cycles depicted similar trading patterns within these price models at their lows. This trend is accentuated by the market’s reverting to the Investor Price level during the volatile period of March 2020.

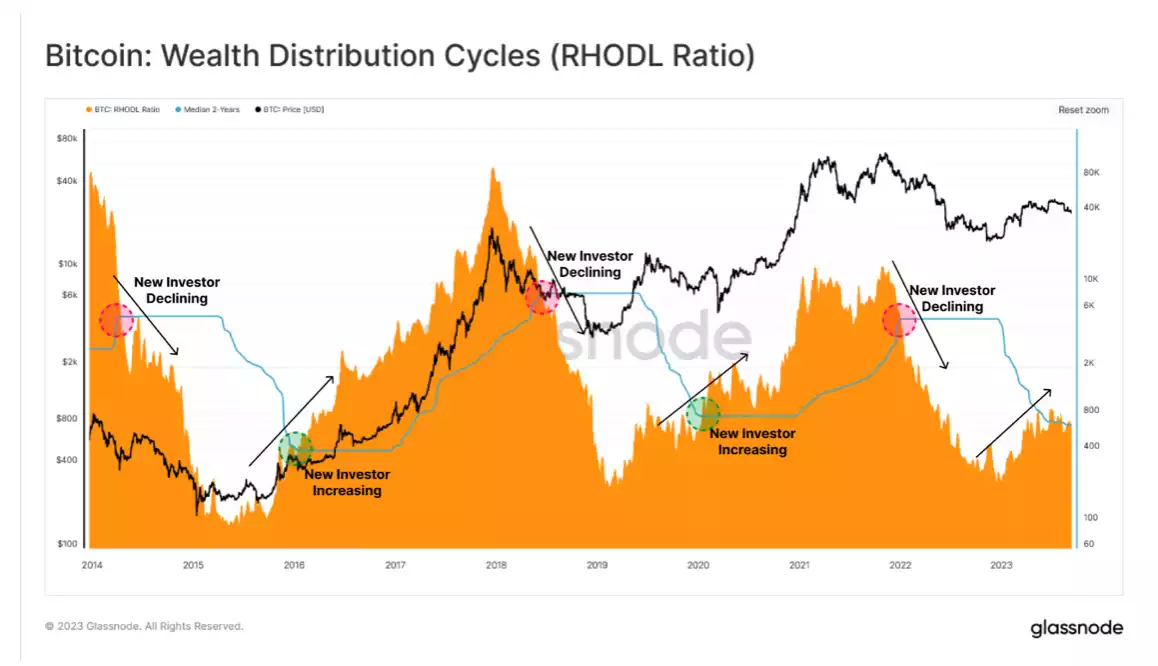

Realised HODL Ratio (RHODL)

the Realised HODL Ratio (RHODL), a pivotal market indicator, meticulously analyses the wealth distribution between recently moved coins (less than a week old) and those held for a more extended period (1-2 years), granting a comprehensive view into market sentiment and behaviour.

An integral part of analysing the Realised HODL Ratio involves the use of a 2-year median as a significant threshold. This innovative approach aids in distinctly identifying transitions between bull and bear market structures, offering a more nuanced insight based on capital flows and laying a solid foundation for informed investment decisions.

Observe the gentle wave of new investors making their entry into the Bitcoin market in the chart below. The RHODL Ratio, while just beginning to align with the 2-year median level, underscores the cautious and tentative nature of new investments in the market. This is not a sign of weakness but a symbol of an evolving market navigating through uncertainties.

The entrance of new investors this year carries a subdued momentum. It’s not just the volume but the pace and intensity of capital influx that holds significance. This scenario offers a grounded perspective, emphasising the prudent, watchful approach adopted by new investors in the current market climate.

The potent combination of the RHODL and the 2-year median level stands out as a reliable toolset for anticipating market trends. The current scenario where the RHODL is in close contention with the 2-year median uncovers potential impending shifts in the market structure. This invaluable insight could play a pivotal role in shaping investors’ strategies, keeping them well-prepared for future market movements.

Harnessing the Accumulation Trend Score (ATS) for Strategic Investment Insights

The ATS is seamlessly employed to accurately visualise capital inflow trends, reflecting the balance change of active investors over the last 30 days. 2023 stands out with its significant accumulation, a key driving force behind the recovery rally witnessed this year. The investment peaks astutely correspond with local tops above $30k, an indication of the prevalent Fear of Missing Out (FOMO) among investors, further fuelling the rally.

In stark contrast to the vibrant accumulation scenario in 2023, the latter half of 2022 was marked by notable capitulation events. New investors astutely capitalised on this, accumulating substantial assets at the lows. This strategic accumulation at lower prices in 2022 markedly contrasts with the FOMO-driven investment surge observed in 2023.

Navigating from 2022 to 2023, a distinct change in investor behaviour is palpable. The market has transitioned from a phase of strategic accumulation at lower price points to a period characterised by FOMO-driven investments at substantially higher prices.

Understanding Short-Term Holder Positions

In the current landscape, a significant proportion of short-term holders find themselves holding coins valued below their purchase cost, exemplifying a situation where a high percentage of short-term holder supply is not in profit.

Historically in bear markets, if more than 97.5% of coins acquired by new investors are at a loss, there’s a considerable increase in the likelihood of seller exhaustion – a scenario where all investors willing to sell have already sold.

In contrast, a market situation where over 97.5% of short-term holder supply is in profit often prompts investors to exit their positions, either breaking even or realising profits. During the recent rally above $30,000, complete profit saturation was observed, a situation reminiscent of the November 2021 all-time high.

However, the recent drop below $26,000 has pushed a significant portion of Short-Term Holder supply into a state of loss. This marks the deepest such level since the FTX collapse, signalling a period of substantial distress for short-term holders in the Bitcoin market.

Conclusion

The Bitcoin market is undoubtedly experiencing a significant shift in sentiment. This period is characterised by a substantial change in sentiment with most short-term holder investments valued lower than their initial spending. This scenario, the first of its kind since FTX’s collapse, is highlighting unusual market distress.

Despite the growing concerns and emerging panic among the short-term holder cohort, it’s important to note the mild but positive influx of new capital and investors this year. Although the momentum remains low, indicating continued market hesitation, this influx is a silver lining, showcasing the market’s potential resilience and allure.

The current state emphasises the importance of vigilance and adaptability in investment strategies. Keeping a close eye on external factors such as global economic shifts and regulatory pressures will be crucial in navigating the crypto space in 2023. Despite short-term turmoil and prevailing market uncertainty, this period can be viewed as a phase of consolidation and stabilisation, setting the groundwork for future growth and recovery in the crypto market. Stay optimistic, stay informed, and most importantly, stay prepared for the market’s ebbs and flows.

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company, or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.