Unveiling the Impact of Inscriptions on Bitcoin Blockspace Since February 2023

October 3, 2023

Since their introduction in February 2023, inscriptions have emerged as significant buyers of Bitcoin blockspace. With their unique role and sensitivity, concerns about their potential to displace monetary transfers have risen. Acting as purchasers for inexpensive blockspace, these entities have displayed a sensitivity to the absolute fee paid, while fulfilling the role of a ‘packing filler’ in blockspace after higher value monetary transfers.

Analysis of Fees and Volume

Inscriptions have brought about a new dimension to the assessment of Bitcoin transactions. They have led to an assignation of a higher perceived ‘value’ beyond the BTC volume being transferred. This unanticipated development has resulted in a meaningful increase in fee revenue for miners, presenting a silver lining amid the challenges faced by the mining community. Despite the financial strain anticipated in the post-halving scenario, the increased fee revenue offers a beacon of financial relief and support for miners.

Role and Sensitivity of Inscriptions

Inscriptions have proven to be significant, yet delicate players in the Bitcoin ecosystem. Despite contributing positively to miners’ revenue through increased fee payments, concerns linger. The potential stress on miner income post-halving remains a topic of discussion, underlining the necessity for a substantial uptick in Bitcoin prices for maintaining miner profitability and sustainability in the long run. Continuous and in-depth monitoring is indispensable for comprehensively understanding and effectively navigating the intricate dynamics evolving between inscriptions and monetary transfers.

Inscriptions in Bitcoin Transactions

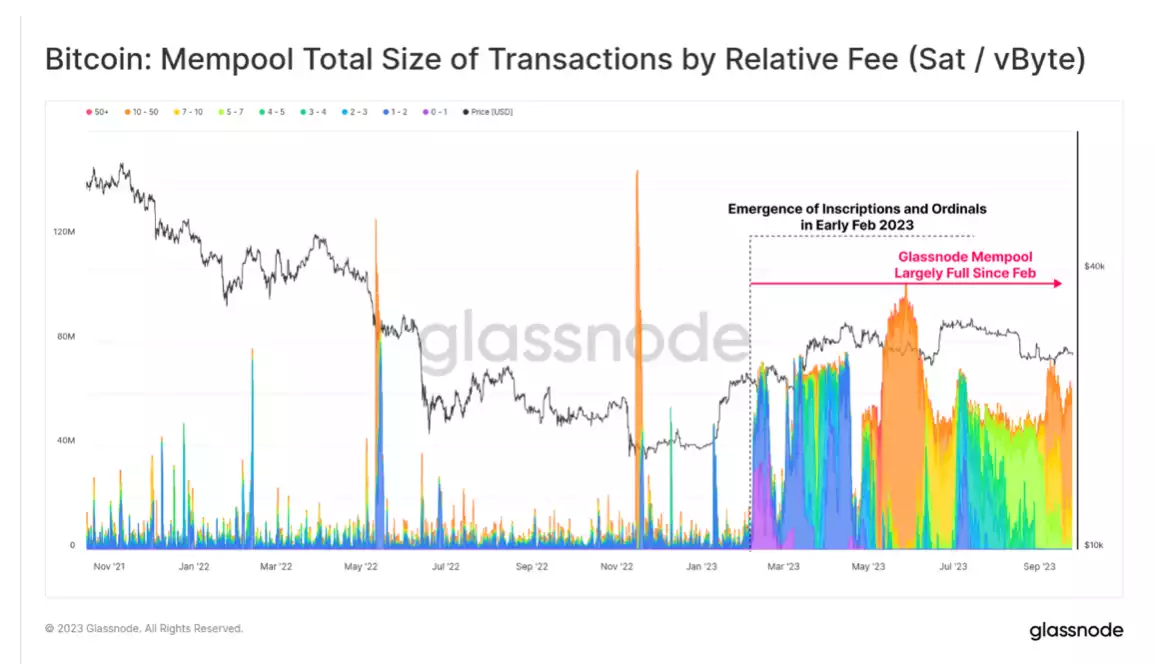

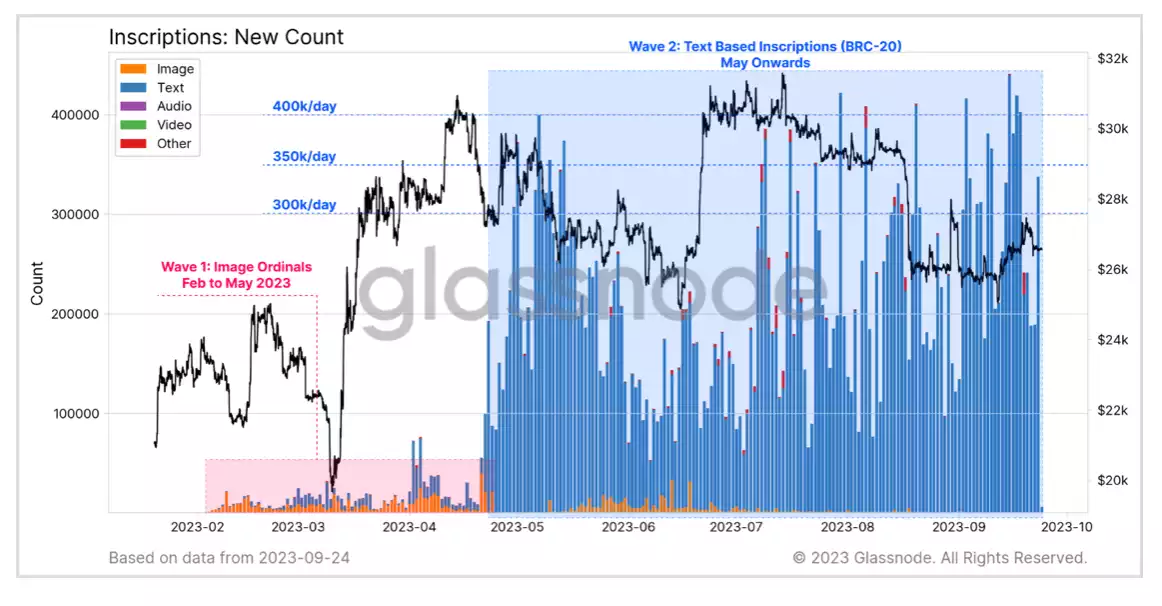

The inclusion of inscriptions in Bitcoin transactions has facilitated the encoding of files into the witness portion of transaction data. This integration has instigated a notable shift in on-chain activities, mempool landscapes, and miner revenues. The significant uptick in the highest fee-paying transactions’ data size in the Glassnode mempool since February, aligned with the release of Ordinals and Inscriptions, bears testament to this emerging trend. This evolution marks a crucial phase in Bitcoin’s journey, laying the foundation for further innovative enhancements and implementations.

Current Blockspace Demand

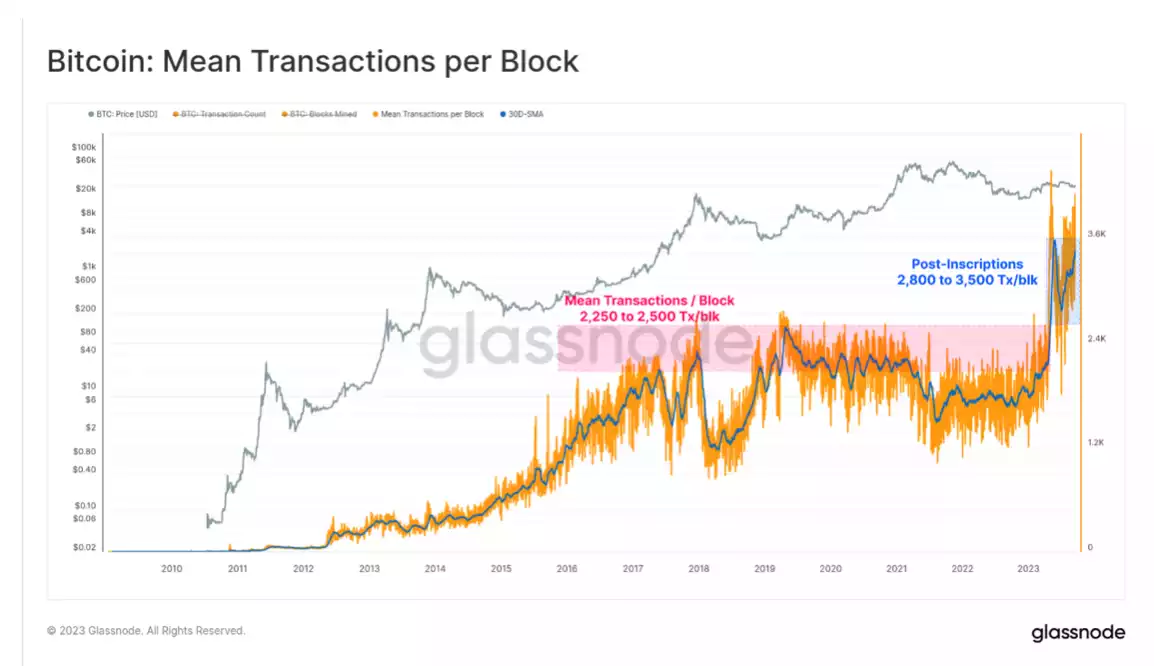

The advent of inscriptions has given rise to a sustained elevated demand for blockspace post-February 2023. This development augurs well for the Bitcoin ecosystem, signaling a potentially enduring and robust demand trend for blockspace. This sustained high demand is anticipated to contribute positively to the overall growth and stability of the Bitcoin market, fostering an environment conducive for further advancement and expansion.

Utilisation and Impact

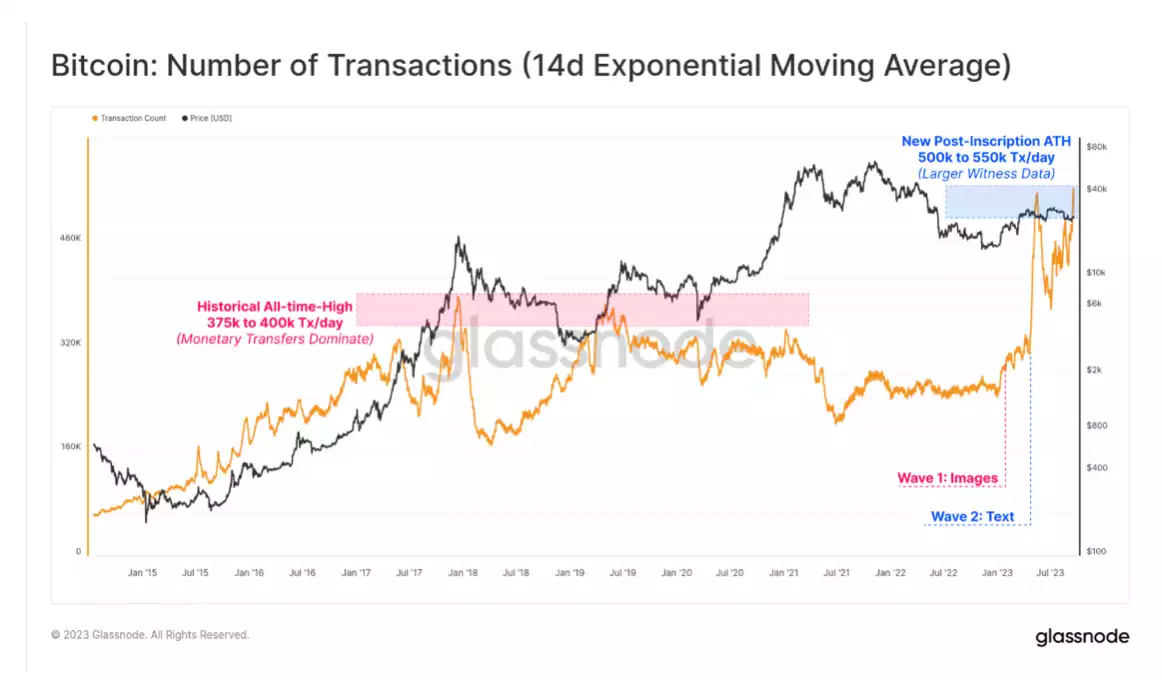

Maximising transactions by employing SegWit’s split data structure, inscriptions have made a significant impact on Bitcoin transaction patterns. This efficient utilisation has allowed the processing of more transactions within the same 4M Wu capped blocksize. In addition, the notable increase in daily confirmed transaction counts further underscores the growing adoption and efficiency of inscriptions. This positive trend indicates a potential shift or expansion in market activity, with a higher volume of transactions being processed daily.

Conclusion

In conclusion, the analysis of several months of inscriptions data reveals their role as ‘packing-fillers’ for blocks without displacing monetary transfers. They have emerged as buyers of last resort for cheap block space, contributing to the increase in base-load demand for blockspace. Despite the possible approaching income stress threshold for miners, the significant rise in fee revenue and a surge in the hash rate of over 50% since February posit a cautiously optimistic outlook. Continuous observation and analysis are imperative for understanding the long-term impacts on blockspace demand and miner revenue in the unfolding Bitcoin landscape.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.