Crypto Market Provides Opportunity

December 14, 2023

Starting the week at US$40.2k, BTC surged to a remarkable yearly high of US$44.6k, only to experience a sharp descent back to US$40.2k by Sunday. This rally was marked by two significant daily increases, each surpassing 5.0%, classified as over +1 standard deviation moves. However, the week ended with a dramatic turn, witnessing a US$2.5k drop (-5.75%), ranking it as the third-largest single-day decline in 2023.

From a Year-to-Date (YTD) perspective, Bitcoin’s peak performance showcased an impressive gain of over 150%, solidly outperforming a host of other assets throughout the year. This exceptional rise puts a spotlight on investor reactions as we approach the year’s end. How investors handle their recent gains could be a key indicator of Bitcoin’s future trajectory. With 2023 drawing to a close, understanding these behavioural responses becomes crucial to predict potential market movements.

The Active Investor Realised Price, underpinned by Cointime Economics, is particularly instrumental in determining Bitcoin’s Fair Value. This model fine-tunes the realised price by taking into account the level of supply tightness or HODLing behaviour across the network. Essentially, more intense HODLing, which suggests a constrained supply, often leads to a higher estimated fair value, and the inverse is true for less constrained supply conditions.

When interpreting this model, a key focus is identifying periods where the spot price is above the classic Realised Price but still below the cycle’s all-time high (ATH). Historically, the journey from surpassing the Realised Price to achieving a new ATH has ranged from 14 to 20 months, with the current cycle observing an 11-month duration. Notably, the path to a new ATH is typically marked by substantial fluctuations, often around ±50% of the Active Investor Realised Price. These fluctuations are illustrated through oscillators mapped for each cycle.

Looking ahead, if past trends are any indication, the market might witness several months of fluctuating conditions around the current ‘fair value’ model, estimated at around US$36k.

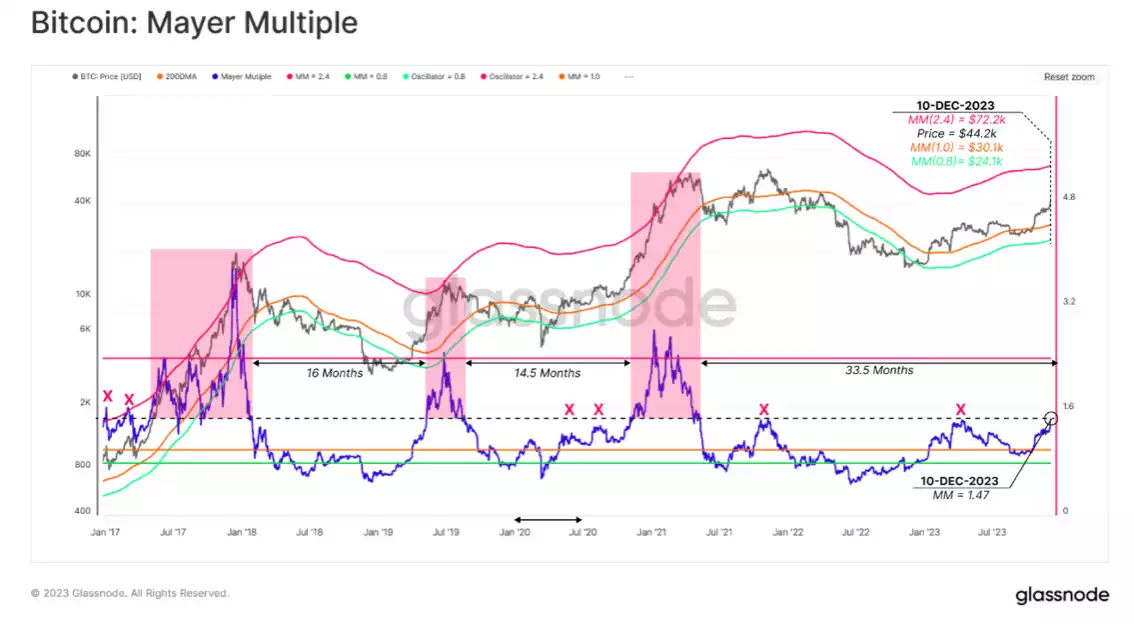

The Mayer Multiple, a respected technical pricing model within the cryptocurrency domain, provides a nuanced understanding of Bitcoin’s market positioning. This model calculates the ratio of Bitcoin’s current price to its 200-day moving average (MA), a metric widely regarded as a bellwether for discerning macro bull or bear market trends.

The significance of the Mayer Multiple lies in its ability to signal market extremes. A Mayer Multiple that exceeds 2.4 is generally perceived as an indication of overbought market conditions, suggesting a market peak or euphoric sentiment. Conversely, a Mayer Multiple falling below 0.8 often points to oversold conditions, highlighting potential market bottoms or undervalued states.

Currently, the Mayer Multiple hovers around 1.47, aligning closely with the historically significant level of ~1.5. This level has previously acted as a resistance point in past market cycles, including during the November 2021 All-Time High (ATH) phase. This current positioning of the Mayer Multiple is noteworthy, as it marks 33.5 months since it last breached this level. This extended duration since its last crossing of this threshold is the longest since the 2013-16 bear market, underscoring the depth and duration of the 2021-22 bear market.

As we reflect on Bitcoin’s market journey throughout 2023, it’s evident that the cryptocurrency has undergone a strong market cycle, escalating to new yearly highs before retracing back towards its weekly opening levels. This recent rally faced noticeable resistance and has held up well.

A key factor influencing this recent market trend appears to be the behaviour of Short-Term Holders (STHs). On-chain data suggests that these investors have played a significant role in driving the recent resistance seen in the market. The actions of STHs, particularly their profit-taking moves, have notably impacted the momentum of Bitcoin’s rally. This highlights the importance of understanding the behaviour and influence of different investor cohorts within the cryptocurrency market.

Let’s see what the next week brings…

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Connect with Ainslie Crypto’s team at 1800 AINSLIE or via info@ainsliecrypto.com.au. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie have been a trusted dealer and custody provider for Gold 1.0 for 50 years and bring the same service to Gold 2.0, Bitcoin, since 2017.

In an era where traditional banking systems impose increasing limitations, Ainslie Crypto offers a forward-thinking payment solution with our Australian Digital Dollar (AUDD) platform. Developed by Novatti, AUDD allows you to navigate beyond the constraints of conventional financial systems, offering stability, security, and ease in your crypto transactions.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provide swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.

Share this Article:

Crypto in your SMSF

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.