Bitcoin Soars Amid ETF Speculation: A New Era for Crypto?

January 9, 2024

As the crypto market enters an exhilarating phase, Bitcoin (BTC) has spectacularly rallied, soaring past AU$70,006 (US$47,000) for the first time since April 2022. This surge comes as anticipation builds around the potential approval of spot Bitcoin Exchange-Traded Funds (ETFs) by the United States Securities and Exchange Commission (SEC), marking a pivotal moment for institutional engagement in crypto.

Over the past 24 hours, Bitcoin has witnessed a staggering 6.5% increase, leaping from around AU$65,532 (US$44,000) on January 8th. This impressive climb, amounting to a 177% surge over the last twelve months, has propelled BTC to a year-to-date high of AU$70,333 (US$47,284. The market is roaring with the potential SEC approval of several spot Bitcoin ETF products, with Bloomberg analysts hinting at a decision possibly arriving as soon as January 10th.

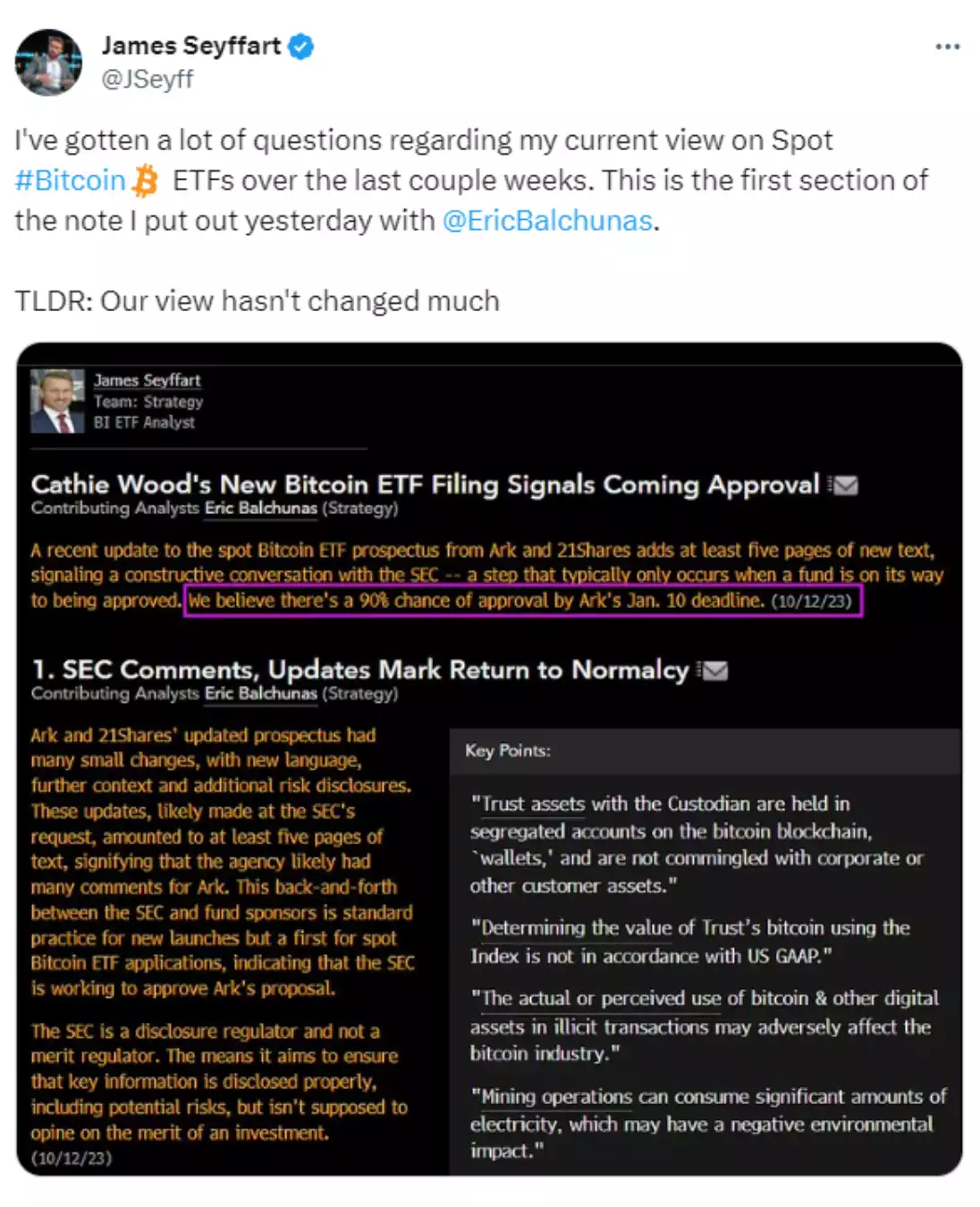

Analyst James Seyffart noted on X the growing anticipation:

Bitcoin’s current market position is a stark contrast to the enduring bear market it faced since April 3, 2022, when it last traded above AU$70,006 (US$47,000). During this period, BTC experienced a significant low, dipping to around AU$23,244 (US$15,600).

The market’s recent dynamics have been particularly punishing for short-term traders. Jin, a prominent trader and analyst, highlighted BTC’s successful pivot above the “21 EMA” support level, predicting a trajectory towards AU$71,616 (US$48,000). Additionally, noted X user Byzantine General pointed out the significant impact of short liquidations, with data from Coinglass indicating Bitcoin short-position liquidations exceeding AU$113 million (US$76 million), and still rising. The total across all cryptocurrencies for short liquidations has surpassed AU$167 million (US$112 million).

This bullish trend is expected to persist, especially with the potential news of a spot Bitcoin ETF approval. The market has already reacted positively to the top BTC ETF contenders’ fee war, as evidenced by recent S-1 amendments aimed at attracting clients post-approval.

In the backdrop of this excitement, the SEC has reiterated its caution against FOMO-driven crypto investments. However, the broader expectation remains that the eventual approval of spot Bitcoin ETFs could herald an influx of trillions of dollars over the coming years, marking a new era of institutional investment in the crypto sector.

This turning point in Bitcoin’s journey, coupled with the impending decision on ETF approvals, underscores the vibrancy and resilience of the crypto market, offering an opportune moment for investors who missed previous dips. As the market recalibrates after squeezing out short-term trades, it signals a robust and potentially transformative phase for cryptocurrencies.

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Join us here or connect with Ainslie Crypto’s team at 1800 AINSLIE or via info@ainsliecrypto.com.au. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie have been a trusted dealer and custody provider for Gold 1.0 for 50 years and bring the same service to Gold 2.0, Bitcoin, since 2017.

In an era where traditional banking systems impose increasing limitations, Ainslie Crypto offers a forward-thinking payment solution with our Australian Digital Dollar (AUDD) platform. Developed by Novatti, AUDD allows you to navigate beyond the constraints of conventional financial systems, offering stability, security, and ease in your crypto transactions.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provide swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.