Bitcoin Report – April 2025

Posted on 29/05/2025 | 258 Views

Today our Independent Research Analyst, Isaac Ho from the Ainslie Research Team brings you the latest monthly deep dive specifically on Bitcoin – including market analysis, on-chain metrics, sentiment, and technical analysis. He highlights some of the key charts that were discussed and analysed by our expert panel in the latest Beyond the Block episode and expands upon his work with some additional insights. We encourage you to watch the video of the original presentation if you haven’t already.

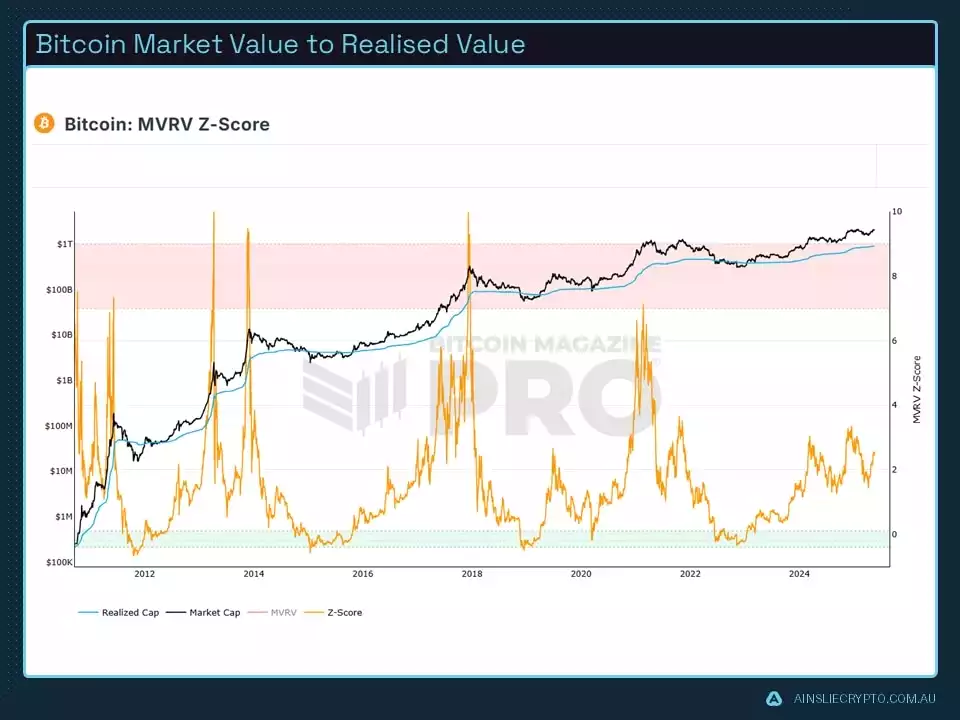

MVRV

When looking at the MVRV Z-score, we don't see anything extreme just yet. It hasn’t reached the euphoric levels we’ve seen in past cycles — which makes sense because this cycle hasn’t felt retail-driven. The staircase-like price action has been quite healthy, slowly raising the realised price and keeping the metric from blowing out. The MVRV can be viewed less as a tool to find the exact top and more as a general health check on our current position in the cycle. And right now? We’re climbing steadily, not exploding — that’s good.

Fear and Greed

Fear & Greed has been useful again. Last month, when we were in extreme fear, that was a very bullish signal. The whole market was terrified — sentiment was shot — but all the data was telling us otherwise. Since then, the price has surged, and the index is

now back in the 70s. That’s not extreme greed yet, but it’s definitely heating up. The speed of that sentiment shift is a possible concern. When it flips that quickly, we can often see the reversal happen just as quickly.

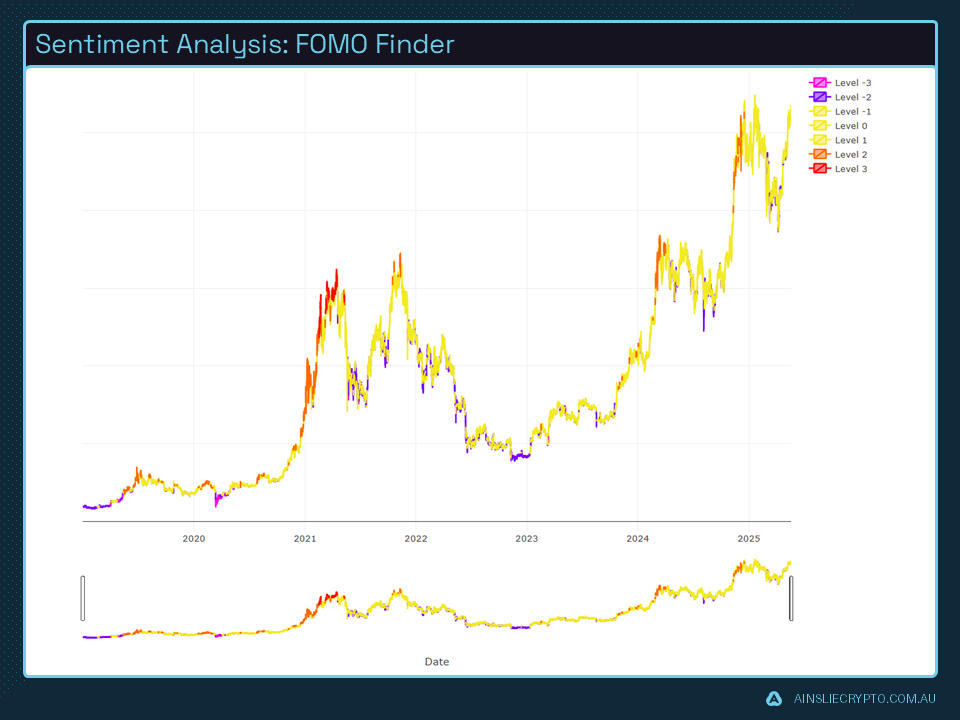

FOMO Finder

The FOMO Finder continues to follow a weekly cycle pattern. We've noticed a lot of fear prints (the purple bars) tend to show up at the same time as key technical and cycle lows. Most recently, we saw a big flush — liquidations, fear, the works — followed by a reversal, exactly what you want to see. Now we’re back in the yellow, which means less fear, but not quite full-on greed. This metric is best used as confirmation when it lines up with everything else — and lately, it has.

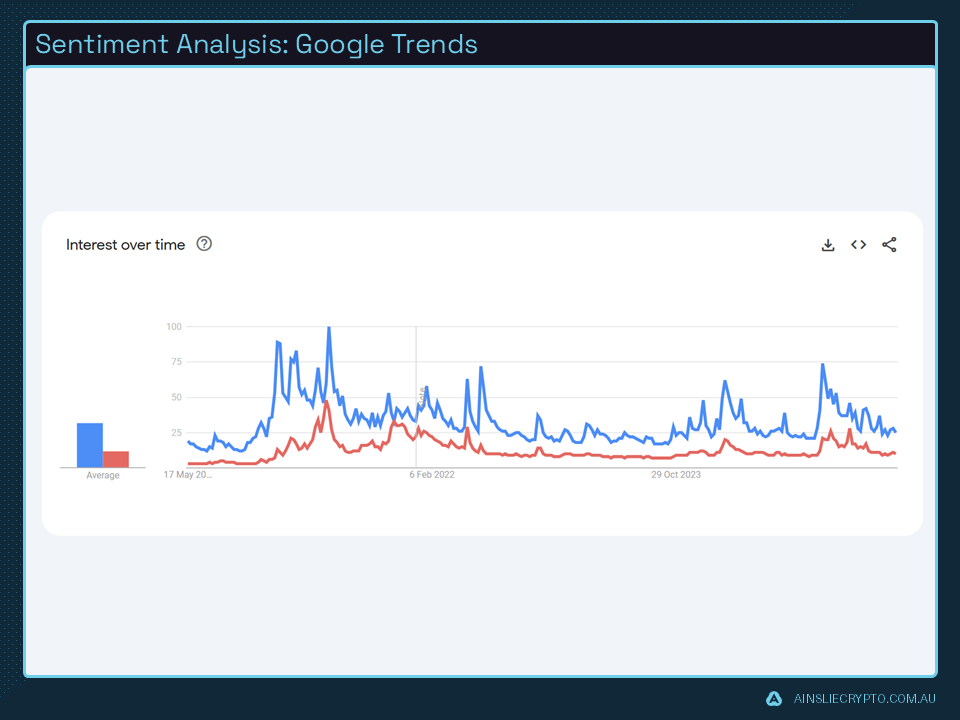

Google Trends

Google Trends is telling the same story — retail still isn’t here. Even as we approach all-time highs, search volume for "Bitcoin" is trending down. It had a spike back in November with the Trump news, but since then has faded away. That confirms what we’ve been feeling: this is still an institutional market. People know about crypto, but they’re not obsessing over it right now. That frenzy hasn’t returned yet — and honestly, that gives us more room to run.

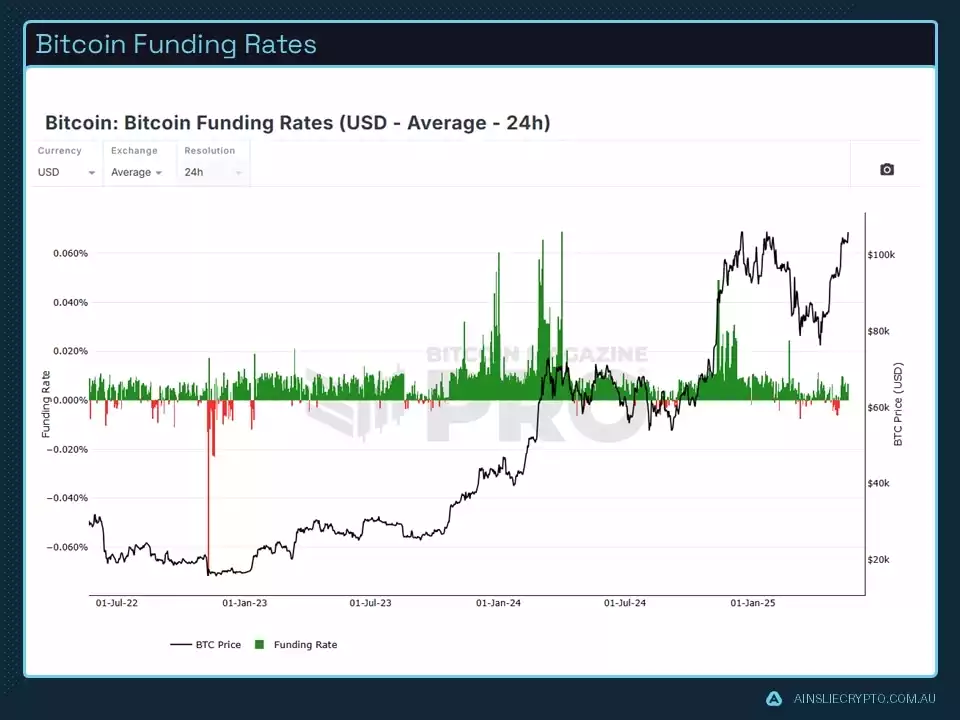

Funding Rates

Funding rates have been all over the place. We were negative at the lows, which usually signals a good long opportunity — and it played out. But now they’ve flipped green again, and not in a strong way. That tells us there’s no clear market bias right now and positioning is pretty balanced. There is a chance we're in a 'chop zone' — not enough leverage on either side to create a big move, which means we might be in for sideways action or just smaller swings for now.

Macrocycles

From a macro perspective, we're still likely in the mid-cycle expansion phase. Liquidity has been growing, albeit slowly, and that’s supportive of higher prices. But there’s a bit of a mismatch right now — Bitcoin has moved faster than liquidity justifies. Back in March, we had a clean setup: liquidity was rising, technicals looked great, sentiment was fearful — everything lined up. Now, the price has front-run the liquidity, which introduces a note of caution. While the mid-to-long-term outlook remains broadly positive, current conviction is somewhat lower compared to the previous month.

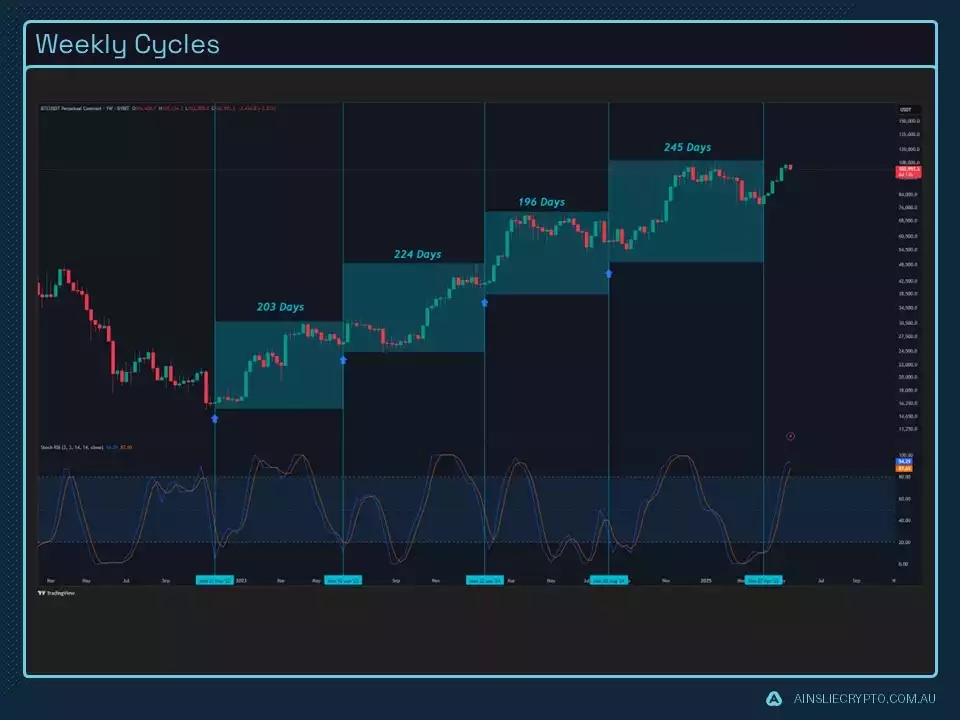

Weekly Cycles

The weekly cycles are becoming extended. Stochastic RSI is flatlining at the top, and historically, that’s where volatility picks up. We’ve seen this before — we can still push higher from here, but it gets harder to hold momentum. This cycle has played out with remarkable consistency in terms of timing, and we’re now in that indecision zone again. It wouldn’t be surprising to see some consolidation or a pullback to reset things.

Volume Profile

Looking at the volume profile, we’re sitting right in a low-volume area just below the high-volume node. That indicates the market is currently in a resistance zone. A close above this region — around US$106,000–108,000 — would suggest a strong likelihood of upward momentum resuming. If we start to roll over, US$92,000 would be the key support to watch. That’s where there’s significant transaction history, so we would expect buyers to step in there if we pull back.

Market Structure

Locally, market structure has flipped bullish. We’ve put in higher highs and higher lows. That’s promising. But again, the question is whether it holds. If we break below the recent swing low, that structure changes quickly. For now, the outlook appears to favour consolidation — maybe a higher low forming — rather than a straight trend continuation. A period of confirmation is preferred before adopting a more aggressive stance.

Trendline

We’ve had a sharp V-shaped recovery back above the main trendline, and that’s impressive. But those kinds of moves often lose steam without consolidation. The green zone we're watching is a cluster of support, and if we lose it, we could retest lower levels — again, probably around the US$92,000 area. But if we hold here and start to build structure, that could be the base for another move higher.

DXY

The DXY is tricky right now. We have a bullish green dot on Market Cipher, which often signals a bounce, but the money flow doesn’t look great. If the dollar starts trending lower, that’s great for Bitcoin — more liquidity, more risk-on sentiment. But if it holds or even bounces more, that could cap the upside for now.

Watch the most recent video presentation of Bitcoin Analysis: Beyond the Block where we share some of these explanations in a panel format, and join the discussion on our YouTube Channel here:

We will return with a more detailed analysis of everything Bitcoin next month, including more market analysis, on-chain metrics, sentiment, and technical analysis.

Isaac Ho

Independent Research Analyst

The Ainslie Group

x.com/IsaacsDevCorner